Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

What Is A Cash

A cash-out refinance is a mortgage refinancing option in which an old mortgage is replaced with a new one with a larger amount than was owed on the previously existing loan, helping borrowers use their home mortgage to get some cash. You usually pay a higher interest rate or more points on a cash-out refinance mortgage, compared to a rate-and-term refinance, in which a mortgage amount stays the same.

A lender will determine how much cash you can receive with a cash-out refinance, based on bank standards, your propertys loan-to-value ratio, and your credit profile. A lender will also assess the previous loan terms, the balance needed to pay off the previous loan, and your credit profile. The lender will then make an offer based on an underwriting analysis. The borrower gets a new loan that pays off their previous one and locks them into a new monthly installment plan for the future.

Being A Financially Responsible Borrower

With the relatively low-interest rates and flexible access to credit, some consumers find it difficult to manage their finances and bring about a cost burden that they cannot cope with.

It is a tempting proposition to less financially disciplined borrowers and research indicates that roughly 4 in 10 borrowers do not make regular payments on their HELOC loans. And, 1 in 4 borrowers only manage to cover the interest on the loan.

While the majority of consumers are fiscally responsible, it is a slippery slope for some borrowers that could bring them down a path of insurmountable debt with further research conducted by supports this theory.

With interest rates at the mercy of market fluctuations, Canadians are most vulnerable to market corrections. They can easily find themselves underwater when their home is worth less than the outstanding loan . This, however, goes for both mortgages and HELOCs.

As indicated in the above chart, Canadian households owed about $1.07 of disposable income in the year 2000. That ratio of debt to disposable income had risen to $1.60 by 2010. That upward trend appears to be levelling off over the last five years but is still gradually continuing its upward trend. One factor to take into consideration is that many consumers are using HELOCs to consolidate other higher-cost forms of debt like credit cards.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

How Home Equity Loans Work

Because home equity loans are essentially second mortgages, they work much like your first. Youll choose a lender, fill out an application, send over your documentation, await approval, and close on the loan. Youll get a lump-sum payment for your loan amount, which youll pay back month by month as you do with your initial mortgage.

Home Equity Loan Vs Mortgage Loan: 5 Main Differences

Debra Tyler : June 22, 2022

6 min read

Whether youre a first-time homebuyer or a seasoned real estate investor, its important to understand the differences between two popular loan options: home equity loans and mortgage loans.

Vaster is here to tell you everything you need to know about these two loan options so that you can make the best possible decision for your financial situation and financial goals.

Also Check: 10 Year Treasury Yield And Mortgage Rates

Heloc Vs Home Equity Loan: Pros And Cons Nerdwallet

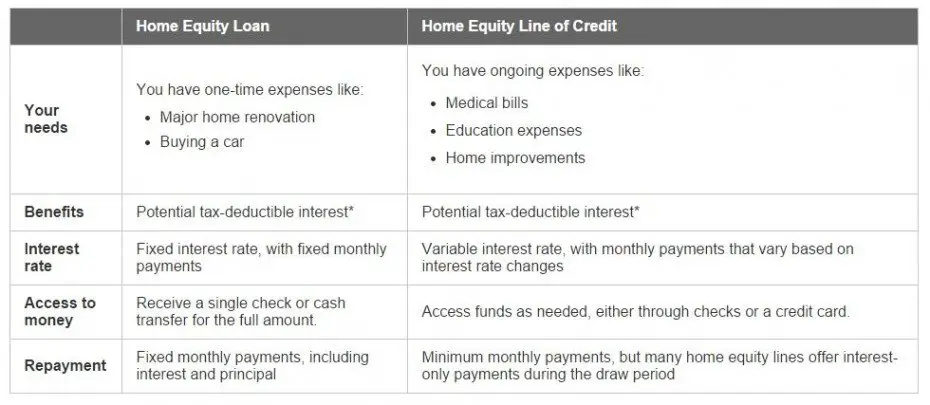

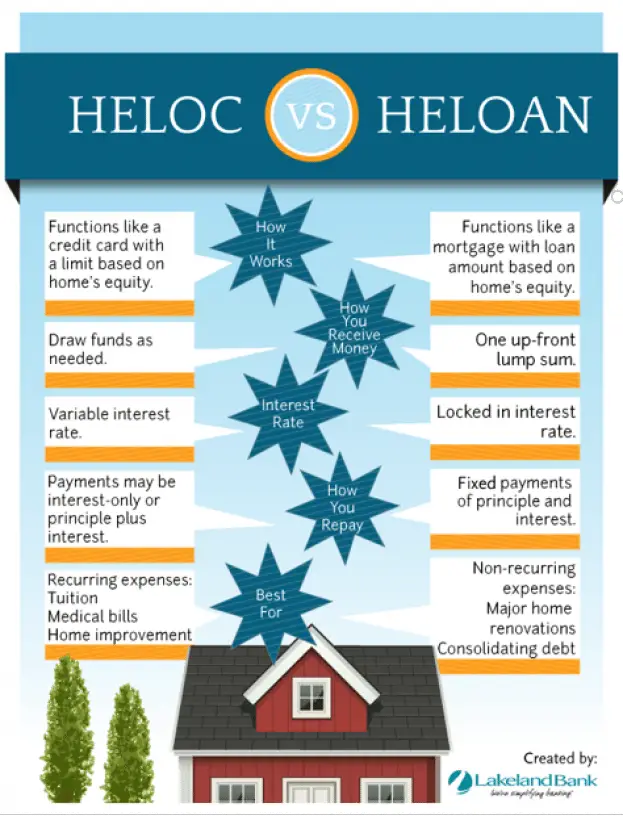

HELOCs often begin with a lower interest rate than home equity loans but the rate is adjustable, or variable, which means it rises or falls according to the

Home equity loans have a fixed interest rate, which can provide some measure of stability since your payment will stay the same every month.

Understanding How Mortgages And Home Equity Loans Work

When people use the term mortgage, they are generally talking about a traditional mortgage, for which a financial institution, like a bank or credit union, lends money to a borrower to purchase a residence. In most cases, the bank lends as much as 80% of the homes appraised value or the purchase price, whichever is less. If, for example, a house is appraised at $200,000, the borrower would be eligible for a mortgage of as much as $160,000. The borrower would have to pay the remaining 20%, or $40,000, as a down payment.

Some mortgages, such as FHA mortgages, allow borrowers to furnish much less than the traditional 20% downpayment, as long as they pay mortgage insurance.

The interest rate on a mortgage can be fixed or variable . The borrower repays the amount of the loan plus interest over a fixed term the most common terms are 15 or 30 years. A mortgage calculator can show you the impact of different rates on your monthly payment.

If a borrower falls behind on payments, the lender can seize the home, or collateral, in a process known as foreclosure. The lender then sells the home, often at an auction, to recoup its money. Should this happen, this mortgage takes priority over subsequent loans made against the property, such as a home equity loan or home equity line of credit . The original lender must be paid off in full before subsequent lenders receive any proceeds from a foreclosure sale.

Also Check: Reverse Mortgage Manufactured Home

What Is The Difference Between A Mortgage And A Heloc

Mortgages are home loans that are offered at either fixed or variable rates with terms between 5 and 25 years. Most Canadian mortgages have five-year interest rates, but some are available at ten-year rates. The loan-to-value rate for a mortgage can’t be more than 95 percent for home purchases. If you are refinancing a current mortgage, the maximum LTV rate is 80 percent. In 2018, 68% of Canadian mortgages were traditional fixed-rate, and 32% had variable or adjustable rates.

A HELOC or home equity line of credit is also based on home value and can be used for home purchase, combined with a traditional mortgage, or used as a stand-alone credit product. The maximum loan-to-value rate for a HELOC is 65 percent of a home’s purchase price or market value. Unlike a mortgage, you can pay off a HELOC and re-use it for another purpose up to your maximum credit limit. A HELOC is a form of revolving credit.

Heloc Vs Mortgage: Everything You Need To Know

There are approximately 3 million HELOC accounts in Canada with an average outstanding balance of $70,000and many Canadians with a HELOC can expect their borrowing cost to increase this year with rising interest rates looming.

Mortgages, on the other hand, are obviously much more widely used in Canada than HELOCs. But, there are many situations where a HELOC may be better than a standard mortgage.

Lets take a closer look.

You May Like: Reverse Mortgage For Condominiums

How Do Mortgages Work

A mortgage loan is a type of loan that you can use to finance the purchase of a property. When you get a mortgage loan, you will borrow money from a lender, and they take a legal charge over the property, which gives them certain rights as the property has been used as collateral for the loan.

Mortgage lenders take a first charge over your property, whereas secured loan lenders take a second charge. This means that the mortgage lenders are in a more secure position, and therefore usually charge lower rates as a result.

Which Option Is Best For You

Even though weve outlined different options for you, choosing the best financing route can still be challenging. Loan decisions vary for each borrower depending on your goals and situation. However, a few rules of thumb can help steer you in the right direction.

Mortgage: For General Home Buying Needs

For most home financing needs, your typical mortgage should be enough. They provide simple rules you have fixed monthly payments for a specified period. For first-time house buyers, this is often the best option on the table.

Home Equity Loans: For Big Life Expenses

Do you need additional funds for a significant life purchase? If you have the equity for it, choose a home equity loan vs. mortgage. They have lower interest rates than any other consumer loan, saving you money in the long run.

Refinancing: For Lowering Your Interest Rates

Some homeowners simply want to lower the interest rate on their original, long-term mortgage. If this is you, consider refinancing. Rate-and-term refinancing, in particular, is straightforward to do.

HELOC: For Flexibility and to Prevent Overspending

If you prefer flexibility since you dont know the exact amount you need to borrow, consider a HELOC vs. mortgage or other lump sum type loans. For example, this option is useful if youre planning to do numerous small home renovation projects, but youre unsure how much each project will cost. HELOC helps avoid over-borrowing while ensuring you have access to additional funding.

You May Like: Rocket Mortgage Loan Types

Make A Big Down Payment

The fastest way to build equity is to come up with a large down payment. The bigger your down payment, the more equity youll immediately have in your home.

Say you buy your home for $180,000. If you put down $5,000, youll owe $175,000 on your mortgage. That leaves you with $5,000 in equity. If you put down $20,000, youll owe $160,000 on a home worth $180,000. That $20,000 in equity is far more impressive than $5,000.

Conventional Mortgage Vs Heloc: Do You Know The Difference

Definition: HELOC is a Home Equity Line of Credit.

It used to be that only professional estate agents could understand the details of home mortgages, with the buyer having only a peripheral understanding of the process. But today there are many homeowners who are doing it for themselves, thanks to the abundance of information available on the internet. Despite the information available, there is still plenty of information that can be confusing and costly and could use the help of an Edmonton Real Estate Lawyer.

If anything was learned from the adjustable rate mortgage disaster, it is that owning a home isnt as easy as its often made to be. This is particularly true of the mortgage and how it is paid. Many potential homeowners want to know the difference between a conventional mortgage and a home equity line of credit .

Don’t Miss: 70000 Mortgage Over 30 Years

How To Use Home Equity

Equity is an important financial tool and one of the greatest financial benefits of owning a home.

You can tap into this equity when you sell your current home and move up to a larger, more expensive one. You can also use that equity to pay for major home improvements, help consolidate other debts or plan for your retirement.

Not all homeowners have equity in their homes. Fortunately, though, most do. And some owners are equity-rich, meaning they have at least 50% equity in their homes.

ATTOM Data Solutions, a property data provider based in Irvine, California, reports that more than 15.2 million homes in the United States were equity-rich as of the end of the second quarter of this year. Thats more than 27.5% of all the homes in the country.

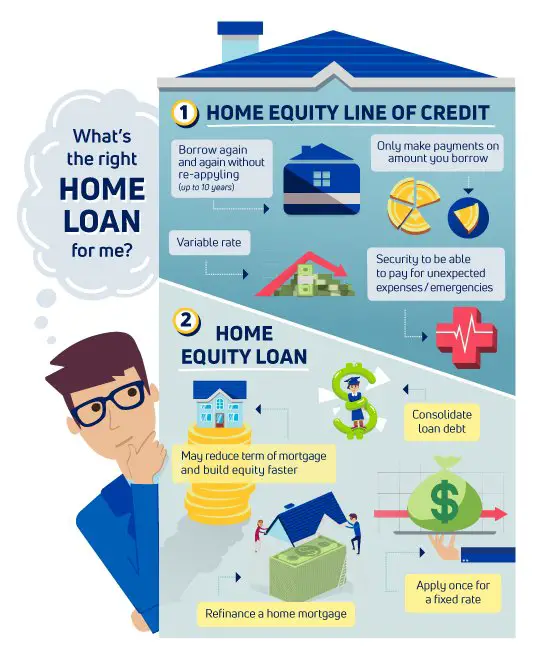

Home Equity Loan Vs Heloc: An Overview

Home equity loans and home equity lines of credit are loans that are secured by a borrower’s home. A borrower can take out an equity loan or credit line if they have equity in their home. Equity is the difference between what is owed on the mortgage loan and the home’s current market value. In other words, if a borrower has paid down their mortgage loan to the point that the value of the home exceeds the outstanding loan balance, the borrower can borrow a percentage of that difference or equity, generally up to 85% of a borrower’s equity.

Don’t Miss: What Does Gmfs Mortgage Stand For

What Are The Requirements For A Heloc Or Home Equity Loan

Generally, borrowers for either a HELOC or a home equity loan need:

- > 20% equity in their home

- A credit score > 600

- Stable, verifiable income history for two+ years

It is possible to get approved without meeting these requirements by going through lenders that specialize in high-risk borrowers, but expect to pay much higher interest rates. If you are a high-risk borrower, it may be a good idea to seek out a for advice and assistance before signing up for a high-interest HELOC or home equity loan.

Does My Mortgage Go Up If I Take Out Equity

If you take some of your equity out of your home within the new mortgage then the loan amount you are asking for increases, and so may the repayment period. Therefore, it is likely that your monthly payment and/or interest rate will increase.

However, this will be determined by individual circumstances and your credit score. If you can get a significantly better mortgage deal today than when you took out your first mortgage, you may not be paying more in monthly payments.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

Mortgage Vs Equity Loan: What Are The Differences And Which

A mortgage occurs before you have a stake in the home and helps you buy it, but once the bank liability is acquired, it also becomes equity, and

As with a home equity loan, a HELOC typically allows you to borrow up to 85% of your home equity. A HELOC, however, has a variable interest rate, which means

A home equity loan is a second mortgage which allows you to borrow money against the value of your homes equity. With this type of loan you get the money as a

How Interest Rates Work For Helocs

The prime rate typically moves in tandem with the Bank of Canadas key interest rate. When the Bank of Canada raises rates, the big banks raise their prime rates in turn. Most banks in Canada have the same prime rate. To provide some context, the Bank of Canada has increased its key rate to 1.25% from 0.5% from a year before. To put that figure into the perspective of the borrower, a rate increase of 0.75% translates into an increase of 23% on a HELOC with an interest rate of 3.2%.

For homeowners with a significant portion of their home paid off and access to ample equity, a rise in interest rates can be more comfortably cushioned compared to homeowners who are living pay cheque to pay cheque. According to a study by Mortgage Professionals Canada, over 1.5 million Canadians have a mortgage and a HELOC while approximately 490,000 Canadians have a HELOC and no mortgage.

Lenders typically offer a conventional mortgage in two types of rates fixed and variable. Most Canadians go with a fixed rate mortgage as it makes it easier to budget for payments with an interest rate that is guaranteed for the lifespan of that mortgage. With a HELOC, it is essential to read the fine print to understand what the notice period is for potential rate increases by the lender.

Read Also: Rocket Mortgage Loan Requirements

How A Mortgage Works

A mortgage is a loan to help you to finance a home. Mortgage lenders have requirements you need to meet to be approved for a loan. These typically involve:

- A minimum credit score that shows a history of responsible payments

- A debt-to-income ratio that shows you earn enough money to cover other expenses such as a car loan or credit card

- A minimum down payment

- Enough cash to cover closing costs on the mortgage

The most common type of mortgage is a 30-year fixed-rate loan, but there are other options for borrowing money for a home, too, such as 15-year fixed-rate loans and adjustable-rate mortgages.

How Much Can You Borrow With A Home Equity Loan

The more equity you have in your home, the more youre eligible to borrow. In general, you can borrow up to 85% of the equity in your home, minus your current mortgage balance. In other words, the combined loan-to-value ratio of your primary mortgage and your home equity loan typically cannot exceed 85%.

The exact LTV maximum will depend on your specific lender, how good your credit is, and what other debts you have. Some lenders may even allow borrowers to take loans of up to 90% LTV out, meaning they only have to keep 10% equity in the house.

A lower loan-to-value ratio means you have more equity in your home. This may give you a better chance of qualifying for a home equity loan or receiving a lower interest rate.

Most lenders also have minimum and maximum loan amounts aside from equity requirements. Even if you have a lot of equity in your home, you may still be limited by the lenders maximum loan amounts.

Also Check: Requirements For Mortgage Approval