Which Option Is Best For Me

As a first time buyer, it will be hard to get an interest-only mortgage, as most lenders require you to earn a minimum income of £100,000. Some lenders wont even offer interest only to first time buyers, regardless of your earnings.

It shouldnt matter, though. Most first time buyers are more interested in paying off their home than having an interest-only mortgage where they would need to sell the property at some stage to pay back the loan amount.

Therefore, its more likely that you will apply for a residential mortgage with repayment where you repay the interest and the loan amount simultaneously.

This Is How Old The Average First

So, just how old is the average first-time home buyer?

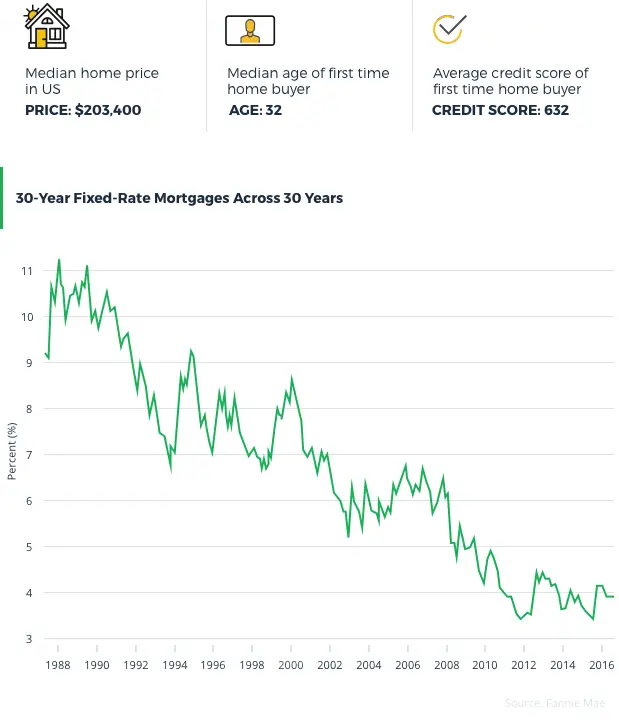

According to a 2021 report from the National Association of Realtors, the typical first-time home buyer was 33 years old. This was the same as in 2019, but up from 32 years old which was the median age of first-time buyers in 2018 and for the two years prior.

The median age has been growing older over time. In the 1970s and in the 1980s, it was 29 and it has been ticking up since then. There are many potential factors that could explain this, including the rising costs of homeownership, the fact that young people face a number of other financial burdens related to educational costs, and the fact that people are getting married and having children later on.

In fact, delayed household formation could be a major reason for the fact homeownership is happening later, as 60% of recent home buyers were married couples according to NAR’s 2021 report. By comparison, just 19% were single females 9% were single males, and 9% were unmarried couples.

What Is A Fixed

A fixed-rate mortgage sees you fixing the interest rate for a set period of time. Historically, two and five years were the most popular terms for fixing a mortgage interest rate. However, an increasing number of products allow you to fix the rate for the long term, sometimes as much as 40 years. If, for example, you fix your rate for five years, then your interest wont change during that time, even if the lender or BOE changes their rate.

Don’t Miss: What Factors Into Mortgage Approval

View Properties Youre Interested In Buying

Once you have an idea of what you can afford, you can start looking for properties with the intention to buy. And, whenever you spot a home that you like the look of, its vital that you arrange to view it in person.

Visiting homes you have your eye on will give you a much better understanding of the condition theyre in. Plus, its much easier to get an idea of whether a property meets your needs when you visit in person. If you find a home you like, its also wise to visit it more than once and at different times of the day, as this will make it easier to spot potential problems, like noisy roads or train lines, and a lack of sunlight in the garden.

What Is A Good Down Payment On A House

While some loan types allow for no down payment or one as low as 3% or 3.5%, most lenders discuss 20% as a down payment size that reduces the loans overall costs. A good down payment could fall anywhere in that range as long as youre satisfied with the terms the lender can offer you, the impact of that down payment on your overall finances, and the home youre trying to purchase. For example, you might consider the effects of making a 7% versus a 12% down payment.

Recommended Reading: Why Get A Reverse Mortgage

How Do I Get Preapproved For A Mortgage

Mortgage preapproval represents a lenders offer to loan the buyer money based on certain financial circumstances and specific terms. Start by gathering documents your lender will need, including a copy of your Social Security card and recent W-2 forms, pay stubs, bank statements and tax returns. The lender you select will then guide you through the preapproval process.

Millennial Home Buying Stats

Millennials are often dragged in the media, sometimes with claims of choosing avocado toast over purchasing a home. This has been debunked. Weve been shown that millennials are serious buyers who want to grow their wealth and be happy in their own property just as much as other generations. Weve rounded up some stats on this important buyer and seller market segment.

- Millennials: 81%

Recommended Reading: How To Shave Years Off Your Mortgage

When Should You Apply For A Mortgage

Its a good idea to start the process of applying for a mortgage perhaps through an independent fee-free broker before you begin your property search. This isnt essential but getting a benchmark figure from the outset can be very useful particularly if youre new to the property buying process.

You can then ask the lender for a mortgage agreement in principle . This is effectively a statement saying it will lend you a given amount and is typically valid for between 30 and 90 days.

But, crucially, an AIP doesnt guarantee youll get the mortgage it just gives you an idea of what you might be offered and shows prospective sellers that youre serious and not a time-waster.

Generally, mortgage lenders will carry out a soft credit check before giving you an AIP, which means your credit score wont be affected. But its worth checking first as full credit check will show up on your credit report.

How Much Deposit Do I Need To Buy A Home

Before looking at properties, you need to save for a deposit.

Generally, you need to try to save at least 5% of the cost of the home youd like to buy.

For example, if you want to buy a home costing £150,000, youll need to save at least £7,500 for the deposit.

Saving more than 5% will give you access to a wider range of cheaper mortgages available on the market and a lower interest rate.

Also Check: How Do I Find My Mortgage Interest Rate

Budget 2021 And Mortgage Guarantee Schemes:

The introduction of a new mortgage guarantee scheme In his Budget speech on March 3, 2021, the Chancellor proposed a new mortgage guarantee programme for first-time buyers and home movers. The government would guarantee banks to enable them to sell 95% mortgages, enabling citizens to purchase a home with just a 5% deposit. New and existing properties valued up to £600,000 will be available for the programme, which will run from April 2021 to December 2022. Learn more about the 95% mortgage guarantee programme in our latest guide.

At present normal 95% mortgages without government backed schemes are available to all types of borrow from First Time Buyers to people who are moving home.

Conventional 97 Loans: 3% Down Payment

The Conventional 97 loan is, like the name implies, a type of conventional loan. These mortgages are backed by Fannie Mae and Freddie Mac.

Available to home buyers with a good credit score of 620 or higher, the conventional 97 loan requires just 3% down. And it lets you cover the whole down payment with gift funds if you wish.

Don’t Miss: How To Buy A House Without A Mortgage

Calculate Your Monthly Mortgage Payment

Your mortgage payment is made up of four parts, collectively known as PITI Principal, Interest, Taxes, and Insurance.

- Principal and Interest: Principal and Interest make up your basic mortgage payment, including your payments toward the loan balance and interest paid to your lender

- Taxes: As a homeowner, youre responsible for paying annual property taxes to the local taxing authority. Property taxes typically range from 1% to 2% of your homes value annually

- Insurance: Then, theres homeowners insurance. Mortgage lenders require that you carry insurance for your home, which typically costs 0.25% to 0.50% of your homes value annually

Some neighborhoods have homeowners associations that charge monthly dues for this example well assume you wont include HOA dues in your monthly housing budget.

So, assuming a home purchase price of $250,000 and a 10% down payment, plan on setting aside $400 for taxes and insurance each month.

This leaves about $1,100 to spend on principal and interest.

Which Option Is Better

For the last 10-or-so years, fixed-rate mortgages have been the most popular. This is because interest rates have been historically low with little room for movement, and with rates likely to increase over the next few years, many borrowers are trying to secure their interest rate with a fixed-rate mortgage.

On the other hand, trackers were popular when rates were higher. This is because there was room for a drop in rates. If interest rates increase to significantly higher levels shortly, tracker mortgages will likely grow in popularity.

Don’t Miss: How Long Does A Mortgage Refinance Take

What Type Of Mortgages Are Available

There are several different types of mortgages on offer to first-time buyers heres a quick look at the main contenders:

Fixed-rate: Offers a set interest rate over a period of usually two, three, or five years. If youre a first-time buyer, this type of mortgage may appeal as it provides the security of fixed monthly repayments that wont change over the agreed term. Mortgages offered under the mortgage guarantee scheme at 95% must all be available as five-year fixed rate deals. But there are also two- and three-year fixed rates on offer, too.

Tracker: Your rate tracks the Bank of England base rate at a certain percentage above. So, your monthly payments vary depending on where the base rate moves. Trackers usually last for between two and five years, but they can run for the life of your mortgage, unless you choose to switch to another deal.

Offset mortgage: These link your savings to your mortgage to offset or reduce the overall amount you pay interest on. You wont earn interest on your savings, but you wont pay interest on that portion of your mortgage debt, either.

However, as a first-time buyer, you are likely to want to channel all of your savings into an initial deposit. Family offsets are available though, where the savings of one or more family members can be used to offset the debt of your mortgage.

Free Mortgage Advice

Is It Easier To Qualify As A First

A mortgage lender wont waive its rules for you just because you qualify as a first-time home buyer. Lenders still need to verify you can afford your monthly payments.

That means youll go through the full underwriting process verifying your credit, income, savings, and other personal finance information just like any other home buyer would. Loan programs dont offer easier requirements for first-time buyers.

But thats in your interest as much as the lenders. Who wants to be saddled with a home loan amount they cant afford?

The application process will ensure youre getting a house within your means and a reasonable monthly mortgage payment.

Also Check: What Is A Mortgage Contingency Date

How Much Is An Average Down Payment On A House

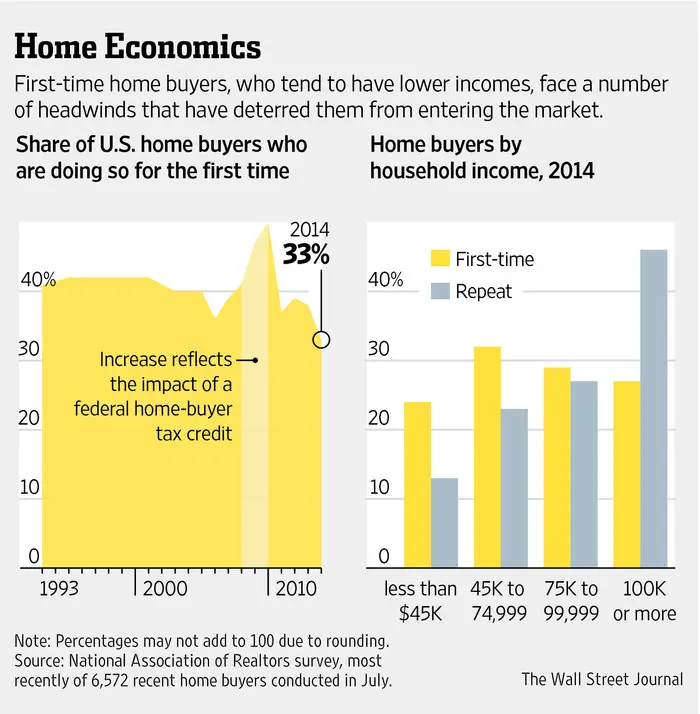

The average first-time buyer pays about 6% for their down payment, while repeat buyers put down 13%, according to data from the National Association of REALTORS®. In other words, you can expect to spend $10,000 $15,000, but this varies drastically depending on the loan type and the current state of the market. Keep in mind that theres no right or wrong answer when it comes to how much you need to have as a down payment to buy a house. If you cant afford your down payment, you may qualify for down payment assistance, which helps you pay the fee. Some things to consider when you think about how much you want to put down include:

- The minimum down payment requirement for your loan type

- Your emergency fund

- The condition of your home and how much you need to spend on repairs

- How close you are to retirement

- Your other debts

How Much Money Do I Need For A Down Payment

The larger the down payment you are able to make, the less youll have to finance when you purchase a home. On a conventional mortgage, making a down payment of at least 20% will prevent you from having to pay for private mortgage insurance. The minimum down payment required varies based on the type of mortgage you obtain. In 2019, the median down payment for first-time buyers was 6%.

Also Check: Who Pays Mortgage Broker Fees

Find Out The Cost Of Your Mortgage

Use our mortgage repayment calculator to get an indication of how much your mortgage might cost each month.

Make sure you remain realistic about how much you could pay for a mortgage each month and consider the impact that a change in interest rates might have. Our calculator can show the change an increase in interest rate will have on your monthly payments. While you can fix your mortgage interest rate, this will only be for a set period of years and a mortgage is a longer-term debt, often of 25 years or more. You could find your second mortgage comes at a different interest rate.

Why Is My Credit Score Important

Your is not only important for qualifying for a mortgage, but its also the key to getting a lower interest rate. The better your credit score, the lower your interest rate will be, which can save you quite a lot of money.

Consider that a borrower with a $300,000, 30-year mortgage with a 3% interest rate will pay $29,635.90 less over the life of the loan than a borrower who has a 3.5% rate. On a monthly basis thats $82 in savings.

Recommended Reading: How Long Is A Mortgage Application Good For

Getting The Best Interest Rate If You Are A First

Before you apply for a mortgage you may already have saved up some money as a deposit, and the larger the deposit the cheaper the interest rate will be.

-

On very rare occasions, a lender will allow first-time buyers to borrow with no deposit, but this will limit the type of mortgage you can get, and means you will pay a higher rate of interest

-

These no deposit mortgages are known as 100% loan to value mortgages

-

Most lenders will only lend to first-time buyers who have a deposit

How Can Families Help First

With house prices continuing to rise and deposits getting much larger, some first-time buyers may need their familys help to get on the property ladder. If youre in a position to help a loved one with this, you may be wondering what the best approach will be.

One of the most common ways you can help a family member to get on the property ladder is by gifting them some money to put towards their deposit. The buyer will need to make their lender and solicitor aware that some or all of their deposit has been gifted and youll typically be required to sign a gifted deposit letter to confirm the money does not need to be paid back and you hold no stake in the property.

Alternatively, you may be looking to sell a property you own to a family member. If so, you can gift equity to them so they will need a smaller deposit. In fact, it can negate the need for a deposit at all, as the equity will be considered the deposit.

If you need any help with a family concessionary purchase, The Mortgage Genie can help. Our expert team is here to talk your family through all of your options so you can ensure you make the best choice.

Don’t Miss: How To Recruit Mortgage Loan Officers

Who Qualifies As A First Time Buyer

Being a first-time buyer isnt all bad. Though there are many challenges, first-time buyers also benefit from certain schemes and allowances to make the home-buying process easier and more affordable. This means its important to define legally what a first time buyer actually is.

In the UK, a first-time buyer is considered to be someone who has never owned any residential property anywhere in the world. This means you must not have owned your own home and you must not have owned any buy-to-let property either. This includes any inherited property .

The good news is that commercial property does not count. Therefore, if you have owned a shop, workshop, warehouse, office etc. before, you still qualify as a first-time buyer for the purposes of buying a home.

Remember too that youre only a first-time buyer if youre buying the home to live in yourself. If youre buying rental property to let out, then you dont qualify for any of the first-time buyer perks.

One more thing: if youre buying with someone else and your partner already owns residential property or has done in the past, you may not qualify for some of the advantages of being a first-time buyer. However, some will still be open to you .