How Do I Compare

Here are tips for comparing loan offers:

-

Apply for a mortgage with multiple lenders. Different mortgage lenders offer different mortgage rates. The more you shop, the more you might be able to save. And consider applying with different types of lenders, such as banks, credit unions and online lenders, so you can compare their offers.

-

Shop for loans within a set window of time. The three big credit bureaus encourage you to shop around. You have 14 to 45 days, depending on the scoring model, to apply for as many mortgages as you want with the same effect on your credit scores as applying for one loan.

-

Compare closing costs using the Loan Estimates. Each lender is required to provide a Loan Estimate form with details of each loan’s terms and fees. The Loan Estimate is designed to simplify the task of comparing mortgage offers.

Fixed Vs Variable Rate Mortgages

Whether the interest rate is fixed or variable affects the rate. All other things being equal, a variable rate mortgage will start with a lower rate than a fixed rate mortgage. Just remember that a variable rate mortgage will go up in a rising-rate environment. And if rates rise significantly, so could your payment.

Adjustable-rate mortgages can be another way to take advantage of low rates. Typically an option like a 5-1 ARM, where your rate is fixed for five years and then varies annually after that, will start out with a lower interest rate up front. But, again, in a rising-rate environment, your interest rate and payment will rise, too.

Lock In Your Mortgage Rate

Once youve picked the best lender for you, lock in your mortgage rate. A rate lock is a commitment to the interest rate youve been quoted, and the rate shouldnt change unless your credit score, down payment or loan program changes. With a refinance, your rate might change if your appraisal comes in low.

Keep an eye on your lock expiration date if you havent closed by that date you may end up paying costly lock extension fees.

Also Check: Do Mortgage Companies Verify Tax Returns With The Irs

Save For A Larger Down Payment

Putting more money down on a homeaka lowering your loan-to-value ratio means a smaller loan amount and therefore less risk to the lender. If you can manage it, an LTV of 80% or less will mean that you dont have to pay private mortgage insurance .Saving for a down payment requires diligence and time just try not to fully deplete your cash reserves because youll need some money in the bank for future expenses.

Programs like FHA and VA have different standards when it comes to LTV, so work with a mortgage professional who can fully explain your options.

Comparing The Top Mortgage Lenders

Whether youre a first-time buyer or youve done this before, purchasing a new home is always a complex process. Getting a mortgage can be particularly challenging given the costs, fees, and paperwork involved. The purpose of this website is to help you understand how to get a mortgage for your home purchase and compare the best mortgage lenders. Well tell you everything you need to know about the mortgage lending market so you dont have to go to the trouble of researching it yourself.

You May Like: How Much Mortgage On 80k Salary

Tip : Reduce Your Debt

Your debt-to-income ratio is another important factor that lenders consider to evaluate your ability to repay the loan. If you are carrying a heavy debt load, your lender might find your financial situation unsustainable, and therefore set a higher rate to compensate them for being willing to take the risk.

Lets say you make $5,000 a month and you pay $1,250 of that toward your student loans, house and car payments. Your DTI is 25%. The lower this ratio is, the less risky you look for the lender and your rate will be lower.

While you dont want to close every account, it can be helpful to pay off certain debts. This can help decrease your DTI and free up more money to spend toward your monthly mortgage payment. Less debt can mean a lower mortgage rate.

Should you save for your down payment or pay down debt? Its important to find the right balance between the two. Lenders dont expect you to be completely debt-free. Some debts are considered good debt by lenders, particularly student loans and reasonable car loans when reliable transportation is necessary for work.

Other debts, like revolving credit card debts, are frowned upon by lenders. High credit card balances are often a sign that borrowers are using credit to supplement their income instead of living within their means.

Tip : Raise Your Income

It sounds simplistic, but realizing the road ahead is very expensive can focus your mind on maximizing income. This can be as simple as asking for a raise, looking for a higher paying job, completing educational requirements or starting a side hustle. Whichever route you choose, increasing your income before you buy will ease the budgetary burden of homeownership.

Also Check: Can You Get A 30 Year Mortgage On Land

Best 3 Year Fixed Rate Mortgage

While the best available rate on a 3 year fix this month is from Skipton Building Society for Intermediaries at 3.62%. Youll need a deposit of 40% and it has an arrangement fee of £995.

This is quite a big jump from the lowest rate on a 3 year fix last month which was from Buckinghamshire Building Society at 3.29%.

Current Mortgage Rates Can Be Deceptive

Shopping around for a mortgage rate means applying with multiple lenders and getting personalized quotes. It does not mean simply looking online and picking the lender with the lowest advertised rates.

Why? Because lenders tend to base their advertised rates on ideal borrowers. They often include points, too, which lower your mortgage interest rate but increase your upfront fees. So unless you have great credit, a big down payment, and dont mind paying extra closing costs, you probably wont get those advertised rates.

The same applies to average rates. By definition, some borrowers will qualify for lower rates and some will get higher ones. What youll be offered will depend on your situation and personal finances.

Recommended Reading: What Income Can Be Used To Qualify For A Mortgage

How To Use Our Mortgage Rate Tool

You need six pieces of information to start comparing rates:

The Best Mortgage Rates Ranked

The following banks and mortgage lenders have the best mortgage rates on average, based on nationwide data filed by lenders under the Home Mortgage Disclosure Act. These averages are from 2021, the most recent data available at the time of writing.

Rates have risen in 2022, and the average rates you see here do not represent mortgage interest rates on offer today. However, historical mortgage rates can be a useful guide to help you find the banks with the lowest mortgage rates on average. The lists below are a great starting point if youre shopping for a new home loan.

Recommended Reading: Can I Get A Mortgage After Filing Chapter 7

Work On Boosting Your Credit Score

Once you have a starting point for where your scores are now, you can take steps to improve them if youre not quite at the 740 level yet. Dispute any errors you find, keep making on-time payments and avoid opening any new credit accounts before applying for a mortgage.

Besides your payment history, your utilization rate has the most impact on your credit scores, and maxed-out credit cards will sink your scores quickly. Keep your credit card balances low or pay them off completely, if possible.

Tip : Choose A Shorter Loan Term

You can save a lot of money over the life of your loan if you choose a 15 year instead of a 30-year repayment term. By shortening your loan term, you can also get a lower interest rate upfront. As we discussed previously, its far less risky to predict repayment 15 years out than it is to predict 30 years out. Youll also build home equity much faster, which reduces your loan-to-value ratio and lender risk.

Among the added benefits of a 15-year repayment term is that youll reach the 20% home equity mark, meaning you can stop PMI sooner. Youll also pay off your mortgage loan sooner, removing a huge chunk of your monthly budget.

However, the monthly mortgage payment on a 15-year loan is significantly higher than that of a 30-year mortgage, and the pandemic housing market has put purchase prices out of reach for many, so it’s most important to be sure that you can afford your monthly mortgage payment.

Use our mortgage calculator to determine your monthly mortgage payment with both repayment terms.

Although your monthly payment will be higher on a 15-year loan, you could potentially save tens of thousands in interest over the life of the loan. Not only will you lower your interest rate, but youll pay more toward your mortgage balance faster than you would on a traditional 30-year loan.

Don’t Miss: When Is Private Mortgage Insurance Required

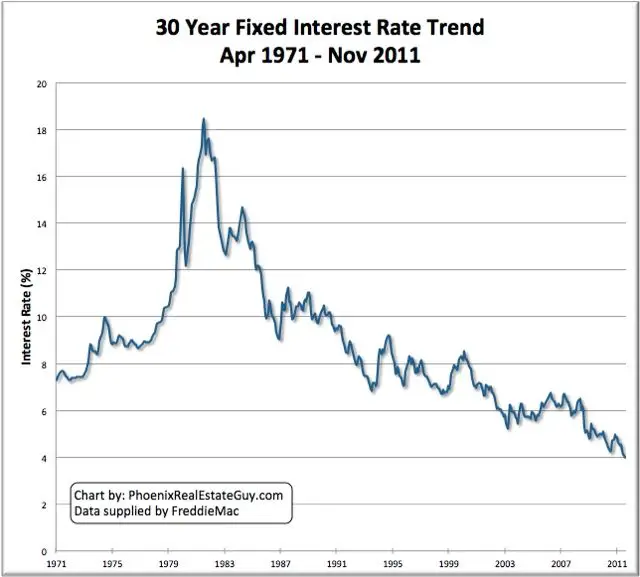

What Are Current Mortgage Rates

Mortgage rates have risen from the record lows seen in 2020 and 2021. That means its more important than ever to shop around for your best deal.

Comparing lenders and negotiating for a better mortgage rate can save you thousands of dollars even tens of thousands in the long run. So its well worth the effort.

Ready to get started?

1Top 50 mortgage lenders for 2021 based on 2020 Home Mortgage Disclosure Act data via Bundle Loan and 2021 data sourced directly from the HMDA data browser

2Rate and fee data were sourced from self-reported loan data that all mortgage lenders are required to file each year under the Home Mortgage Disclosure Act. Averages include all 30-year loans reported by each lender for the previous year. Your own rate and loan costs will vary.

Could Interest Rates Double Within A Year And Wholl Be Hit Worst

Another month where were left wondering: will there be another rise in the base rate? The Bank of Englands Monetary Policy Committee meets again on 15 September and many experts are predicting another increase to the base rate of interest will be announced.

Any increase would follow the announcement on 4 August which hiked interest rates from 1.25% to 1.75% their highest level since December 2008, as the Bank of England tries to curb surging inflation.

And it looks like further increases are on the cards with financial markets betting interest rates will more than double by next May to 4%.

Whenever interest rates are increased this has a knock on effect on mortgage rates so a rise to 4% would have a drastic impact if it happens. According to researchers at the IFS the impact of further interest rate rises may be felt worst by lower-income and older home owners, as they are more likely to be on a variable rate mortgage.

So it has never been more important to check how any increase will affect your mortgage.

Read Also: Where Do Mortgage Brokers Work

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners’ insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

Read Also: How To Buy Mortgage Leads

Introduction To Mortgage Refinancing

A mortgage refinance involves paying off your old loan and replacing it with a new one from a lender of your choice. People refinance for a variety of reasons, including reducing their interest rate, shortening their repayment term, and tapping into home equity to access cash.

The most important thing to know about refinancing is that it involves closing costs, so it only makes sense to refinance if the new interest rate is substantially lower than the old one. In principle, the more time that has elapsed since your initial mortgage began, the wider the gap in interest rates needs to be for a refinance to be profitable. As a rule of thumb, in the early years of a mortgage a 0.75% lower interest rate should be enough to deliver savings, while in the mid-to-late years of the repayment term, a 1-2% lower interest rate is needed. Of course, always do your own calculations before refinancing.

Consider A Shorter Loan Term

When you take out a 15-year fixed-rate mortgage instead of a 30-year fixed-rate mortgage, the interest rate will normally be lower. In mid-September 2020, for example, the 30-year rate was 2.87%, and the 15-year rate was 2.35%.

You also could consider an adjustable-rate mortgage. Its introductory rate may be lower than what you could get on a fixed-rate mortgage. It depends on the market, though: In mid-September, a 5/1 ARM had an interest rate of 2.96%.

Even if you can get a lower rate on an ARM, youâre taking a risk. It might be cheaper in the short term, but it could be more expensive in the long term. Why?

- No one knows what interest rates will look like when the ARMâs introductory period ends.

- Thereâs no guarantee youâll be able to refinance or sell when the ARMâs introductory period ends.

Recommended Reading: How Do You Get A Cosigner Off A Mortgage

Strategies To Get A Lower Interest Rate

Heres a recap of the best strategies to get a lower interest rate and save on your mortgage loan:

And, if you have time before you plan to buy or refinance:

- Boost your credit score before you apply

- Reduce your debts before you apply

- Save a bigger down payment. The higher your down payment, the lower your mortgage rate is likely to be

With those last three, theres only so much you can do. Few of us could save more at the same time were paying down debt.

But prioritize areas where you think you have the most room to grow as a borrower. And just do what you can. Because even a little can sometimes help a lot.

It Is Worth The Money You Will Spend On The Fees They Are Asking

Is it necessary to hire the best Mortgage Broker and to spend money on fees if you can apply for a loan yourself? If this is your first time, it is recommended that you make use of a mortgage broker. They have the experience, knowledge and contacts to get the best loan at the best rates. Even if you dont have a lot of money, this is still something to consider.

So, Yes, it is worth the money you will spend on the fees that you will need to pay for their services. In return, they will make sure that you are getting the best loan at the best interest rate. And the best change is that the mortgage loan will be approved. Without them, it will be much harder to get an approved loan.

Also Check: How To Get Approved For A Larger Mortgage