Average Mortgage Interest Rate By Type

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

- Rocket Mortgage by Quicken Loans

- AmeriSave Mortgage Corporation Mortgages

Here’s how these three types of mortgage interest rates stack up:

| Mortgage type |

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rates and an annual percentage rate . Thats understandable since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a $300,000 loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

Is Now A Good Time To Refinance Your Mortgage

Refinancing your mortgage can provide a lot of advantages, from lower monthly payments to being able to take equity out of your home for major repairs or unexpected expenses. With interest rates currently averaging 2.78%, its a great time to reevaluate your home loan and see if a refi is the right option for you.

Ever since the pandemic hit and mortgage rates crashed, homeowners have flocked to mortgage lenders looking for a loan refinance. Applications for refis made up 65% of all home loan requests for the week ending July 16, according to the Mortgage Bankers Association. In fact, refinance applications have made up at least 60% of all loan originations for more than a year.

While plenty of homeowners have already taken advantage of the opportunity provided by low-interest rates, there are many more who stand to benefit from a mortgage refinance. As of late June, there were 12.2 million homeowners who can qualify for a meaningfully lower interest rate on their home loans and save an aggregate of $3.4 billion in monthly payments, according to data analytics firm Black Knight.

With the potential to save hundreds of dollars on your monthly payments, it makes sense to at the very least check out your mortgage refinance options.

Don’t Miss: How To Calculate House Mortgage Payment

Mortgage Rate Just Jumped From 269 To 325 Should I Lock In Now Or Hope For Drop Before Close

A little over a month ago, my wife and I went under contract to buy a $500K townhome . At the time, we were quoted a 2.625% mortgage, but couldn’t lock it in because the home is still being built and they didn’t have a completion/close date yet. Still don’t, but we were just told it will before the end of April. So we can go ahead and lock in our rate. Rate just went up to 3.25% today, which puts us very close to our spending cap. I’m leaning towards locking it because if it goes up much more, I’m not sure we can afford the place. But I’m going to kick myself if rates start falling.

Also, more than a little chapped that we missed out on the 2.65 rate because the builder couldn’t give us a closing date in a timely manner.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Read Also: How Do You Prequalify For A Mortgage

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

The Lender Says 325% Is What Rates Are At 30 Years Fixed But I Look Online And See Them Cheaper

Hi –

First-time home buyer 715k , 15% down 10k closing costs and my lender says we got a great rate at 3.25%. Then I spoke with a friend who says his lender is getting him between 2.75-2.9% . I mean I know things are different for everyone but my wife and my credit score together are in the 780’s. When I search online it says the national average on google are around 3.226% APR.

Then when I go on Bankrate or sites like this:

I see others are in the 2.7 range – am I missing something? My lender let me know that rates went up – but google says they went down .11 from last week. Am I just seeing a search bias? My lender works for one of the largest lenders in the US, and is a great guy, and anytime I reach out he lets me know it’s not true, the bond market got hit hard, rates are going up and we got a great deal. Before we started escrow on 10/28th I had 2 other lenders that were offering 3.25 as well – So I felt good about it. Am I overreacting or am I missing something? I meant even if we got 2.9% that .25% does help over 30 years.

Don’t Miss: Should I Get A 30 Or 15 Year Mortgage

Finding The Best Mortgage Rate

Read on to discover how to find the best mortgage rate for you

Everyone is looking to get the lowest mortgage possible but how exactly does one go about performing this small miracle? What does a good mortgage even look like? And how are you supposed to know if you have found one?

These are difficult questions to answer because a good mortgage for one person is different from a good mortgage for another person. The answer could be 3.25% for one buyer, but 4.25% for another buyer on the very same day.

The most important question is how to find the best rate for you. The process involves speaking with a few lenders and getting their estimates. The average rates you calculate are what a good mortgage will look like for you.

Summary Of Current Mortgage Rates

Mortgage rates were higher this week

- The current rate for a 30-year fixed-rate mortgage is 5.89% with 0.7 points paid, an increase of 0.23 percentage points from a week ago. This week last year, the 30-year rate averaged 2.88%.

- The current rate for a 15-year fixed-rate mortgage is 5.16% with 0.8 points paid, 0.18 percentage points higher week-over-week. The 15-year rate averaged 2.19% a year ago this week.

- The current rate on a 5/1 adjustable-rate mortgage is 4.64% with 0.4 points paid, up by 0.13 percentage points from a week ago. The average rate on a 5/1 ARM was 2.42% this week a year ago.

Read Also: How Long Does A Mortgage Refinance Take

Why Mortgage Rates Are Not As Low As You Think They Are See The Latest Trend In Sonoma County Mortgage Rates And How To Lock In Your Best Loan Program Get Prequalified Online Today

So is it true 30 year mortgage rates are at 3.25%? Well that depends on how you look at. The answer is yes if you willing to invest discount points to purchase your interest rate down, so long as your financial profile is completely flawless. Otherwise for the 99.9% us, 30 year mortgages are trailing between 3.5% to 4.25%. Thats been the reality of the mortgage bond market over the last few weeks since the 30 year fixed rate mortgage hit an all-time record of 3.53% on July 19, 2012.

30 year mortgage rates you see on television and the internet are not the best barometer of where rates truly are

Heres why: the bond market is moving all day long in multiple different directions based on how trades are being executed on Wall Street. Once the news hits the media, the information is immediately outdated and new information is regurgitated through the system, making such commodities as a 30 year mortgage rates, yesterdays information. Yesterdays information does not help you lock in an interest rate. That said, 30 year fixed-rate mortgages are still quite low and its a matter of locking a rate based on a favorable lock day.

Look At An Interest Rate And Apr

Most borrowers are focused on interest rates and this is important. But the APR that you will pay on this loan is just as important or even more important than that basic interest rate.

The annual percentage rate takes all the costs of borrowing the cash and spreads them out across the lifetime of your loan. But the can tell you a lot about what you are paying for this loan.

You must remember that the APR assumes that you will be abiding by the terms of the contract and loan plan until the end of the term. Most borrowers do not do this, typically they will sell or refinance before the mortgage term ends.

So, compare APR, but also remember that this is not all you will pay. You can find more information on how to compare APR to interest rates here.

Read Also: Can You Be A Mortgage Broker Part Time

What Is A Good Mortgage Interest Rate

Mortgage rates are typically based on the prime rate. The prime rate set on March 16, 2020, for example, was 3.25%. That rate for a mortgage right now would be considered a good mortgage interest rate.

However, if a lender is using the prime rate as an index, it would add on fractions of percentage points or more based on factors in your specific credit profile. Those factors can include your credit, how much you are borrowing, the value of the home, and other data.

The prime rateand mortgage rates in generalcan rise or fall on average for many reasons. At one point during the COVID-19 pandemic, for example, the Federal Reserve lowered the federal funds rate to 0 to 0.25%, which could have impacted mortgage loans issued during that time.

The Consumer Financial Protection Bureau provides a tool that lets you explore what the average lender is offering at various times. You enter a credit score range, state, home price, down payment amount, and terms of the loan. The CFPB uses its database of lenders to let you know what rates banks are offering on those loans at that time.

How To Find The Best Mortgage Rate For You

Different lenders will look at your financial circumstances in different ways.

For example, a lender that specializes in FHA loans will rarely raise an eyebrow if your credit score is in the 580 to 620 range. But one that caters to super-prime borrowers likely wont give you the time of day.

Ideally, you want a mortgage lender that is used to dealing with people who are financially similar to you. And the best way to find your ideal lender is by comparing loan offers. Heres how to do that.

You May Like: How Low Are Mortgage Rates

Whats Currently Happening With Mortgage Rates

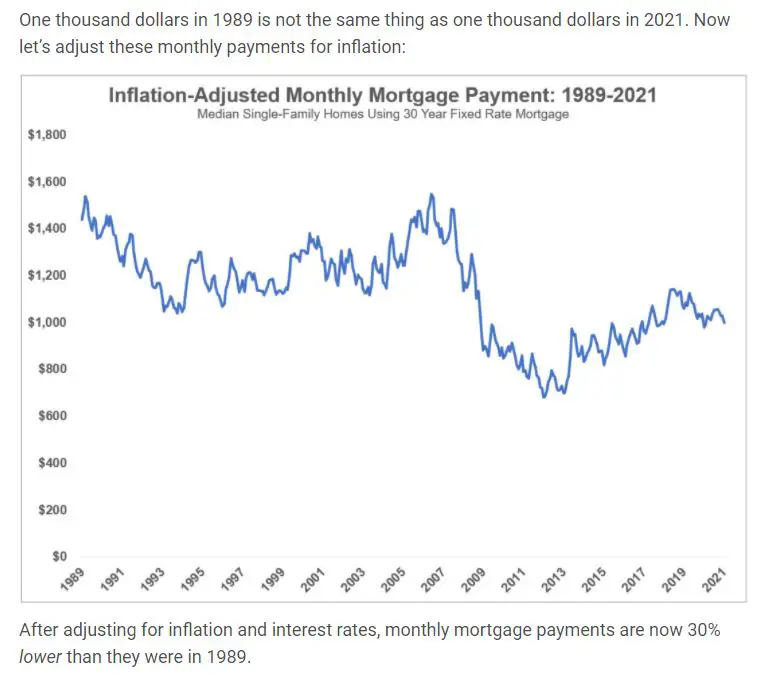

COVID-19 pushed mortgage interest rates down to record lows, dipping to a jaw-dropping 2.67% in December 2020. But theyve since climbed back up to pre-pandemic levels, reaching a 5.5% average as of June 2022.

But dont feel too bummed out. Consider that back in the 80s a typical mortgage rate was between 10% and 18%, and a 5.1% rate doesnt seem too bad comparatively. Of course, the cost of real estate has risen since then, but mortgage rates themselves are still substantially lower than they could be.

Is 325 A Good Mortgage Rate What Determines Mortgage Rate

The rate of a mortgage loan usually depends on many things. Some common factors are your credit score, loan amount, loan duration, etc. If you have a high then you can expect to have a low mortgage rate. If you consider the current loan market then definitely 3.25 is a good mortgage rate. However, many lenders offer mortgage loans at 2.5% and even 1.75% on 15-year loans but it mostly depends on your credit score.

Jump To A Section

Don’t Miss: Can You Refinance Your Mortgage With Bad Credit

Legal Information And Disclosures:

All loans subject to credit approval, standard mortgage qualifications and underwriting requirements. Additional fees, conditions, and restrictions may apply.

A mortgage preapproval is a no-cost service offered by Bank of the West and is subject to conditions that must be met before final loan approval. Additional restrictions may apply.

2Relationship Pricing Discounts may be available for eligible Bank of the West deposit customers, Bank of the West Global Investment Fiduciary Solutions investment clients, and investment customers of BancWest Investment Services with at least $100,000 in assets under management . For adjustable rate mortgages, the discounts are applicable only during the initial fixed-rate period. Discounts are not available for deposits or other AUM held in insurance accounts, the name of a business, or the name of the trustee of an irrevocable trust. Balances owed or available on lending or credit products and any account or asset where inclusion for relationship pricing eligibility might breach the owners fiduciary duty or breach any law or regulation applicable to the owner or Bank of the West or its affiliates are also ineligible .

4Calculators are provided as a convenience. Bank of the West makes no warranties about the accuracy or completeness of the calculations.

5Major U.S. bank defined as U.S. banks with excess of $90B in assets. Read more about our restrictive fossil fuel policies here.

Are Mortgage Rates High Right Now

Rates have been higher a lot higher than they are today. In October of 1981, for example, average rates topped 18 percent. Forty years later, in October of 2021, average rates on 30-year mortgages were below 3 percent. So, most homebuyers today are paying rates much closer to record lows than to record highs.

Tim Lucas

Editor

You May Like: How To Get Mortgage Forgiveness

How Do I Compare Current 30

Comparing 30-year fixed mortgage rates isnt as straightforward as looking at the mortgage interest rates you qualify for with different lenders. This is because a mortgage interest rate doesnt account for mortgage fees. To get an understanding of the overall cost of your home loan, you need to also compare annual percentage rates , which factor in other costs like loan origination fees and discount points.

After you apply for a mortgage youll get what is known as a Loan Estimate from the lender. Learning how to read a Loan Estimate is important because it shows an estimate of every fee the lender is charging you. Since every Loan Estimate form is the same, its a vital tool for comparing mortgage lenders and for keeping your closing costs low.

How To Get The Best Mortgage Rate

If you are looking for the best mortgage rate for your situation then you should shop around with multiple lenders. According to research from the Consumer Financial Protection Bureau , more than half of the borrowers do not compare quotes when shopping for a home loan. It means they are losing out on substantial savings. Moreover, the interest rate also helps determine your monthly mortgage payment as well as the total amount of interest youll have to pay during the loan period. You might think that a half of a percentage point might not make a big difference but its completely wrong. If you can decrease half of a percentage of your mortgage loan then you can easily save a significant amount of money. While applying for a Mortgage loan make sure you compare quotes from three to four lenders to make sure you are getting the most competitive mortgage rate for you. Moreover, if the lenders can understand that you are comparing with other lenders then the lenders might be willing to waive certain fees or offer better terms depending on your credit score.

Recommended Reading: What Is Fha Mortgage Insurance