Whats Included In A Mortgage Payment

Your mortgage payment consists of four costs, which loan officers refer to as PITI. These four parts are principal, interest, taxes, and insurance.

- Principal: The amount you owe without any interest added. If you buy a home for $400,000 with 20% down, then your principal loan balance is $320,000

- Interest: The amount of interest youll pay to borrow the principal. If the same $320,000 loan above has a 4% rate, then youll pay $12,800 for the first year in interest repayment

- Taxes: Property taxes required by your city and county government

- Insurance: Homeowners insurance and, if required, private mortgage insurance premiums on a conventional loan

When determining your home buying budget, consider your entire PITI payment rather than only focusing on principal and interest. If taxes and insurance are not included in a mortgage calculator, its easy to overestimate your home buying budget.

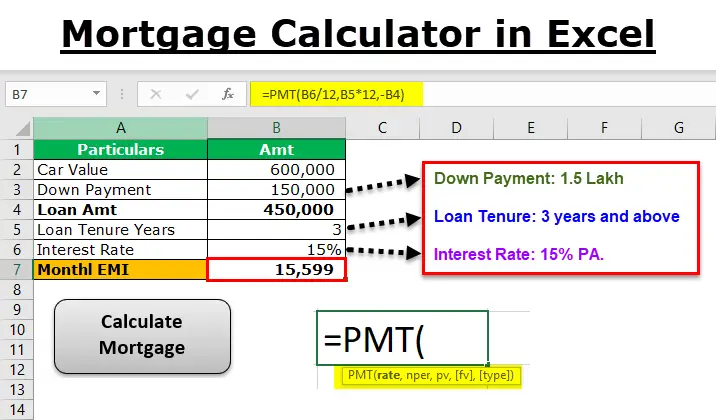

How Do Banks Calculate Mortgage Payment

Herein, How do banks calculate mortgage payment?

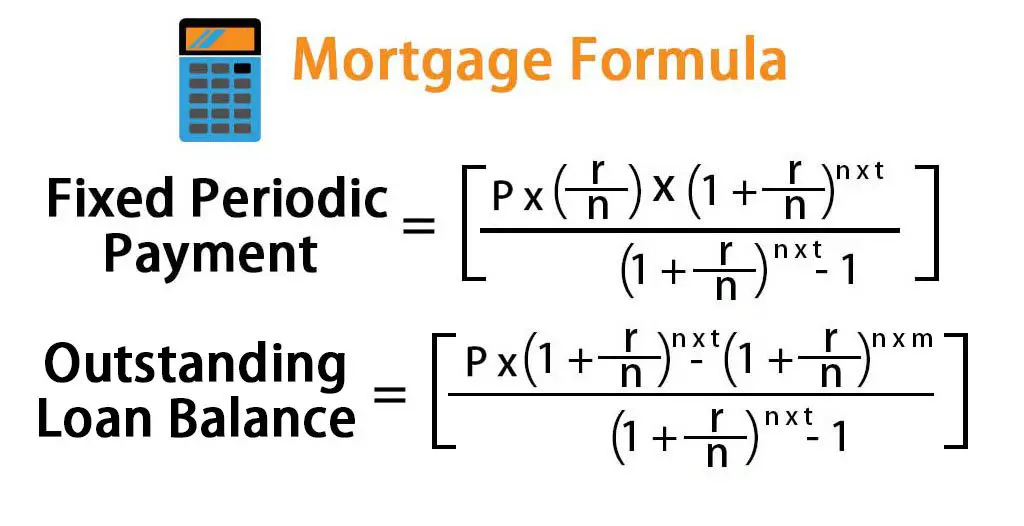

Mortgagepaymentsare calculatedwith an algebraic formula that takes into account the term of the loan,the interest rate and the amount of the loan. The formula ensures that the same paymentis made each month of the term,even though the amount of principal and interest are varying.

What is the formula for calculating a mortgage payment?

To calculate your mortgage payment manually,apply the interest rate ,the principal and the loan length in months to this formula: P = B/. This formula takes into account the monthly compounding of interest that goes into each payment.

How do you calculate a mortgage payment?

Mortgagepaymentsare calculatedwith an algebraic formula that takes into account the term of the loan,the interest rate and the amount of the loan. The formula ensures that the same paymentis made each month of the term,even though the amount of principal and interest are varying.

How do Mortgage Lenders calculate monthly payments?

8 steps to calculating how much a mortgage payment would cost you every month Determine your mortgage principal. The initial loan amount is referred to as the mortgage principal. Calculate the monthly interest rate. The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Calculate the number of payments. Find out whether you need private mortgage insurance.

How to figure out my mortgage payment?

To calculate that payment:

Whats Behind The Numbers In Our How Much Can I Borrow Mortgage Calculator

When buying a home, the question How much can I borrow? should be the second question you ask. The most important consideration is, How much house can I afford? Thats because, even with all the angst involved in applying for and being approved for a home loan, lenders are often inclined to loan you more money than you expect.

Thats a surprising and important reality.

As much as you want to buy a home, lenders want to loan you money. And the bigger the loan, the happier they are. Youll know why when you see the estimate of the interest youll pay over the life of the loan. Its a really big number.

But if you know how much home you can afford, of course, youll want to learn how much you can borrow. The NerdWallet How much can I borrow? calculator can give you a solid estimate.

The calculator considers standard mortgage payment elements, such as principal and interest. Then, we take things a few steps further, factoring in taxes, insurance even homeowner association dues to help determine a real-life monthly payment.

We also examine your income and debt, just as a lender would, to determine the maximum home loan amount youre likely to qualify for.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

Recommended Reading: Can You Get A Mortgage With A Low Credit Score

% Down Is Great But Not A Requirement

Theres a general perception that you have to put 20% down to get a mortgage. Thats just not true. There are many mortgage options with low or no down payment requirements.

Depending on the type of loan you choose and the amount of your down payment, you may be required to pay private mortgage insurance . PMI protects the lender against any loss if you fail to pay your mortgage. In some instances, mortgage insurance is required for the life of the loan. Other times, its only required until the loan is paid down to a certain percentage of the original amount. Mortgage insurance is known for its bad rap, but its not always the enemy. The benefit to you is that it allows you put less than 20% down.

Consider your options. Gifts or loans from relatives and programs like an 80/10/10 combination loan can help you avoid PMI. 80/10/10 loans consist of a first mortgage and a second mortgage that total 90% of the purchase price, and a 10% down payment. These loans allow you to put just 10% down while helping you avoid the mortgage insurance payments typically associated with conventional loans with down payments of less than 20%. Our down payment calculator can help you to understand the costs and benefits of different down payment amounts so you can decide what makes the most sense for you.

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnt pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnt mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youll have on-hand after you make the down payment. Its best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youre comfortable withjust because a bank pre-approves you for a mortgage doesnt mean you should maximize your borrowing power.

Also Check: How High Will Mortgage Rates Go

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

Money You Will Spend Beyond The Mortgage

When figuring out how much of a payment one can afford, there are other expenses that must be considered aside from the mortgage. These addition financial obligations can be:

- Home Maintenance: There will be some maintenance during ownership of the home. Appliances break down, carpet needs replaced, and roofing goes bad. Being overextended due to the mortgage can make repairs more of a burden.

- Utilities: These expenses keep the home heated, lit up, water running, and other items such as sewer, phone, and cable T.V. going.

- HOA Fees: If the community in which the borrower moves in has amenities, there may be Homeowners Association Fees that must be paid. The fees can vary based on what amenities the community is offering. Sometimes the price can be $100 per month or $100 per year.

You May Like: How To Figure Out The Mortgage Payment

What Does Borrowing Power Mean

Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan, calculated generally as your net income minus your expenses. Your expenses include all your daily living costs and regular financial commitments like bills, groceries and petrol, as well as any other debts you hold such as a credit card, car loan or personal loan.

Once you have a ballpark figure for your borrowing power youll be able to house hunt with a price range in mind. See our tips for what to consider when working out how much to borrow.

The Health Of The Economy

Mortgage rates vary based on how the economy is doing today and its outlook. When the economy is doing well meaning unemployment rates are low and spending is high mortgage rates increase. When the economy isn’t doing as well, like when unemployment rates are high and the demand for oil is low, mortgage rates fall.

Don’t Miss: How To Get Out Of A Westgate Timeshare Mortgage

My Result Came Out Higher Than The Amount I Wish To Borrow What Now

Now that you have ascertained that you are in a strong enough financial situation to sustain the purchase of your desired property, you need to set about getting in touch with some mortgage providers.

Fortunately, we have made this process very easy for you. Simply click the Get FREE Quote button and you will be taken through a very brief set of questions. We will then ask our carefully selected lenders to contact you directly with the very best quotations they can provide. By reaching out to lenders this way, you get the best deal possible and are saved the effort of contacting them yourself â it couldnât be simpler!

What Can A Mortgage Calculator Help Me With

Whichever mortgage calculator you use, its objective should always be to help you feel more informed on how to get a mortgage and your budget for buying a home, or to decide whether to move forward with a refinance. It all depends on your lifestyle and personal goals.

Below are some of the questions a mortgage calculator can answer.

Don’t Miss: Can I Apply For Mortgage With Multiple Lenders

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

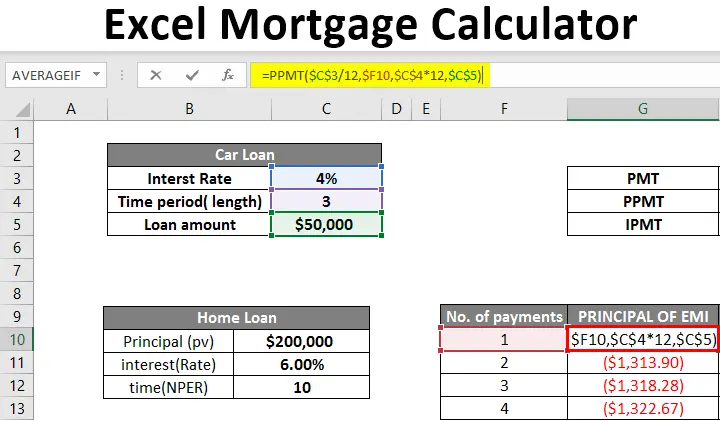

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lenders charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

Also Check: Can You Sell House Before Paying Off Mortgage

What Percentage Of Income Do I Need For A Mortgage

A conservative approach is the 28% rule, which suggests you shouldn’t spend more than 28% of your gross monthly income on your monthly mortgage payment.

Be aware that lenders look at far more than the percentage of monthly income put towards a mortgage. Outside of credit score, lenders typically look at your debt-to-income ratio, which compares your monthly debts, including the prospective mortgage payment, to your expenses. With lenders looking at income and expenses, our mortgage calculator provides a great option when determining what you can potentially afford.

The Assessment Rate Is Higher For Investors

When the real estate market is hot, its common for the Australian Prudential Regulation Authority to require banks to increase this borrowing buffer for investors.

For example, for a $150,000 interest loan at 4.5% per annum, your actual repayments are $6,750 a year or $562.50 a month.

Under tighter serviceability rules, your bank may assess your borrowing power at principal and interest at 7.50% or even higher.

So on that same loan amount, you would need to show a sufficient income to debt ratio to afford $11,250 per annum or $937.50 per month.

Recommended Reading: How Do You Estimate A Mortgage Payment

How Taking Cash Out Affects Mortgage Rates

If youre looking to convert your home equity into cash, youll get a slightly higher rate than if you were buying a home or doing a refinance solely to lower your interest rate or change your term. This is because youre taking on a higher balance than what you had going into the transaction, which entails more risk for lenders and mortgage investors.

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Don’t Miss: What Documents Do I Need For A Mortgage

How To Lower Your Monthly Mortgage Payment

If the monthly payment you’re seeing in our calculator looks a bit out of reach, you can try some tactics to reduce the hit. Play with a few of these variables:

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums, In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

Don’t Miss: What Is Fha Mortgage Insurance

Calculating Your Mortgage Payment

This mortgage calculator can answer some of the most challenging questions in the home search journey, short of talking to a lender, including what kind of payment can I afford? How much do I need to make to afford a $500,000 home? And how much can I qualify for with my current income?

We’re able to do this by not only considering the loan amount and interest rate but the additional factors that affect your ability to qualify for a mortgage. We include your other debts and liabilities that have to be paid each month and costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment. Doing so makes it easy to see how changes in costs and mortgage rates impact the home you can afford.

While determining mortgage size with a calculator is an essential step, it won’t be as accurate as talking to a lender. Get pre-approved with a lender today for exact numbers on what you can afford.

How Do Mortgage Lenders Decide How Much You Can Borrow

When you visit your lender to get a mortgage for your home, they will tell you the maximum amount that you are allowed to borrow. But how do they reach this total and what factors do they take into consideration?

How do they determine that one borrower can take on a bigger mortgage than the next? This decision is made by mortgage companies by considering a wide range of factors, including your credit information, your salary and much more.

Here Are Some Of The Common Ways That Lenders Determine How Much You Can Borrow:

1. Percentage Of Gross Monthly Income

Many lenders follow the rule that your monthly mortgage payment should never exceed 28% of your gross monthly income.

This will ensure that you are not stretched too far with your mortgage payments and you will be more likely to be able to pay them off. Remember, your gross monthly income is the total amount of money that you have been paid, before deductions from social security, taxes, savings plans, child support, etc.

2. Debt To Income Ratio

Another formula that mortgage lenders use is the Debt to Income ratio, which refers to the percentage of your gross monthly income that is taken up by debts. This takes into account any other debts, such as credit cards and loans. Many lenders say that the total of your debts shouldnt exceed 36% of your gross monthly income.

For more info about mortgages and your home, contact your mortgage professional.

Read Also: How Much Mortgage On 80k Salary