Original Notes And Loan Papers: What Does A Lender Need To Foreclose

Especially for new homeowners, understanding the precise nature of every mortgage related document you sign throughout the closing process can be difficult. However, even though these original documents are the keys to ownership of your real property, the more a loan interest changes hands, the higher the likelihood that these original documents may be misplaced in the process. Because these original documents prove ownership of the mortgage, and thus the right to initiate the foreclosure process, the rules of evidence in New York State Supreme Court may require production of the original promissory note in order to proceed with foreclosure litigation. Without said note, a borrower in default may be entitled to defend against a foreclosure action for lack of authentic proof that the lender initiating the foreclosure actually owns the mortgage interest. Accordingly, it is essential to understand how and when to demand production of the original mortgage documents throughout the foreclosure litigation process.

West Virginia Borrowers Represented By Counsel

Pursuant to state law, and at the direction of the West Virginia Attorney Generals Office, if a borrower is represented by counsel in West Virginia, we are not permitted to talk to the borrower directly without written authorization from the attorney authorizing such communication.The form can be downloaded, completed and returned to us via one of the following methods:Via fax at 972-459-1611 or email at .

Preventing Loss Of A Promissory Note

An original promissory note, and any related documents such as a mortgage, security agreement, or amortized payment schedule, should be kept in a safe place. This might be a safe deposit box, safe, or other secure storage facility. Copies of the documents should be made, and kept in a separate place from the originals. Scanned or photographed images of the documents also can be kept in a computer file. Even if the original note is lost, the other original documents or the copies can be used to establish the existence of the loan.

You may want to hire an online service provider to assist you in preparing the replacement promissory note, as well as the Affidavit of Lost Promissory Note and Indemnity Agreement.

About the Author

Edward A. Haman, Esq.

Edward A. Haman is a freelance writer, who is the author of numerous self-help legal books. He has practiced law in HawaRead more

Recommended Reading: Can You Pay Off A Mortgage Early

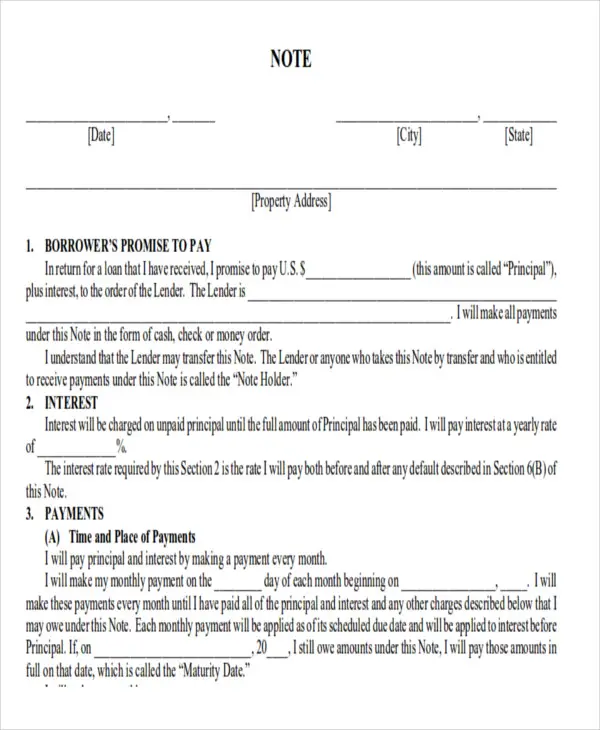

Key Elements In A Mortgage Note

A mortgage note usually includes:

- Amount of the loan, also known as the principal

- Interest rate for the loan

- Amount of money for the down payment

- Monthly payment amount

- Due dates for mortgage payments

- Repayment schedule for the loan and an estimated final payment date

- Any other relevant terms of the mortgage

Recommended Reading: How Does Rocket Mortgage Work

Recording Chester City Deeds

E-recording

Submit the deed with the Chester City registration form as a page in the document.

Once accepted and recorded with the Recorder of Deeds, YOU send the Chester City form and a check for $10.00 to the city at the address on the form.

Mail Recording

The deed is mailed to our office with the Chester City registration form as a page. Please also provide a $10.00 check made payable to the City of Chester and a self-addressed, stamped return envelope addressed to the city at the address on the form. We will mail it ourselves once the deed is recorded.

Also Check: Why Are 15 Year Mortgage Rates Lower Than 30 Year

What Is A Mortgage Assignment

An assignment transfers the mortgage from one lender to another. Like a mortgage, the lender records an assignment in the county land records.

Generally, each assignment must get recorded. However, in some cases, the mortgage designates Mortgage Electronic Registration System, Inc. as a nominee for the lender. In that situation, MERS tracks the loan transfers in its computerized system, eliminating the need for separate assignments when the loan is transferred.

Dont Miss: Can You Get A Mortgage With No Credit

Origin Of Original Notes And Loan Papers

When you are closing on a home for which you require a mortgage, there are three main documents you should be looking for throughout the process. The first is your actual mortgage, also known as a deed of trust or security instrument. This document essentially secures your mortgage by permitting the lender to foreclose on and take possession of the real property interest at issue if you fail to make your mortgage payments as agreed. It is also called a security instrument because the real property is acting as the lenders security should you default on your mortgage loan obligations. The second document, which is often confused with a mortgage, is your promissory note. The promissory note is the actual legally binding document by which you, as the borrower, agree to repay your mortgage loan according to the agreed upon terms. The lender keeps the original promissory note until you have fulfilled all obligations, i.e., paid off, your mortgage. A promissory note will generally contain the following information:

- The total amount of money borrowed

- Your interest rate

- The date payments are due

- The length of time for repayment

- The place where payment is to be remitted and

- The consequences of late payment.

Also Check: Are There Any Mortgage Lenders For Bad Credit

How To Get Copies Of A Mortgage Deed Promissory Note

Related Articles

Although home loans are commonly referred to as “mortgages,” the loan itself is not the mortgage. The mortgage is the instrument that secures the loan. In California, deed of trusts are commonly used instead of mortgages. Although the documents are similar, some distinctions exist. For example, unlike a mortgage, a deed of trust involves a third-party trustee. If you need copies of your mortgage, deed of trust, home deed, or promissory note, you can use a few methods to obtain the documents.

County Recorder Or Register Of Deeds

All mortgages, deeds and other land records are taken to the county register of deeds or recorder of deeds . These documents are public record and are available to anyone who wants to view them and obtain copies of them, as long as you have the property address and/or the owner’s name. The clerk’s office will only have recorded documents, however. You can get copies of your mortgage and your deed here, but you generally won’t be able to get copies of the note or any of the other closing documents from the county.

Also Check: What Is A Good Tip For Mortgage

How To Find A Home’s Original Value

A mortgage promissory note is the agreement you sign at a mortgage closing which obligates both you and your lender to abide by the terms set out in the agreement. At a typical closing, three copies are usually signed: one for the lender’s records, one for your records and one that is to be recorded at your local registry of deeds. If you need additional copies of your mortgage note, there are a couple different ways to get them.

The Effect Of A Recorded Mortgage

After you execute the note and mortgage when you buy a house, the bank or the title company will need to record the mortgage. The mortgage will be recorded with the register of deeds for the county in which the property is located. When the mortgage is brought to the recorder, the person recording it pays a fee, and the document is stamped with a date and time. The mortgage will be kept in a book of mortgages, and the stamp will also include the book number and page number where the mortgage is kept.

The recording puts the world on notice that the mortgage is there. If you later want to borrow money from someone else and that new lender wants a mortgage, the new lender will run a title search on the property and see that another mortgage is already there. The new lender’s mortgage will be behind the existing mortgage in priority. If a mortgage is not recorded, it’s not enforceable against subsequent mortgages.

Deeds are also recorded and stamped by the county and kept in a book of deeds.

Don’t Miss: Can I Pay My Mortgage Online

Secured Loans Vs Unsecured Loans: Whats The Difference

A secured loan comes with some type of collateral. In real estate, the property serves as the security for the loan. That means that if you default on the loan, you will be subject to foreclosure action by your lender to take ownership of the property so it can sell it and recoup as much of the loan as is possible.

What If The Debt Is With A Debt Collector

You can still request documents but it may take longer. A debt collector who has bought the debt has the same responsibility as the original credit provider. If you have not paid the debt for a long time you should be careful not to admit you owe the debt, and you should consider reading our Recovery of Old Debts factsheet and using our Old Debt Sample Letter. If you dispute that you owe the debt or the amount, you should review clause 13 of the Debt Collection Guidelines.

You May Like: Can You Have A Second Mortgage With A Va Loan

What Is Second Mortgage

Category: Loans 1. Second Mortgage Definition Investopedia Key Takeaways · A second mortgage is a loan made in addition to the homeowners primary mortgage. · HELOCs are often used as second mortgages. · Homeowners might What Is a Second Mortgage? · How a Second Mortgage Works A second mortgage is

Make Mortgage Notes Easier With Adobe Acrobat Pro With E

A mortgage is one of the most important documents in a home buyers life. Buying a single-family home is the largest financial transaction that most people will perform in their lives, and its essential that the information about that transaction be clear, easy for the borrower to access, and compliant with all relevant laws and regulations. Adobe Acrobat Pro with e-sign makes it easy to sign mortgage notes and other relevant documents. E-sign everything from prepayments to promissory notes safely and quickly with technology that cuts down on paperwork and gets the job done faster.

Don’t Miss: Do You Have To Pay Taxes On A Reverse Mortgage

Who Holds The Original Mortgage Note

Because a mortgage note is a security instrument, it can be bought and sold on the secondary mortgage market. Therefore, mortgage lenders sometimes sell mortgage notes to real estate investors who are attracted to these relatively risk-free investments and the potential to earn passive income.

Because lending institutions sell mortgage notes, real estate investors technically own a mortgaged property. These investments are low-risk, because the only way investors will lose money is if a borrower defaults on their loan or avoids paying interest by prepaying their mortgage. Even in the latter situation they may not lose money but also wouldnt make much money because they wouldnt be earning interest.

Regardless of who holds the mortgage note, the borrower is obligated to follow the terms of the mortgage. The borrower wont be affected by any change in who holds the note because the payments will consistently be made to a third-party entity throughout the life of their loan.

The borrower wont have the original copy of their mortgage note until theyve paid off their loan. At closing, the borrower will receive a copy of the mortgage note.

This is part of the legal process and helps the borrower to understand what their responsibility is in paying back a loan. Once theyve paid off the entirety of the loan, theyll receive the deed to their home.

Buying Performing Real Estate Notes

In the case of performing notes, you can also find these through the individual investor/sellers that I referenced above who are already skilled at unearthing these assets directly from the note holders themselves.

But if you want to maximize your profits, you can do your own marketing in order to find these individual note holders who are or may want to sell their note for cash.

If Im looking for performing notes today and I have any kind of a marketing budget, Im looking at purchased lists of seller-financed note holders which have already been compiled through the public records and pre-screened by experienced researchers .

You just craft your I will buy your note for cash marketing message and send it out to the list. From our experience, for every 1,000 note holders on the list, somewhere around 2% are seriously interested in selling their note at any given time this means 20 out of 1,000 and also those not yet motivated will become motivated the next month and so on and so on 20 out of 1,000 potentially represents anywhere from $60,000- $100,000 in face profit, which can be well worth the $200 bucks or so .

Also Check: Where To Get A Mortgage With Low Credit Score

How Do I Get A Copy Of My Mortgage Satisfaction

Your mortgage company should provide our office with a Satisfaction of Mortgage to be recorded in the Official Records of Orange County, Florida. You may contact us at 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site to see if your Satisfaction has been recorded.

Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan. If your Mortgage was an assumed loan, the Satisfaction will list names of the original borrower/mortgagornot the current borrower/mortgagor.

If it has been more than six weeks since you paid off your loan and we are unable to locate your recorded Satisfaction, you will need to contact your mortgage company.

Mailing Address:Orange County Comptrollers Office Attn:Official Records Department

Find A Mortgage That Fits Your Life

See what mortgage you qualify for

Its all nervous giggles and sweaty palms as you iron out the last few details of owning your dream home. After the offer is accepted and you sign on the dotted line, those keys drop into your palm, and youre ready to step over the threshold.

But lets rewind to that dotted line and, cough, the mortgage contract. Do you plan on reading every sentence of each closing document?

Now would be the time to learn what that final document the mortgage note is all about and why its important.

Recommended Reading: What’s Needed To Apply For A Mortgage

How Can You Sell Your Mortgage Note

These are the steps to selling a mortgage note:

Investors and businesses in the secondary mortgage note industry can buy private mortgage notes from those looking to sell. When a note owner wants to convert his or her note into a lump sum, the owner begins the private mortgage note selling process.

Before you begin the selling process, have all of the information on the mortgage note you own. These attributes include detailed information on the property, the interest rate, the term of the loan, the creditworthiness of the homeowner, and the homeowners equity in the property.

- 1 S. Orange Ave, Suite 200Orlando, FL 32801

What Is A Real Estate Note

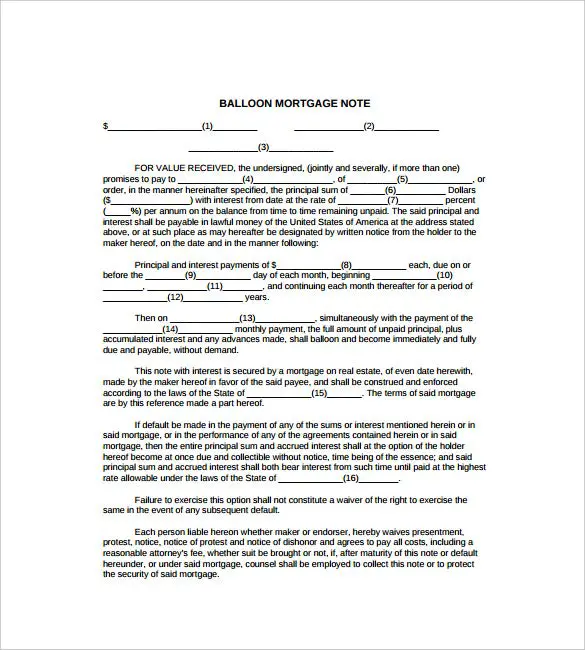

A real estate note, also called a mortgage note, is a promissory note associated with a mortgage or deed in trust. The mortgage allows the lender to take possession of the real estate in the case of a default, while the note is the borrowers promise to pay back the loan.

Notes can be bought, sold, or otherwise transferred as long as there is an outstanding balance. When you purchase a real estate note, you acquire the right to receive the borrowers future mortgage payments.

Read Also: Chase Mortgage Recast Fee

Recommended Reading: What Fees Are Associated With Refinancing A Mortgage

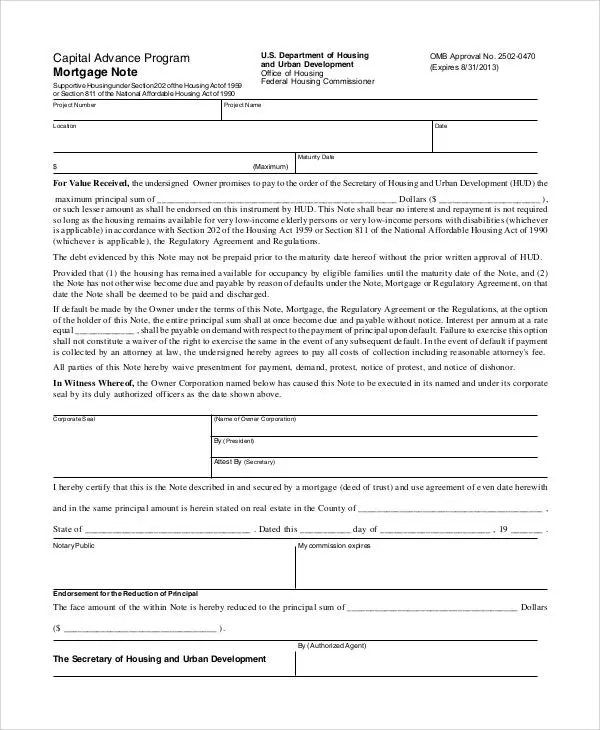

What Is A Mortgage Promissory Note

The mortgage note is often accompanied by a promissory note. A promissory note essentially outlines the terms to pay back the lending institution.

A promissory note provides the financial details of the loans repayment, such as the interest rate and method of payment. A mortgage specifies the procedure that will be followed if the borrower doesn’t repay the loan. If you live in a deed of trust state, you will not get a mortgage note.

Therefore, its essential to ensure that your mortgage note and all other legal documents involved in your home buying process are completely accurate. When you get a mortgage, you and a lawyer should read through the mortgage note to make sure the terms are 100% accurate and that all agreements are included. You want this document to protect you as much as it protects your lending institution.

What Is A Copy Of Mortgage Note

At closing, the borrower will receive a copy of the mortgage note. This is part of the legal process and helps the borrower understand their liability in repaying a loan.

At closing, the borrower will receive a copy of the mortgage note. This is part of the legal process and helps the borrower understand their liability in repaying a loan. Once they have fully repaid the loan, they will receive the deed to their house. The mortgage note is part of your closing documents and you will receive a copy at closing.

There are several ways a borrower can request a copy of their mortgage note. At the close of your mortgage, you will receive a copy of the mortgage note. Your mortgage company or other financial institution will keep the original version of the mortgage note. Mortgages are usually bought and sold on the secondary market with the original promissory note.

Regardless of who owns your loan and which institution you make payments to, you will receive the original promissory note at the end of your loan once it has been paid off in full. The promissory note and mortgage note are essential to the homebuying process and contain important details of your loan. A mortgage note is the agreement that you sign at the closing of the mortgage that obliges both you and your lender to comply with the terms set out in the agreement. If the loan has changed hands, contact the most current servicer for a copy of your mortgage documents or trust deed.

References

You May Like: How Do You Figure Out Your Monthly Mortgage Payment