Reducing Your Mortgage Term

You could ask to reduce the 40-year term by remortgaging to a new deal during the lifetime of your mortgage. This would mean paying your mortgage off quicker by increasing your monthly payments, reducing how much interest you pay in total. This might be when you get a pay rise and can afford regular, higher monthly payments.

Changing your mortgage term is a big decision, so it’s important to understand your options. Reducing your term lacks the flexibility of overpayments, so youll need to be sure you can maintain that level of monthly repayments, so it stays affordable. And if you remortgage, take into account any fees or penalties you might have to pay, and that youll need to pass affordability checks.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Read Also: How Much Per 1000 On Mortgage

Find A Mortgage Broker Or Lender

A mortgage broker is a middleman between you, the borrower/homeowner, and your lender. Brokers work with numerous banks and are able to match borrowers with mortgage programs that fit their needs best. Picking the proper mortgage broker will make a huge difference while youre deciding if a 40-year mortgage is for you. Youll need someone you can trust. They can inform you of other products that might be a better fit for your financial situation.

40-year mortgages are a long-term commitment, so its generally wise to seek advice before committing to this type of mortgage.

The bottom line with current 40-year mortgages is that, with any financial decision, it will depend on your financial goals and objectives. But before deciding, you need to look at your situation objective, ask a mortgage professional, and do your homework to ensure youre making a wise decision.

A 40-year mortgage is just what the name impliesâa home loan is designed to be paid off after 40 years as opposed to the more traditional 30- or 15-year terms. 40-year home loans tend to be more popular in high-interest-rate environments, according to Michael Larson of Bankrate.com, and they are accompanied by some risks that should be considered before you sign up for this longer-term mortgage option.

Also Check: Is Home Insurance Part Of Mortgage

What Is Good About A Long

1. Predictable repayments

The big plus point about a longer term fixed deal is that your monthly repayments are predictable for a long time.

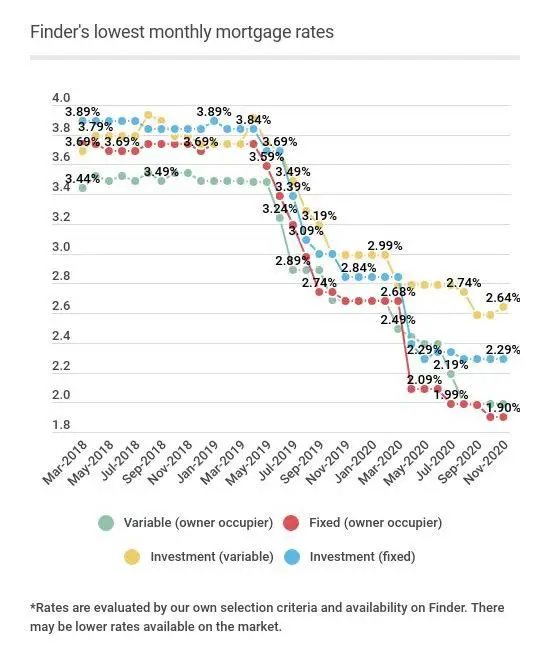

It means that you dont have to worry about whats happening in the wider mortgage market and are effectively protecting yourself against interest rate rises.

For example, if you secure a five-year deal and interest rates creep up in five years time, when you switch to a new deal you might have to pay a rate that is higher than the one you are currently on.

2. It saves time

People on shorter term deals also have to shop around every few years, which can be time consuming.

Each time you switch you would probably spend time researching the mortgage market and speaking to a broker to choose a new deal.

3. It saves money

Admittedly you will pay more in interest if you opt for a long term fixed deal, but you could save money on lender fees.

This is because most deals come with product charges, typically costing around £1,000. If you were to switch 10 times over 35 years, that is an extra £10,000 in fees that you might have to pay on top of your mortgage.

If you are paying a mortgage broker each time you switch to a new deal, the fees can also mount up to thousands of pounds over the lifetime of your loan .

Opting for a long term fixed rate mortgage means you no longer have to worry about these extra costs.

Times Money Mentor can help you choose a mortgage with this comparison tool.

Open And Closed Mortgages

There are a few differences between open and closed mortgages. The main difference is the flexibility you have in making extra payments or paying off your mortgage completely.

Open mortgages

The interest rate is usually higher than on a closed mortgage with a comparable term length. It allows more flexibility if you plan on putting extra money toward your mortgage.

An open mortgage may be a good choice for you if you:

- plan to pay off your mortgage soon

- plan to sell your home in the near future

- think you may have extra money to put toward your mortgage from time to time

Closed mortgages

The interest rate is usually lower than on an open mortgage with a comparable term length.

Closed term mortgages usually limit the amount of extra money you can put toward your mortgage each year. Your lender calls this a prepayment privilege and it is included in your mortgage contract. Not all closed mortgages allow prepayment privileges. They vary from lender to lender.

A closed mortgage may be a good choice for you if:

- you plan to keep your home for the rest of your loans term

- the prepayment privileges provide enough flexibility for the prepayments you expect to make

You May Like: What Is Mortgage On A 500k House

Prepare Your Credit Before Applying For A Mortgage Loan

Whether or not you’re thinking about pursuing a 40-year mortgage, it’s crucial that your credit profile is in tip-top shape before applying for a home loan. Check your credit report and to determine where you stand and take steps to address potential issues that could affect your approval odds.

This may include paying down credit card debt, bringing past-due accounts up to date and more. Also, avoid applying for new credit in the six to 12 months leading up to your mortgage application because it could impact your credit score and your debt-to-income ratio.

As you prepare to apply for a mortgage loan, working to improve your credit can help you reduce your monthly housing costs and maximize your total savings.

Youll Pay Off Your House In Half The Time

Guess what? If you get a 15-year mortgage, itll be paid off in 15 years. Why would you choose to be in debt for 30 years if you could knock it out in only 15 years?

Just imagine what you could do with that extra money every month when your mortgage is paid off! Thats when the real fun begins! With no debt standing in your way, you can live and give like no one else.

Recommended Reading: How To Calculate Principal And Interest For Mortgage

How Will This Ginnie Mae Change Affect Va Loans

In the same Ginnie Mae press release, the executive also noted that: The terms and extent of use of the new pool type would ultimately be determined by the Federal Housing Administration and Department of Veterans Affairs , whose programs are the basis for the loans in Ginnie Mae pools. Translation: its up to the FHA and VA to determine how theyll implement these changes related to loans modified into 40-year terms.

And, in response to these changes, VA spokesman Gary Kunich stated that VA is aware of the change that Ginnie Mae has instituted. Once the moratorium on foreclosure and evictions for VA-backed loans ends, VA will provide appropriate guidance.

How Can I Get A 40

In 2013, the Consumer Financial Protection Bureau a US government entity prohibited the issuance of new 40-year mortgages. More precisely, the Bureau established a set of rules to help ensure new homeowners could afford their mortgage payments. Accordingly, mortgage lenders no longer recognize these loans as qualified mortgages, that is, ones that follow the Bureaus rules.

Regardless, some lenders have continued offering these 40-year terms as nonqualified mortgages. In other words, these loans do not adhere to federal government regulations, meaning lenders cannot as easily sell 40-year loans to investors. This reality means lenders assume more risk with 40-year mortgages, which makes finding a lender willing to originate one challenging. But, these loan products do exist if youre willing to look.

Also Check: How Much Is The Average Monthly Mortgage

What Is An Extended Mortgage

An extended mortgage is considered to be any mortgage that is repaid over a period longer than 25 years. In the UK, 25 years is usually the maximum length of a mortgage term, so anything longer than this counts as extended.

There are now many lenders who offer mortgages longer than 25 years, with the longest readily available being 40 years. As of March 2020, lenders of 40-year mortgages include Halifax, Nationwide, Leeds Building Society and Yorkshire Building Society.

Use our Mortgage Calculator to find out how much you could borrow, how much it might cost a month and what your loan to value ratio would be.

Start By Selecting Your State

- Could be a good option at times when a higher interest rate climate exists as a 40 year loan may offer a lower payment alternative to other shorter term mortgages. As most consumers tend to maintain a mortgage for an average period of only 5-7 years before selling the home or refinancing, this initial payment relief can be welcome. Hopefully the 40 year term borrower can refinance into more attractive financing options in the future as their income grows.

- Attractive to high wage earning households whose primary tax deduction is that of mortgage interest. .

- May be beneficial to borrowers who plan to remain in a property indefinitely as this will lessen their risk in taking on a long term mortgage if rates were to increase and they were unable to refinance or in the event that housing prices declined.

Cons:

Nancy Osborne has had experience in the mortgage business for over 20 years and is a founder of both ERATE, where she is currently the COO and Progressive Capital Funding, where she served as President. She has held real estate licenses in several states and has received both the national Certified Mortgage Consultant and Certified Residential Mortgage Specialist designations. Ms. Osborne is also a primary contributing writer and content developer for ERATE.

“I am addicted to Bloomberg TV” says Nancy.

Read Also: What Is The Average Mortgage Rate In Florida

A New Path To Get Out Of Forbearance

Housing and policy experts largely support the governments actions, saying it will help people remain in their homes during and after the pandemic.

As the pandemic began to hit and unemployment reached 14.8% in April 2020, businesses closed and more than 7.2 million borrowers enrolled in forbearance programs, according to Black Knight, a data analytics firm. That number has dropped significantly, but there are still roughly 2 million borrowers who remain in forbearance in mid-July.

As the first wave of forbearance plans nears expiration in September, Ginnie Maes announcement dovetails with the Consumer Financial Protection Bureau finalizing changes to a rule that will help borrowers transition safely out of forbearance. For some homeowners, that could mean selling their home, while others might opt for a loan modification.

These new rule changes would require lenders to redouble their efforts to work to prevent avoidable foreclosures. It includes giving borrowers enough time to evaluate their options after forbearance ends, allowing streamlined loan modifications and increasing educational outreach to borrowers so that theyre fully aware of their choices.

Potential For Bigger Short

If youre considering an interest-only payment option in the first 10 years of your 40-year loan, you can create more room in your budget during that first decade. Keep in mind, however, that paying only interest means you might not be building any equity in the property, so its an asset you cant leverage initially.

Recommended Reading: Which Credit Report Do Mortgage Lenders Use

What Is The Best Length Of Time For A Mortgage

There is no single best term length for a mortgage. The ideal terms depend on your financial circumstances, age, and financial goals. A 15-year mortgage will cost you less in the long run, but it won’t be helpful if you can’t afford the steep monthly payment. A 30-year mortgage will make your monthly payments more manageable and may free you to invest that extra money elsewhere, but you will pay more in interest in the long term. Assess your financial situation carefully before you decide on your mortgage terms.

How Can I Pay Off My 30

How to Pay Your 30-Year Mortgage in 10 Years

Also Check: Can You Get A Mortgage With Less Than 20 Down

Is It Better To Pay Lump Sum Off Mortgage Or Extra Monthly

Regardless of the amount of funds applied towards the principal, paying extra installments towards your loan makes an enormous difference in the amount of interest paid over the life of the loan. Additionally, the term of the mortgage can be drastically reduced by making extra payments or a lump sum.

Ginnie Mae Changes And The 40

But, new federal policies may change the VAs position on 40-year mortgages.

Ginnie Mae stands for the Government National Mortgage Association, and its a government-owned corporation within the Department of Housing and Urban Development. Ginnie Mae has a goal of indirectly promoting homeownership among Americans. More precisely, when government-insured loans are rolled together and sold as an investment , Ginnie Mae guarantees the principal and interest payments on those investments. In other words, when a homeowner misses a mortgage payment, Ginnie Mae will step in and make sure the investor who indirectly purchased that mortgage still gets paid.

This Ginnie Mae model helps guarantee a steady flow of investor funds into the US mortgage loan market, ultimately keeping loan costs low for buyers. Though complicated, the important takeaway is: when Ginnie Mae changes its rules, these changes open the door for changes to the underlying mortgage products that make up the pooled investments it guarantees.

And, Ginnie Mae just announced a major rule change. Following recent leadership changes, Ginnie Mae introduced a new 40-year mortgage pool for its approved issuers . In theory, because Ginnie Mae will accept 40-year mortgages into its investment pools, the underlying lenders will begin offering 40-year mortgages.

You May Like: What Is Interest Rate On 30 Year Mortgage

‘getting A Mortgage Pre

Last week, the 30-year fixed rate mortgage jumped by the largest week-over-week amount in 35 years to 5.78% the highest level since November 2008. Since the start of the year, rates have climbed more than 2.5 percentage points, creating additional barriers for homebuyers, especially first-time ones, who are facing a shortage of properties for sale and double-digit home price growth.

Homebuyers are putting down nearly double for down payments than in 2020. They also need an additional $30,000 in income to afford a home. Some experts have called it the worst housing affordability crisis.

With home prices up and interest rates way up, getting a mortgage pre-approval is harder than it has been in the past several years, John Stearns, senior loan officer at American Fidelity Brokerage Services, told Yahoo Money.

Is There A 50 Year Mortgage

50 yearloan50year50year mortgage50loan50year

. Also to know is, is there such a thing as a 60 year mortgage?

And yet, just like the interest-only mortgage loans, homebuyers are willing to risk it all and take on a 40- 50-60 year mortgage. If you need to apply for a 50 year mortgage loan to stretch out high payments youâre probably buying much more than you can really afford.

Also Know, can you get a 40 year mortgage? Basics. Most mortgages are 15 or 30 years long a 40âyear mortgage is not that common. However, because the loan is 10 years longer, the monthly payments on a 40âyear mortgage are smaller than those on a 30-year loanâand the difference is greater still when compared to a 15-year loan.

Regarding this, can you get a 100 year mortgage?

One hundred year mortgage are exceptionally rare in the United States, as much of the secondary market built around insuring and securitizing home loans is built around 30-year and 15-year mortgages. The most common home loan term in the US is the 30-year fixed rate mortgage.

What is the longest amount of time you can have a mortgage?

You may have thought that 30 years was the longest time frame that you could get on a mortgage, but some mortgage companies are now offering loans that run as long as 40 years. Whatâs more, 35- and 40-year mortgages are slowly rising in popularity.

Also Check: Can You Apply For A Mortgage Before Finding A House

Recommended Reading: How Much Is A Habitat For Humanity Mortgage

Can I Pay Off My Mortgage At The End Of The Term

At the end of the term, you can renew or renegotiate your contract, including the interest rate and payment schedule. You also have the choice of staying with your current lender or shopping around to find a better deal. This ensures you aren’t locked in to the same agreements over the entire length of your mortgage.