Is A Reverse Mortgage A Good Idea

A reverse mortgage can be a help to homeowners looking for additional income during their retirement years, and many use the funds to supplement Social Security or other income, meet medical expenses, pay for in-home care and make home improvements, Boies says.

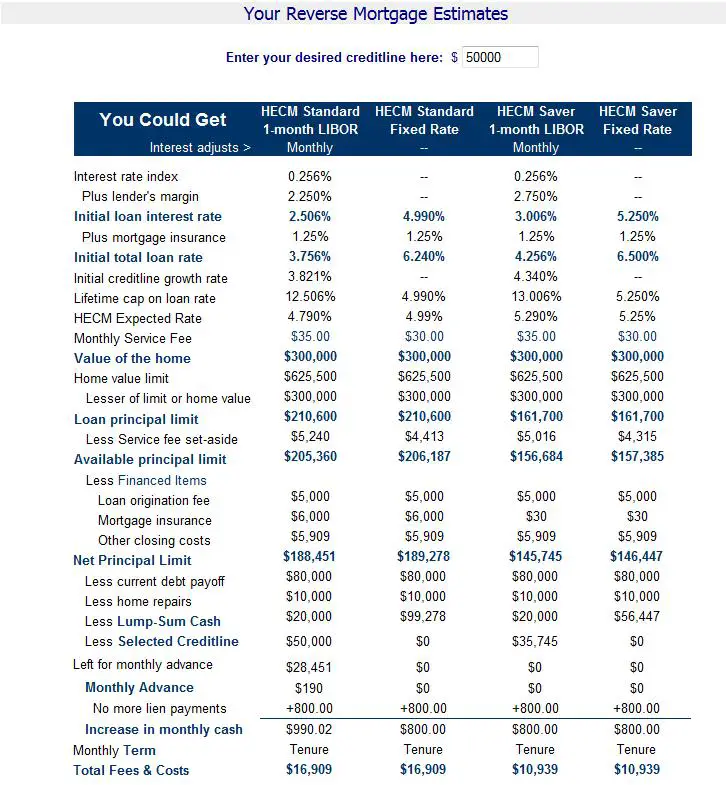

There are also flexible ways to receive the money from the reverse mortgage: a lump sum, a monthly payment, a line of credit or a combination.

Plus, if the value of the home appreciates and becomes worth more than the reverse mortgage loan balance, you or your heirs may receive the difference, Boies explains.

The opposite, however, can pose a problem: If the balance exceeds the homes value, you or your heirs may need to foreclose or otherwise give ownership of the home back to the lender.

There are also potential complications involving others who live in the home with the borrower, and what might happen to them if the borrower dies. Family members who inherit the property will want to pay close attention to the details of what is necessary to manage the loan balance when the borrower dies.

There are provisions that allow family to take possession of the home in those situations, but they must pay off the loan with their own money or qualify for a mortgage that will cover what is owed, McClary says.

Additionally, while not all reverse mortgage lenders use high-pressure sales tactics, some do use them to attract borrowers.

Can You Make Payments On A Reverse Mortgage Loan

Most people associate a mortgage with a predetermined set ofpayments, usually monthly, that you are obligated to make to your lender untilyour debt has been satisfied. This borrower-to-lenderflow of payments is known as a traditional mortgage.

A reverse mortgage reverses the process. Instead of makingmonthly payments to your lender, your lender makes payments to you.

Lets take a closer look at how this happens.

If you qualify for a reverse mortgage , the firstthing your reverse mortgage will do is pay off your current mortgage, if onestill exists. Although repayment of the old mortgage means you have no moremonthly mortgage payments, you are still responsible for maintaining your homeand paying property taxes and homeowners insurance, as you did with atraditional mortgage.

You still have a mortgage, only now its a reverse mortgage.With a reverse mortgage, monthly mortgage payments are optional. A new reversemortgage does not have to be repaid until you sell orpermanently leave the home, pass away, or fail to honor your loan terms. Itsconceivable that if you take out a reverse mortgage at 62, the earliest age toqualify for one, you could live in your current home for decades without makinga monthly mortgage payment.

Is A Reverse Mortgage Right For Me

A reverse mortgage is a complex financial product and you should carefully consider whether it is right for you. When considering whether to apply for a reverse mortgage, you should consider, among other things, whether:

- you want to remain in your home

- you are healthy enough to continue living in your home

- other alternatives, such as selling your home and purchasing a smaller, less expensive home, would be better for you

- your children, or other heirs, want to inherit the home

- the loan proceeds will be enough, with any other source of income you have, will be enough to enable you to live in your home

This is not an exclusive list of topics to consider, and everyones situation is unique. It is important for you to weigh whether a reverse mortgage is right for your situation and, you should consult with a legal or financial advisor or a housing counselor to help you assess your options.

A list of New York non-profit housing counseling agencies is available.

You May Like: Why Pay Additional Escrow On Mortgage

What Is Shared Appreciation And Equity Participation

In exchange for a lower interest rate the lender and the borrower may agree to equity participation. Participation mortgages are so named because the lender participates, or has the right to a share in any increase in the value of your home.

A Shared Appreciation Mortgage takes into account the appreciation in value of the house between the time the loan is signed and the end of the loan term. The lender receives an agreed-to percentage of the appreciated value of the loan when the loan is terminated.

Reverse Mortgage Tax Deductions

Disclaimer: Alpha Mortgage Reverse Division is not a tax advisor and does not offer tax advice. We recommend consumers consult with licensed tax professionals regarding potential tax deductions related to reverse mortgages. The information on this page may have changed since it was posted. Please verify any of the topics below with your tax advisor.

When it comes to tax deductions, a reverse mortgage offers similar benefits as a traditional mortgage. However, there may be some key differences. Namely, the accrued interest in a reverse mortgage may only be deductible after it is paid. This may be true for a traditional mortgage as well, but since reverse mortgage borrowers generally do not make payments on their loan, the tax deduction may be little more difficult to get.

Read Also: How Often Do You Pay Your Mortgage

Read Also: How Much Do Mortgage Points Usually Cost

Can You Payoff A Reverse Mortgage Early

MortgageReverse mortgagescanearlyyoureverse mortgagesMortgageearly payoff

Repay the reverse mortgageA borrower who wishes to repay their reverse mortgage loan may do so without penalty at any time, said Irwin. They are only responsible for repaying the balance of the loan, which is the amount borrowed plus interest.

Also, can you buy back a house that has a reverse mortgage? Therefore, the answer is yes: a borrower can sell a home with a reverse mortgage at any time they choose, just like a traditional mortgage. When a borrower sells their home, they must repay the reverse mortgage loan balance and their lender will close their account. Borrowers then keep the remaining equity.

Herein, is there a prepayment penalty on reverse mortgages?

You can make a prepayment to your reverse mortgage at any time for any amount you choose. There are no prepayment penalties if you choose to do so. Pay the interest and principal to avoid the loan from growing A reverse mortgage is a type a loan which means that interest will accumulate on the loan.

What is the downside to a reverse mortgage?

CONS of a reverse mortgageThe loan balance increases over time as interest on the loan and fees accumulate. As home equity is used, fewer assets are available to leave to your heirs. Fees may be higher than with a traditional mortgage.

reverse mortgageyouyouryour homeyouyour homereverse mortgageloseyouyour home’syouyouyouyououtlivereverse mortgageinterest rateinterest rate

Example 2 Variable Reverse Mortgage Interest Rate Term

Lets consider the same example: a home valued at $600,000 and $150,000 in CHIP money. For this example, you decide to take a variable term rate. Your initial interest rate will be the HomeEquity Bank prime rate plus the fixed spread all outlined in the table above. If the Bank of Canada changes its prime rate, then more than likely HomeEquity Bank prime will change. Your variable rate would then change to the new HomeEquity Bank prime rate plus the fixed spread, which is guaranteed for a five-year period.

If you have any questions about the CHIP Reverse Mortgage rates or if you are interested in understanding more about Reverse Mortgage, you can check this page on How a Reverse Mortgage Works. If you have any other questions, feel free to give us a call at 1-866-758-2447.

Also Check: How Much Is The Average Mortgage Insurance

Reverse Mortgage Tax Deductions The Basics

1. Typically, you can only deduct the interest that youve paid. So, if you have not made any payments toward your accrued mortgage interest, then you may not have anything to deduct. Even if you dont pay anything toward the principal balance, if you manage to pay the interest every year, you may be able to get the tax deduction.

2. A second thing to keep in mind is that deducting your reverse loan interest may be allowed on only certain portions of your mortgage proceeds. In other words, the deductible interest may depend on what you used the payments for.

According to the Journal of Financial Planning, a taxpayer may deduct interest paid on only certain portions of the loan proceeds such as portions used to construct, acquire or substantially improve the mortgaged residence.

Additionally, interest accrued and paid on portions of the mortgage proceeds that go toward refinancing previously existing acquisition indebtedness may also be deductible. This is where things get a little more complicated, so be sure to go over these points with your tax professional.

3. Typically, mortgage insurance premiums are not tax deductible with reverse mortgages. However, there may be some instances where a portion of the mortgage insurance premium may be deductible under certain circumstances. Check with your tax professional for details.

Request a FREE Info Packet!

5. Some fees may be tax deductible on a reverse mortgage, such as the origination and broker fees.

Fixed Vs Variable Interest Rates

Reverse mortgages can have either fixed or variable interest rates. With a fixed interest rate, the rate is set at the time the loan is originated, and it doesnt change for the lifetime of the loan. Variable rates, on the other hand, can change over time. Additionally, there are other key differences between fixed and variable rates as it relates to reverse mortgages.

| Fixed Interest Rate | |

|---|---|

| No protection against rate increases | |

| No access to more funds in the future | Access to more funds in the future |

Also Check: How To Become A Mortgage Closing Agent

When Is A Reverse Mortgage A Good Idea

A reverse mortgage may be a good idea in some situations, but it isnt for everyone. If youre not sure if a reverse mortgage is a good choice for your finances, consider working with an approved reverse mortgage counselor. The U.S. Department of Housing and Urban Development offers information on finding an approved counselor at 800-569-4287 or online at HUD.gov.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

How A Reverse Mortgage Works

With a reverse mortgage, instead of the homeowner making payments to the lender, the lender makes payments to the homeowner. The homeowner gets to choose how to receive these payments and only pays interest on the proceeds received. The interest is rolled into the loan balance so that the homeowner doesnt pay anything up front. The homeowner also keeps the title to the home. Over the loans life, the homeowners debt increases and home equity decreases.

As with a forward mortgage, the home is the collateral for a reverse mortgage. When the homeowner moves or dies, the proceeds from the homes sale go to the lender to repay the reverse mortgages principal, interest, mortgage insurance, and fees. Any sale proceeds beyond what was borrowed go to the homeowner or the homeowners estate . In some cases, the heirs may choose to pay off the mortgage so that they can keep the home.

Reverse mortgage proceeds are not taxable. While they might feel like income to the homeowner, the Internal Revenue Service considers the money to be a loan advance.

Don’t Miss: How To Increase Mortgage Score

Comparing Reverse Mortgages To Home Equity Loans And More

A Reverse Home Mortgage is not the only way to cash in on your home in retirement. Other ways of getting money out of your home include:

I. Downsizing

- Cash-out Mortgage Refinancing with either fixed or adjustable rates

- Second Mortgages

- Home Equity Line of Credit

While home equity interest rates can be lower than those charged on Reverse Mortgages, the primary disadvantage of home equity loans is that you will have to make loan payments, and if the rate is adjustable, those payments can increase dramatically if interest rates go up. This is often difficult for retirees living on a fixed income. It is also possible to default on a home equity loan and lose your home.

Summary Of Moneys Guide To Reverse Mortgages

- A reverse mortgage can be a valuable tool to support retirement goals, reduce housing costs or cover the costs of necessary home improvements or property taxes.

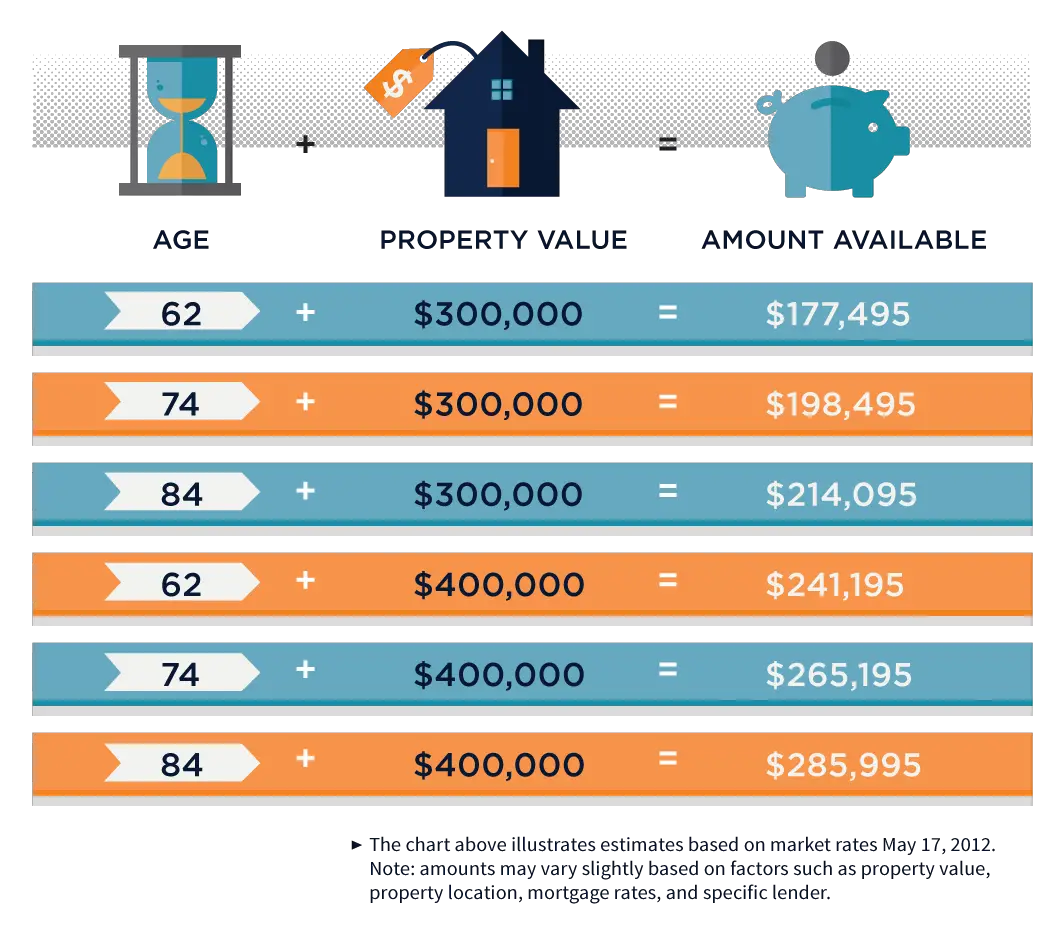

- Reverse mortgages can be accessed through FHA-approved lenders and private mortgage lenders. They are available for homeowners starting at age 55 to 62.

- These loans can be disbursed as a lump sum payment, as a line of credit or as a monthly annuity. You can also combine monthly payments and a line of credit.

- Homeowners should be fully aware of the responsibilities, conditions, and possible scams when looking for and applying for a reverse mortgage. Comparing lenders is also critical to ensure you receive good service and that you get the best deal.

- A financial assessment is an important step before applying to see if youll be able to afford living expenses, health care costs, insurance and taxes after taking this type of loan. All federally backed reverse mortgages require professional counseling before you can be approved.

Read Also: What Is Needed To Get Approved For A Mortgage

What An Equity Release Agreement Costs

It’s not a loan, so you don’t pay interest. Instead, you pay fees such as:

- an application fee

- periodic service fees, potentially deducted in advance from your home’s equity

- a fee to end the agreement

Get the fund to go through projections with you, showing the impact on your home equity over time. Get a copy of this to take away, and discuss it with your adviser. Ask questions if there’s anything you’re not sure about.

What Our Clients Say

Andrew Cate from Seniors First was amazing, he managed to arrange my reverse mortgage seamlessly. Working with him made the whole process completely painless and he explained every step along the way. I have no hesitation in recommending him to anyone thinking of this kind of mortgage Thank you so much Andrrw and Seniors First!

From the outset Andrew Cate was very helpful, considerate and very informative. He was available to answer questions at all times and we appreciated his professionalism and understanding of our needs during our application. Highly recommended. Thank you Andrew from Michael and Cherie Nikolaidis

Outstanding customer service received from Andrew Cate, Reverse Mortgage Specialist who expertly guided me through the loan process and kept me informed every step of the way. Sincere thanks to Andrew and Seniors First .. the loan has been life changing.

We recently completed a transaction through Seniors First and have been very impressed with the way it has been handled. we would have no hesitation in recommending them to anyone looking to secure their future requiements for finance. In particular we were looked after by Andrew Cate who gave us great help throughout the process.

Also Check: How Do Mortgage Payments Work

Is Making Monthly Payments Right For You

Although reverse mortgage payments will reduce your overall debt, it may not make sense for everyone.

If you plan on keeping your home for yourself or your heirs, reverse mortgage payments make sense. Making payments will reduce the amount you owe, which means itâll be easier to repay the reverse mortgage when the loan comes due.

If you are OK with selling your home to repay the reverse mortgage and having less left over afterward for yourself or your heirs, then making payments is unnecessary.

âMost people in a reverse are using it to be able to afford to live,â Westreich says. âMaking an unnecessary payment would hurt their quality of life.â

Reverse Mortgage Interest Calculation

Lets look at a home that has an appraised value of $500,000. You are 80 years old, which qualifies you to borrow a maximum of 55% of your homes value. You choose to borrow a lump sum of $100,000 for a 5-year term with Equitable Bank. With Equitable Bank’s Flex reverse mortgage, your annual interest rate is 4.89% before fees.

To calculate your reverse mortgage interest:

Convert to a daily interest rate

Reverse mortgage interest rates are quoted based on an annual interest rate. However, reverse mortgage interest is charged on a daily basis. This is similar to how interest is charged for a credit card. We can simply divide the annual interest rate by 360 to get a daily rate.

4.89% / 360 days = 0.01358%/day

Calculate the daily interest charged

To calculate the daily interest charged, multiply the daily interest rate by the amount borrowed, which is $100,000.

$100,000 x 0.01358% = $13.58 per day

Compound interest

Interest is only compounded twice a year, semi-annually. This means that the first six months are not compounded. Since interest costs $13.58 per day for a $100,000 mortgage, then multiply by six months.

$13.58 x 180 days = $2,444

After six months, the reverse mortgage balance is now $102,444. Interest will now be charged on top of the $2,444 interest, which is calledcompound interest. First calculate the daily interest charged, then again multiply by another six months.

$102,444 x 0.01358% = $13.91 per day

$13.91 x 180 days = $2,504

Recommended Reading: How To Qualify For The Lowest Mortgage Rate

Reverse Mortgage Interest Rate Faqs

What is the current interest rate on reverse mortgages?What is the downside of a reverse mortgage?

Monthly reverse mortgage payments are optional the full loan balance comes due when the last borrower dies or moves out of the home.Even though your client won’t have to make a monthly mortgage payment, they will need to continue paying property taxes and homeowners insurance premiums. They’ll also have to keep up with regular maintenance and repairs on the property.

What are the closing costs on a reverse mortgage?

Look Out For Reverse Mortgage Scams

Reverse mortgage borrowers are a common target for scammers. Fake lenders could come out of the woodwork to offer you a reverse mortgage that isn’t real, and they steal your money.

To avoid a scam, don’t respond to unsolicited emails or phone calls about reverse mortgages. Do your own research and approach a lender, instead of responding to a lender who approaches you.

Don’t Miss: What Mortgage Lenders Use Equifax