Year Mortgage Rate Forecast For 2022 2023 2024 2025 And 2026

| Month |

| 102.2% |

30 Year Mortgage Rate forecast for .Maximum interest rate 6.07%, minimum 5.71%. The average for the month 5.89%. The 30 Year Mortgage Rate forecast at the end of the month 5.89%.

Mortgage Interest Rate forecast for .Maximum interest rate 6.31%, minimum 5.89%. The average for the month 6.06%. The 30 Year Mortgage Rate forecast at the end of the month 6.13%.

30 Year Mortgage Rate forecast for .Maximum interest rate 6.70%, minimum 6.13%. The average for the month 6.37%. The 30 Year Mortgage Rate forecast at the end of the month 6.50%.

Mortgage Interest Rate forecast for .Maximum interest rate 6.81%, minimum 6.41%. The average for the month 6.58%. The 30 Year Mortgage Rate forecast at the end of the month 6.61%.

30 Year Mortgage Rate forecast for .Maximum interest rate 6.91%, minimum 6.51%. The average for the month 6.69%. The 30 Year Mortgage Rate forecast at the end of the month 6.71%.

Mortgage Interest Rate forecast for .Maximum interest rate 7.32%, minimum 6.71%. The average for the month 6.96%. The 30 Year Mortgage Rate forecast at the end of the month 7.11%.

30 Year Mortgage Rate forecast for .Maximum interest rate 7.52%, minimum 7.08%. The average for the month 7.25%. The 30 Year Mortgage Rate forecast at the end of the month 7.30%.

Mortgage Interest Rate forecast for .Maximum interest rate 7.97%, minimum 7.30%. The average for the month 7.58%. The 30 Year Mortgage Rate forecast at the end of the month 7.74%.

How To Get A Good 15

Lenders take your finances into consideration when determining an interest rate. The better your financial situation is, the lower your rate will be.

Lenders look at three main factors: down payment, credit score, and debt-to-income ratio.

- Down payment: Depending on which type of mortgage you take out, a lender might require anywhere from 0% to 20% for a down payment. But the more you have for a down payment, the lower your rate will likely be. If you can provide more than the minimum, you could snag a better rate.

- : Many mortgages require at least a 620 credit score, and an FHA loan lets you get a mortgage with a 580 score. But if you can get your score above the minimum requirement, you’ll probably land a better interest rate. To improve your score, try making payments on time, paying down debts, and letting your credit age.

- Debt-to-income ratio: Your DTI ratio is the amount you pay toward debts each month in relation to your monthly income. Some lenders want to see a maximum DTI ratio of 36%, but you can get a lower mortgage rate with a lower ratio. To decrease your DTI ratio, you either need to pay down debts or consider ways to increase your income.

You should be able to get a low 15-year fixed rate with a sizeable down payment, excellent credit score, and low DTI ratio.

You might like a 15-year fixed mortgage if you plan to stay in your home for a long time and want to be aggressive about paying off your mortgage.

Comparison To Other Options

While the 15 year is one of the more popular mortgages, there are several other products which are available. A 15 year can be compared to the following:

Get the Best of Both Worlds

You can take out a 30-year mortgage then use that interest rate to calculate how much you would need to pay each month to get your home paid off in 15 years. This method would have you pay a slightly higher interest rate than the 15-year fixed, but it would give you more financial flexibility month to month. If your loan is structured as a fixed-rate loan and interest rates go up then you can pay off the home loan more slowly while investing in other faster appreciating assets.

You May Like: What Can I Do To Lower My Mortgage Payments

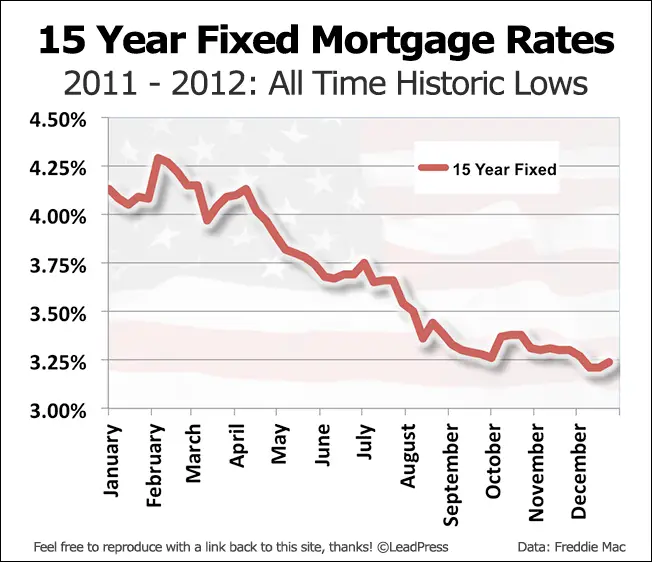

How Mortgage Rates Have Changed Over Time

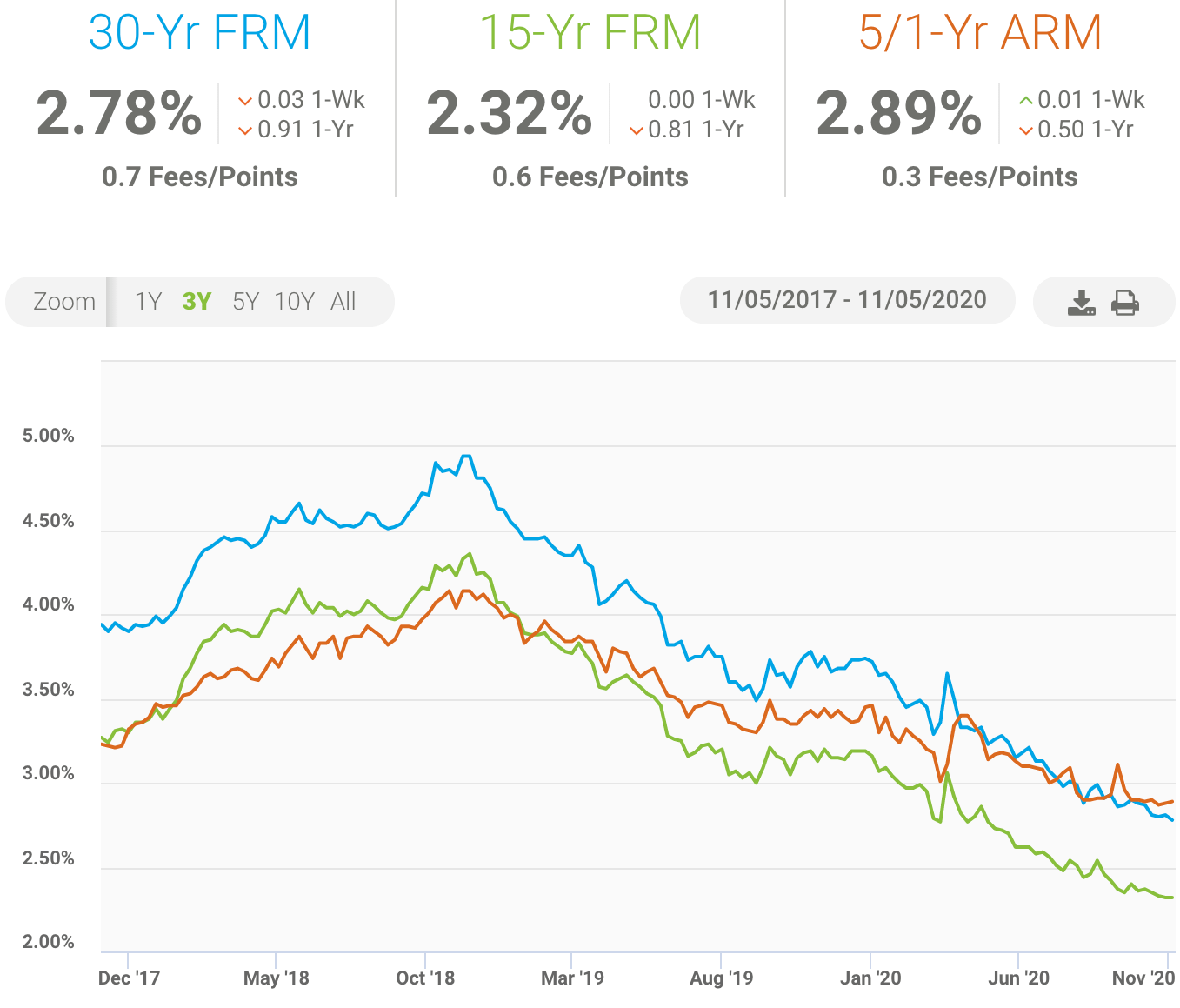

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of todays lower interest rates. When considering a mortgage refinance or purchase, its important to take into account closing costs such as appraisal, application, origination and attorneys fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

Are you looking to buy a home? Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Use Credibles online tools to compare rates and get prequalified today.

Thousands of Trustpilot reviewers rate Credible “excellent.”

How Do Fixed Rate Mortgages Work

Fixed rate mortgages lock in the interest rate you pay over the duration of the fixed term. The result is that youll know exactly what your monthly repayment will be for the entirety of the fixed term, regardless of whether the Bank of England changes interest rates or not.

This way you can manage your finances and know how much youll have left over to put into savings or use for other purposes like going on holiday.

While a fixed rate mortgage will provide certainty on what your monthly mortgage outgoings will be, do bear in mind that BoE interest rates could go down as well as up during your fixed term, but your payments will always remain the same.

Fixed rate mortgages also tend to be more expensive the longer you tie your fixed in rate for, so youll need to weigh this up when deciding what type of mortgage you want to apply for.

Fixed rate mortgages also tend to have fewer extra features, such as options to lower your interest payments by using on offset account. However, this can vary from lender to lender.

Also Check: Where Is Mortgage Rates Going

Whats The Difference Between Interest Rate And Apr

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

You May Like: What’s The Rule Of Thumb For Mortgage Payments

How Much House Can I Afford

Buying a house is a huge purchase and can put a big dent in your savings. Before you start looking, its important to figure out both what you can afford and youre willing to spend.

Not only do you want to consider your income and debt, but you also want to factor in emergency savings and any long-term financial goals such as retirement or college.

These are some basic financial factors that go into home affordability:

/1 Arm Interest Rates

A 5/1 ARM has an average rate of 4.58%, which is an uptick of 6 basis points compared to last week.

An adjustable-rate mortgage is ideal for households who will refinance or sell before the rate changes. If thats not the case, their interest rates could end up being significantly higher after a rate adjusts.

For the first five years, a 5/1 ARM will typically have a lower interest rate compared to a 30-year fixed mortgage. Keep in mind that your payment could end up being hundreds of dollars higher after a rate adjustment, depending on the terms of your loan.

Also Check: How Much Would 200k Mortgage Cost

When Not To Refinance To A 15

You will find that there are a few reasons that you might want to avoid refinancing to a 15-year fixed-rate mortgage. For example: There are often significant costs associated with refinancing, such as closing costs, title fees, appraisals, etc. As you weigh your options here, ideally, youll want to see an interest rate drop from your current mortgage rate and should consider holding off on refinancing if interest rates are going up from your current rate.

You should also consider waiting on refinancing if you aren’t planning on staying in the home long enough to recoup the costs of the refinance.

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rates and an annual percentage rate . Thats understandable since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a $300,000 loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

You May Like: How Long Does It Take To Qualify For A Mortgage

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Money’s Average Mortgage Rates For September 9 2022

Mortgage rate moved lower across all loan categories today. The average rate for a 30-year fixed-rate loan was down for the second day in a row, decreasing by 0.136 percentage points to 6.731%.

- The latest rate on a 30-year fixed-rate mortgage is 6.731%.

- The latest rate on a 15-year fixed-rate mortgage is 5.601%.

- The latest rate on a 5/6 ARM is 6.395%.

- The latest rate on a 7/6 ARM is 6.422%.

- The latest rate on a 10/6 ARM is 6.393%.

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Macs rates, which represent a weekly average based on a survey of quoted rates offered to borrowers with strong credit, a 20% down payment and discounts for points paid.

Read Also: Can I Refinance My Mortgage If I Have Bad Credit

Do You Get A Better Interest Rate With A 15

Yes, a 15-year mortgage always has a lower interest rate than a 20-year mortgage or a 30-year mortgage. Because the term is half as long, youll also pay a lot less interest during the loans life. Of course, this means your monthly payment will be more than on a 30-year loan. In addition to a better rate, 15-year fixed-rate loans have less interest over the life of the loan and allow you to be debt free sooner.

Who Should Consider A 15

Homeowners who want to save significantly on a home loan and can afford to pay the higher monthly mortgage payments are best suited for 15-year mortgages.

The loans tend to have lower interest ratesgovernment-supported agencies like Fannie Mae and Freddie Mac tend to impose loan-level price adjustments, which drive up the costs of 30-year mortgages.

Borrowers considering 15-year mortgages need to consider whether they can afford the monthly payments, as they will be higher compared to a 30-year or 20-year mortgage.

Also Check: What Is The Mortgage Pre Approval Process

How Credible Mortgage Rates Are Calculated

Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

Is It Harder To Qualify For A 15

On paper, its no harder to qualify for a 15-year mortgage loan than a 30-year one. Guidelines vary by loan type , but within each program, requirements for a 15- and 30-year loan are generally the same.

For instance, a 15-year FHA loan will likely require a credit score of at least 580, down payment of 3.5%, and debt-to-income ratio below 50%, just like a 30-year FHA mortgage.

But in reality, its much harder to qualify for a 15-year loan because of the higher monthly payments.

A bigger mortgage payment means your home loan will eat up more of your monthly income. This will have an impact on your debt-to-income ratio.

For most home buyers, a 15-year mortgage payment plus existing debts will take up more than 43% to 50% of their monthly income, which is the maximum DTI range most lenders allow.

If youre set on a 15-year mortgage but have a tighter monthly budget, paying down existing debts before you apply for the home loan could help you qualify.

Also Check: How Does Usda Mortgage Work

Less In Total Interest

A 15-year mortgage costs less in the long run since the total interest payments are less than a 30-year mortgage. The cost of a mortgage is calculated based on an annual interest rate, and since you’re borrowing the money for half as long, the total interest paid will likely be half of what youd pay over 30 years. A mortgage calculator can show you the impact of different rates on your monthly payment, as well as the difference between a 15- and a 30-year mortgage.

/1 Arm Rate Climbs +007%

The average rate on a 5/1 ARM is 4.53 percent, adding 7 basis points since the same time last week.

Adjustable-rate mortgages, or ARMs, are mortgage loans that come with a floating interest rate. To put it another way, the interest rate can change periodically throughout the life of the loan, unlike fixed-rate mortgages. These types of loans are best for people who expect to sell or refinance before the first or second adjustment. Rates could be considerably higher when the loan first adjusts, and thereafter.

While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen.

Monthly payments on a 5/1 ARM at 4.53 percent would cost about $503 for each $100,000 borrowed over the initial five years, but could climb hundreds of dollars higher afterward, depending on the loans terms.

You May Like: Can You Write Off Points On A Mortgage

Mortgage Rates On Sept 14 202: Rates Move Higher

Today a handful of key mortgage rates crept higher. If you’re in the market for a home loan, see how your payments might be affected by inflation.

A handful of principal mortgage rates are now higher today. The average 15-year fixed and 30-year fixed mortgage rates both were higher. The average rate of the most common type of variable-rate mortgage, the 5/1 adjustable-rate mortgage, also floated higher.

Though mortgage rates have been rather consistently going up since the start of this year, what happens next depends on whether inflation continues to climb or begins to retreat. Interest rates are dynamic and unpredictable — at least on a daily or weekly basis — and they respond to a wide variety of economic factors. Right now, they’re particularly sensitive to inflation and the prospect of a US recession. With so much uncertainty in the market, if you’re looking to buy a home, trying to time the market may not play to your favor. If inflation rises and rates climb, this could translate to higher interest rates and steeper monthly mortgage payments. For this reason, you may have better luck locking in a lower mortgage interest rate sooner rather than later. No matter when you decide to shop for a home, it’s always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.