End: Payoff Vs Principal Balance

As you approach the end of your loan term, inching closer to being mortgage-free, it becomes time to settle your balance. Your outstanding principal as shown on your mortgage statement is not the total amount needed to pay off your loan. This is because interest will accumulate up until the day your loan closes. And, there may be other fees youve incurred but not yet paid, such as late fees, deferred interest, hazard/flood insurance, etc. Bottom line expect a balance thats higher than your principal balance. This is whats called a payoff amount or payoff quote.

Key takeaway:

The easiest way to determine your payoff balance call your mortgage servicer. Its far easier and more accurate than doing the math yourself. You can request a payoff quote that will illustrate what needs paying before the loan is resolved. Just know that payoff quotes have expiration dates, and some servicing companies may even include a charge to have your payoff faxed or emailed to you. If you do not pay your account in full before the quote expiration date, your payoff amount will change.

Are Closing Costs Tax Deductible In 2021

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is no. The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

You May Like: Can A Student Get A Mortgage

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

You have an adjustable-rate mortgage in which your payment stays the same for an initial term and then readjusts annually.

If you have an escrow account to pay for property taxes or homeowners insurance, because those taxes or insurance premiums may increase. Your monthly mortgage payment includes the amount paid into escrow, so the taxes and premiums affect the amount you pay each month.

You may have been assessed fees. Check your mortgage statement or call your lender.

Must reads

Read Also: Can I Sell A Home With A Mortgage

How Much Should You Save For A Down Payment

Save up a down payment of at least 20% so you wont have to pay private mortgage insurance . PMI is an extra cost added to your monthly payment that doesnt go toward paying off your mortgage. If youre a first-time home buyer, a smaller down payment of 510% is okay toobut then you will have to pay PMI. No matter what, make sure your monthly payment is no more than 25% of your monthly take-home pay on a 15-year fixed-rate mortgage. And stay away from VA and FHA loans!

Saving a big down payment takes hard work and patience, but it’s worth it. Here’s why:

- Youll have built-in equity when you move into your home.

How Do Mortgage Rates Affect Monthly Mortgage Payments

Higher mortgage rates mean higher monthly payments, but just how much higher depends on the size of your loan.

Using Experian’s mortgage calculator, here’s how monthly loan payments on a 30-year fixed-rate mortgage change, given a $400,000 home purchase with 20% down:

| Monthly Loan Payments from 3% to 6% | |

|---|---|

| Interest Rate | |

|

$2,226.90 |

$569.43 |

In this example, you’re borrowing $320,000 and paying it off over 30 years, but at four different interest rates. At 6% interest, your monthly payment is $569.43 more than it would be if your interest rate was 3%. A $569.43 increase hits hard on your monthly budget, but also consider the additional total costs over a year: $6,833.16. Over the 30-year life of the loan, you’ll pay $204,994.80 in additional interest, versus the same loan at 3%.

The range of 3% to 6% is hypothetical, but it’s not far out of line with the way actual rates have changed in recent years. In January 2021, Freddie Mac reported an average interest rate of 2.65% on a 30-year fixed-rate mortgage. By August 2022, that same mortgage averaged 5.55%. Mortgage rates are fluctuating as the Fed raises interest rates to curb inflation. Whether the Fed will continue to raise ratesand to what extentremains a matter of speculation.

You May Like: What To Watch For When Refinancing Mortgage

Calculating Your Mortgage Payment

Calculating your monthly mortgage payment will require information about your loan and some math. The formula will look something like this:

P / = Monthly Mortgage Payment

To calculate your payment, first, take your annual interest rate and divide it by twelve. This will give you the monthly interest rate, which you can plug into the i variable. Then, take the length of the mortgage and multiply it by 12. This will give you the total number of payments needed on the mortgage to use as n. The variable P is the principal owed on the loan.

Lets say you borrow $250,000 with a 30-year mortgage at 3.5 percent. Following the steps above, your monthly interest rate would be about .0029 percent and the total number of payments would be 360. The completed formula would be as follows:

$250,000 / = $727.01

Based on the formula, your monthly mortgage payment would be around $727.

How Does A Higher Mortgage Rate Hurt Home Affordability

The higher your mortgage interest rate, the less home you can afford. Lenders consider your debt-to-income ratio when deciding how much to approve on a mortgage. Your DTI is your monthly debt payments divided by your gross monthly income.

Requirements can vary from lender to lender, but typically a lender might look for a front-end DTI of no more than 28% and a back-end DTI of no more than 43%. Suppose you’re applying for the loan in our earlier example and your gross monthly income is $7,500. Here are a few ways a lender might look at your DTI at 3% and 6%:

- Front-end DTI at 3%: $1,657.47 + $350 , divided by $7,500 = 27%

- Back-end DTI at 3%: $1,657.47 + $350 + $200 credit card payments + $400 car loan, divided by $7,500 = 35%

- Front-end DTI at 6%: $2,226.90 + $350 , divided by $7,500 = 34%

- Back-end DTI at 6%: $2,226.90 + $350 + $200 credit card payments + $400 car loan, divided by $7,500 = 42%

At a 3% interest rate, a front-end DTI of 27% and a back-end DTI of 35% both look good. But at 6%, back-end DTI is borderline and front-end DTI at 34% may be too high for this loan to be approved. The higher interest rate in this example turns an affordable loan into an unaffordable oneand decreases the chances of getting the loan.

Read Also: How Much Should You Borrow For A Mortgage

What Is Your Interest Payment

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Most lenders calculate and determine your mortgage rate in terms of an annual percentage rate . is the actual amount of interest that you pay on your loan per year . For example, if you borrow $100,000 at an APR of 5%, youd pay a total of $5,000 per year in interest. At the beginning of your loan , most of your monthly payment goes toward paying off interest.

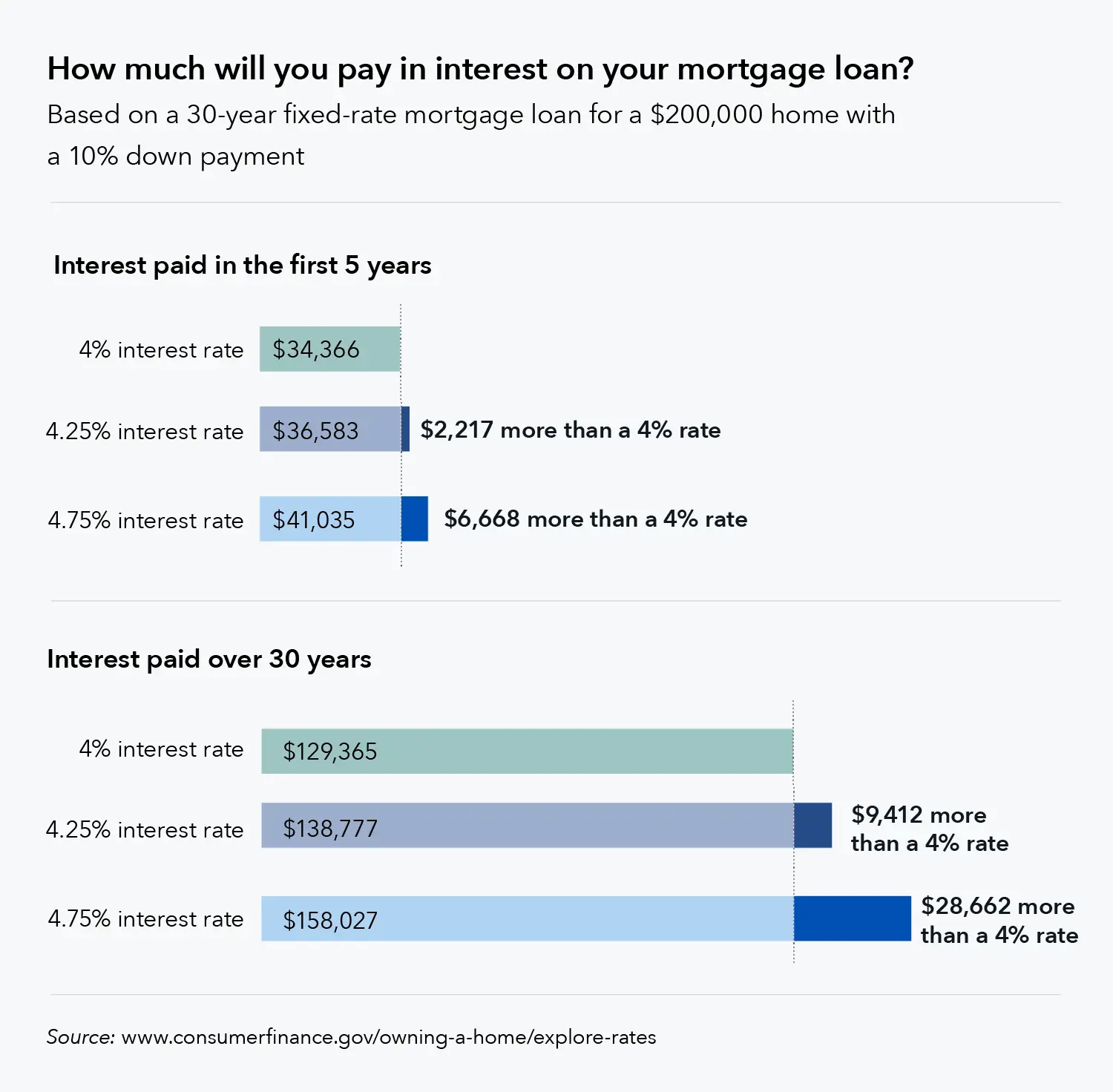

Just a few percentage points of interest can make a huge difference in how much you eventually end up paying for your loan. For example, lets say you borrow $150,000 at a 4% interest on a 30-year loan. With this loan, your monthly payment would be $716.12. If you take the same loan with a 6% interest rate, youd pay $899.33 each month.

The interest rate on your loan depends upon a number of factors. Your credit score, income, down payment, and the location of your home can all influence how much you pay in interest. If you know your credit history isnt that great, you may want to take some time to raise your credit score so you can save thousands of dollars in interest over time. Lets take a look at an example.

Say you have a choice between two lenders. One offers you $150,000 for a 30-year loan with 4% interest. The other lender offers you the same $150,000 for a 30-year loan, but with a 6% interest rate.

Explanation Of Mortgage Terms

Mortgage terminology can be confusing and overly complicatedbut it doesnt have to be! Weve broken down some of the terms to help make them easier to understand.

Learn about

Home Price

Across the country, average home prices have been going up. Despite the rise in home prices, you can still find a perfect home thats within your budget! As you begin to house hunt, just make sure to consider the most important question: How much house can I afford? After all, you want your home to be a blessing, not a burden.

Learn about

Down Payment

The initial cash payment, usually represented as a percentage of the total purchase price, a home buyer makes when purchasing a home. For example, a 20% down payment on a $200,000 house is $40,000. A 20% down payment typically allows you to avoid private mortgage insurance . The higher your down payment, the less interest you pay over the life of your home loan. The best way to pay for a home is with a 100% down payment in cash! Not only does it set you up for building wealth, but it also streamlines the real estate process.

Learn about

Mortgage Types

15-Year Fixed-Rate Mortgage

30-Year Fixed-Rate Mortgage

5/1 Adjustable-Rate Mortgage

Learn about

Interest Rate

Learn about

Private Mortgage Insurance

Learn about

Homeowners Insurance

Learn about

Homeowners Association Fees

Learn about

Monthly Payment

Learn about

Property Taxes

Mortgage Calculator Uses

Also Check: What Bank Gives The Best Mortgage Loans

Mortgage Effective Annual Rate Formula

To account for semi-annual compounding, you can calculate your mortgages effective annual rate . The number of compounding periods in a year is two. To use the effective annual rate formula below, convert your interest rate from a percent into decimals.

For example, if your mortgage lender quotes a mortgage rate of 3%, then your effective annual rate will be:

If your mortgage lender quotes a mortgage rate of 5%, then your effective annual rate will be:

This calculation assumes that interest will be compounded semi-annually, which is the law for mortgages in Canada. For a more general formula for EAR:

Where n is the number of compounding periods in a year. For example, if interest is being compounded monthly, then n will be 12. If interest is only compounded once a year, then n will be 1.

Suggested Next Steps For You

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Any reference to the advisory services refers to Personal Capital Advisors Corporation, a subsidiary of Personal Capital. Personal Capital Advisors Corporation is an investment adviser registered with the Securities and Exchange Commission . Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC.

Recommended Reading: How Low Can Mortgage Interest Rates Go

Mortgage Interest Calculator Canada

When you make amortgage payment, you are paying towards both your principal and interest. Your regular mortgage payments will stay the same for the entire length of your term, but the portions that go towards your principal balance or the interest will change over time.

As your principal payments lower your principal balance, your mortgage will become smaller and smaller over time. A smaller principal balance will result in less interest being charged. However, since your monthly mortgage payment stays the same, this means that the amount being paid towards your principal will become larger and larger over time. This is why your initial monthly payment will have a larger proportion going towards interest compared to the interest payment near the end of your mortgage term.

This behaviour can change depending on your mortgage type. Fixed-rate mortgages have an interest rate that does not change. Your principal will be paid off at an increasingly faster rate as your term progresses.

On the other hand,variable-rate mortgageshave a mortgage interest rate that can change. While the monthly mortgage payment for a variable-rate mortgage does not change, the portion going towards interest will change. If interest rates rise, more of your mortgage payment will go towards interest. This will reduce the amount of principal that is being paid. This will cause your mortgage to be paid off slower than scheduled. If rates decrease, your mortgage will be paid off faster.

How Do I Pay A 30 Year Mortgage In 15 Years

The best way to pay a 30-year mortgage in 15 years is to pay larger amounts at once or increase the frequency of your payments. If you find yourself with extra monthly cash flow, whether from a raise at work or renting out a spare bedroom, it may be possible to increase your regular payment. Just be sure to consult your lender and confirm that your extra funds are going directly to the principal.

Another way to pay off your mortgage quicker is to increase the number of times you pay. For example, many homeowners make one mortgage payment a month. However, if you get paid biweekly, you could set up a loan payment to automatically come out on payday. Over a year, this would equate to 13 full payments instead of 12. These strategies will not only help you increase equity in your home, but they will also get you closer to making your final mortgage payment.

Also Check: What Will My Total Mortgage Payment Be

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnt pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnt mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youll have on-hand after you make the down payment. Its best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youre comfortable withjust because a bank pre-approves you for a mortgage doesnt mean you should maximize your borrowing power.