Home Buyers Should Shop Around For Lenders And Loans

Different lenders offer different types of loans, which come with different interest rates and terms, so buyers should talk to more than one lender. Lenders assess buyers entire financial situation, determine whether and how clients can improve their profile, and figure out which programs benefit them most.

Its amazing what a great lender can do, said real estate broker Barnshaw. Theyre like a magician.

Sharpe said a good lender should offer a menu of different programs based on a buyers qualifications. Lenders recommend that buyers ask for and consider all their options.

For example, although 30-year fixed-rate mortgages are most popular, adjustable-rate mortgages have grown in popularity as rates have climbed from historic lows early in the pandemic. Homeowners pay an initial interest rate that is typically lower than for a fixed-rate loan. After a certain number of years, the rate periodically adjusts based on economic conditions.

Buydown programs also have become more popular. Sellers contribute money at closing, and buyers pay lower interest rates for the first year or years. For example, if a buyer purchases with a 30-year, 3-2-1 buydown mortgage at a 6.99% rate, the rate the first year would be 3.99%, then 4.99% for the second year, 5.99% for the third, and 6.99% for the remaining years.

These programs can be especially attractive for buyers who will have higher incomes in the next few years.

How To Remove A Name From A Joint Mortgage

Although most homes are purchased using mortgage loans, few borrowers completely understand the details involved with adding and subtracting owners from the mortgage or deed. Situations like marriages and divorces can prompt borrowers to want to change the names on their mortgages, but the situations in which banks will allow you to modify your deed or mortgage are very limited.

How The Limits Work

There are 2 types of limit:

- Loan-to-value is based on the ratio of the size of the loan to the value of the home you want to buy

- Loan-to-income is based on ratio of the size of the loan to the income of the borrower

In general, you will have to meet both of these limits for your mortgage tomeet the Central Banks requirements. The lender must also assess each loanapplication on a case-by-case basis see Assessment by the lenderbelow. The regulations do allow lenders to be flexible in some cases seebelow.

You May Like: What Do Lenders Check For Mortgage

Whose Names Go On The Mortgage

Additional applicants can add strength to a mortgage loan application. This is especially true if you do not have enough income or hold too much debt to support the payments. To add someone as an applicant, however, they have to have an interest in the property as a co-borrower. If not, the best they can be is a co-signer.

TL DR

There’s not a legal limit to the number of names on a mortgage as long as each borrower qualifies, but not all lenders will underwrite a multiple-applicant mortgage.

How Many People Can Get An Fha Loan Together

Related Articles

The Federal Housing Administration has lower credit score and down payment requirements than conventional loans require. The FHA insures loans made by approved lenders, and the lender can decide the maximum number of loan applicants for a single loan, as FHA does not specify it. The FHA has helped millions of borrowers of modest means to buy and refinance home loans. FHA-insured loans are known for flexible underwriting guidelines.

Don’t Miss: What Would The Payment Be On A 100 000 Mortgage

Why Would Someone Want To Include More Than One Name On A Mortgage Unless They Are Married

There are a few reasons that borrowers may want to include more than one name on a mortgage when they are applying for funding to purchase a home

Applying with a co-borrower might make it easier to get approval on a loan if the co-borrower has great credit and a steady income. It can help strengthen the loan application and make it appear that you are less of a risk to loan money to which increases your chances of loan approval.

Applying for a mortgage loan with a co-borrower allows you to put the other persons name on the title as well. This is very important if you plan to jointly own the home.

Something important to remember: any borrower on the loan is wholly responsible for loan payments if the other borrower stops paying for their part of the loan payment and must continue to pay each payment on time to avoid damage to their credit or losing the property.

How Many Mortgages Can You Have On One Property

There is technically no legal limit to the number of mortgages you can have on a single property, however, most lenders will extend a maximum of 2-4 HELOCs or mortgages on a single property.

The reason some people have more than one mortgage on a single property is in order to tap into the equity of the home to make repairs, use the cash to pay off additional debt, or other financial reasons.

You May Like: What Is Rocket Mortgage Interest Rate

Get Everything In Writing

Get an agreement in writing that includes everything from dealing with disagreements to plans for eventually selling the property, said Whyte.

What happens when you want to sell the house? Is there first right of refusal?

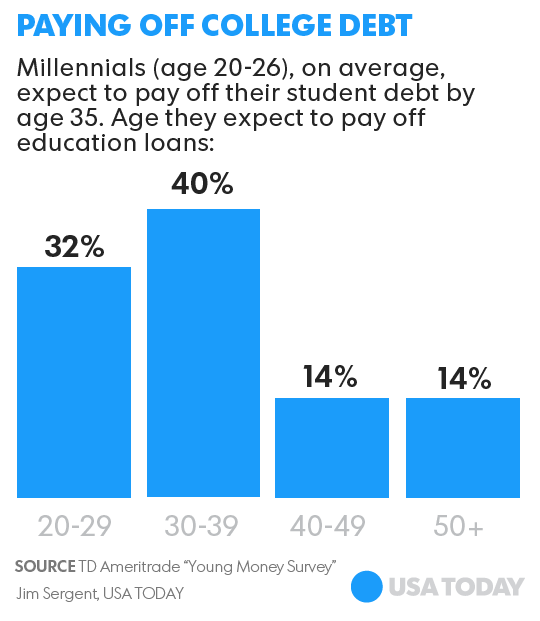

READ MORE: Numbers show its harder for millennials to buy a home than it was for their parents

Should relationships fall apart or one person wants to get out of the mortgage, what are you going to do?

Even with the best intentions, sometimes things dont work out and it could be for unforeseen circumstances so youve got to protect all parties as fairly and equitable as possible, said Whyte.

Be prepared for things to get messy, said Laird.

Whatever the nature of the relationship was entering, when you mix business and money with friendships and family then youre risking those relationships for sure.

A Joint Mortgage Doesn’t Mean Joint Ownership

As mentioned before, just because both parties are on a loan doesn’t mean they own equal shares of the property. Unless they are joint tenants/have full joint ownership, it’s likely that only one of the borrowers in a joint mortgage has their name on the actual house title.

Explore your mortgage options.

You May Like: How To Add A Name To A Mortgage

How To Buy A House With Multiple Owners

When you think of more than one name on a mortgage application, you probably assume its a married couple. However, there are lots of other people who enter into buying a home together siblings, parents and their children, extended family, non-married couples, and even friends. This is known in the industry as a joint mortgage.

On the positive side, sharing the burden of a home loan can make homeownership accessible to those for whom it might not be possible alone. However, making a big commitment as complex as sharing a home and a mortgage means you have a long-standing financial obligation to each other, so you want to be certain that you are fully prepared before entering a joint mortgage.

We connected with Mike Venable, head of underwriting at TD Bank for his thoughts on home sharing to help you decide if its an option worth exploring. Plus, we will outline some best practices when learning how to buy a house with multiple owners.

How Can You Protect Yourself As A Co

Before you agree to apply for a mortgage with other people it is a good idea to make sure you know all that you can and your options for protecting yourself. It is a good idea to consult with a business or real estate attorney to help explain your options, your risks, and your responsibilities in becoming a co-borrower on the loan.

If you are becoming a co-borrower in an investment property with friends or family members forming an LLC can help protect members from liability if there is a dispute or lawsuit in regards to the investment property or if someone stops paying their portion of the mortgage payments and wants to sell the property when you want to retain it. If you are forming an LLC after getting preapproval on a mortgage it is a good idea to see if forming this LLC will inhibit your ability to qualify for the mortgage that you were seeking as some lenders will see this as a deal-breaker for final approval.

For more information on your mortgage options in Mission Viejo and surrounding areas please contact me any time.

You May Like: How Much Mortgage Can I Afford Nerdwallet

You May Like: Is A Mortgage Pre Approval A Soft Inquiry

Which Credit Score Is Used For A Joint Mortgage

When individuals apply for joint mortgages, the lender looks at the of all applicants. Since your credit score impacts your mortgage rates, you’ll want to make sure you and all co-borrowers have done everything you can to improve your credit before borrowing.

Lenders may be more willing to lend to a bad-credit borrower if the other borrower have good credit. However, they’ll still consider it to be a riskier loan. One borrower’s bad credit could affect both your ability to secure a loan and the rate you are offered.

How Many People Can Be On A Home Loan

Home loans are also associated with many big terms one should learn about first like any other loan. The most common question asked about home loans is how many names can be on a loan. Its natural to assume that a mortgage application with more than one name is for a married couple. In addition to siblings, parents and children, extended families, non-married couples, and even friends, there are other people who purchase a home together. These people are referred to as joint mortgages.

Also Check: What Is The Current Trend In Mortgage Rates

How Many People Can Be On A Single Mortgage

There is no legal limit as to how many people can be on a single mortgage, however, your lender may have their own limits in place. Its worth noting that if multiple people going to be on the mortgage, they each have to qualify in order for it to be approved.

Most traditional lenders permit a maximum of 2 people on a single mortgage which tends to be married people. There are lenders that will permit more but they may have additional underwriting requirements.

Whose Credit Score Is Used On A Joint Mortgage

When you get a joint mortgage, your lender will look at the credit history and credit scores of all applicants that will be on the loan. Since everyone’s credit will impact the loan you qualify for, it can be detrimental if you or the person you’re applying with has a poor credit score.

If you or your co-borrower’s is making getting a joint mortgage difficult, remember that there are always other options. You may still be able to qualify for joint ownership, which won’t put the borrower with poor credit’s name on the loan but will grant them legal ownership of the property alongside the other borrower involved.

Also Check: Will Mortgage Rates Keep Dropping

Getting Out Of A Joint Mortgage

Getting out of a joint mortgage isnt always simple.

In order to approve this, a mortgage lender will need to be convinced that the remaining owners of the property can still afford the mortgage repayments.

Theyll be put through the same financial and credit checks as would happen during a remortgage.

If the remaining owners cant agree new mortgage terms, their options are:

- Keep the departing owner on the deeds

- Remortgage with a different lender

The process can be particularly complicated when two spouses are divorcing, as their future financial situations are likely to be unclear. Often, lenders will refuse to remove a departing spouse from the property deeds until the financial settlement from the divorce is finalised.

How Many People Can Buy A House Together

In general, up to four people can jointly own the property, and banks lend mortgages to up to four individuals for a property. You can borrow with someone with a regular income as it increases affordability to buy expensive property. Applying for a mortgage jointly defrays the increased cost of monthly payments and equally spreads the responsibility.

Read Also: How Much Money Do I Need To Get A Mortgage

The Advantages Of Applying With Multiple Lenders

Fact: Nearly one out of four home purchase applications are denied.

If 25 percent of mortgage applications are turned down, a little insurance could translate to a lot of peace of mind. This is especially true if you have less-than-perfect credit.

Another reason to shop around is that mortgage programs, closing costs, interest rates and service can vary significantly from one lender to the next. Obtaining more than one loan approval allows you to test the waters with lenders on these variables.

It doesnt hurt to tell lenders that you are shopping around. In fact, you should tell them.

Mortgage competition is alive and well in our current economy. If you are at good credit risk, lenders may be more likely to compete for your business.

Informing lenders that youre shopping and comparing will typically result in the lender being more inclined to put their best foot forward from the very beginning.

How To Protect Yourself

Before you agree to a mortgage with other people, protect yourself and consult with a business or real estate attorney who can explain your options and outline the risks you face.

Contact an attorney to work out what type of entity is going to take title to the property. This could be an LLC, a corporation, a trust or a partnership, says Jim Finn, an attorney at Clark, Hunt, Ahern & Embry in Cambridge, Massachusetts. Once you decide what would work best for your particular situation, then the attorney can draft the legal documents.

If youre going in on an investment property with a few friends or family members, forming an LLC can protect members from liability if theres a dispute or lawsuit, or someone stops paying the mortgage or wants to sell the property.

If its an investment, I would suggest they do an LLC because thats going to give them insulation from personal liability, Finn says. They would have an operating agreement which would spell out how theyre going to split proceeds and share costs.

Before you form an LLC, however, make sure your lender is open to giving mortgages to LLCs or similar entities, Finn says.

Some lenders do not want trusts or LLCs to be on the mortgage they want individuals, Finn says.

Also Check: What Credit Score Do You Need For A Mortgage Loan

Leaving A Joint Mortgage

Circumstances can change and there could be instances when one party wants to leave a joint mortgage, or a partner passes away.

If the person you have a joint mortgage with dies and you were joint tenants, then as the surviving partner, you inherit their share of the property. If theres no life policy in place to cover the mortgage debt, then youll be responsible for the remaining mortgage repayments.

You may need to remortgage or sell the home if you cant afford the repayments on your own.

If you split up with your spouse or partner, then there are a few options.

You could sell the property and divide the proceeds.

Or, if you can afford the repayments on your own, you could choose to stay in the property and buy out your partner. Youll need to contact your lender and theyll want to do an affordability check to be sure your income is adequate to keep up with the repayments.

If someone wants to leave a joint mortgage where you have a tenancy in common and cant agree on how the house value should be divided, you may have to go to court, which can be extremely costly.

If the remaining mortgage holder/s intend to stay in the property, a remortgage may be necessary to cover the cost of the outgoing borrowers share of the mortgage.

Talk To A Real Estate Attorney

![American Debt Statistics [ Updated March 2021] Shift Processing American Debt Statistics [ Updated March 2021] Shift Processing](https://www.mortgageinfoguide.com/wp-content/uploads/american-debt-statistics-updated-march-2021-shift-processing.jpeg)

Before jumping into co-ownership, talking to a real estate attorney is a smart move. You and your co-borrowers can work out potential legal issues ahead of time to avoid a messy situation later on.

Specifically, you should discuss title options, division of shares, and the process to pursue if an owner wants to leave the arrangement. Additionally, you may want to discuss what would happen if someone could not keep up their end of the bargain.

Recommended Reading: How Do You Sell A House That Has A Mortgage

A Lack Of Research Can Cost Homebuyers Thousands Of Dollars

Westend61 / Getty Images

Recent research by Zillow Home Loans suggests that just 13% of prospective homebuyers shop around for a mortgage before applying. In fact, people spend more time researching vehicles and vacation destinations than they do a home loan.

This lack of research could be costing mortgage borrowers thousands of dollars. It has always been important to shop around for the best mortgage deal, and to understand how to improve your credit score before applying. But at a time when mortgage rates are at record highs, its more important than ever.

- Recent research by Zillow Home Loans suggests that just 13% of prospective homebuyers shop around for a mortgage before applying.

- 30% of prospective homebuyers in Zillows survey said they feared that making multiple mortgage applications would adversely affect their credit score. It generally wont

- Paying down existing debts, paying your bills on time, and regularly reviewing your credit report to spot errors can all increase your credit score, and ultimately reduce the cost of your mortgage.