Know The Difference Between Interest Rate And Apr

One major distinction you should know before you begin comparing lenders is the difference between interest rates and APR.

An interest rate is simply the price you pay for borrowing money, expressed as a percentage of the principal amount you’re borrowing. As a basic example, if you’re borrowing $1,000 for one year, a 4% interest rate implies that you’ll pay $40 in interest to the lender.

On the other hand, annual percentage rate, or APR, is the total cost of borrowing money. In addition to the interest, or finance charge, APR also includes certain fees you’ll pay to borrow the money, such as a mortgage origination fee charged by the lender.

The point is that APRs and interest rates are often slightly different, and APR is the number you should consider when comparing lenders’ offers. You may be surprised how different the APR can be between two loans with the exact same interest rate.

Request A Loan Estimate Written Quote Or Lender Fees Worksheet From The Lenders You Contact

When you contact lenders request a Loan Estimate, quote or Lender Fees Worksheet that outlines the key items in their mortgage proposal. You should use the mortgage rate and closing cost information presented in these documents to compare mortgage proposals and select a lender.

Lenders should ask you questions regarding your personal and financial profile as well as the details of your home purchase so that they can provide the most accurate proposal possible. When you contact lenders ask that they not pull your credit report as this can negatively impact your credit score. For most borrowers, they should be able to use your summary credit information to provide you a Loan Estimate, mortgage quote or Lender Fees Worksheet.

We summarize each of these items below. Please note that lenders should provide these documents free of charge.

Use our free personalized mortgage quote feature to compare no obligation quotes from top lenders. Our quote form is easy-to-use and requires minimal personal information. Comparing multiple mortgage quotes is the best way to find the lender and loan that meet your needs.

- Lender Fees Worksheet. Borrower should also request a Lender Fees Worksheet that provides a detailed breakdown of all the costs and expenses associated with a mortgage including fees charged by lenders and other third parties. The lender is not required to provide you with the worksheet by law, but will likely provide it to you if you ask.

What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

You May Like: How Much Will A Mortgage Lender Lend Me

How Do Fha Home Loans Work

FHA mortgages are fixed-rate loans that the borrower must repay over a period of usually 15 or 30 years. These are the main points of difference between an FHA loan and conventional loan:

1) Low down payment: Under Federal Housing Administration rules, lenders can offer 2 tiers of FHA loans. Home buyers with a 580-619 credit score may take out an FHA loan with only a 3.5% down payment. Home buyers with a 500-579 credit score may take out an FHA loan with a 10% down payment.

2) Private Mortgage Insurance: All borrowers must pay monthly PMI until they have paid off at least 20% of the value of their home. PMI consists of an upfront payment of 1.75% of the loan amount, plus an annual premium that varies from 0.45%-0.85% depending on several factors.

3) Maximum loan amounts: The FHA sets a maximum loan amount for each part of the country, based on median home prices for the area. In 2022, the maximum loan amount stands at $822,375 in the highest cost areas . The maximum stands at $356,362 in the lowest-cost areas.

Assessing The Mortgage Rate Market

As you can see in the above graph, mortgage rates change year after year, so the factors impacting your potential mortgage rate arent entirely in your hands. Of course, controlling some factors that dictate your mortgage rate are totally in your power. Snagging a lower rate is all about making yourself appear a more trustworthy borrower.

You see, lenders charge different borrowers different rates based on how likely each person is to stop making payments . Since the lender is fronting the money, the lender decides how much risk its willing to take. One way for lenders to mitigate losses is with higher interest rates for riskier borrowers.

Lenders have a number of ways to assess potential borrowers. As a general rule of thumb, lenders believe that someone with plenty of savings, steady income and a good or better score is less likely to stop making payments. It would require a pretty drastic change in circumstances for this kind of homeowner to default.

On the other hand, a potential borrower with a history of late or missed payments is considered a lot more likely to default. A high debt-to-income ratio is another red flag. This is when your income isnt high enough to support your combined debt load, which can include student loans, car loans and credit card balances. Any of these factors can signal to a lender that youre a higher risk for a mortgage.

Read Also: How Many People Can Be On A Mortgage

How To Compare Mortgage Rates

When shopping around for a mortgage, its important to compare mortgage rates. Bankrate can help you shop for mortgage quotes through our mortgage rate tables, which allow you to plug in general information about your finances and location to receive tailored offers.

When comparing offers, consider the interest rate and annual percentage rate . Interest rates can be fixed or variable and are determined by market factors and your own creditworthiness. The APR, on the other hand, includes the interest rate and fees incurred when borrowing. The APR is the better tool for comparing the cost of a mortgage however, if youre not planning to stay in a home long-term, the interest rate might matter more, since APR assumes youll stick with the loan over its full term.

Keep in mind that the interest rate only tells you so much about the cost of buying a home. Lenders typically disclose additional closing costs on the loan estimate. The difference in closing costs might turn out to be more important than small differences in the interest rate.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Compare top mortgage lenders

Read Also: Do Multiple Mortgage Pre Approvals Affect Credit Score

San Diego County Credit Union: Nmls#580585

Min. down payment

SDCCU offers conventional loans for as little as 5% down.

National / regional

View details

Why we like it

Good for: Californians who are looking for a conventional or jumbo mortgage and who want to shop rates online.

Pros

-

Offers purchase, refinance and jumbo mortgages, plus loans for second homes and home equity products.

-

Provides customized rate and fee quotes without requiring contact information.

Cons

-

No FHA, VA or USDA mortgages.

-

Loans are available only in California.

National / regional

Alliant Credit Union offers conventional loans with as little as 3% down.

View details

View details

Why we like it

Good for: first-time home buyers who want to avoid mortgage insurance and prefer a digital application process.

Pros

-

Low- or no-down-payment options with no mortgage insurance.

-

Offers a home equity line of credit, or HELOC.

-

Mortgages are available for non-warrantable condominiums.

Cons

-

Doesn’t offer government-backed mortgages, like FHA or VA loans.

-

Mortgage origination fees are on the high side, according to the latest federal data.

Min. credit score

Carrington Mortgage Services offers conventional loans for as little as 5% down.

View details

Good for: first-time home buyers or credit-challenged borrowers interested in government loan products.

Pros

Cons

-

Doesn’t offer home equity lines of credit.

-

Lender fees are on the high side, according to the latest Federal data.

View details

Gather The Necessary Documentation

Once you know the kind of mortgage and term you want, gather documents that show your income, investments, debt and more. In order for lenders to give you the most accurate quote, theyll need your:

- Statements for any investments, including brokerage and retirement accounts

- Records of all your debt, including student loans, car loans and personal loans

- Renting history

- Gift letters indicating that money gifted to you to buy a home is not a loan, if applicable

- Divorce, child support and alimony documentation, if applicable

- Records of bankruptcy and foreclosure, if applicable

You May Like: Can I Have Multiple Mortgages

Best Mortgage Refinance Companies

Compare the best mortgage refinance companies and save by lowering your interest rate. Replace your loan and save with a new, trusted lender rated and reviewed by experts.

- Fast and easy online quote process

- A+ Rating from Better Business Bureau

- No closing cost options available

- Second largest non-bank lender in the States

- In business for over a decade

- Offers over 200+ locations nationwide

- Low rates for refinance and cashout refinance

- Get a customized rate quote in 3 minutes with no impact to credit

- Online application accessible 24×7

- Wide range of loan options

- A+ BBB rating with over 20 years experience

- Offers cash-out, cash-in, rate & term, or HELOC refinancing

- Explore potential benefits by using the free refinance calculator

- Provides a personalized refinancing rate in only 5 minutes

- Enjoy a simplified process for a hassle-free experience

- Backed by a 5-year rate protection pledge

- Reach your financial goals with cash-out refinancing

- Explore competitive interest rates & homeowner-friendly terms

- Take advantage of a quick & easy online application process

- Website features free calculators & educational resources

- Voted highest in customer satisfaction for 8 consecutive years

- Discover competitive rates for cash-out or rate & term refinancing

- Connect with real home loan officers to discuss your refinance goals

- Enjoy 24/7 access via the website or app

- Streamlined application process that is 100% digital

- Features a near-perfect 4.9 star rating on the app store

Rocket Mortgage Application Requirements

When Rocket Mortgage evaluates a loan application, they look for a few factors. While each persons approval procedure is distinct, there are some fundamental rules to follow. Ideally, your monthly costs should not exceed 45% of your monthly income.

MoneyGeeks Rocket Mortgage loan review outlines more of the following information that you need to prepare on hand to start your application:

Your income and employer information

Your Social Security number

Rocket Mortgage also needs to track your assets when you buy or refinance a home. Having two years of employment history with confirmation of current, solid income is also preferred. In certain cases, a credit score of 580 will suffice. But, in most cases, a credit score of 620 is required.

You May Like: Where Are 30 Year Mortgage Rates Headed

Read Also: How Do I Become A Mortgage Loan Officer

How To Shop For A Mortgage In 7 Steps

Shopping for a mortgage isnt all that hard. At least, not if you know what to expect. Heres how the process will go:

Well cover these points in more detail below. But those are the basic steps to shopping for a mortgage and finding the lowest rate.

Rates Fees Rolled Into A Single Figure

The APR takes all those things that make it hard to figure the cost of a mortgage – the interest rate, lender fees, discount points and loan duration – and rolls them into a single number – the annual percentage rate. This number, which is similar to – and often confused with – the interest rate, shows what your actual cost of borrowing is. By law, the APR must be listed on the Truth-in-Lending statement all mortgage lenders are required to provide.

For example, consider two loans, both for $200,000 at 5 percent interest. Just for the sake of an example, we’ll say the first loan has no fees or points paid, so the borrower is simply borrowing $200,000 at 5 percent interest. On the second loan, however, the borrower is paying $5,000 in fees and points, which are included in the $200,000 balance the borrower owes. So in reality, the borrower is getting a $195,000 loan, with a $5,000 charge added right on top.

The APR takes into account this $5,000 charge in figuring the cost of borrowing $195,000 – the amount actually available for the borrower to use. It does this by spreading the $5,000 over the term of the loan – in this case, we’ll say 30 years – and rolling it into the interest rate. Taking that into account, it means the borrower is effectively paying an annual rate of 5.218 percent to borrow $195,000 over 30 years – even though the actual terms of the loan are $200,000 at an annual rate of 5 percent.

You May Like: Is Fairway Mortgage A Broker

Getting Prescreened Mortgage Offers In The Mail

Why am I getting mailers and emails from other mortgage companies?

Your application for a mortgage may trigger competing offers . Heres how to stop getting prescreened offers.

But you may want to use them to compare loan terms and shop around.

Can I trust the offers I get in the mail?

Review offers carefully to make sure you know who youre dealing with even if these mailers might look like theyre from your mortgage company or a government agency. Not all mailers are prescreened offers. Some dishonest businesses use pictures of the Statue of Liberty or other government symbols or names to make you think their offer is from a government agency or program. If youre concerned about a mailer youve gotten, contact the government agency mentioned in the letter. Check USA.gov to find the legitimate contact information for federal government agencies and state government agencies.

Do lenders have to give me anything after I apply for a loan with them?

Under federal law, lenders and mortgage brokers must give you

- this home loan toolkit booklet from the CFPB within three days of applying for a mortgage loan. The idea is to help protect you from unfair practices by lenders, brokers, and other service providers during the home-buying and loan process.

- a Loan Estimate three business days after the lender gets your loan application. This form has important information about the loan:

- the estimated interest rate

What Is A Loan Estimate

The Loan Estimate form contains important information about the mortgage youre being offered. Its designed to help you better understand the terms of the loan and any special features that go with it. This tool lets you confirm youre getting the loan you want and also compare loan offers to find the one thats right for your budget. You will receive your Loan Estimate from a lender within three business days of completing a mortgage loan application.

Don’t Miss: When Do You Lock In Your Mortgage Rate

Get All Important Cost Information

Information can be sought about mortgages from several lenders or brokers. You must check your finances and know how much of a down payment you can afford, and find out all the costs involved in the loan. It is not enough to just know the amount of the monthly payment or the interest rate. Gather information and compare the same loan amount, loan term, and type of loan. The following information is important to get from each lender so you can Compare Mortgage Lenders:

1) Rates :

- Check with all the lenders and brokers for a list of their current mortgage interest rates and if the rates are the lowest for that day or week.

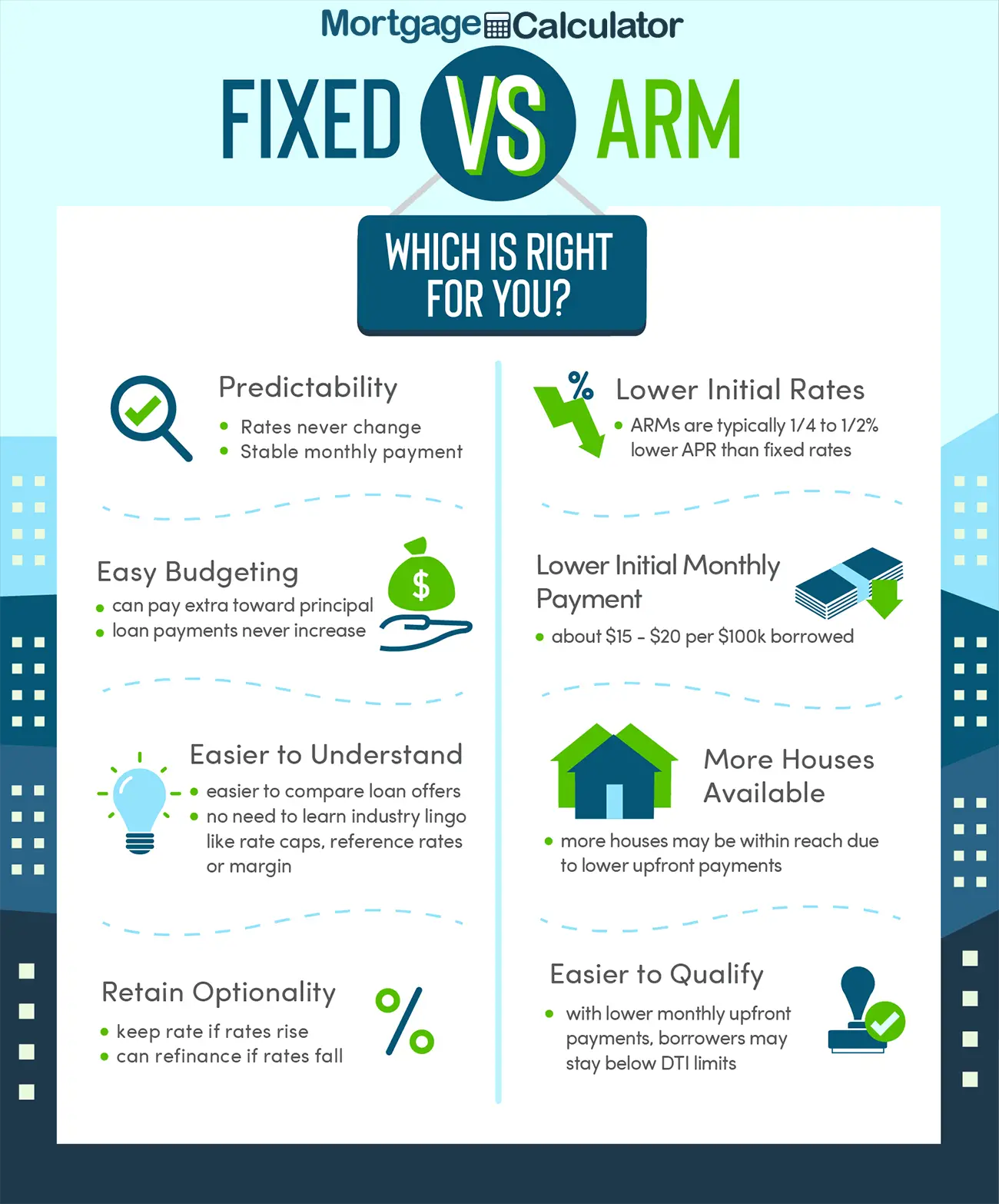

- Check if the rate is fixed or adjustable. Understand that when interest rates for adjustable-rate mortgages go up, the monthly payments do.

- Ask how your rate and loan payment will change in case of an adjusted rate mortgage, and if your loan payment will be reduced when rates go down.

- Get information on the loans . The APR takes into account the interest rate, points, broker fees, and some credit charges called the yearly rate that you may need to pay.

2) Points : The fees paid to the lender or broker are known as Points. It is inversely proportionate to the interest rate, the more points you pay, the lower the rate.

- The local newspaper gives information about rates and points currently being offered.

- Ask for the points to be quoted as a dollar amount, so that you are aware of how much you will actually have to pay.