How Long Is A Home Loan Pre

The good-for period varies with the lender, but typically anywhere from a month to 90 daysand, in some cases, six months. Its good practice to keep track of the expiration date so that you dont run into a situation where you find a dream home that you can afford only to learn that your pre-approval has expired.

Learn More About The Benefits Of Prequalification And Preapproval

As you look for a home, you may be asked to get prequalified or preapproved. Before you start, its important to understand the difference.

When you want to talk to a lender to establish a general range of home prices, you can get prequalified, which is simply a lenders estimate of what you could potentially borrow.

This can be completed easily and conveniently online, in person, or over the phone in just a few minutes with basic information like your income and expected down payment.

When you want to give yourself a competitive edge over other buyers in the market, you can get preapproved. Having a preapproval lets sellers know that you already qualify for the home financing which greatly increases your chance of having your offer selected.

Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay stubs, bank statements and tax returns.

The lender will then use these documents to determine exactly how much you can be preapproved to borrow.

Once youre preapproved, youll have 90 days to find a home you love. Then you can lock your rate and complete your application.

Whether you choose to get prequalified or preapproved, you will have a better sense of whats in your price range and can hunt for a house with confidence.

Two Smart Homebuying Moves: Mortgage Prequalification And Preapproval

Find out how much house you can borrow before you start looking and how you can make the strongest offer possible on the property you choose.

If youre ready to make your dream of owning a home a reality, youve probably already heard that you should consider getting prequalified or preapproved for a mortgage. Its time to understand exactly what each of those terms means and how they might help you. And when youre working toward a goal this big, you want every advantage.

Ready to prequalify or apply? Get started

You May Like: What Mortgage Amount Do I Qualify For

Dont Get Preapproved Too Far In Advance

When you receive your preapproval letter, it will probably say its good for 30 to 90 days. Since thats a relatively short period, youll probably want to wait to get preapproval letters until youre ready to start seriously shopping for a home. And remember, a preapproval is only a conditional approval. If you rack up more debt, change jobs or reduce your savings, you could get denied when you go to get final mortgage approval.

How Long Preapproval Lasts

Preapproval doesnt last forever. Check your expiration date and keep it in mind as you look at homes. Though it varies from lender to lender, preapproval is typically valid for 60 90 days. If you havent settled on a house, you can request a renewal by giving your lender your most up-to-date financial and credit information.

The right home is out there.

Find it online at RocketHomes.com.

Read Also: How Much Work History For Mortgage

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partners income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you dont know them.

With these numbers, youll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

What Should I Get Preapproved

In todays housing market, it will be almost impossible to get a seller to consider your offer unless you have a mortgage preapproval . There are simply too many buyers for sellers to be willing to take a chance on one who hasnt at least talked to a lender about getting a mortgage.

Another important reason to get preapproved: It gives you an idea of how much home you can afford based on how much money a lender is prepared to let you borrow. This can save you time during house hunting by eliminating properties out of your price range.

Don’t Miss: What Is The Easiest Mortgage Loan To Get

Why Is My Pre Approval So Low

Pay Off Debts When determining how much you can borrow, a lender will look at your monthly debt payments. If you have an extensive monthly debt burden, your preapproval amount will be lower. But if you can eliminate some of these debts from your books, then a lender may be willing to increase your preapproval amount.

Does Having An Unused Line Of Credit Affect Mortgage Approval

An increase in balances, credit limit or missed payments could have an impact on the potential mortgage advance. Some lenders may require a line of credit or credit card to be paid out or closed prior to approving a mortgage. You should clarify this during the pre-approval process and well before your closing date.

Recommended Reading: Can You Add Debt To Your Mortgage

Mortgage Preapproval In Hindsight

Katerina Matsa ultimately closed on her first home purchase in late 2018. Looking back, she only now appreciates the critical financial role that her lender played in the home buying process.

If I could go through the preapproval process again, I would have more thorough conversations with the lender about our mortgage options. I would ask more questions and make sure I fully understand various details. Everything happened so fast. That was the downside of starting the process so late.

Pick The Best Mortgage

Choosing the right mortgage is more than just picking the one with the lowest interest rate. There are many different types of mortgages, and some will be better than others for your situation.

As a rough outline, there are three main categories of loans.

Conventional Loans: These are best for people who have a solid credit score and a large down payment saved up.

Government-Backed Loans: These allow people with small down payments and low credit scores to still get a mortgage. Some have regional restrictions, and others are limited to certain groups, such as VA loans for veterans and their families.

Jumbo Loans: Theseare for those with deep pockets. Lenders can only lend conventional loans up to a certain amount . Folks who want to buy a house more expensive than that will need a jumbo loan.

You may also qualify for government assistance, such as the first-time home buyers tax credit. Just remember that if you dont live in the home for three years, youll have to make first-time homebuyer installment payments to pay it back.

Recommended Reading: How Much Is A Home Mortgage

A Limited Pool Of Financial Data

There are certain pieces of financial data your mortgage lender will have access to in the course of approving your home loan application. Your lender will need to know how much money you earn and what your existing debts look like. Those factors, plus your credit score, will help your lender decide whether you’re approved for a mortgage and what that loan amount looks like.

But your income and existing debts don’t tell your entire financial story. And so it’s important to consider your own big picture when deciding how much of a mortgage to take out.

Let’s say you currently spend $4,000 a month on childcare. Since that’s not a debt, your lender may not know or ask about it. As such, your lender might calculate your mortgage amount under the assumption that you aren’t on the hook for $48,000 a year in daycare expenses.

Or, to put it another way, your lender might determine that you can swing the monthly payments on a $400,000 mortgage based on your existing debts and income. But if, based on your total expenses, you feel you can only cover the payments on a $300,000 loan, then that’s the mortgage amount you should limit yourself to.

What Is Conditional Pre

Conditional pre-approval is an indication from a lender that youre eligible to apply for a home loan up to a certain limit. Youre under no obligation to take the loan, and the lender has no obligation to lend you that amount, but it can show sellers youre serious about buying and that youre confident you can afford the property.

In order to give you an indication of what you can reasonably expect to borrow, a lender should take into account your personal financial situation and the price range of properties youre looking at.

Read Also: When Is A Mortgage Payment Considered Late

Can I Do 2 Mortgage Applications At The Same Time

Never apply to multiple lenders within a short time frame There are consequences for your credit score when you apply for more than one loan or line of credit within a short space of time. Multiple applications for loans can suggest that you’re reckless with money and can make it more difficult to obtain credit.

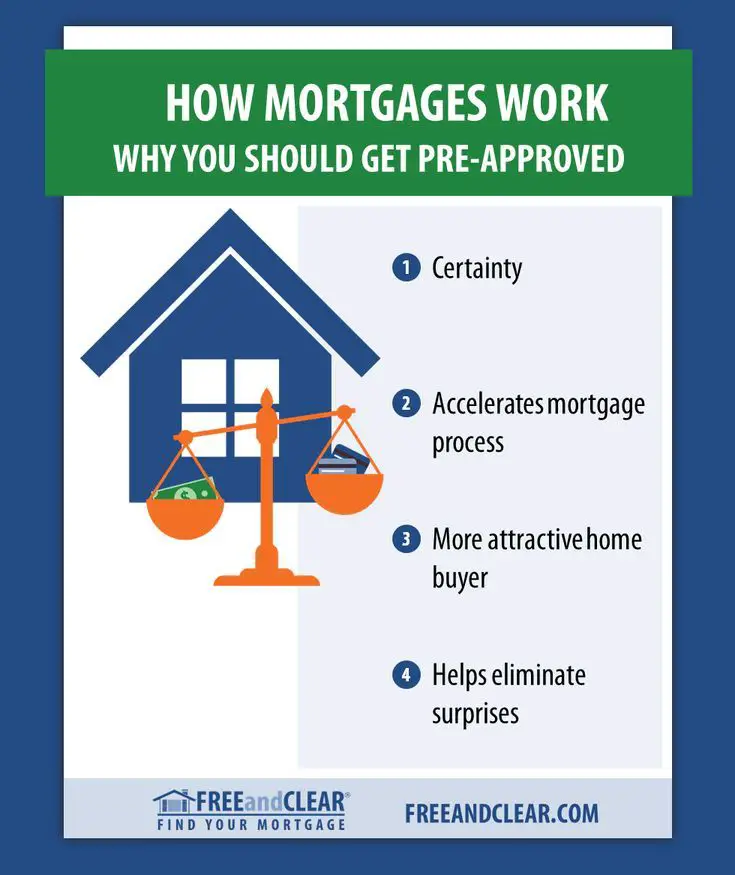

Why Should I Get Preapproved

If a preapproval doesnt get you a loan right away, why get one? Preapprovals have several benefits:

- Its easier to shop: Many real estate agents require you to get preapproved before you shop for a home. Preapprovals make the house hunting process easier for you and your real estate agent.

- It makes your offer stronger: If youre shopping in a competitive housing market, a preapproval can be crucial to getting your offer accepted. Sellers arent just looking for the highest offer. Theyre also looking for offers that arent likely to fall through. A preapproval tells buyers you can get financed for the amount youve offered.

- It gives you time to sort out issues: There are reasons both buyers and sellers may need to get to closing fast. Getting preapproved means youre getting the bulk of the mortgage process done upfront. That way, once youve had an offer accepted, you can just focus on getting ready for your move.

Also Check: How Is Debt To Income Ratio Calculated For A Mortgage

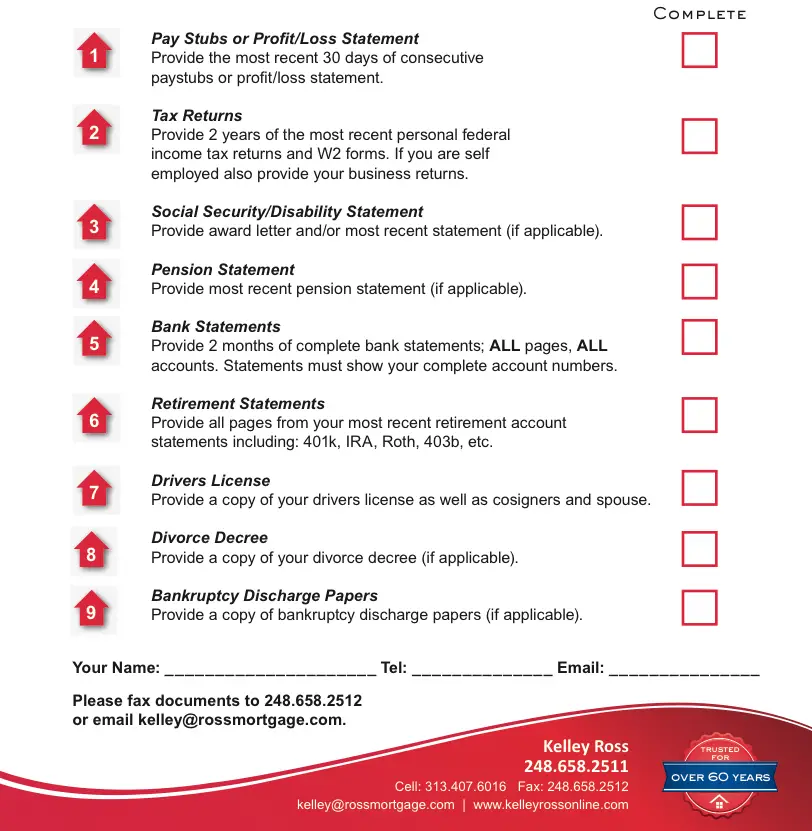

Home Loans Preapproval Checklist

- A drivers license or U.S. passport

- A Social Security number or card. If not a U.S. citizen, a copy of the front and back of your green card

- Verification of employment

- Copy of their credit reports from the three national credit bureaus

- Recent pay stubs covering the last 30 days

- W-2 forms from the previous two years

- Proof of any additional income

- Last two years of personal federal income tax returns with all pages and schedules. If self-employed, last two years of individual federal income tax returns with all pages and schedules, as well as a business license, a year-to-date profit and loss statement , a balance sheet, and a signed CPA letter stating you are still in business

- Bank account statements proving that you have enough to cover the down payment and closing costs. If someone is helping you with the down payment, a gift letter stating that the fund is a gift and not an IOU

- Last quarterly statements for asset accounts , IRA, stock accounts, mutual funds)

Also Check: What Is A Teaser Rate Mortgage

How Long Does A Preapproval Last

Many mortgage preapprovals are valid for 90 days, though some lenders will only authorize a 30- or 60-day preapproval. If your preapproval expires, getting it renewed can be as simple as your lender rechecking your credit and finances to make sure there have been no major changes to your situation since you were first preapproved.

Read Also: Do Multiple Mortgage Applications Hurt Credit

You May Like: Can You Get A Mortgage To Build A House

Can You Make An Offer On A House With A Pre

So the question is: Can you make an offer on a house before you’ve even been pre-approved for a mortgage? Yes. … Anyone can make an offer to buy a house that is listed for sale. With that being said, sellers typically don’t put their homes under contract unless they feel good about the buyer who is making the offer.

What Are The Advantages Of Conditional Pre

Not only does conditional pre-approval show sellers that youre serious, it can also help to be well progressed with your finance as soon as you find your dream home.

If youre early on in your home buying journey, getting conditional pre-approval can help you focus your property search by giving you a clear idea of what youre likely to be able to afford based on what a lender is prepared to loan you. If something changes while youre looking for a new home your financial situation, for example you can always renew your conditional pre-approval.

You May Like: What Is A Good Dti For A Mortgage

Take Stock Of Your Finances

Most lenders determine what mortgage loan amount you can get by applying the 28/36 rule. According to the rule, your monthly mortgage payment should be no more than 28% or less of your gross monthly income. You should also only spend 36% of your gross income on all your debts, including your mortgage and other recurring debts, such as a car or student loan payments.

For example, if you earn $3,500 a month pretax, your monthly mortgage payment should be no higher than $980, which would be 28% of your monthly income. Some lenders may let you borrow more, but experts say its best to avoid taking on a larger payment so that you dont stretch your finances too thin and risk falling behind on your mortgage.

To avoid surprises, take a close look at your household income, monthly expenses, investment bank accounts, and credit score before applying for preapproval. Youre entitled to a free copy of your report from each of the three major credit bureaus Equifax, Experian, and TransUnion at AnnualCreditReport.com.

This process will also help you determine how much youre comfortable spending each month, which may be less than what a lender will offer, and how large a down payment you can make.

Does Mortgage Pre

Speaking of timing, if youâre worried about your credit taking a hit, you should probably focus on improving it before applying for a mortgage pre-approval. Getting pre-approved for a mortgage does have an impact no your credit score, albeit a small one.

When lenders check your credit, they usually perform a hard k inquiry which will come off your report after two years. If youâre planning to get pre-approval letters from multiple lenders, you should do it within a 45-day window because inquiries within this time frame all count as a single credit check, rather than multiple ones.

Read Also: What Would The Mortgage Be On A 250 000 House

Is A Mortgage Pre

No! Mortgage pre-approval and pre-qualification are not interchangeable.

The difference is really in the depth of the lenders research. In order to be pre-qualified, you report your income, debt and assets to your lender, and your lenderwithout questioning your numberstells you, “Based on the numbers you gave us, you may qualify for this much of a mortgage.”

But those numbers dont have to be accurate. If you bent the numbersif you werent precise about your income, your tax returns, or your debta pre-qualification will only give you a rough estimate.

A mortgage pre-approval, on the other hand, is a thorough inquiry into your finances. A lender wont simply ask how much income you makeyoull have to prove it. Your lender will also pull your credit history, verify your income and assets, and assess your financial situation before they give you a mortgage pre-approval.

What Documents Are Needed For A Mortgage Preapproval

- Pay stubs from at least the past 30 days Your current income is a major consideration in getting preapproved for a loan, so your lender wants to see that you have a reliable, predictable cash flow coming in.

- Federal income tax returns from the last two years These will help verify your employment history and show the lender a longer-term track record of your income.

- Bank statements from at least the past two months Lenders like to make sure all your money is accounted for, so they want to check your bank statements to see that there arent any major unexplained deposits or withdrawals that could affect your loan.

- Investment account statements Returns on your investments can count as income, and lenders need to know about all your sources of money, not just your day job.

- Documentation related to any gift funds youre receiving If a family member or friend is giving you money to help you buy a home, put together a document signed by them explaining the gift and the amount, and that the gift will not need to be repaid.

- ID (such as a drivers license or passport Lenders need to make sure they know who theyre giving their money to, so theyll want to verify your identity and that youre a U.S. citizen. Foreign nationals can get financing, but its much more complicated.

Recommended Reading: What Should Your Credit Score Be For A Mortgage

Know When To Get Preapproved

Preapproval isn’t just for your lender. Knowing how much mortgage you can expect to take out is also highly beneficial to you as a buyer, and it can help you narrow down and focus on your best options.

That means the best time to get preapproved is at the start of your home buying journey. If you know you’re in the market for a new home, apply for preapproval now to get an early picture of your mortgage options and show agents you’re a serious buyer.