So Should I Remortgage Now

If your mortgage is approaching expiry, it may be worth locking in for a couple of years now, to shield you from any further rate rises next year.

Many lenders issue offers which last six months, so you can secure a rate now, and take it in May 2023.

These providers include Natwest, Nationwide and Barclays, but remember, thats from the date of offer issue .

There are a few exceptions. Halifax and Santander can go up to six months. These have standardised offer validity lengths based on dates of mortgage deal issue, rather than mortgage offer date.

Smaller or specialist building societies usually offer three to six months, so some will cut off after around 90 days. But many will be open to extending their offer based on your circumstances or for a fee.

If you will be looking to get a mortgage in the coming months, get your documents in order in good time.

Things like your ID being up to date and your address being correct on your bank statements will help avoid delays on your mortgage application. Its also worth checking your credit report for any errors.

Remortgaging with the same lender can save some time, and often doesnt come with fees, but you cant be sure youre getting the best interest rate on the market so shop around.

What Should Homebuyers Do During This Time

In anticipation of possible increases, assessment criteria for mortgages have been based on a rate higher than the one offered. That means that the buyers ability to repay the mortgage has already been verified, even within the context of a higher interest rate. If a buyers financial situation has changed, it would be time to speak to an advisor to help them recalculate.

If the buyer has a fixed-rate mortgage, the payment stays the same until it is renewed. For variable-rate mortgages, on the other hand, the payment amount is also fixed. More interest means the buyer will pay less principal on the mortgage with every payment, meaning that at the end of the term, the balance could be more than initially thought.

It’s also possible to talk to your clients about buying mortgage points, this could be helpful if they have some savings and they do the math on how much they will save over the long term.

In other words, it is important to understand that your financial situation was accounted for even within the context of these rate increases, and not to panic.

In This Post We Look At Whether Mortgage Rates Are Rising In Response To Consecutive Interest Rate Hikes In The Uk

With the BoEs base interest rate now at 3.5%, its significantly higher than before the Covid-19 pandemic.

And as recently as December 2021, interest rates were at their record low of just 0.1%, meaning that in just 12 months weve seen 9 rate hikes in response to rising inflation.

The bank rate is now 35x higher than it was last December – so, what does it mean for your mortgage?

Also Check: What Is A Mortgage Company

Are Mortgage Interest Rates Going Up

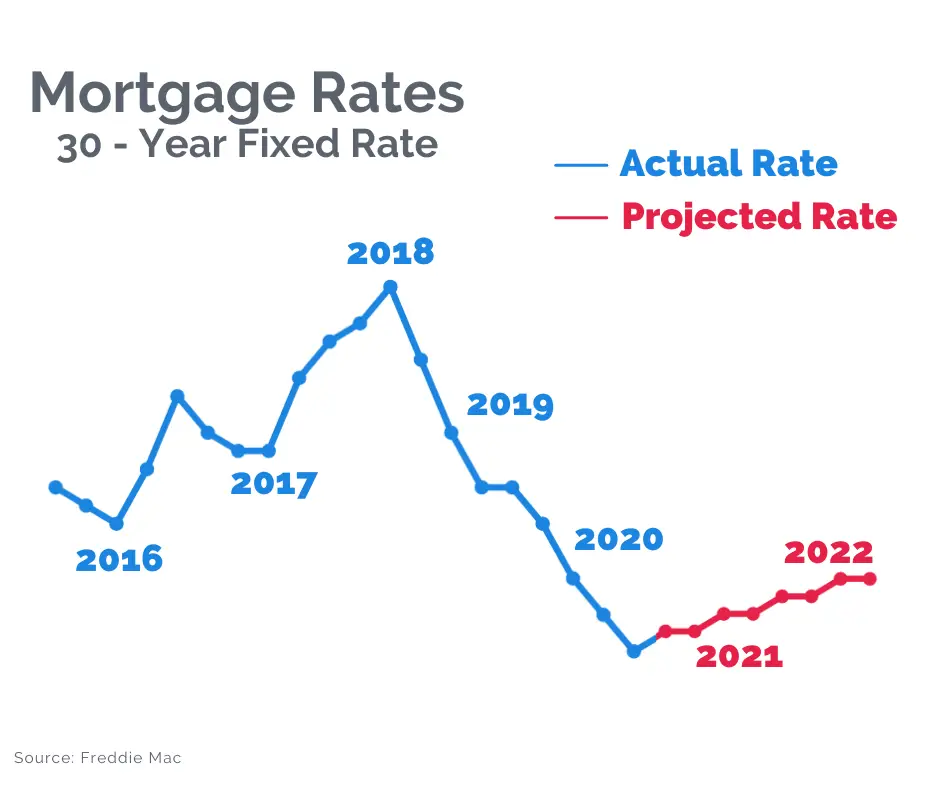

In early 2022, the Fed indicated they may raise the federal funds rate more aggressively in an attempt to control inflation, and theyve since followed through with their word. On September 21, 2022, the Fed hiked interest rates by 3/4 of a percentage point, marking the fifth rate hike in 2022. This rate hike brought the federal funds rate to 3.25%, the highest since 2019. This, in turn, has caused mortgage rates to rise.

So, how can you determine how much the rising federal funds rate is expected to impact your potential mortgage interest rates? Each quarter, Freddie Mac publishes a report with its rate predictions. Freddie Macs Economic & Housing Research Group forecasts what we can expect from interest rates in the coming months. You may want to keep tabs on this report to see what’s potentially coming in the future.

Rapid Increase In Rental Prices

Rents have also increased. With home prices higher, many lower-income people found it more challenging to afford a home. Many middle-class wage earners also were priced out of the hot housing market. Some people that could afford to buy a house decided to keep renting, waiting for home prices to drop. Gen Z is hoping for a real estate crash like the one experienced in 2008.

Also impacting rental prices were previous homeowners who sold their homes in favor of renting. They sold their homes to realize the appreciation and turned to rent for a period until housing prices cooled off before buying again. As more people were forced to or chose to rent, monthly rents increased.

Related to this was the explosion of people and businesses involved in the rental real estate market. Some investors bought homes and rented them out as long-term rentals. Others were buying homes and renting them out as short-term rentals on sites like Airbnb and VRBO. In both cases, the investor’s goals were to profit, which also impacted rent prices.

The good news is that the rental market is slowly returning to normal. Before the pandemic, rents typically increased until the fall before declining for the remainder of the year. However, during the pandemic, rents decreased in the spring of the year as well as the winter, but rents only dropped during one month in 2021.

Recommended Reading: What Happens If You Pay Your Mortgage Twice A Month

Bank Savings: Shop Around

If youve been stashing cash at big banks that have been paying next to nothing in interest for savings accounts and certificates of deposit, dont expect that to change much, McBride said.

Thanks to the big players paltry rates, the national average savings rate is still just 0.16%, up from 0.06% in January, according to Bankrate.coms October 26 weekly survey of large institutions.

But all those Fed rates hikes are starting to have a more significant impact at online banks and credit unions, McBride said. Theyre offering far higher rates with some topping 3% currently and have been increasing them as benchmark rates go higher.

As for certificates of deposit, theres been a noticeable increase in return. The average rate on a one-year credit union CD is 1.05% as of October27, up from 0.14% at the start of the year. But top-yielding one-year CDs now offer as much as 4%.

So shop around. If you make a switch to an online bank or credit union, however, be sure to only choose those that are federally insured.

House Prices Expected To Rise Again In 2023

SYDNEY: Up 8 to 12 per cent

MELBOURNE: Up 2 to 6 per cent

BRISBANE: Up 3 to 7 per cent

ADELAIDE: Up 1 to 4 per cent

PERTH: Up 9 to 13 per cent

HOBART: Up 0 to 4 per cent

CANBERRA: Minus 3 per cent to 2 per cent

DARWIN: Minus 4 per cent to 1 per cent

The 30-day futures market, which bets on interest rates, is also predicting a cash rate peak near that level by August, but no rate cuts until 2024.

Mr Christopher said the end of rate rises, in this monetary policy tightening cycle, would mean a return to house price increases in 2023.

Sydney was expected to see an 8 to 12 per cent increase next year, in a city where house and unit rents during the past year have surged by 28.9 per cent to $711.65.

‘Sydney is expected to lead the recovery,’ Mr Christopher said.

‘This recovery in Sydney will be driven by the surge in underlying demand for residential property as a result of the rise in overseas arrivals, the return to the office, the existing shortage of rental accommodation, the new stamp duty/land tax changes and the expected ongoing strength of the Sydney economy.’

The NSW Coalition government has introduced a policy allowing first-home buyers to pay an annual property tax instead of an upfront stamp duty in the tens of thousands of dollars, but the Labor Opposition has vowed to scrap the policy should it win the March 2023 election.

Perth was expected to see an even bigger 9 to 13 per cent increase.

You May Like: How Do You Calculate Pmi On A Mortgage

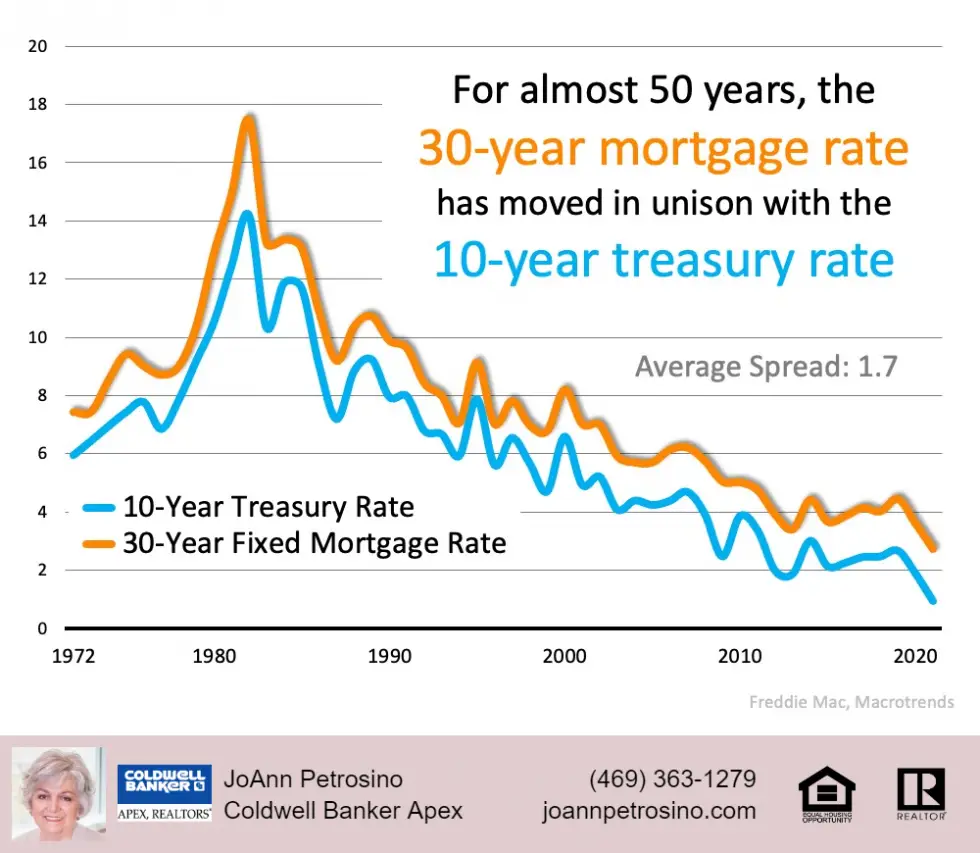

Why Do Mortgage Rates Follow The Yield On The 10

Even though 30-year mortgages can be held for three decades, most people sell their house or refinance within a decade, which means the investor who is receiving the mortgage payments is effectively investing in a 10-year bond.

As a result, the average 30-year fixed rate mortgage interest rate is normally 1 to 2 percentage points higher than the yield on the 10-year Treasury bond.

However, when the economy has more uncertainty than usual, like earlier this year, this spread can get as large as 3 percentage points. This uncertainty can be the result of a potential economic downturn, the possibility of the Fed raising rates more than expected, inflation, Fed balance sheet changes or all of the above as happened in 2022.

Shall I Get A Variable Rate Mortgage

Variable rates are typically a little lower than fixed rates because the borrower takes on the risk of rates changing over time.

Variable rates are expected to remain below 4 per cent well into 2023. That’s pretty low, but it is still possible to lock in a 5-year guaranteed fixed rate pretty close to that rate today. As well, recently economists have been continually revising their forecasts upward. There’s a lot of uncertainty about the future of interest rates.

Read Also: How Do I Make My First Mortgage Payment

What’s Causing Mortgage Rates To Rise

A number of factors caused mortgage interest rates to shoot up in 2022 and these trends seem likely to continue well into 2023.

- Persistent inflation, which was up 8.2% annually at the time of this writing

- Large hikes to the Federal Reserves fed funds rate, with further increases expected in 2023

- Global uncertainty caused by the continued conflict in Ukraine

- Volatility in global and U.S. stock markets

- Recessionary fears and economic uncertainty

- Continued supply chain disruptions and labor shortages

It has been a dismal year for mortgage rates after record lows, with rates now soaring upward to over 7%, says Brandon Boudreau, CEO of Alliance Title.

Inflation has been the main culprit, with the Federal Reserve trying to combat it by raising key interest rates, he explains, adding that geopolitical events can have a strong effect, good or bad when it comes to rate movements.

How Does All This Affect You

Learning about inflation and mortgage rates can help you understand whats happening in the bigger economic picture.

But what does it all means for you? How does inflation affect your own home loan and your current or future mortgage payments?

If youre refinancing, when should you lock a rate?

Choosing when to lock your mortgage rate is always a gamble. You weigh the odds of different scenarios arising and of the different risks and rewards they present.

For example, it usually makes sense to lock your mortgage if you think rates are likely rise. And if you believe rates will full substantially? You might wait.

But theres never a right answer. Because, as we said, theres never any guarantee about how rates will move from one day to the next.

The Mortgage Reports provides advice updated every business day and on Saturdays on what we think may be the smartest move: to lock your rate or to continue to float it.

You can visit that page as a resource, and keep popping back until youre ready to lock.

If youre deciding when to buy a home

Home buyers might be thinking now is a bad time to get into the real estate market.

Mortgage rates were at the time this was written than they were for much of 2020. And home price rises are trending upward, too.

CoreLogic reckons: Home prices nationwide, including distressed sales, increased year over year by 11.3% in March 2021 compared with March 2020 and increased month over month by 2% in March 2021 compared with February 2021.

Also Check: How To Get A Copy Of Mortgage Note

Prequalify Before You Shop

If you’re actively in the market for a home, you will need to get prequalified before you start shopping around. While there are interest rate averages, each bank has its own underwriting guidelines, so your interest rate with each one may vary.

And on a mortgage, each interest point can make a significant difference in your overall amount of interest paid. On the same $300,000 home mentioned above, the difference between a 6% and 6.125% fixed-rate mortgage over 30 years is nearly $9,000 in additional interest.

So if you’re beginning to look at homes, be sure to get prequalified with some of Select’s favorite mortgage lenders:

-

Apply online for personalized rates fixed-rate and adjustable-rate mortgages included

-

Types of loans

Conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, HELOCs, Community Loan and Medical Professional Loan

-

0% if moving forward with a USDA loan

Terms apply.

-

Apply online for personalized rates fixed-rate and adjustable-rate mortgages included

-

Types of loans

Conventional loans, FHA loans, VA loans, DreaMaker loans and Jumbo loans

-

3% if moving forward with a DreaMaker loan

Terms apply.

-

Apply online for personalized rates

-

Types of loans

Conventional loans, FHA loans, VA loans and Jumbo loans

-

Terms

8 29 years, including 15-year and 30-year terms

-

Typically requires a 620 credit score but will consider applicants with a 580 credit score as long as other eligibility criteria are met

-

Minimum down payment

Editorial Note:

Where Will Rates Go In 2023 And Beyond

But a lot will depend on the economic environment and lending competition, as well as decisions made by the BoE.

The pricing of fixed-rate mortgage deals has been edging down recently, and if this continues, we would expect five-year fixes below 4% by early 2023, Mark Harris, of mortgage broker SPF Private Clients, told the i news site.

Lenders could lower rates even further if the base rate peaks at around 4.5% in early 2023, below the 6% initially projected. But even so, rates are likely to remain sticky, said Bloomberg economist Niraj Shah. We may have to get used to a new normal as we are unlikely to see the ultra-low interest rates we had all got used to.

Experts expect the BoE to ease up on the base rate in the second quarter of 2024, Bloomberg reported. That should translate into slightly lower mortgage rates, the website said.

Recommended Reading: What Mortgage Could I Get

What Is Your Forecast For Inflation And Mortgage Rates Over The Next Two Years

As previously mentioned, we believe inflation peaked at 7.3% in the year to June 2022. We expect to see inflation easing from here. Inflation should fall back to within the RBNZââ¬â¢s target band of 1-to-3% late in 2023. Mortgage rates are likely to peak at higher levels in the first half of 2023. And mortgage rates are likely to hold at higher levels well into 2023. By the end of 2023, we expect mortgage rates to start falling again.

Can Banks Adjust Mortgage Rates

Image by assurancemortgage.com

The interest rates that lenders can charge are determined by the best borrowers, and the interest rates that lenders adjust are determined by the riskiest borrowers. Your personal circumstances will determine how best to obtain the best mortgage rate possible, and you have complete control over them.

A buyer can negotiate mortgage rates and other fees with banks and mortgage lenders. The interest rate on a home loan will have a significant impact on your monthly payments and overall loan costs. Before you make an offer, you should first determine what type of loan you are looking for and what terms you want, as well as how the loan will affect your budget. At least one credit union, one national bank, and one online lender are all acceptable options. To assist you in comparing terms and fees, consider the annual percentage rate of each loan. The total cost of the loan, including fees, is calculated as the annual percentage rate . If your lender is willing to lower their interest rates, you will be able to make more money.

The closing costs of a home loan typically range from 2% to 6%. As a result, a $300,000 home would be worth between $6,000 and $18,000. It is possible to save a significant amount of money by negotiating fees in addition to a better mortgage rate.

Don’t Miss: What Is The 30 Year Fha Mortgage Rate

Are Mortgage Rates Going Up

The rate of interest set by the BoE determines two things:

- The amount of interest your bank pays you on your cash savings

- And how much they charge you for money you borrow

Mortgage Advisers at Clifton Private Finance have already seen lenders updating their rates in reaction to the latest few interest hikes mortgage lenders generally calculate the interest rates they offer in line with the BoEs rate.

So, the higher the bank rate, the more expensive your mortgage will be. For more details on how this affects your payments, read our guide on how mortgage interest works.

If you’re looking to remortgage soon, or youre buying a new property, you could be looking at higher interest rates the longer you wait.

How To Shop For A Home Amid High

The advice of Melissa Cohn, the regional vice president of William Raveis Mortgage, is simple: “You marry the house but date the rate.”

This comes from the idea that your home is a long-term purchase, while a mortgage is something you can easily move on from by refinancing. Refinancing a home mortgage is taking your outstanding home debt from one agreement, and moving it to another with more favorable repayment terms. Refinancing is typically done when you have a higher interest rate but lower mortgage rates have become available.

She says to look at the initial mortgage on a home purchase as a “bridge” to better financing later on. She also added that, “It’s highly likely that rates will be lower by the middle of next year and even if that projection misses the mark certainly by the end of 2023 or early 2024.”

So if you’re not particularly happy with the rate you lock in today, consider putting money aside each month for refinancing costs in the near future.

But for those that are on the fence financially when it comes to homeownership, Michele Raneri, TransUnion’s vice president of financial services research and consulting, suggests possibly waiting on the sideline. She gives a great example of what monthly payments will look like on a $300,000 home with a 30-year fixed-rate mortgage, assuming a 20% down payment.

Read Also: What Happens If You Miss A Mortgage Payment