Compare Different Lenders’ Rates And Terms

Shopping around for the best mortgage refinance rates will likely save you money. For convenience, you might start with your current lender to see what kind of rates it is offering.

From there, you can expand your search to include other lenders, including online ones. In addition to their advertised interest rates, check on their:

- Minimum credit score and income requirements

- Loan-to-value ratio requirements

- Estimated time to close

- Loan repayment terms

Whats The Difference Between Refinancing Vs Renewing Your Mortgage

Renewing your mortgage means staying with your current lender for another term. Youll have an opportunity to renegotiate your interest rate and term, and you wont need to re-apply.

When you refinance, you are paying out your existing mortgage in order to negotiate a new mortgage loan agreement. This is usually because you want to access the equity in your home or lower other borrowing costs. There may be prepayment charges depending on when you choose to refinance.

Statements Of Outstanding Debt

Even though your lender will be able to see your existing debts via your credit report, you will still have to provide documentation detailing your current outstanding financial obligations. You will need to gather account statements on all remaining debts, including your existing mortgage, home equity lines of credit, car loans and student loans.

You May Like: What Does A Cosigner Do For A Mortgage

Don’t Miss: How Long Does A Mortgage Take To Pay Off

Pros And Cons Of A Mortgage Refinance

A mortgage refinance is best suited for homeowners that have home equity and are looking to borrow a large amount at a fixed rate. This allows homeowners to borrow money cheaply, but this would only be the case if the amount being borrowed is significant enough or if current mortgage rates are low enough to offset the costs of refinancing.

For borrowers that need quick access to money, or need to borrow small amounts at a time, a mortgage refinance might not be the best method to borrow money. Applying and being approved for a mortgage refinance can take time. The costs of a mortgage refinance will also deter those looking to borrow a small amount.

Some pros and cons of a mortgage refinance include:

Advantages

- Access your home equity at a low rate

- A fixed mortgage rate lets you lock in a lower mortgage rate

- You can borrow a large amount of money all at once

- You can extend your mortgage amortization to lower your monthly payments

Disadvantages

- Rates can be higher than mortgage renewals

- You will be charged penalties if you refinance before your mortgage is up for renewal

- You will need to pass the mortgage stress test in order to be approved, and approval takes time

- Frequently resetting your amortization can cause you to pay more interest

Cons Of Refinancing Your Mortgage

- Stringent requirements. Youll have to meet the lenders eligibility criteria in order to refinance, which usually means you must have decent credit, verifiable employment, a low amount of debt and a sufficient amount of home equity. While government-backed loans tend to have more relaxed qualifications, youll still need to satisfy the requirements set by the lender you choose.

- Closing costs. As with your original mortgage, youll pay a hefty amount in closing costs to refinance your loan. While some lenders offer no-closing-cost mortgages, this simply means your closing costs will be rolled into your loan amountand youll pay interest on those fees.

- Higher monthly payments. If you choose to shorten your repayment term, youll save money on interest, but your monthly payments will increase. You can use our mortgage refinance calculator to estimate what your payments could look like with different term options.

- Increase total interest. Refinancing also provides the option to extend your repayment term, such as from a 15-year to a 30-year loan. This could be a helpful option if you want to reduce your monthly payments however, doing so means youll pay more in interest over time.

Also Check: How Long Does A Mortgage Refinance Take

What You Need: Your Refinance Documents Checklist

When you apply for a refinance, your lender needs certain documentation to be able to approve you for the loan. This documentation may vary depending on the lender youre working with, the type of refinance youre seeking and your personal financial situation. Here are some of the items youll typically be asked to provide.

Set A Refinancing Goal

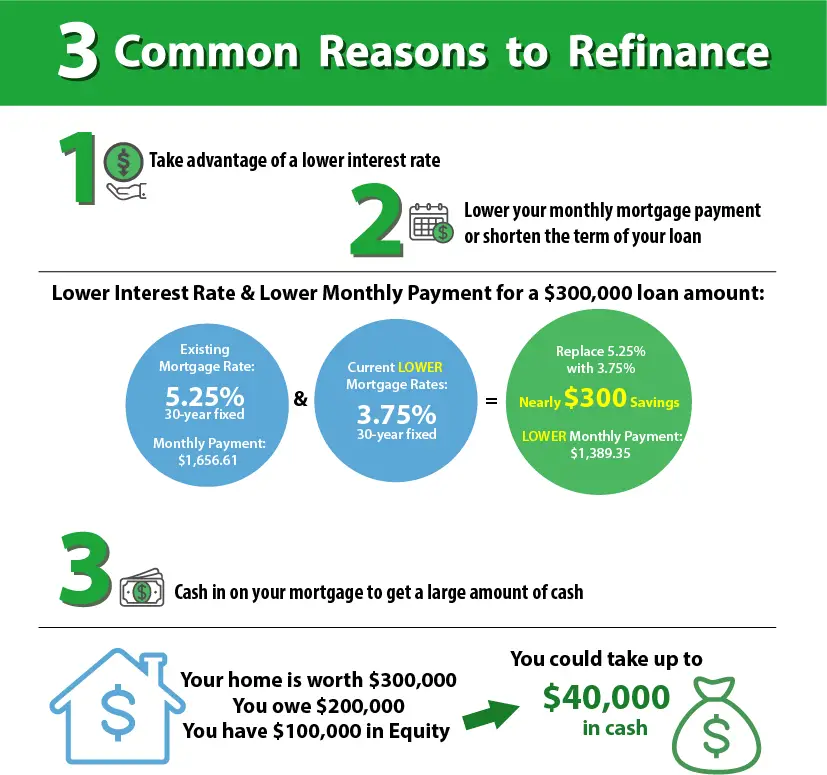

Most homeowners refinance in order to get a lower interest rate and, as a result, reduce their monthly payments. However, thats not the only reason to refinance.

Different loan types offer different advantages.

You may want to switch from an adjustable-rate mortgage to a fixed-rate mortgage to guarantee a permanently lower rate. Maybe you want to switch from a 30-year loan to a 15-year loan to pay off your mortgage faster. If you have enough equity, you may also be able to save on mortgage insurance by switching from an FHA loan to a conventional mortgage.

Perhaps you’ve recently run up against major medical bills, unexpected home repairs or other expenses that are weighing you down financially. If youve built up enough equity in your home, a cash-out refi will not only let you refinance your loan but also take out extra cash.

Knowing what you want to accomplish with a refi will help you determine the type of mortgage product you need. Consider all the options to see which works best for you.

Recommended Reading: What Are The 3 Types Of Mortgages

When Does It Make Sense To Refinance

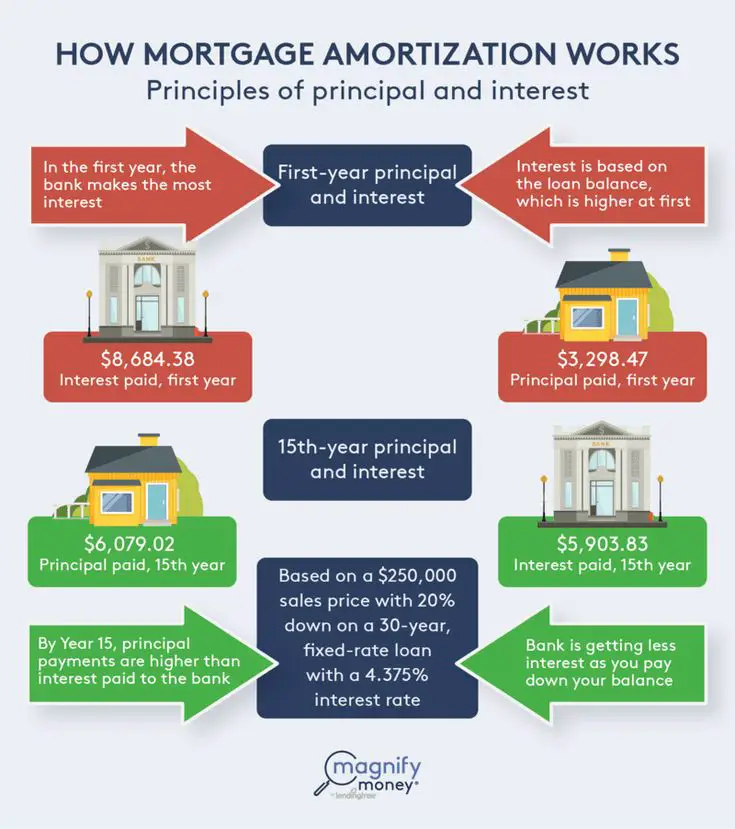

In general, mortgage refinancing will likely make sense when it makes sense for your finances. But part of that depends on your financial goals. For instance, do you want a lower monthly payment? Are you trying to save in total interest paid? Do you need to extract cash from your home with equity youve built? You can use Credit Karmas loan amortization calculator to explore how different loan terms affect your payments and the amount youll owe in interest.

Here are five situations to think about before you refinance.

Decide On Your Financial Goal

A mortgage refinance only makes sense if it improves your financial situation. Lenders call this a net tangible benefit. In fact, lenders are required to prove theres a financial benefit to approving your refinance. Set a clear goal, asking yourself the following questions so you know exactly what you want to achieve:

- Do you want a lower monthly mortgage payment?

- Would you like to pay off your loan faster by switching to a shorter term?

- Is it time to make some home improvements or upgrades to your home?

- Could you benefit from paying off high-interest credit card debt?

- Can you get rid of your monthly mortgage insurance?

Knowing your mortgage refi goal will help lenders quote you an accurate rate based on your financial priorities.

Also Check: What Is Balloon Payment Mortgage

Youve Seen A Jump In Income

An increase in income can be great if youre looking to refinance to a shorter loan term. Going from a 30-year mortgage to a 15-year term can save you thousands of dollars in interest.

As in the example above, a 30-year fixed loan of $100,000 at a high credit score of 760 to 850 would result in a monthly payment of $444 and a total interest amount of $59,993 at an APR of 2.845 percent. If you reduce your loan term to 15 years, however, the APR on the same amount of loan principal and at the same credit score changes to 2.845 percent, and the total interest amount drops to $22,967 a difference of $37,026. Thats an even bigger jump in savings than by improving your credit score.

A caveat of the 15-year loan term, though, is your monthly payment increases. At a 30-year term, your monthly payment is $444. However, with a 15-year term, your monthly payment is $683. If your budget can comfortably accommodate an additional $239 a month, then this may be an excellent option for you. But if the increased monthly payment makes your budget uncomfortably tighter, you may want to consider sticking with your 30-year loan term.

With a 15-year fixed loan term, you may pay more toward your mortgage each month, but youll also see huge savings in the amount of interest you pay over the term of your loan. High-income earners or those with enough wiggle room in their budget may want to opt for the shorter loan term.

What Are The Income Requirements For Refinance Mortgages

Your lender must look at your finances to determine the interest rate to charge on your refinance and will require proof of income when you apply. You can use:

Paystub requirements apply to co-borrowers on the loan as well. Lenders use these details to make sure you can afford your mortgage payments in the future.If youre self-employed, you’ll also need to provide:

- Federal income taxes for the past 2 years

- Profit-and-loss statements

Don’t Miss: How Much Is Mortgage On 150k House

Mortgage Refinance Vs Heloc

AHome Equity Line of Credit is similar to a mortgage refinance in the sense that you can borrow your home equity, however, there are major differences between these two products.

A HELOC is a revolving account that allows you to borrow money at any time. On the other hand, a mortgage refinance would be a one-time event where you receive a lump-sum amount.

HELOCs also have different credit limits, where you can only borrow up to 65% of the homes value if you have no mortgage, or up to 80% when combined with a mortgage.

HELOC ratesare variable, while refinance mortgage rates can be either fixed or variable. If you choose a fixed refinance mortgage rate, you will be able to lock in a rate. Variable HELOC rates mean that you will be paying more interest if interest rates rise. Refinance mortgage rates are also generally lower than HELOC rates.

Can I Refinance My Mortgage Without A Job

Most times lenders wont approve unemployment as proof of income, but there are a few ways to get around not having a job when planning to refinance.

- Find a co-signer. This is someone who will pledge to pay the lender any mortgage payments you cant afford. Having one assures the loan will be repaid and greatly increase your chances of being approved by a lender without having any income.

- Speak with a housing counselor. If youre completely lost at where to begin, turn to a professional. They can guide you through what the process would look like, and the U.S. Department of Housing and Urban Development offers low-cost or free advice.

- Show other documentation. Prepare to show your lender youre financially responsible in other ways. This could be showing them documents including bank account information, tax returns, proof of insurance, proof of unemployment, and proof of any additional income .

- Communicate with your lender. Be honest with them about your goals and see if they can offer a different repayment plan. It never hurts to ask!

Recommended Reading: How Much Will I Pay In Mortgage Interest

How Much Will It Cost To Refinance My Mortgage

You will need to pay for legal fees,home appraisalfees, and mortgage registration fees, but can avoid paying for prepayment penalties and mortgage discharge fees under certain circumstances. The mortgage discharge fee can be avoided if you stay with the same lender. If you leave your current lender to refinance with another lender, you will have to pay a mortgage discharge fee.

If you wait until the end of your term to refinance, you wont have to pay mortgage penalties. If you refinance before your term is over, you will be charged penalties if you choose to refinance at current mortgage rates. However, you can choose to blend and extend your mortgage rate, which mixes your mortgage rate with current rates. This allows you to avoid paying for mortgage penalties, although your interest rate will not be fully adjusted to current interest rates.

These fees can add up to a hefty amount depending on which fees apply to you.

It becomes clear when adding up these refinancing fees that mortgage prepayment penalties will be the largest cost to a refinanced mortgage, but some fees are also avoidable. Here are the total costs for refinancing your mortgage for a typical mortgage:

-

Refinancing with your current lender at the end of your term:

$1,120 to $1,920

-

Refinancing with a different lender before the end of your term:

$1,320 to $2,270 plus mortgage penalties

Monthly Principal And Interest On 30

| 30-Year Vs. 15-Year |

|---|

Keep in mind that in some cases, a lender might be willing to waive certain fees , so be sure to ask if any of your closing costs are negotiable or if any discounts are available.

There are also several lenders that offer no-closing-cost refinance options, which allow you to roll your closing costs into your loan amount. However, this often results in a higher interest rate and higher monthly payments. If you plan to stay in your home for a long period of time, its generally better to cover your closing costs upfront to avoid paying more over time.

Additionally, getting your financial profile in the best shape possible with a good credit score, stable income and low amount of debt can help you qualify for a competitive rate on your mortgage, which will reduce your costs over the life of your loan.

Recommended Reading: How To Get Your Mortgage Credit Score

You’re Too Focused On The Immediate Savings

If you can find a better deal than what you have now, refinancing to score a lower interest rate and lower monthly mortgage payment can be smart but not if the new home loan won’t really save you money.

A refi doesn’t make financial sense if you may be moving soon. If you’re going to save $100 a month but will have to pay closing costs of $3,000, you’ll need to stay in the home for more than 30 months to come out ahead.

A refinance also can be a money loser when it causes you to stretch out your loan term. If you’ve been paying on your 30-year loan for 10 years and refi into a new 30-year mortgage, refinancing will saddle you with 10 extra years of interest charges.

Your Mortgage Refinancing Checklist: Ready To Refi

02/08/2017Kristin Demshki

With some mortgage experts projecting rates to remain near historically low numbers, itâs no surprise that refinancing continues to be a popular home loan option. Before you start comparing lenders, however, itâs important to take a 360-degree view of your options.

Before mortgage refinancing, you should run through the checklist below and answer each of the questions.

1. What are your goals?

- Are you trying to lower your monthly payments?

- Do you want to shorten or extend the life of your loan?

- Would you like to use equity to pay off debt or fund home upgrades?

- Do you qualify for a government-backed conventional refinance program?

2. Does refinancing make financial sense?

- Is the interest rate lower than your existing rate?

- Will the new rate increase your monthly payments?

- Will you pay more money over the entire length of the loan?

3. Can you afford closing costs and fees?

- Are you prepared to pay the application fee?

- Have you determined title insurance, attorney and closing costs?

- Do you have these funds to pay upfront?

4. Have you determined what the payoff amount will be ?

- Calculate the payoff amount

- Determine any payoff penalty fees

- Request a copy of the payoff statement

5. Do you know what mortgage refinancing documents are needed to apply? Can you obtain them?

- Tax Returns, W-2s, and/or 1099s

- Statement of Assets

Read Also: How To Figure Mortgage Interest Rate

Set A Clear Financial Goal

There should be a good reason why youre refinancing, whether its to reduce your monthly payment, shorten the term of your loan or pull out equity for home repairs or debt repayment.

What to consider: If youre reducing your interest rate but restarting the clock on a 30-year mortgage, you may end up paying less every month, but more over the life of your loan. Thats because the bulk of your interest charges are in the early years of a mortgage.

Do I Need Title Insurance

Yes, and as a homeowner, you may have already purchased a title insurance policy to protect your interests as an owner. This owner’s title policy remains in effect for as long as you own the house. Title insurance is protection against loss that arises from problems connected to the title of your property. The coverage includes liens, fraud, undisclosed heirs, unpaid real estate taxes and more.

There’s a separate policy that protects the lender’s interests. It’s good for as long as you have your loan, so each time you get a new mortgage, you’ll need a new lender’s title policy.

Recommended Reading: How Much Is A 2 Million Dollar Mortgage A Month

The 7 Types Of Documents You Need For A Refinance

Get these documents together before you start the refinance process to streamline your loan.

With so many people filing for refinance these days, it can take a lot longer than you’d expect to have your refinance go through. You don’t have control over how backed up your lender is with applications. However, you can speed things up on your end by gathering all of the appropriate documents before starting the refinance process.

Think back to your original mortgage and all of the documents that you had to gather. For a refinance, the documentation for your refinance is pretty much the same. The overall purpose is to prove different aspects of your finances to your lender.

All lenders have slightly different requirements, but you can bet that they’ll probably ask for documents in the following seven categories:

1) Proof of income: Proving your income generally requires the following documents.

- The last 30 days of pay stubs

- Your current tax returns

- Tax forms like W-2’s and 1099s

2) Insurance: You’ll probably need to produce documentation for two kinds of insurance:

- Homeowners insurance, to verify that you have enough current coverage for your home.

- Title insurance, to help your lender to check the taxes, the names on the title, and the legal description of the property.

3) Credit information: You’ll need a recent credit score and credit reports.

- Your current mortgage

- Other real estate