In Summary Reverse Mortgage Costs And Fees

That is it there are no other fees or costs involved in setting up a reverse mortgage in Canada.

While the amounts can vary these are all the costs at this point in time.

And remember, in terms of upfront costs that you actually have to pay in cash you are only talking around $150-400.

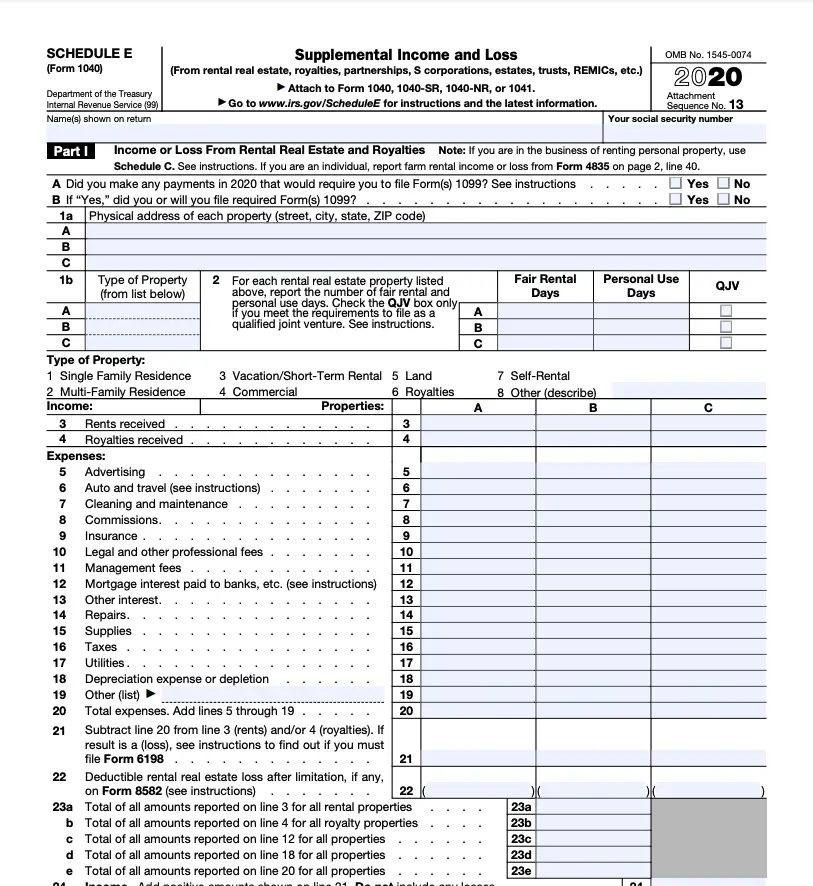

Here is a short table to summarize the costs/fees:

Which Closing Costs Are Tax

Unfortunately, not many closing costs are tax-deductible. Two exceptions are any points you buy to reduce your loans interest rate, and any property taxes you pay in advance.

Property taxes are always deductible. When you take out a mortgage loan, though, youll usually have to pay some property taxes upfront, before theyre due. Thats because lenders typically create an escrow account for borrowers.

In an escrow arrangement, youll pay extra money with your monthly mortgage payment to cover the costs of your yearly property taxes and homeowners insurance. When your insurance and tax bills are due, your lender will dip into these funds and pay them on your behalf. Once tax time rolls around, you can deduct any property taxes that you paid in advance.

Mortgage points are also tax-deductible. Home buyers purchase these points to lower the interest rate on their mortgages, with each point costing 1% of their total loan amount. For instance, one point on a mortgage loan of $200,000 would cost $2,000. Each point typically drops a borrower’s interest rate by 0.25%. One point, then, would lower a mortgage interest rate of 5% to 4.75% for the life of a mortgage loan.

Points can pay off in lower interest costs throughout the life of a loan. They can also help at tax time. The IRS allows you to deduct the full amount of your points in the year borrowers pay for them. To claim this deduction, your mortgage must be used to buy or build your primary residence.

Sign Up For Investor News

Stay informed about the latest investor initiatives, educational resources and investor warnings and alerts.

This website is provided for informational purposes only and is not a source of official OSC policy or a substitute for legal or financial advice. We recommend that you consult with a qualified professional advisor before acting on any information appearing on this website. For details, please see our full Terms of Use and Privacy Policy.

Also Check: How Much Is A 95000 Mortgage Per Month

You Have To Pay For It

Reverse mortgages have costs that include lender fees , FHA insurance charges and closing costs. These costs can be added to the loan balance however, that means the borrower would have more debt and less equity. Youll also be paying pesky servicing fees each month that can be as high as $35 if your interest rate adjusts on a monthly basis.

Are Closing Costs On Your Mortgage Tax Deductible

Buying a house is expensive. Even with a loan, you will still have to make a substantial down payment . On top of that, there are numerous closing costs that you will need to pay for. Fortunately, you can offset some of these costs by writing them off on your taxes. Just keep in mind that when it comes time to file your taxes, you wont be able to deduct your closing costs if you take the standard deduction. If you want to write off your closing costs, you will need to itemize your deductions. Of course, you need to know which mortgage closing costs are tax-deductible and which arent.

Recommended Reading: How To Figure Home Mortgage Payments

True Costs Of A Reverse Mortgage Loan

In the same way you likely had lots of questions about the various fees and costs of the traditional mortgage you used to buy your house, you probably now have similar ones about a reverse mortgage:

What is the cost of a reverse mortgage? How much are reverse mortgage fees? Whats the interest rate for reverse mortgages? What decides the rate?

The truth is, fees and costs apply to any kind of mortgage, including reverse mortgages.

As with any type of financial tool, especially one youre considering for retirement, it is important to have a clear understanding of its associated costs. With this information, you can begin to objectively compare one home equity strategy, is this case a reverse mortgage, versus others, such as refinancing or selling your home.

To help you better understand the costs of a reverse mortgage, weve broken down the costs into fees, interest rate, insurance costs and ongoing costs.

As important as the numbers are, dont lose sight of the big picture. Where do you see yourself thriving the most in retirement: In your current home updated and improved so you can safely and comfortably age in place or in a new home and community that your current situation cant offer?

Know your numbers, but also know your heart.

Donât Miss: What Fees Are Involved In Refinancing A Mortgage

How To Calculate Refinance Closing Costs

This calculator allows you to estimate the closing costs of a refinance for different loans such asconventional loans,FHA loans,VA loans, andUSDA loans. Even though their fixed costs tend to be the same, their variable costs and mortgage insurance costs may differ. For example, FHA loans require anFHA upfront mortgage insurance premiumof 1.75% which is included in the closing costs. On the other hand,private mortgage insuranceused for conventional loans is usually paid in monthly installments, and it may not be considered a part of closing costs.

Understanding your refinance closing costs allows you to estimate how much you will have to pay for the closing costs at the time of the refinance as well as save on some of the closing costs if they are negotiable or not required. The following list describes the items that are usually included in the refinance closing costs.

Loan Application Fee: This fee is an administrative fee charged by your lender for the preparation of the refinance application and all related documents. It is usually non-negotiable, and it ranges from $75 to $500 depending on the lender.

Credit Report Fee: A lender will request afrom one of the. These agencies charge a fee for their services that usually cannot be negotiated. In addition to that, their services have a fixed price because they do not vary based on the refinance loan principal. Credit reporting agencies usually charge between $10 and $100.

Don’t Miss: Is It Easier To Get A Mortgage The Second Time

Are Closing Costs For A Rental Home Deductible

Taxes can get pretty complicated when you decide to become a landlord. Honestly, life in general can get complicated when you decide to rent out a housebut thats a different story.

If you have a rental house, that means youll have rental income. Just like with your primary residence, you can deduct things from your rental income like mortgage interest, PMI and taxes.

But waitif you can deduct mortgage interest, that means you borrowed money to buy a rental. If youre not in the position to pay cash for a rental, dont buy it. Its that simple. Dont count on rent from tenants to cover the mortgage. Wait until you have the money to afford the entire house on your own, then buy the house.

If you purchased a rental home with cash, you can add any closing costs not related to a home loan to the cost basis of the home.10 So, if you bought a home for $100,000 and paid $3,000 in closing costs, your total cost of the home is $103,000. This is important because a rental home can be depreciated as an asset, which means you can take small deductions based on the cost of the home over 27.5 years.11

Rules On Reverse Mortgage

FHA rules on the Home Equity Conversion Mortgage govern the reverse mortgage contract. Homeowners must be 62 or older and must own the home free of existing liens. If not, any previous liens must be paid off with the proceeds from the HECM. Lenders will not require a credit check — repayment of the loan is guaranteed by the sale of the house. While the homeowner remains in the home, he is still responsible for maintaining the house, keeping up on property insurance and paying property taxes.

Also Check: How Does Selling A Home With A Mortgage Work

Over The Lifetime Of The Mortgage

You can choose to spread out the deduction for mortgage points over the life of the mortgage. There might be years in which it makes more financial sense to claim the standard deduction than it does to itemize. You can hold off, then, and only claim the points deduction in those years in which you do itemize.

When you refinance to a mortgage loan with a lower interest rate, youre replacing your primary mortgage with a new one. Because of this, a refinance is considered the same as a primary mortgage for tax purposes. This means that the same closing costs those used to prepay property taxes and those used to buy down your interest rate are the only ones that can be deducted on your federal income taxes. Using your refinance for tax purposes, as well as lowering your interest rate, can be a great way to maximize your savings.

If youre closing a cash-out refinance, where you refinance for more than what you owe on your existing mortgage and take the difference as a lump-sum cash payment, you might be able to use the proceeds to adjust the cost basis of your home, reducing your capital gains tax when you eventually sell. You can only do this, though, if you use the money from your cash-out refinance to make capital improvements to your home.

Never Owe More Than What The Home Is Worth*

When you permanently move out of your home, whether you sell it or pass away, neither your estate nor your heirs are responsible to pay the deficit if the balance owed on your reverse mortgage exceeds the home value. If your heirs want to keep your home, they can purchase it for 95% of the current appraised value.*There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes, insurance and maintenance . Credit is subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.

Don’t Miss: What Is The Average Interest Rate On Home Mortgages

What Closing Costs Can I Deduct On My Taxes

Before you can even think about deducting closing costs from your income taxes, you have to meet one big qualification: The home must be your primary residence. And no, that vacation house youve had your eye on is not a primary residence.

And one more thingand this is a big onein order to deduct any closing costs youll have to itemize deductions instead of taking the standard deduction. And the vast majority of Americans take the standard deduction because it saves them the most money on their taxes.2

All that said, here are closing costs that usually are tax-deductible:

- State and local property taxes

- Prepaid interest

- Private mortgage insurance

How To Claim The Mortgage Interest Deduction

Youll need to take the following steps.

1. Look in your mailbox for Form 1098. Your mortgage lender sends you a Form 1098 in January or early February. It details how much you paid in mortgage interest and points during the tax year. Your lender sends a copy of that 1098 to the IRS, which will try to match it up to what you report on your tax return.

You will get a 1098 if you paid $600 or more of mortgage interest during the year to the lender. You may also be able to get year-to-date mortgage interest information from your lenders monthly bank statements.

2. Keep good records. The good news is that you may be able to deduct mortgage interest in the situations below under certain circumstances:

- You were a co-op apartment owner.

- You rented out part of your home.

- The home was a timeshare.

- Part of the house was under construction during the year.

- You used part of the mortgage proceeds to pay down debt, invest in a business or do something unrelated to buying a house.

- Your home was destroyed during the year.

- You were divorced or separated and you or your ex has to pay the mortgage on a home you both own .

- You and someone who is not your spouse were liable for and paid mortgage interest on your house

The bad news is that the rules get more complex. Check IRS Publication 936 for the details, or consult a qualified tax pro. Be sure to keep records of the square footage involved, as well as what income and expenses are attributable to certain parts of the house.

You May Like: Is It Better To Get Mortgage From Credit Union

What Are The Ongoing Costs For Reverse Mortgages

Ongoing costs are added to your loan balance each month. This means that each month you are charged interest and fees on top of the interest and fees that were added to your previous months loan balance. Ongoing costs may include:

- Servicing fees paid to your lender to cover such costs as sending you account statements, distributing your loan proceeds, and making certain that you keep up with the loan requirements

- Annual mortgage insurance premium which is 0.5% of the outstanding mortgage balance and

- Property charges such as homeowners insurance and property taxes, and if applicable, flood insurance.

The larger your loan balance and the longer you keep your loan, the more you will be charged in ongoing costs. The best way to keep your ongoing costs low is to borrow only as much as you need.

Note: This information only applies to Home Equity Conversion Mortgages , which are the most common type of reverse mortgage loan.

How To Choose A Reverse Mortgage

A reverse mortgage may or may not be your best option. Here are some factors to keep in mind:

- A reverse mortgage is not a good choice if you want to leave your home to your heirsthey likely will have to sell the house when you die.

- Reverse mortgages work best for older homeowners who plan on living in their home for many more years.

- If you have to move out of your home into a nursing home or assisted living facility, your reverse mortgage will become due and payable. As a general rule, you’re deemed to have moved if neither you nor any other co-borrower has lived in your home for one continuous year.

- If you don’t pay property taxes, carry homeowner’s insurance, or maintain the condition of your home, your loan may become due and payablemeaning you could lose it to a foreclosure if you don’t pay the loan back.

- You might get a better deal by taking out a regular home equity loan at a lower cost.

- If you take out a reverse mortgage without adding your spouse as a co-borrower , your spouse might have to move out or repay the loan if you die before your spouse.

Do your homework before taking out a reverse mortgage. See the Nolo article Reverse Mortgage Scams, for advice on heading off problems. For more information about reverse mortgages, visit the website of the Consumer Financial Protection Bureau and AARP’s useful articles on reverse mortgages.

You May Like: Do I Have To Refinance To Remove Mortgage Insurance

Be Wary Of Sales Pitches For A Reverse Mortgage

Is a reverse mortgage right for you? Only you can decide what works for your situation. A counselor from an independent government-approved housing counseling agency can help. But a salesperson isnt likely to be the best guide for what works for you. This is especially true if he or she acts like a reverse mortgage is a solution for all your problems, pushes you to take out a loan, or has ideas on how you can spend the money from a reverse mortgage.

For example, some sellers may try to sell you things like home improvement services but then suggest a reverse mortgage as an easy way to pay for them. If you decide you need home improvements, and you think a reverse mortgage is the way to pay for them, shop around before deciding on a particular seller. Your home improvement costs include not only the price of the work being done but also the costs and fees youll pay to get the reverse mortgage.

Some reverse mortgage salespeople might suggest ways to invest the money from your reverse mortgage even pressuring you to buy other financial products, like an annuity or long-term care insurance. Resist that pressure. If you buy those kinds of financial products, you could lose the money you get from your reverse mortgage. You dont have to buy any financial products, services or investment to get a reverse mortgage. In fact, in some situations, its illegal to require you to buy other products to get a reverse mortgage.

Other Taxable Situations With Reverse Mortgages

Taking out a reverse mortgage wont spare you from paying property taxes. You still hold title to your home, so your county or municipal authority will continue to assess property taxes against you personally, not your lender. And not paying them could effectively result in foreclosure. Your lender may call the entire reverse mortgage balance due. Your homes equity secures your loan, and your lender wont want to lose that collateral to your local taxing authority if you dont pay.

Capital gains tax may come due as well if you or your heirs should sell the home to pay off the mortgage. You could owe capital gains tax on the difference between what you initially paid for and invested into the property and the amount of the sale. But that amount would have to be rather significant before a capital gains tax kicks in. The IRS offers a home-sales exclusion if you owned and used your home as your primary residence for at least two of the last five years. You can realize up to $250,000 in gains as of 2022 without paying a tax if youre single, or $500,000 if youre married and file a joint tax return with your spouse.

Read Also: Can You Use Collateral For A Mortgage

You May Like: How Can I Get Qualified For A Mortgage