Submit Your Loan Application

Once the offer on your house is accepted, you can apply for a home loan. With Credible, you can easily complete the whole process online.

Getting pre-approved for a mortgage can make you a more desirable buyer, and can give you an idea of how much you can really afford to spend on a home, depending on your financial situation.

Ready to get pre-approved?

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

Can You Borrow With Your Current Income

Though you may feel that your finances are ready for a new home, the bank may not feel the same way. Mortgage lenders use a complex set of criteria to determine whether you qualify for a home loan and how much you qualify for, including your income, the price of the home, and your other debts.

The pre-qualification process can provide you with a pretty good idea of how much home lenders think you can afford given your current salary, but you can also come up with some figures on your own by learning the criteria that lenders use to evaluate you.

Factors That Determine If You’ll Be Approved For A Mortgage

If you think now is a good time to buy a home, chances are good you’ll need a mortgage. Mortgages can come from banks, credit unions, or other financial institutions — but any lender is going to want to make sure you meet some basic qualifying criteria before they give money to buy a house.

There’s variation in specific requirements from one lender to another, and also variation based on the type of mortgage you get. For example, the Veterans Administration and the Federal Housing Administration guarantee loans for eligible borrowers. This means the government insures the loan, so a lender won’t face financial loss and is more willing to lend to risky borrowers.

In general, however, you’ll typically have to meet certain criteria for any mortgage lender before you can get approved for a loan. Here are some of the key factors that determine whether a lender will give you a mortgage.

Jump To

Read Also: How Many Times Can I Apply For A Mortgage

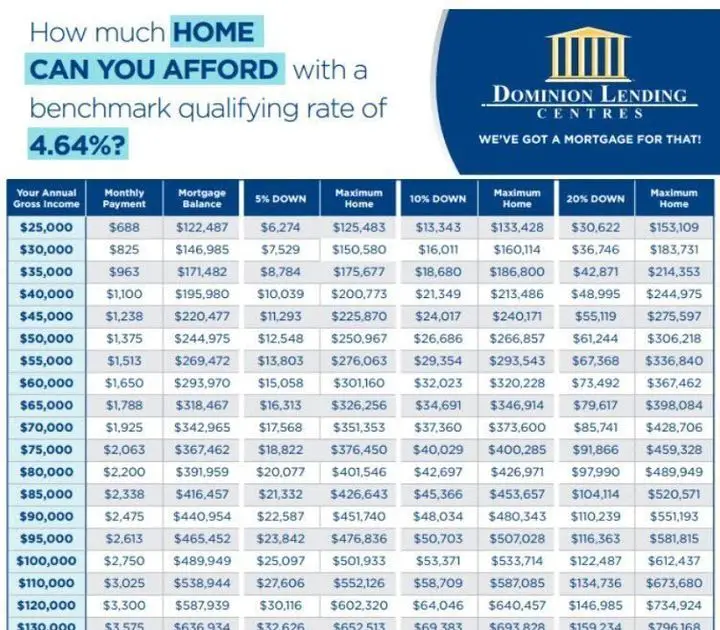

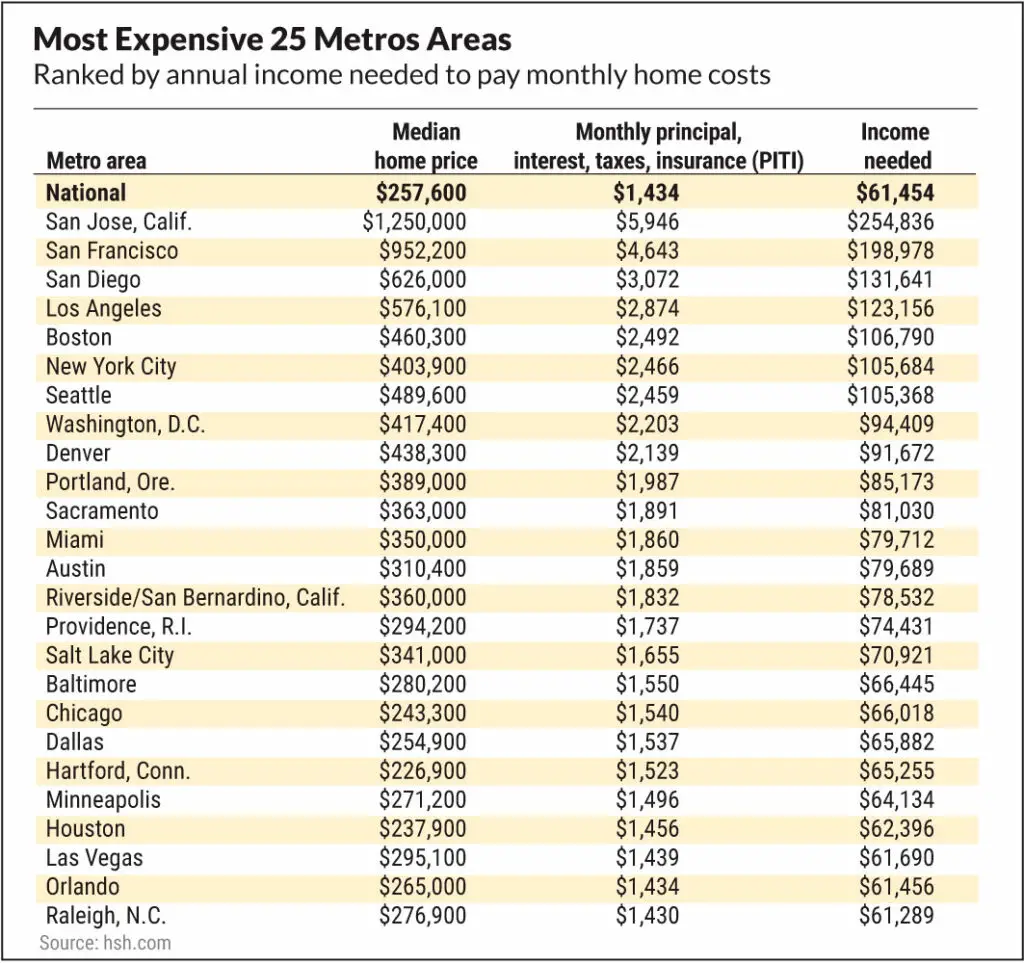

How Much Of A Mortgage Can I Afford Based On My Salary

The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x to 2.5x your gross annual income on a mortgage . Other rules suggest you shouldn’t spend more than 28-29% of your gross income per month on housing.

Can I Get A Mortgage On $20k A Year

Yes, itâs possible to get a mortgage on 20k a year. Assuming a loan term of 30 years with an interest rate of 5%, you may qualify for a home up to $74,066 and have a monthly payment of $467. Head on over to our mortgage qualifying calculator to determine what those amounts will be with different interest rates and loan terms.

Read Also: Can You Consolidate Credit Card Debt Into Mortgage

Also Check: What Is 1 Point On A Mortgage

View Affordability From Two Perspectives:

- Your overall monthly payments which included household expenses, mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

What’s The Best Age To Buy A House

There is an ideal age to buy your first home, and that’s between the ages of 25 to 34. As you enter your golden years and retirement, the equity in your home will become even more important to your financial health, especially should you need to refinance to cover any gaps in your retirement savings.

You May Like: Where Are Mortgage Rates Trending

Most Mortgage Applicants Do Get Loan Approval

At first this seems backwards, because more money in the bank sounds like a sure path to mortgage approval. And when it comes to credit scores, higher is always better, right?

Not quite.

Lenders are concerned about the balance of risk and reward. In an ideal situation, lenders like to see no risk, but in practice they have to deal with the real world. As this is written that means interest rates around 4 percent and borrowers who finance with little down.

According to Ellie Mae, as of July 2017, mortgage lenders approved 70.6 percent of loan applications started during the previous 90 days. This does not mean 29.4 percent of all the remaining applications failed. Some may have begun late in the cycle, and are still being processed. Other borrowers started with one lender and switched to another.

However, this also means loan approvals are not automatic.

Are There Any Extra Charges

Although its free for the first five years, from year six youll need to pay a service charge.

The charge covers maintenance of the First Home scheme and is a percentage of the governments initial stake. You wont be charged interest, because its not a loan.

The longer you stay in the scheme, the more youll pay.

| Years | |

|---|---|

| 30 and over | 2.85% |

1.75% for years 6 to 152.15% for years 16 to 292.85% for years 30 and over

Youll also have to pay a valuation fee if you want to buy back all or part of the equity share.

Don’t Miss: What’s The Average Mortgage Payment

How Does Your Credit Score Impact Affordability

Your credit score is the foundation of your finances, and it plays a critical role in determining your mortgage rate. For example, lets say you have a credit score of 740, putting you in the running for a rate of 4.375 percent on a loan for a $400,000 property with a 20 percent down payment. If your credit score is lower 640, for example your rate could be higher than 6 percent. In that scenario, the monthly payment to cover the principal and interest could be $300 cheaper for the higher credit score.

To find out your score, check your credit report at one of the big three agencies: Equifax, Experian and TransUnion.

Assessment By The Lender

In addition to the Central Banks lending limits, its ConsumerProtection Code 2012 requires all regulated lenders to assess your personalcircumstances and financial situation thoroughly before agreeing to offer you amortgage.

The lender must carry out detailed assessments of the affordability of theproduct being offered and of its suitability for you. When offering you amortgage, the lender must give you a written statement, setting out the reasonswhy the mortgage product being offered is considered suitable for your needs,objectives and circumstances.

Also Check: What Does Points Mean Mortgage

What If You Cant Get Pre

Not everyone will get pre-approved for a mortgage, but there are a few things you can do to get better prepared for the financial responsibility of homeownership:

- Work to improve your credit score. Your credit score is impacted by payment history, outstanding debt, the length of your credit history, recent new credit inquiries, types of credit used, and more. Generally a score of 720 and higher will get you the most favorable mortgage rates.

- Correct any errors on your credit report, which could help to raise your credit score. The lender will analyze your credit report for any red flags, such as late or missed payments or charged-off debt. Even if you are deemed to have bad credit, there are ways to still get pre-approved for a mortgage.

- Decrease your overall debt and improve your debt-to-income ratio. In general, a debt-to-income ratio of 36 percent or less is preferable 43 percent is the maximum ratio allowed. Use our debt-to-income calculator to determine your debt-to-income ratio.

- Increase your down payment amount in order to qualify for a larger loan. Learn more about down payments.

Be sure to ask your lender for tips on how you can improve your chances of qualifying for a loan.

What Details Are Required In The Pre

A lender will generally start by asking for some basic information about you and your financial history. If you have a co-borrower, the lender will also need this information about them. Generally, a lender will then request your Social Security number and permission to pull your required credit report . If the information you provide and the information obtained from your credit report satisfies the lenders guidelines, the lender will make a preliminary determination in writing stating that you would qualify for a particular loan amount subject to the conditions outlined in your pre-approval letter. Please note that each lender has its own standards and processes for determining whether to grant a pre-approval letter.

Also Check: How Do I Become An Underwriter For Mortgage

Don’t Miss: Can I Roll My Down Payment Into My Mortgage

Employment And Income History

When you apply for a mortgage, lenders go to great lengths to ensure you earn a solid income and have stable employment. Thats why lenders request two years worth of W-2 tax forms and contact information for your employer. Essentially, lenders want to ensure that you can handle the added financial burden of a new mortgage.

Youll also be asked to provide salary information, so a lender has evidence that you earn enough money to afford a mortgage payment and related monthly housing expenses. Youll also have to provide 60 days of bank statements to show you have enough cash in hand for a down payment and closing costs.

What Should I Get Preapproved

In todays housing market, it will be almost impossible to get a seller to consider your offer unless you have a mortgage preapproval . There are simply too many buyers for sellers to be willing to take a chance on one who hasnt at least talked to a lender about getting a mortgage.

Another important reason to get preapproved: It gives you an idea of how much home you can afford based on how much money a lender is prepared to let you borrow. This can save you time during house hunting by eliminating properties out of your price range.

Don’t Miss: How Many Mortgage Lenders Should I Apply To

Tips For Getting The Mortgage Pre

Mortgage Approval Process Canada

The actual mortgage approval process starts when your offer has been accepted by the seller because your lender will need to know what the value of the property is based on current market conditions, as well as the amount of your down payment. In order for the approval process to be completed, your lender will require the purchase agreement as well as the MLS listing. The value of the property youve agreed to purchase will be assessed by an appraiser appointed by the lender to make sure that the price you agreed to pay is on par with what the home is actually worth.

The property will also need to be approved by the mortgage insurer if you are putting less than a 20% down payment. Your income, credit score, and debt, and any other financial information will be re-verified, and the specific type of mortgage product that youve decided on will be factored into the equation.

Take a look at this infographic to learn all about the true cost of borrowing.

Dont Miss: How Long Till I Can Refinance My Mortgage

Recommended Reading: How Do I Become A Mortgage Loan Officer

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Can You Get A Second Mortgage To Buy Another House

Yes, you typically can use a second mortgage to buy another home, though this will depend on the lender. A second mortgage allows you to borrow against the equity of your home without actually refinancing. With this type of loan, you can access up to 85% of your total home value . Youâll typically need at least 20% equity in your home to qualify.

There are two main types of second mortgages:

- Home equity loan. With this kind of loan, youâll receive a lump sum to use how you wish, which youâll pay off in fixed installments over a period of timeâsimilar to a personal loan.

- Home equity line of credit . Unlike a home equity loan, a HELOC is a type of revolving credit that lets you repeatedly draw on and pay off a credit lineâsimilar to a credit card.

Keep in mind that while interest rates tend to be lower on second mortgages compared to personal loans and credit cards, these types of loans are secured by your home. This means you risk foreclosure if you canât keep up with your payments.

Also remember that taking out a second mortgage means youâll have to make payments on two loans at once.

Don’t Miss: How To Buy Notes And Mortgages

Can You Get A Home Loan With A Low Income

While it might be harder to get a mortgage with a low income, itâs definitely possible. There are several types of loans specifically geared toward low-income borrowers, such as FHA, USDA and VA loans as well as Fannie Mae HomeReady loans and Freddie Mac Home Possible loans.

These loan programs typically require little to no down payment and often accept lower credit scores.

How Do Appraisals Affect Your Mortgage

In order to assess the homes market value and make sure the borrower isnt attempting to borrow more money than the house is worth, all lenders order an appraisal during the mortgage process. When buying, a home appraisal can play a role in determining if your lender will approve your loan. When refinancing, a home appraisal will determine your LTV, which can affect the interest rate you receive.

Related Topics

Don’t Miss: How Much Does A Mortgage Appraisal Cost

What If The House Price Increases

The equity share in your home is a percentage of the market value of your home. So, if property prices increase, the amount you have to pay back will increase.

For example, if you buy a house for 350,000 and the FHS provides equity of 20% and you want to buy back the equity share when the property is valued at 400,000, youll pay 20% of the new price, which is 80,000.

How To Determine How Much House You Can Afford

Your housing budget will be determined partly by the terms of your mortgage, so in addition to doing an accurate calculation of your existing expenses, it’s important to get an accurate picture of your loan terms and shop around to different lenders to find the best offer. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments.

Recommended Reading: Can I Refinance My 2nd Mortgage