What Happens If You Dont Get Pre

In order to qualify for a mortgage, you must meet specific criteria for income, credit score, down payment, and debt-to-income ratio. Not everyone will pre-qualify for a mortgage, and not everyone will get pre-qualified for amount of money they think they would. If you find yourself in that scenario, there are some things you can do:

- Increase your down payment amount. This can help increase the loan amount you would qualify for, and also help lower your monthly mortgage payments. Learn more about down payments and see why 20% is ideal.

- Decrease your overall debt to improve your debt-to-income ratio. Typically, a debt-to-income ratio of 36 percent or less is preferable 43 percent is the maximum ratio allowed. Use our debt-to-income calculator to estimate your debt-to-income ratio.

- Work to improve your credit score by doing things like correcting errors on your credit report, addressing any red flags such as late or missed payments, and reducing the number of hard credit inquiries on your report. Even if you are deemed to have bad credit, you may still be able to qualify for a mortgage. But in general, a score of 720 and higher will help you get the most favorable interest rates.

Ready to get pre-qualified? In minutes, you can find a local lender on Zillow who can help pre-qualify you for a mortgage.

Related Topics

What If You Don’t Get Pre

After reviewing a mortgage application, a lender will provide a decision to pre-approve, deny, or pre-approve with conditions. These conditions may require the borrower to provide extra documentation or reduce existing debt to meet the lending guidelines. If denied, the lender should explain and offer options to improve a borrower’s chances for pre-approval.

Mortgage Prequalification Vs Preapproval

The terms preapproval and prequalification are sometimes used interchangeably, but theyre not the same.

There are two main differences between mortgage prequalification and preapproval:

Recommended Reading: How To Become A Mortgage Closing Agent

What To Do If You Cant Get Preapproved

If you cant get a preapproval, ask the lender why you were denied. If its an issue you can remedy, like an error on your credit report thats causing the lender to reject your application, you can address that right away and seek a preapproval again when its resolved.

If you credit score is too low or other financial roadblocks prevent you from being preapproved, you can work to improve those areas, too. Raise your score by making payments on time and paying down your debt load, for example, or lower your debt ratio by finding a way to increase your income. Depending on your situation, this could take time, but itll go a long way.

Some lenders have very stringent qualifying criteria, so another option is to work with a different, more flexible lender. If youre an account holder with a local bank or member of a credit union, these institutions might be more willing to work with you to get you preapproved.

What If I Don’t Pre

Reach out to your lender and ask them why you didn’t get pre-qualified. Most lenders will work with you and provide tips onhow to improve your chancesofgetting pre-qualified for a home loan. Here are few things that you can work on if you don’t pre-qualify:

You May Like: Can You Get A Mortgage While In Chapter 13

The Buyer Lost Income Or Piled On Debt

A home buyers ability to repay its mortgage gets based on Debt-to-Income. DTI is the amount of debt a buyer has compared to their income.

Mortgage approvals cap a buyers debt-to-income ratio near 50 percent.

If the buyers debt rises but their income stays the same, the pre-approval may get revoked at the point of purchase.

The Easiest Way Is To Prequalify Online

You have options when it comes to prequalifying for a bad credit loan. We review our top loan options for personal, auto, and home loans designed specifically for consumers with a less-than-perfect credit history.

Best of all, you can choose an online loan option from the comfort of home and instantly learn whether you prequalify for one.

Also Check: What To Know About Getting A Mortgage

What Is Mortgage Pre

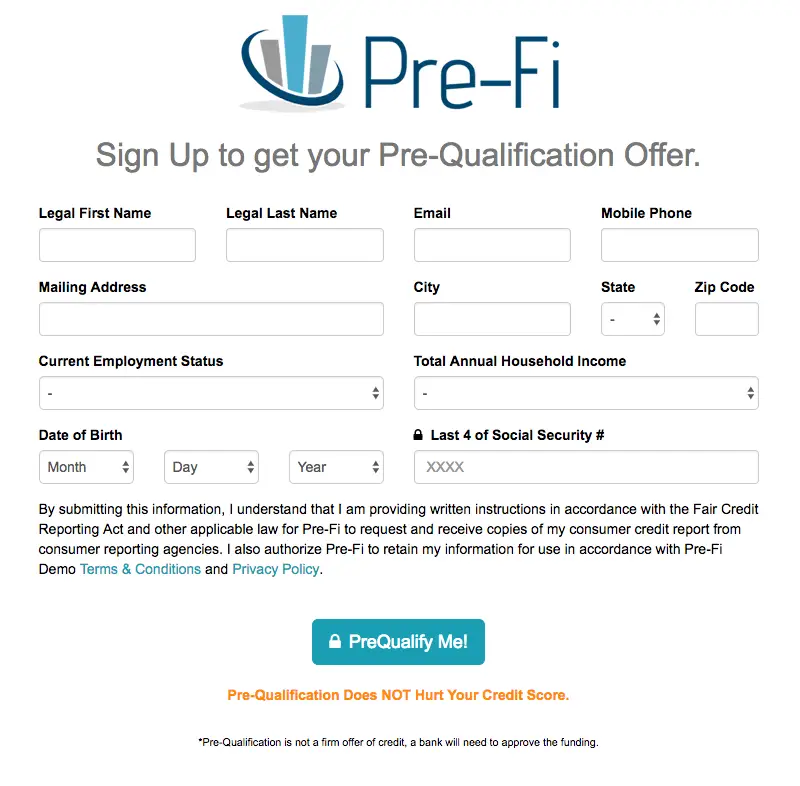

Mortgage pre-qualification is an informal evaluation of your creditworthiness and how much home you can afford based on self-reported information like your credit, debt, income and assets. Based on these inputs, pre-qualification estimates the amount a lender may be willing to lend you.

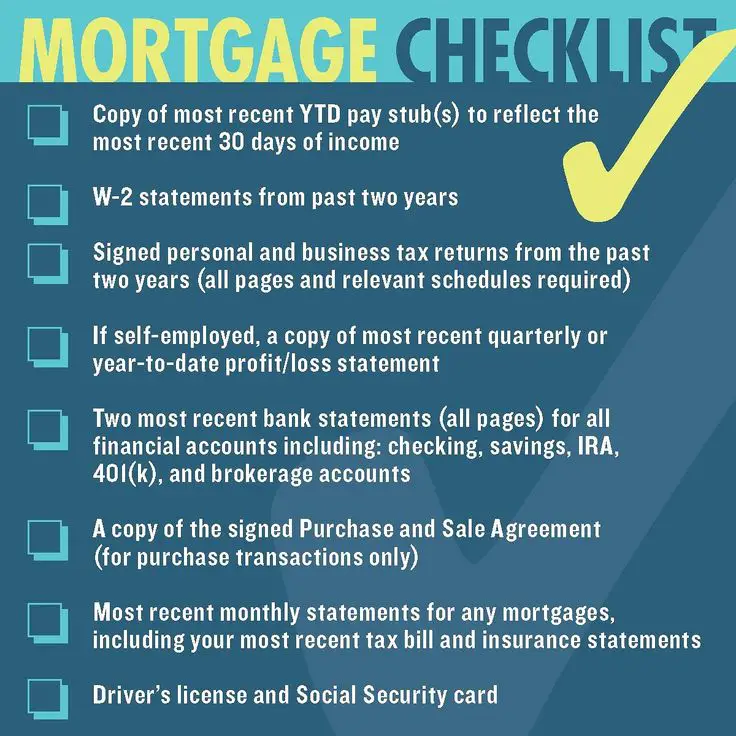

If youve gotten pre-qualified, the next step, called preapproval, involves providing documentation of everything you reported in your pre-qualification and a hard credit pull. Preapproval demonstrates a more serious step towards homeownership, whereas pre-qualification is an optional process that can be helpful for understanding your financial readiness to buy a home.

Whats The Primary Benefit Of Being Prequalified For A Mortgage

Getting prequalified for a mortgage will help you determine the price range of homes you can afford. It can also give real estate agents and home sellers confidence you can afford to buy a home. Getting pre-approved can give agents and sellers even more confidence you can afford to buy a home because it is based on verified financial information. Getting preapproved also helps you collect the documents you will need when you complete your mortgage application.

Don’t Miss: How Can I Make My Mortgage Payments Lower

A Step Further: Getting Preapproved

As noted above, a preapproval is a more formal step than to prequalify for a mortgage. You need to fill out a mortgage application, allow the lender to pull your credit score and provide documentation of your income and other finances.

A mortgage preapproval allows a lender to make a determination as to whether you can be approved for a mortgage or not. Once you’re preapproved, the lender will give you a letter that you can show to home sellers when making an offer, as evidence of your ability to obtain a mortgage.

Getting preapproved for a home loan does not guarantee you’ll be approved for the mortgage you could still be turned down if the home you chose does not appraise for an adequate value or if problems are discovered with your application during the underwriting process.

Though they aren’t mandatory, both mortgage prequalifying and preapproval are important steps in qualifying for a mortgage and buying a home. Both should be part of your plans for buying a home.

Follow us on and .

Selecting A Mortgage Lender

A first-time home buyer understandably might assume that all mortgage lenders offer the same thing: money to purchase a house. After all, mortgage lending is a competitive industry in which individual lendersespecially on the local levelrarely differentiate themselves in a publicly visible way.

Now that several large, national mortgage lenders have shifted the preapproval process online, buyers may feel tempted to proceed with the fastest or least-invasive option. Yet, small differences in mortgage lenders can help to avoid regrettable decisions and even secure meaningful savings over the long term.

A good mortgage lenders preapproval letter should carry significant weight with the real estate agent responsible for the property that the buyer most desires. The lender essentially builds this credibility through strong customer service. In this context, that means asking questions about why youre interested in homes at a particular price point, what monthly payment your budget can absorb and what else you may need your savings for.

Any lender can quickly preapprove a buyer for the maximum amount that their company permits based on certain variables. A listing agent will have learned over time, though, that these lenders customers are more likely to encounter issues before closing. This is one reason why real estate agents are a good source for finding a lender.

Recommended Reading: What Is Considered Good Credit Score For Mortgage Loan

How Are Mortgage Interest Rates Determined

From an economic perspective, the most important factors that affect mortgage rates are inflation, economic growth, Federal Reserve monetary policy, the bond market, and the housing market. At the borrower level, your credit score, home location, home price, loan amount, down payment, loan term, loan type, points, and interest rate type determine your interest rate.

Dont Miss: Can You Get A Reverse Mortgage On A Mobile Home

How Does Requesting A Credit Limit Increase Affect Your Credit

Requesting an increase in your credit limit can have both positive and mild negative effects on your creditworthiness. Increasing your line of credit can improve your credit, as a larger line of credit will help reduce the use of your debt, which is one of the most important factors in your credit score.

Jobs without high school diplomaWhat jobs can you get with no high school diploma? According to the BLS Occupational Outlook Handbook, people without a high school diploma can find many jobs in the hospitality industry. Waiters, hostesses, bartenders, bakers, cashiers and chefs are just a few examples of industry occupations that do not require advanced training, although many do require on-the-j

Also Check: Who Pays Mortgage Broker Fees

Find A Mortgage Company To Pre

Mortgage pre-approvals are available for free through most mortgage websites with no obligation to proceed. Many home buyers get their mortgage from a different mortgage company that pre-approved them. So, dont overthink this step.

The critical part of getting your pre-approval is that you get it. Without a pre-approval, you cannot buy a home.

How To Prequalify For A Home Loan As A First

If you want to prequalify for a home loan as a first-time buyer, the process might seem daunting. The good news is thats a relatively straightforward step.

Generally, youll answer a few questions through an online form or by phone. Afterward, the lender may issue a prequalification that includes a maximum loan amount and potential interest rate for your loan.

Its important to note that a prequalification offer is not binding. Instead, its subject to a further review of your financial details.

Recommended Reading: How Does Selling A House Work With Mortgage

What Does Mortgage Qualification Mean

A mortgage qualification essentially lets you know how much a lender is likely able to lend you. It is important to note that the dollar amount laid out in your mortgage prequalification is not a guaranteed loan offer.

Although your prequalification will not be an offer that is set in stone, it can help guide you while you are shopping for a home. Importantly, it will help you narrow your home buying search to properties that you can likely afford. With that, you can prevent yourself from falling in love with your dream home that is just too far out of your price range.

In addition to helping you stay on budget, a mortgage qualification shows sellers and real estate agents that you are serious about buying a house. With the knowledge that you are prequalified up to a certain amount, a real estate agent will likely feel more comfortable taking the time to show properties.

However, prequalification is just the first step in the process to obtain a mortgage. After that, youll still need to decide on a home, initiate the closing process, part with your down payment, sign dozens of loan documents, and finalize the loan.

When Should You Get A Mortgage Preapproval

You should get a mortgage preapproval if youre serious about looking for and making an offer on a home within the next two months. Preapproval letters are good for 30 to 60 days, according to the Consumer Financial Protection Bureau .

If it takes you longer than a month or two to find a home, the lender may need to update your preapproval with more recent pay stubs and bank statements. If your house hunt takes more than 90 days, the lender may also need to pull a new credit report, which may impact your credit score.

Don’t Miss: What Is The Interest Rate For Home Mortgage

Do I Need To Get Prequalified

You might ask, is a prequalification really necessary when buying a home? The short answer is no.

Theres no rule that says you must get prequalified before shopping for a home. However, prequalification has its benefits.

Getting prequalified gives you clues about potential eligibility for a mortgage loan, as well as an idea of your home buying budget. This is need-to-know information, especially if youre questioning whether your income is enough to afford a home purchase.

For example, after a review of your prequalification form, a lender might say you prequalify for a mortgage up to $150,000.

If you believe youre able to find a suitable property within this price range, you might proceed with the mortgage application process. But if not, you could postpone the mortgage and wait until your financial situation improves.

But although a prequalification is a helpful first step and provides information about budgets, it doesnt carry as much weight as a preapproval.

Even if its not a necessity, prequalification is always good to do ahead of rate shopping, especially if you dont get preapproved, says Jon Meyer, The Mortgage Reports loan expert and licensed MLO. Getting prequalified will help you understand your limits.

What Is A Mortgage Preapproval

A mortgage preapproval is a statement, usually a document or letter, of how much money a lender is willing to let you borrow to pay for a home. The preapproval indicates that the lender is prepared to move forward with the loan, as long as the home meets certain criteria and your financial situation doesnt change drastically while you look for a home to purchase.

The preapproval is based on your financial profile, including your income, how much money you have in the bank and investment accounts and your debts. The lender performs a hard credit inquiry as part of the preapproval process, as well. With this information, the lender can make an informed estimate about how much house you can afford, and, if you qualify, can preapprove you for a certain loan amount.

Also Check: Can You Haggle With Mortgage Lenders

How To Increase Your Pre

Pre-qualification can help you form a realistic budget and get ready to start looking at homes. You could pre-qualify for a larger loan and expand your options if you:

-

Grow your credit score: Three ways to do this quickly include correcting errors on your credit report, using less of your credit limit and paying bills on time and in full each month.

-

Consolidate or pay off debts: If you have high-interest debt spread out over several credit cards, consolidating it will reduce your monthly debt payments. Eliminating debt completely, through larger or more frequent payments, is even better. Reducing expenses and following a budget will help.

-

Increase your income: A higher gross income will improve your DTI ratio and may qualify you for a larger loan amount. You may be able to achieve this by asking for a raise or starting a side hustle.

Which One Should I Get

If youre new to home buying, not sure whether you can support a mortgage, or if youre just not ready to buy yet, pre-qualification makes more sense. Getting pre-qualified doesnt affect your credit score, so its a good way to begin if youre just browsing.

Now, if youre ready to buy within 90 days, pre-approval is what you want. When the housing market is hot, homes sell fast sometimes within hours of being listed. If you already have financing, you too can move fast, and that gives you an immediate advantage over other buyers. There is a small credit hit , but if youre serious about buying a house, you need to get pre-approved right away.

Recommended Reading: Rocket Mortgage Conventional Loan

Also Check: How To Get Pre Approved For A Fha Mortgage

The Buyers Credit Score Dropped Below The Minimum

Mortgage pre-approvals are test runs for a buyers actual mortgage approval. So, if the buyers credit score drops before finding a home, the buyers pre-approval may be invalidated.

In general, the minimum credit score requirements are:

- FHA: 500 credit score

Learn more about how to fix your credit score to buy a home.

What Is Mortgage Preapproval

Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. Theyll also perform a credit check. If youre preapproved, youll receive a preapproval letter, which is an offer to lend you a specific amount, good for 90 days.

Don’t Miss: Are Mortgage Rates Predicted To Go Up Or Down

What Is Mortgage Prequalification

Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, youre getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check.

Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals.

What Factors Lenders Consider When Granting Your Mortgage Preapproval

Lenders scrutinize all of your financial decision-making, from how youve managed credit to how stable your income is. Heres a brief overview of the most important mortgage preapproval factors:

- Your credit score. Your credit score will make or break a mortgage preapproval. Some loan programs permit scores as low as 500, but the road to preapproval will be very bumpy, and youll pay a higher rate. The gold standard is 740 for the lowest rate taking these simple steps can help give you a boost before you apply:

- Pay everything on time. Recent late payments will knock your score down faster than any other credit action.

- Keep your credit balances low. Although its best to pay balances off to zero, try to keep your credit charges at or below 30% of the total amount you can borrow. For example, if you have $10,000 worth of credit, dont charge more than $3,000 in any given time period.

Read Also: How Much Of Your Mortgage Interest Is Tax Deductible