Repayment Or Credit Risk

The most important risk for the lender is that you wont repay the loan. A high credit score can help lessen this concern, as it shows the lender youve been good at repaying your debts. So, you may pay a lower interest rate than those who have a lower score.

If your mortgage is worth more than 80 percent of the value of the home, youll have to buy mortgage default insurance. But since insurance protects the lender from the risk of default, you may get a lower interest rate than if you go for an uninsured mortgage with a bigger down payment.

How To Save Interest On Your Mortgage

Now that you know a bit more about how interest is calculated lets look at the ways you can actually pay less of it.

- Get the best rate. Shopping around for a better interest rate can save you thousands of dollars. If you already own a home, you may want to consider refinancing with your current lender or switching to a new lender.

- Make frequent payments. Because there are a little over four weeks in a month, if you make biweekly instead of monthly mortgage repayments, youll end up making two extra payments a year.

- Make extra payments. The quicker you pay down your loan amount, the less interest youll need to pay on your smaller outstanding loan amount. If you have a variable interest rate, you can save even more by making extra payments when interest rates are low.

- Choose a shorter loan term. The longer you take to pay off your loan, the more interest youll end up paying. Remember, banks calculate interest on your loan amount daily, so choosing a 25-year loan term instead of 30 years can make a big difference.

Factors Within Your Control

Your credit score

Maintaining a good can make a big difference, since it shows mortgage lenders that youre responsible about paying your bills. Generally speaking, people with higher scores get lower rates.

Heres one example of how that might play out, based on the Lending Trees February 2021 Mortgage Offers Report:

- Homebuyers with credit scores of at least 760 were offered average annual percentage rates of 2.86% for 30-year, fixed-rate loans.

- Homebuyers with scores of 680 to 719 were offered average APRs of 3.09%.

- Based on the APR difference, the second group of borrowers would pay almost $13,231 more over the life of a 30-year mortgage.

Your down payment

Generally speaking, the more you put down, the lower your mortgage rate will be because a bigger upfront payment reduces the lenders risk. A down payment of 20% means other benefits, including eliminating the need for private mortgage insurance.

If you can put down at least 20% without busting your budget, it could lower your monthly payments.

You loan type

Conforming loans are those that can be purchased by Freddie Mac or Fannie Mae. They usually have the lowest interest rates. However, if you cant put 20% as your down payment amount, youll have to buy private mortgage insurance.

Non-conforming loans, which cannot be sold to Freddie Mac or Fannie Mae, arent available from every lender. If you go this route, look for a mortgage interest rate thats competitive with conforming loan rates.

Your mortgage term

Don’t Miss: What Is My Mortgage Payment Going To Be

How Mortgage Rates Are Determined: A 2022 Guide

There are many factors that come into play when it comes to determining mortgage rates. These factors include overall economic health and personal factors like credit score, the size of the loan compared to the value of the property, and how you occupy your home.

Many people think about the mortgage market when they want to buy or refinance a home. a mortgage is a home loan from a lender like a bank or financial institution. If you dont know that much about mortgages, then you might be thinking that there is some sort of mysticism involved that mere mortals cant understand.

This post is going to look at these factors in detail so that you can know how mortgage rates are determined and what you can do to get a good rate.

When Should You Lock A Mortgage Rate

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-central-new-jersey.jpeg)

If mortgage rates are constantly changing, how do you know when its time to lock in a rate?

Luckily, its not as tough as it sounds.

Youll likely have a short window for rate shopping before its time to lock and move forward with the loan.

And in that time, you shouldnt expect rates to rise or fall too dramatically. Movements are typically small from one day to the next.

So the decision is less about timing your rate lock, and more about choosing the right lender.

Youll likely save more by comparison shopping than by trying to play the market, since even seasoned economists have trouble predicting how mortgage rates will move.

You May Like: How To Get Prequalified For A Mortgage With Bad Credit

What The Forecast Means For You

Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

Higher interest rates mean higher monthly payments for borrowers. For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172. This doesnt include insurance, taxes or other loan costs. If the rate rises to 6%, the monthly payment jumps to $2,398.

This means time is running out for homeowners who hope to lock in a lower interest rate by refinancing.

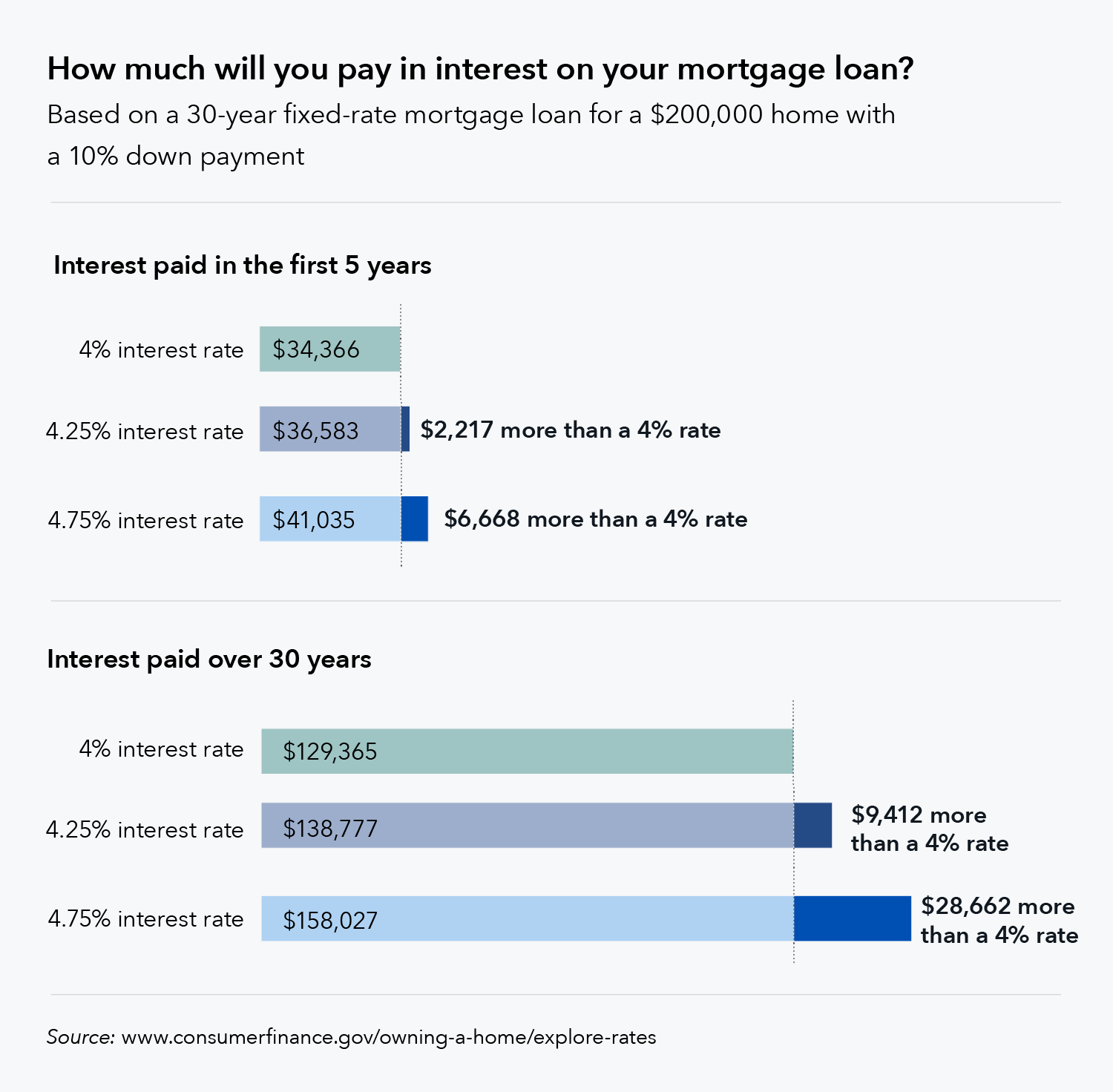

How Much Interest Can Cost

Your interest rate and how its calculated affects your regular mortgage payments. A mortgage is usually a large amount of money. Therefore, small differences in the interest rate can have a significant impact on your costs.

Figure 1: Example of monthly mortgage payment for a mortgage of $300,000.00 with an amortization of 25 years at various interest rates

| Interest cost over 5 years | Interest cost over 25 years |

|---|---|

| 2.50% | |

| $73,097.91 | $233,738.23 |

Make sure your home is within your budget. Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, you may be overextending yourself.

Don’t Miss: What An Average Monthly Mortgage Payment

How Do I Find The Best Mortgage Rate

The best way to find the most competitive mortgage rates based on your financial situation is to get quotes from multiple lenders. When you do, ensure that you carefully examine the loan estimate document to find out how much you will be paying. If you are a first-time home buyer, most states have programs offering below market rates to accelerate your path to owning a home.

What Personal Factors Affect Mortgage Rates

Economic factors aside, many personal factors affect the par rate, or the interest rate before expenses like origination fees are factored in, a mortgage lender will give you. Lenders have interest rates they can charge for the best borrowers, and they adjust rates for the riskier borrowers. Fortunately, you can control your personal factors, which means you can indirectly affect your mortgage rate.

Follow these guidelines to get the best mortgage rate possible.

Don’t Miss: What Is The Mortgage Payment For A 150k House

How Are Fixed Rates Set

Fixed mortgage rates are set according to the bond yield market trends, and set higher than bond yields at a spread relationship of 1-2%.

The 5-year fixed rate mortgage is the standard term that banks compete on, and so watching 5-year bond yields offer a good indication of where fixed rates may be going.

- When 5-year bond yields are up, it usually means fixed rates will follow if the trend continues.

- When 5-year bond yields are down, it usually means fixed rates will lower, though banks will react more slowly to decrease their rates.

- Bonds trade daily, so the 5-year mortgage rates can move at any time.

- Mortgage rates don’t move lockstep with bond yields but have a spread-relationship that can help determine where rates may be headed.

When you sign up for a fixed rate, it’s yours for your full term and won’t change until it’s time to renew.

Consider Which Mortgage Rate Is Right For You

| Defining features | |

|---|---|

|

Fixed term and changing interest rate Same payment for the length of the term Can be converted to another term at any time Benefit from decreasing rates, but when interest rates rise, more of the payment goes to paying interest rather than the principal The variable rate is often lower than the fixed rate. |

You want to take advantage of changing interest rates, but want a fixed payment amount for the entire term of the mortgage |

Also Check: What To Know Before Applying For A Mortgage

Comprehending The Bond Market And Its Influence On A Fixed

The biggest influence on a fixed-rate mortgage is the bond market, which the chartered banks use to determine their mortgage rates. A mortgage and a Government of Canada bond are two investments that banks use to generate profits. But there are many differences between these two types of investments, and banks use bonds as a security against losses in their mortgage departments. Bonds are:

- A no-risk financial endeavour for banks

- Guaranteed to yield at least a minimal profit

- A no-cost investment

On the other hand, when a bank lends money for a mortgage, they are:

- Carrying a much higher risk

- Incurring costs associated with approval and set up

- Not guaranteed profit, and at risk of loosing money if the borrower defaults

Banks, therefore, calculate the interest rates on the money they lend based on the interest rates they are getting on the money they have invested , and use their forecasted earnings from bond investments to cover the costs and possible losses incurred through a mortgage. Consequently, the more lucrative the bond market and the higher the bond rates, the lower your fixed-rate mortgage will be.

Some Factors Are Part Of The Cost Of All Mortgages

Think of a mortgage as a product you buy. Any business that sells you something tries to make a profit. To do that, the price they charge for the product has to be higher than the cost to make it. A lender profits on your mortgage because you pay more in interest than what they paid to borrow the money themselves .

This funding cost makes up most of the interest rate on your mortgage. Other factors include your lenders operating costs and how much the lender needs to cover the risk that you wont repay the loan. But funding cost is the most important factor.

So, what determines funding cost?

You May Like: How To Pay Points On Mortgage

Avoid Adding Any New Debt

Adding new debt to your credit report can dock your score and give potential new lenders pause. That’s because new accounts will

- Increase your total debt burden

- Increase your monthly debt obligation

- Drop your average age of accounts

- Add a new hard inquiry to your credit report

For these reasons, you should try to avoid applying for or opening any new accounts leading up to your mortgage refinance.

What Is A Mortgage Rate

A mortgage rate is the rate of interest charged on a mortgage. Mortgage rates are determined by the lender and can be either fixed, staying the same for the term of the mortgage, or variable, fluctuating with a benchmark interest rate. Mortgage rates vary for borrowers based on their credit profile. Mortgage rate averages also rise and fall with interest rate cycles and can drastically affect the homebuyers’ market.

Don’t Miss: Can I Add Someone To My Mortgage Without Refinancing

Follow The Money: The Secondary Mortgage Market

Contrary to what many people assume, the bank or lending institution that grants you a home loan doesn’t usually hold on to it. Instead, it enters what’s called the secondary mortgage market:

These final investors buy tranches to receive a return on investment, which they get from homeowners’ mortgage payments. With this system, you can see how the lender and aggregator are middlemen who try to balance interests of the homebuyer and investor. The lower the mortgage rate, the more attractive it is to a homebuyer. The higher the mortgage rate, the more attractive it is to the investor. And both sides are competitive: The homebuyer shops around for the lowest interest rate, while the investor compares the return against other investments.

So, if investors help determine mortgage rates by deciding how much they are willing to pay to invest in mortgage-backed securities, we could ask what goes into such decisions. And that’s exactly what we’ll explore next.

What Is The Best Type Of Mortgage Loan

The best type of mortgage loan depends on your personal financial profile, lifestyle goals and the type of property you want to own.

For example, a 30-year mortgage might be better for someone who prefers the lowest monthly payments and plans to live in the house for a long period of time. However, if you want to pay off the home quickly, you can opt for a 10-, 15- or 20-year mortgage. The monthly payments will be higher, but the house will be paid off faster.

If interest rate cost is an important factor for you, you might also consider an adjustable-rate mortgage . The most popular ARM is called the 5/1 ARM, which has a fixed rate for the first five years of the loan and then switches to an adjustable rate for the remainder of the 30-year loan term. When the loan hits the adjustable-rate period, it typically adjusts annually.

This can be a good option if you feel ARM rates are likely to stay lower than fixed rates in the future. For example, the 30-year fixed rate has dramatically increased since the start of 2022, which has made the ARM rate a lower, more attractive option right now.

Related: Current ARM Rates

However, if ARM rates exceed fixed rates in a couple years, it could mean you face higher mortgage payments when the 5/1 mortgage reaches the adjustable-rate period. So its important to be prepared for changes in mortgage costs when applying for a 5/1 ARM or other ARMs.

Don’t Miss: How To Purchase A House That Has A Reverse Mortgage

Other Types Of Loans And Financing

In many cases, other types of loans are calculated monthly, and sometimes even daily. Using the same mechanics, this inflates the actual rate, that is to say the rate you are really paying.

An unpaid balance on a credit card with a 20% interest rate will wind up costing you more than 20% down the line. Thats why its important to avoid large debt on this type of financing, especially on cash advances, as the interest is often compounded daily.

How Do You Shop For Mortgage Rates

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. Youll also want to compare lender fees, as some lenders charge more than others to process your loan.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

Each lender is required to give you a loan estimate. This three-page standardized document will show you the loans interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years.

Recommended Reading: How To Calculate Mortgage Loan Amount

How Are Mortgage Interest Rates Determined

Like most things in this world, mortgages are not always what they seem to be on the surface instead of being a straightforward loan so that you can purchase and pay off a home, there are hidden fees in the form of mortgage interest rates. Theres nothing to fear, though: Mortgage interest rates are dependent on a whole bunch of different factors, some of which you can control and some of which you cannot. Understanding this is the key to understanding how mortgage interest rates are determined.

Mortgage Rate Forecast For 2022 And 2023

Wondering if mortgage rates are going up or down in 2022 and the year after? Wonder no longer.

The following table provides 2022 mortgage rate predictions for the 30-year fixed from well-known groups in the industry, along with a 2022 estimate.

Take them with a grain of salt because theyre not necessarily accurate, just forecasts for future rate movement.

| Mortgage Rate Predictions |

Also Check: Can You Get A Reverse Mortgage On A Condo

You May Like: Does It Make Sense To Pay Off Mortgage Early

Why Do Mortgage Rates Vary By Lender

Mortgage rates vary from one lender to the next due to a variety of factors, one of which is the use of different risk-based pricing models. Lenders will assess borrowers and charge either lower or higher rates based on risk factors, such as the likelihood of a borrower to make timely payments. Lenders also have varying profit margins and operational costs, which may affect the rates they offer.