Pay Off The Mortgage On Your Own If You Can Afford It

You can also pay off the loan so you can hang on to the home. Unless you inherited a large sum of cash along with the house, youll most likely have to finance the loans repayment.

In this scenario, youd have to meet certain lending requirements as far as your credit, income and debts go to qualify for a new mortgage. That makes it all the more important to continually check your credit report and keep your finances in order.

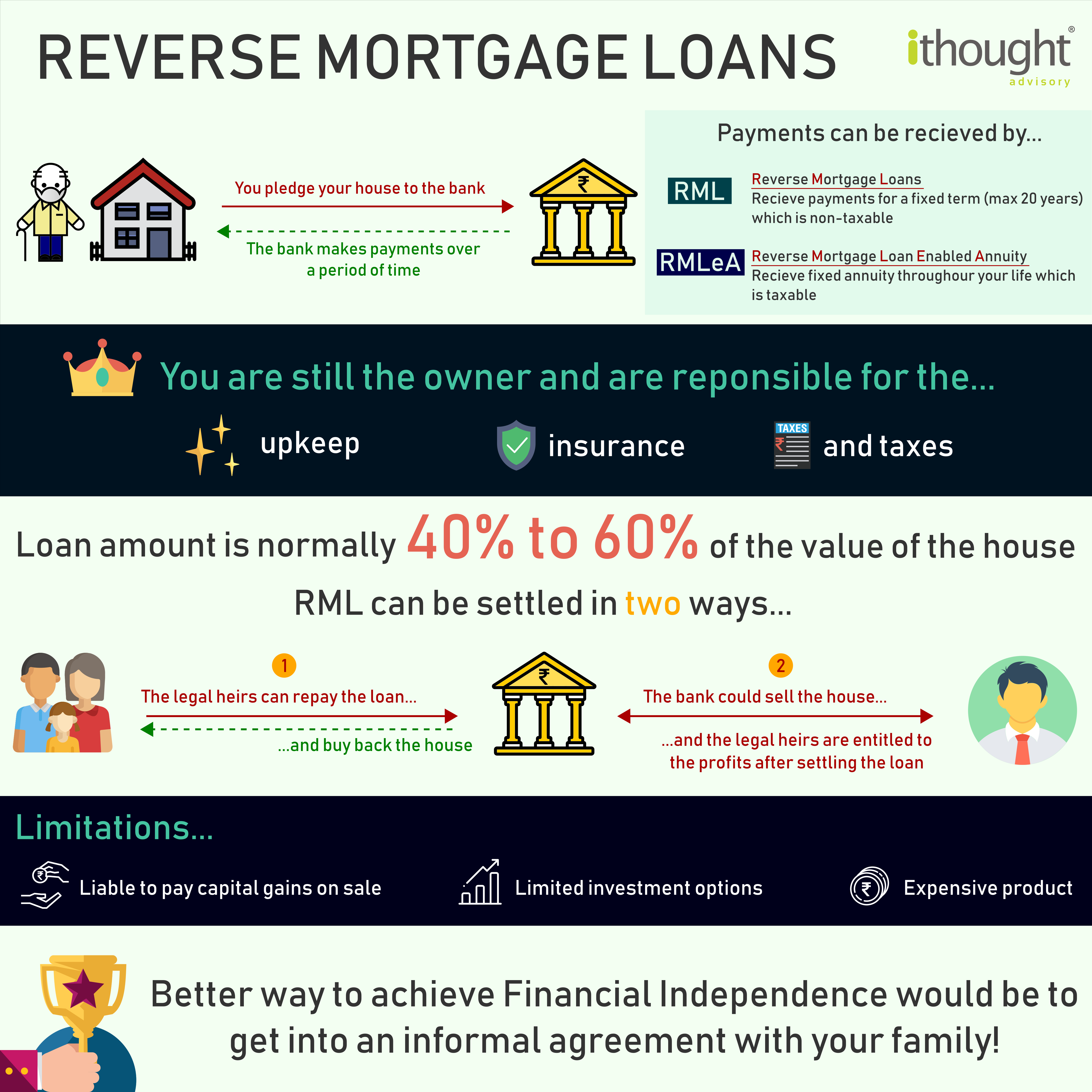

In A Reverse Mortgage Who Owns The House

With a reverse mortgage, you legally the own your home and owe a smaller amount at the loan origination. This smaller amount increases until you die or permanently leave the house.

However, there are some restrictions like you cannot rent out the home or use it for home-based businesses while you are occupying it. This is because the aim of a reverse mortgage is to help retirees keep their home as their primary residence.

The interest amount accumulates over time. Therefore, you owe more when it is the time to pay back the loan. The loan is usually repaid by opens in a new windowselling the home on the reverse mortgage.

You Must Pay Taxes And Insurance

While reverse mortgage holders dont have a monthly mortgage payment, its important to remember the loan also becomes due if you stop paying your property taxes or homeowners insurance, or if you fail to maintain the property in good repair. Failure to pay taxes and insurance is the number one reason behind most of the foreclosures, says Dan Larkin, divisional sales manager of Schaumburg, Illinois-based PERL Mortgage, Inc.

However, the most common reason a reverse mortgage becomes due is when the borrower has passed away, says Ryan LaRose, president and chief operating officer of Celink, a reverse mortgage servicer.

Once the reverse mortgage is due, it must be paid back in full in one lump sum, LaRose says.

Just as reverse mortgage borrowers are required to adhere to guidelines under the terms of their loans, heirs must also abide by certain requirements following the death of their borrowing parents.

Don’t Miss: Can You Refinance Mortgage Without A Job

Who Is Responsible For The Repayment Of The Loan After The Borrower Dies

When a person passes away, their outstanding debts often become the responsibility of their estate. That means the money or property they owned will pay off these debts. If there is insufficient funds or property to cover the debts, they will often go unpaid. In most cases, the deceased person’s debts are no one else’s responsibility.

The same logic goes with reverse mortgages. Alas, depending on whether there was a co-borrower or an eligible non-borrowing spouse on the loan may change that.

You Might Lose The Home To Foreclosure Before You Work Out Another Option

The U.S. Department of Housing and Urban Development , the regulator of HECMs, has guidelines that say servicers of these loans should inform survivors and heirs of their options and resolve the loan within six months of a death.

So, generally, under the guidelines, heirs should have six months to satisfy the debt. If they’re selling the property and it’s still on the market after six months, or they’re still actively seeking financing, heirs can contact the servicer and request a 90-day extension, subject to approval by HUD. One more 90-day extension can be requested, again with HUD’s approval. But the guidelines don’t prevent the servicer from pursuing a foreclosure during this time. In fact, HUD’s policies require servicers to initiate foreclosure within six months of a default.

While you face delays or roadblocks due to an issue with the property’s title, an impending foreclosure, or a lack of information from the servicer, you’ll have to pay for the home’s upkeep, taxes, and insurance. Interest and fees will continue to accrue on the debt while you try to work out any of the above options.

Also, heirs have noted that servicers often won’t negotiate and don’t communicate during the workout process, and homes end up being foreclosed in many cases.

Read Also: How To Stop Paying Pmi On Mortgage

How To Create A Payoff Plan For A Reverse Mortgage

If you intend on getting a reverse mortgage for your home, you need to be aware of what it means for your heirs and spouse when it becomes due and payable. If you go forward with your plan to get a reverse mortgage without informing and preparing those you may leave behind, they could panic when they find out.

What Do Lenders Usually Do About Reverse Mortgages After The Borrower Dies

When you take out a reverse mortgage, youre borrowing a certain amount of money against your homes equity. While your loan may only be for a percentage of your homes value, your property is still used as security for the loan. This means that the lender can repossess and sell your home if the loan is not repaid. Since you have to be over 60 years old to take out a reverse mortgage, your death is often the trigger for lenders to seek repayment for the loan. Lenders need to ensure that youre fully aware of the conditions of your reverse mortgage before you sign the contract.

Unless youve made arrangements through your will or estate planning, anyone living with you at the time of your death could need to vacate the house before its sold. Dealing with a reverse mortgage when the homeowner dies can add to your familys pain and grief, which is why you should discuss it with your lender before borrowing the money. For instance, you could check if the lender accepts other forms of security, such as an investment property, instead of your residence. You should also consider the total repayment due on the reverse mortgage, which includes the compounded interest over various periods.

Also Check: How High Credit Score For Mortgage

What Happens When Siblings Inherit A House

Unless the will explicitly states otherwise, inheriting a house with siblings means that ownership of the property is distributed equally. The siblings can negotiate whether the house will be sold and the profits divided, whether one will buy out the others shares, or whether ownership will continue to be shared.

Other Kinds Of Reverse Mortgages

Some lenders offer “proprietary” reverse mortgages. One kind of proprietary reverse mortgage is called a “jumbo reverse mortgage” because only people with very high-value homes can get them. Proprietary mortgages aren’t FHA-insured.

Other proprietary reverse mortgages have a lower minimum age requirement than HECMs, such as age 55. But, again, the federal government doesn’t back these mortgages. So, proprietary reverse mortgages carry all of the risks of a HECM with none of the government’s regulation.

Another type of reverse mortgage is a single-purpose reverse mortgage, which restricts the homeowner’s withdrawals to paying for specific costs, usually property taxes and home repairs. Some state and local government agencies, as well as non-profit organizations, offer these loans. If you qualify, these programs are a much better option than getting another type of reverse mortgage.

Read Also: How Much Will Monthly Mortgage Payment Be

Spouses And Heirs Have Both Rights And Obligations

Spouses Responsibility after Death of the Borrower:If the spouse dies, the surviving partner owns the property with the reverse mortgage. If he or she is a co-borrower on the mortgage, s/he may keep occupying the property as long as all conditions are met.

New reforms made by the Reverse Mortgage Stability Act provide opens in a new windownon-borrowing spouses protection as well. According to the new HUD policy, if an FHA-backed reverse mortgage was borrowed on or after August 4, 2014, the non-borrowing spouse may occupy the house after the primary borrower dies. In both cases, repayment can be deferred until after their death.

However, these are applicable if the non-borrowing spouse:

- Is wedded to the borrower during closing and stays wedded to the borrower for the lifetime

- Discloses his or her spousal status at the loan origination and closing

- Is listed in the HECM documents

- Has kept and continues to keep the home as a primary residence

- Can prove his or her legal ownership of the house within 90 days after the death of the borrower

- Meets all of the obligations stated in the mortgage documents

- Ensures the loan is never Due and Payable

Heirs Responsibility after Death of the Borrower:An FHA HECM loan is a non-recourse loan. So when the last surviving borrower dies, the heirs will not be held responsible for paying more than the homes value. Heirs can either pay 95% of the current homes value or the outstanding balance, whichever is less.

What Is The Downside Of A Reverse Mortgage

A reverse mortgage means that you are taking out a loan from your home equity. This means that your heirs will inherit less of your estate, regardless of what they decide to do. They still have to make sure that the loan is repaid.

Moreover, you still have to keep the home in good shape, pay your property taxes, and fulfill similar responsibilities of homeownership to avoid a foreclosure sale. You also still have to cover your property taxes while you live there. In some cases, this may mean that you wont be able to make payments. This could lead to an early foreclosure.

Read Also: What Would The Repayments Be On A 100k Mortgage

What Happens When You Die With A Reverse Mortgage

Reverse mortgages allow senior homeowners to occupy their house without making additional payments and supplements their monthly income. But what happens to this mortgage after your death? Who pays the loan balance, and how it affects your heirs?

Read this guide about how a reverse mortgage follows after the primary borrower dies.

What Is A Mortgage Consultant

Category: Loans 1. Mortgage Broker Definition Investopedia A mortgage broker is an intermediary who brings mortgage borrowers and mortgage lenders together, but who does not use their own funds to originate Jun 10, 2021 Mortgage consultants, also known as mortgage brokers, are finance professionals who help people find

Also Check: How Long To Wait To Refinance Mortgage

Learn More About Reverse Mortgages

In this guide, we explained what happens to a reverse mortgage after death. The person who you choose to bequeath your home to matters. If its your spouse, then chances are, they will be eligible to continue living in the home and benefiting from the reverse mortgage. The home and mortgage then become a part of their estate to pass on. If the heir is a loved one other than your spouse, such as a child, then the mortgage becomes due upon your passing. They have three options, including buying the house, selling it, or transferring the deed to the lender.

A reverse mortgage impacts your home equity, and thus the value of your estate. In the context of estate planning, taking out a reverse mortgage impacts how much equity youll be able to pass down to your heirs. As explained above, if you bequeath your home to a loved one who isnt a spouse, they might be forced to buy or turn over the home. If they are attached to your home and wish to keep it in the family, then the reverse mortgage may not be the answer. Otherwise, they might be forced to buy it using their own funds.

To learn more about reverse mortgages, be sure to check out our other guides:

Reverse Mortgage After Death Of The Borrower: Spouses Responsibility

With most married couples, a reverse mortgage after death is fairly straightforward: the couple jointly owns the home and completed the reverse mortgage application process together in the event that one spouse dies, the surviving spouse becomes the sole owner of the home with the reverse mortgage.

So long as the surviving spouse is listed as a co-borrower on the reverse mortgage, he or she may continue to occupy the home. If the spouse continues to live in the home, repayment can be deferred until after their death.

A co-borrowing spouse is protected in a reverse mortgage after death and may continue to live in the home so long as qualifying conditions are met. The Reverse Mortgage Stability Act introduced new reforms that benefit and protect the interests of non-borrowing spouses, as well.

HUD policy now states that if an FHA-backed reverse mortgage was issued on or after August 4, 2014, the non-borrowing spouse may remain in the home after the HECM borrower dies. In addition, the loan repayment will be deferred.

However, these instances are only true if certain criteria are met, including the following:

If the non-borrowing spouse does not meet these requirements, the loan becomes Due and Payable. Learn more about non-borrowing spouse protections here.

Its therefore highly encouraged to consider any adult children living at home before obtaining a reverse mortgage and to have a careful conversation with all family members involved.

Read Also: Can You Undo A Reverse Mortgage

How Do Reverse Mortgages Work

A “reverse” mortgage is a particular type of loan in which older homeowners convert some of their home’s equity into cash. The most popular type of reverse mortgage is the FHA-insured Home Equity Conversion Mortgage . The insurance protects the lender, not the borrower.

This kind of loan is different from regular “forward” mortgages. In a reverse mortgage, the lender makes payments to the homeowner rather than the homeowner making payments to the lender. The cash is generally distributed in the form of a lump sum , monthly amounts, or a line of credit. You can also get a combination of monthly installments and a line of credit.

Because the homeowner receives payments from the lender, the homeowner’s equity in the property decreases over time as the loan balance gets larger.

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

A reverse mortgage allows seniors age 62 or older to tap their home equity. Nearly all reverse mortgages are federally backed Home Equity Conversion Mortgages. The homeowner doesn’t make payments on the loan while living in the house, but the loan becomes due at the death of the last borrower.

Heirs get an initial six months to deal with the loan payoff. And it’s to their advantage to move as quickly as possible. Until the loan is settled, interest on the balance and monthly insurance premiums will continue to eat into any remaining equity.

The good news for heirs is that reverse mortgages are “nonrecourse” loans. That means if the loan amount exceeds the home’s value, the lender cannot go after the rest of the estate or the heirs’ other assets for payment. “The estate can never owe more than the value of the property,” says Gregg Smith, president and chief operating officer of One Reverse Mortgage.

The difference is covered by federal mortgage insurance, which the borrower pays while holding a HECM. If there is leftover equity after the loan is paid off, that money goes to the estate.

Also Check: Is A Home Equity Line Of Credit Considered A Mortgage

How To Pay Back A Reverse Mortgage After Death

A reverse mortgage must be paid off when the borrowers move out or die. A Home Equity Conversion Mortgage is the most common type of reverse mortgage because it is backed by the Federal Housing Administration . Here are the options for paying off a reverse mortgage before or after the borrowers death.

Sell the house and pay off the mortgage balance. Usually, borrowers or their heirs pay off the loan by selling the house securing the reverse mortgage. The proceeds from the sale of the house are used to pay off the mortgage. Borrowers keep the remaining proceeds after the loan is paid off.

Sell the house for less than the mortgage balance. HECM borrowers who are underwater on their house can satisfy their loan by selling the house for 95% of its appraised value and using the difference to pay the HECM. Even though the sale may not cover the balance due on the loan, the Federal Housing Administration doesnt allow lenders to come after borrowers or their heirs for the difference. Borrowers with jumbo reverse mortgages need to check with their lender to see if they are liable to repay any difference after the home is sold.

Have a child take out a new mortgage on the house after your death. An heir who wants to keep a house can either pay off the HECM or take out a new mortgage to cover the balance of the reverse mortgage. If the balance on the reverse mortgage is higher than the value of the home, heirs can buy the house for 95% of its appraised value.

If Your Spouse Or Partner Is A Co

When you and your spouse are co-borrowers on a reverse mortgage, neither of you have to pay back the mortgage until you both move out or both die. Even if one spouse moves to a long-term care facility, the reverse mortgage doesnt have to be repaid until the second spouse moves out or dies.

Because HECMs and other reverse mortgages dont require repayment until both borrowers die or move out, the Consumer Financial Protection Bureau recommends that both spouses and long-term partners be co-borrowers on reverse mortgages.

Recommended Reading: How To Add A Mortgage Calculator To My Website

What Happens To A Reverse Mortgage After Death

After the passing of the last surviving borrower, the reverse mortgage loan balance becomes due and payable. Many believe that the home reverts to the bank upon the death of the last borrower, but that is not the case.

Your heirs will have the option to decide whether they want to repay the loan balance and keep the home, sell the home and keep the equity or simply walk away and let the lender dispose of the property.

If they choose to keep the home, they will need to repay the loan and that means either refinancing the loan with new financing or with other money available to them. They can pay off the loan at the lower of the amount owed or 95% of the current market value.

If they wish to sell the home, they need to make sure that they take whatever steps are required to change the title so that they can sell the home and we encourage borrowers to contact an estate attorney to be sure they are taking the property steps for their circumstances.

The lender will work with heirs and if they are refinancing into a loan of their own they will typically give them up to 6 months to close that loan, or up to 12 months if they are selling the home.

Every 3-month extension may require evidence the home is listed for sale on the MLS. During this time, the lender or the lenders servicer will want to see the efforts of the family to sell and this is where the communication is important.