Mortgage Rate Trends: Where Rates Are Headed

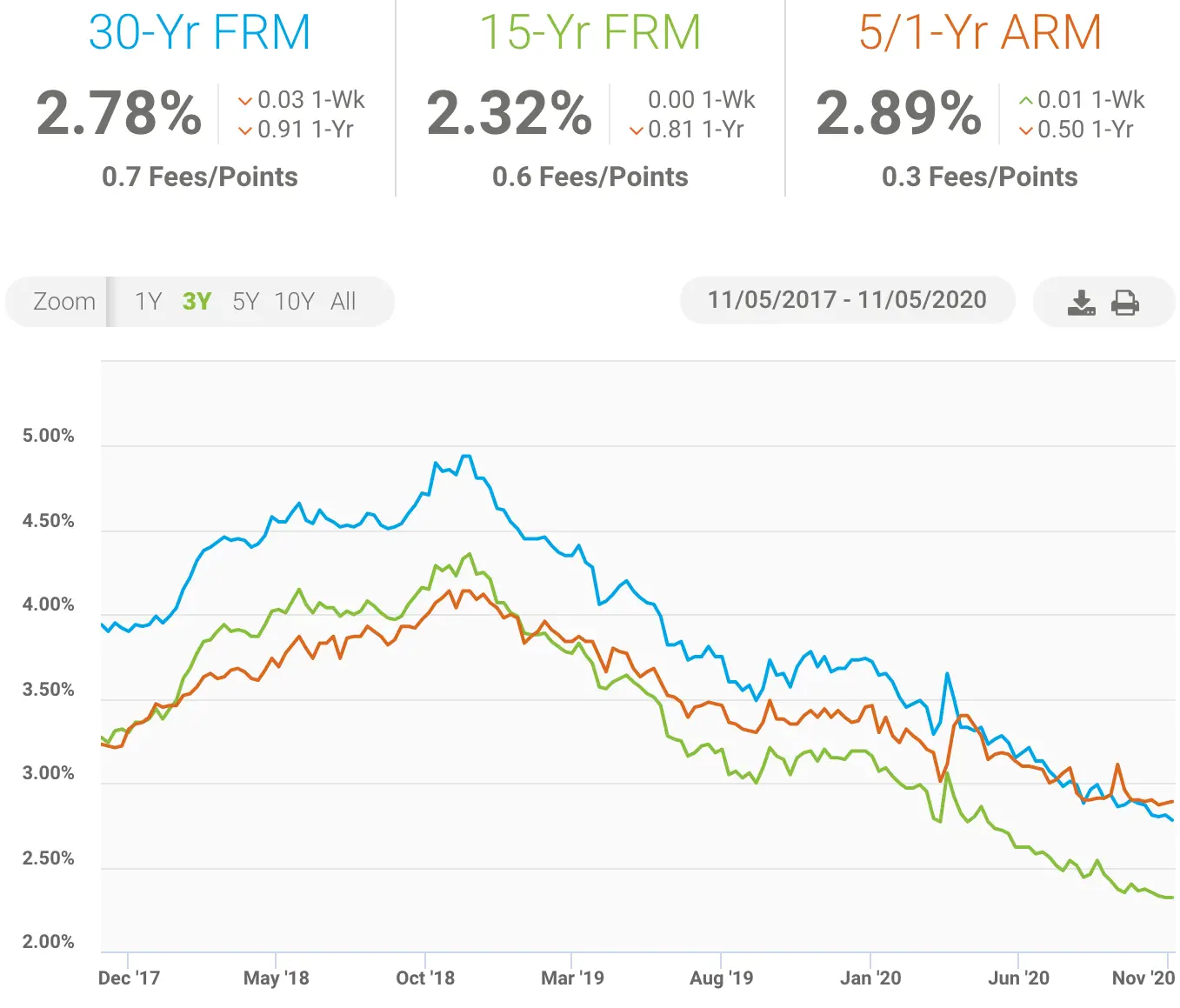

The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and rates have so far risen beyond 7 percent in 2022.

“Low interest rates were the medicine for economic recovery following the financial crisis, but it was a slow recovery so rates never went up very far,” says McBride. “The rebound in the economy, and especially inflation, in the late pandemic stages has been very pronounced, and we now have a backdrop of mortgage rates rising at the fastest pace in decades.”

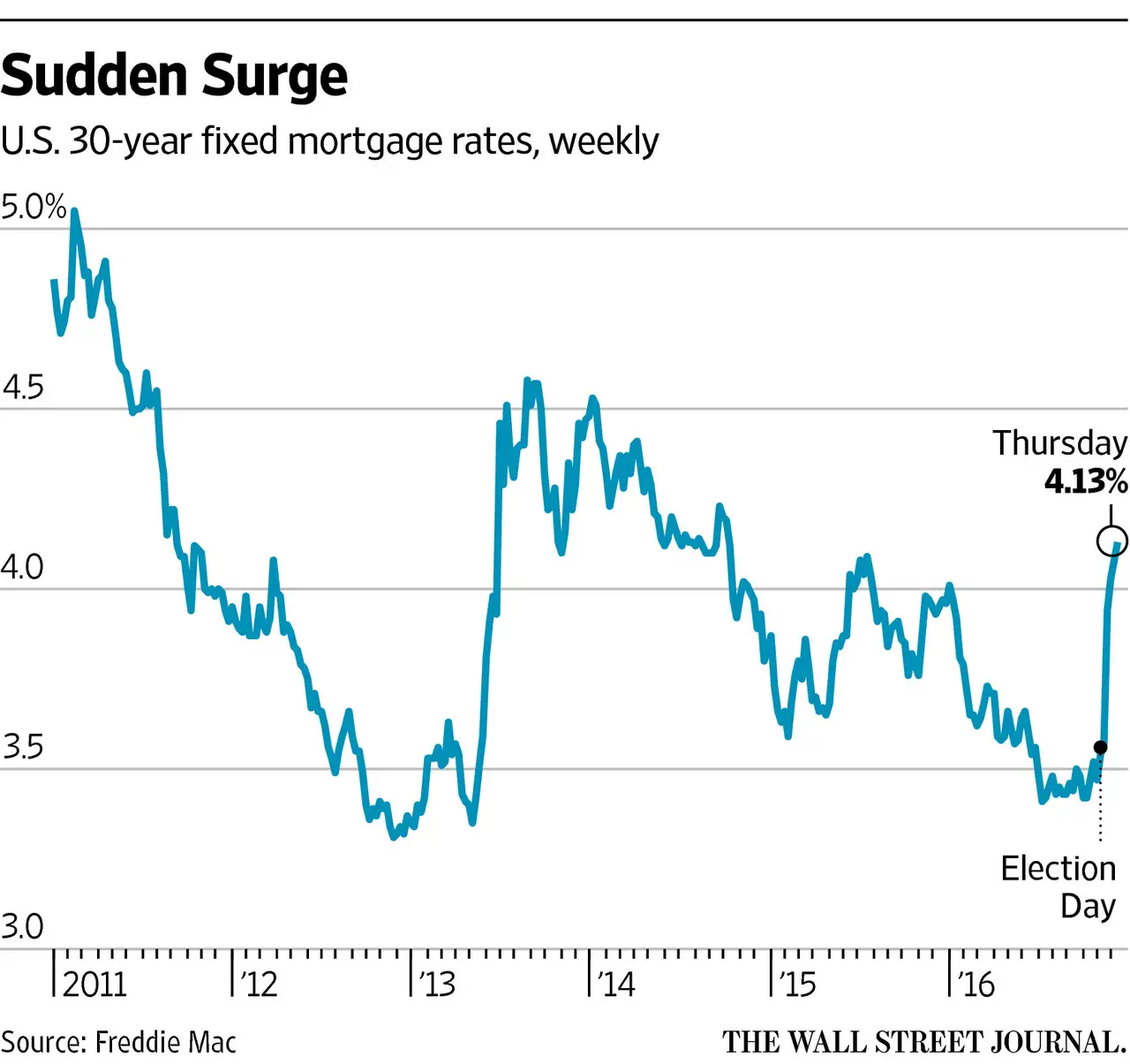

A Look At Mortgage Rates Over Time

After rising sharply throughout 2022, mortgage rates took their largest dip in 41 years on November 17. While current mortgage rates are well above recent levels, theyre still below average from a historical standpoint.

Keep in mind that average mortgage rates are just a benchmark. Borrowers with good credit and strong finances often get mortgage rates well below the industry norm. So rather than looking only at average rates, its worth taking the time to get a personalized estimate and see what you qualify for.

In this article

Uk Mortgages: Average Rate On A Two

Governments 45p tax U-turn and calmer stock markets do not result in cheaper new mortgage deals

The average rate on a two-year fixed mortgage has jumped to just under 6%, according to data released on Tuesday, dashing hopes that UK government efforts to calm the financial markets might ease the cost of home loans.

Amid warnings from brokers that 95% mortgages could be the next casualty of the financial uncertainty triggered by Kwasi Kwartengs mini-budget, research firm Moneyfacts said the average new two-year fixed rate jumped to 5.97% on Tuesday, having already risen to 5.75% on Monday.

Lenders effectively pulled down the shutters after the market turbulence caused by the 23 September mini-budget, withdrawing 40% of deals last week. Many of the biggest lenders have now re-entered, with Nationwide, NatWest, Barclays, Virgin Money and Skipton returning with new offers.

While there had been hopes in some quarters that the governments 45p tax U-turn on Monday and the slightly calmer market conditions that have followed, might translate into slightly cheaper new mortgage deals, so far the opposite has happened.

Data shared with the Guardian shows that the total number of new 95% mortgage products available has fallen to 129 less than half the number on sale on the day of the mini-budget, because of fears homeowners could end up in negative equity if house prices were to fall by 10% or more.

But he added: Rates are inflated at the moment.

Read Also: What Is The Current Prime Mortgage Interest Rate

Current 30 Year Mortgage Refinance Rate Moves Higher +015%

The average 30-year fixed-refinance rate is 6.60 percent, up 15 basis points compared with a week ago. A month ago, the average rate on a 30-year fixed refinance was higher, at 6.77 percent.

At the current average rate, you’ll pay $638.66 per month in principal and interest for every $100,000 you borrow. That’s up $9.88 from what it would have been last week.

Refinancing Into A 15

If you have a 30-year mortgage and are more than halfway through your loan term, refinancing into a 15-year loan with a lower rate can save you thousands in interest. In general, 15-year mortgages have higher monthly payments due to the shorter term but, depending on how much lower you can cut your rate and the balance of your current loan, your monthly payment might not increase as much as you think it will, or at all.

Whichever type of refinance you pursue, be sure to shop around for rates and compare offers, including lender fees.

Read more about how to refinance your mortgage.

Jeff Ostrowski covers mortgages and the housing market. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal.

You May Like: How Do You Buy Points On A Mortgage

When Should I Lock My Mortgage Rate

Its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, ask your lender for a float down. With this option, you get the lower of the two rates. Pay attention to the fine print, though. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

Key Mortgage Terms Explained

We know that when it comes to choosing a mortgage, there’s a lot of jargon to get your head around. That’s why we’ve listed some common mortgage terms here.

Loan-to-value

This represents the percentage of the property value you want to borrow. For example, a £100,000 property with an £80,000 mortgage would be an 80% LTV. The maximum LTV we’ll lend you depends on your individual situation, the property, the loan you choose and the amount you borrow.

Initial interest rate This is the initial percentage rate at which we calculate the interest on the mortgage.

Variable rateWhen your initial mortgage rate ends, the interest on your mortgage will be calculated using the HSBC Standard Variable Rate or HSBC Buy to Let Variable rate. This will vary over the term of the loan and is set internally. HSBC Standard Variable Rate and HSBC Buy to Let Variable Rate do not track the Bank of England base rate.

Initial interest rate period This is the period during which the fixed or tracker rate applies. For fixed and tracker rate mortgages, when the specified period expires, the rate will revert to the HSBC Standard Variable Rate/Buy-to-let Variable Rate.

Annual Percentage Rate of Charge The APRC represents the overall cost for comparison and can be used to compare mortgages.

Booking feeA fee charged on some mortgages to secure a particular mortgage deal.

Annual overpayment allowance

Recommended Reading: Are Online Mortgage Calculators Accurate

Is It Worth Refinancing To A 15

You can save money and build home equity faster with a 15-year mortgage than with a 30-year mortgage. But the monthly mortgage payment will be higher on a 15-year mortgage because there is less time to pay off the loan.

Its worth comparing 15-year mortgage rates if youll be able to afford the monthly payments and still have enough money for other needs, such as saving for retirement.

Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

When you compare 15-year refinancing offers using the Loan Estimates you receive from lenders, youll feel confident when you identify the offer that has the best combination of rate and fees.

Can I Get A Mortgage With Bad Credit

- Poor: 579 or less

- Very good: 740 to 799

- Exceptional: 800 or more

To qualify for a conventional loan one thats not backed by any government agency youll usually need a fair credit score of at least 620. But its possible to qualify for FHA loans, which are insured by the Federal Housing Administration, with a poor credit score as low as 500.

And Veterans Administration loans, which are for veterans, active-duty service members and their spouses, have no minimum credit score requirements. USDA loans, which help very low-income Americans buy in certain rural areas, also have no minimum credit score requirements.

If youre trying to find the right mortgage rate, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. Hes been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.

Recommended Reading: How Fast To Get Pre Approved For Mortgage

What Are Points On A Mortgage Rate

Mortgage points represent a percentage of an underlying loan amountâone point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when theyâre initially offered the mortgage.For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Itâs important to understand that buying points does not help you build equity in a propertyâyou simply save money on interest.

What Are Mortgage Points

Also known as discount points, this is a one-time fee or prepaid interest borrowers purchase to lower the interest rate for their mortgage. Each discount point costs one percent of your mortgage amount, or $1,000 for every $100,000 and will lower the rate by a quarter of a percent, or 0.25. For example, if the interest rate is 4 percent, purchasing one mortgage point will reduce the rate to 3.75 percent.

Recommended Reading: Is Freedom Mortgage A Bank

Someone Moving In Less Than 10 Years

A 30-year term with a fixed rate buys you security and predictability over three decades. But suppose you dont need all that time, because you know youll be moving on in ten years or fewer.

In this case, you might be better off with an adjustable-rate mortgage .

Adjustable-rate mortgages typically come in 3 forms: the 5/1, 7/1, and 10/1 ARM. All have 30-year terms, but the first number refers to the amount of time your interest rate is fixed.

If youre certain youll be moving before that fixed-rate period ends, you could opt for an ARM and enjoy the introductory rate it offers which is usually significantly lower than 30-year mortgage rates.

Your Fixed Mortgage Rate Source

There are many things to consider when buying a home in Canada, not the least of which is the loan term and type that you will need to pay for your home. The fixed-rate mortgage may indeed be the best choice for you, but there are many other mortgage options. We want to help you make the right mortgage choice, so choose the best rate on this page or fill out the online mortgage application form for more information on Canadian mortgage rates and all of the possibilities for home loan financing in Canada.

Don’t Miss: What Are 30 Year Mortgage Rates

How Do I Choose The Best Mortgage Lender

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees vary, but the quality of service as well. Regardless of what lender you end up working with, its important to find someone that can help your individual challenges. For example, if youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

To find a trusted lender, you can look at online reviews, or even better, ask around. Your real estate agent and friends who recently purchased a home are great sources for mortgage lender recommendations. Try comparing a variety of different mortgage lenders. The best mortgage lender for you may be a bank, credit union, mortgage broker, or an online mortgage lender, depending on your situation.

What Is A Good Mortgage Interest Rate

In general, you can consider a good mortgage rate to be the average rate in your state or below. This will vary depending on your credit score better scores tend to get better mortgage rates. Overall, a good mortgage rate will vary from person to person, depending on their financial situation. In 2020, the US saw record-low mortgage rates across the board that continued into 2021. But rates have increased significantly since then.

Read Also: How To Apply For Mortgage Assistance

How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 6.5% right now.

Recommended Reading: Are Cash Out Mortgage Rates Higher

What Is A Mortgage Rate Lock

A mortgage rate lock means that your interest rate won’t change between the day your rate is locked and closing as long as you close within the specified timeframe of the rate lock, and there are no changes to your application. If your interest rate is locked, your rate won’t change as a result of market fluctuations, but it can still change if there are changes in your application – such as your loan amount, credit score or verified income.

First Home Loan Program

If youre a first-time homebuyer or havent owned a home in the past three years, you may qualify for a low-interest, fixed-rate mortgage through Maine Housing. Maine Housing mortgages have low- or no-down payment options. Eligible properties include single-family homes, condos, owner-occupied apartments with two to four units and some mobile homes.

Household income limits apply , and a minimum credit score of 640 is required.

Read Also: How Long Does It Take To Get A Mortgage Commitment

Home Buyers With A Lot Of Monthly Income

If you have plenty of cash left over every month, you may be able to afford the higher payments that come with a shorter-term mortgage.

Opting for a shorter term could save you a bundle, because it means you pay less interest.

Instead of borrowing over 30 years, youd be borrowing for 20, 15, 10 or even fewer. And the less time you pay interest, the more you save.

The same benefits apply when refinancing to a 15-year term instead of a new 30-year term.

Intrigued? Run your figures through The Mortgage Reports mortgage calculator.

Youll notice the payments for a 15-year loan are much higher. But you may be shocked by how much interest youd save.

How Do Lenders Calculate My Dti

At a minimum, lenders will total up all the monthly debt payments youâll be making for at least the next 10 months Sometimes they will even include debts youâre only paying for a few more months if those payments significantly affect how much monthly mortgage payment you can afford.

Lenders primarily look at your DTI ratio. There are two types of DTI: front-end and back-end.

Front end only includes your housing payment. Lenders usually donât want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance. For example, if your total monthly income is $7,000, then your housing payment shouldnât be more than $2,170 to $2,520.

Back-end DTI adds your existing debts to your proposed mortgage payment. Lenders want this DTI to be no higher than 41% to 50%. Letâs say your car payment, credit card payment and student loan payment add up to $1,050 per month. Thatâs 15% of your income. Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450.

Also Check: How Does Making Extra Payments On Mortgage Work

Fixed Or Variable Mortgage Which Is Best

Choosing between a fixed and variable deal can be a tough decision. Variable and tracker mortgages may be cheaper than fixes right now but will leave you at the mercy of interest rate rises. If youre considering a variable rate deal while you see what happens with fixed rate mortgages, look for one with no early repayment charge. By contrast, with fixed deals, youll know what your monthly repayments will be for the duration of the fixed rate period.

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

Also Check: What Is The 30 Year Fha Mortgage Rate