The Bottom Line: Should You Get A 10/1 Arm

A 10/1 ARM makes the most sense if you plan to sell your home or refinance your mortgage before the 10-year fixed period ends. If you do this, you can take advantage of the low initial interest rate that comes with an ARM without worrying about your rate rising once the fixed period ends.

Youll need a risk tolerance, though. Even if you plan to sell or refinance before the fixed period ends, theres no guarantee that youll be able to accomplish these tasks before your rate enters its adjustment phase.

Although we dont offer 10/1 ARMs, a 10/6 ARMs could help you accomplish the same goals. If you are interested in learning more about 10/1 ARMs or any other real estate loan options, talk to a Home Loan Expert at Rocket Mortgage today.

What You Need To Know

- A 10/1 ARM loan has a fixed rate for the first 10 years of the loan and will have variable rates for the remainder of the loan

- 10/1 ARM loans often have lower interest rates than fixed-rate mortgages during fixed-rate periods but can have costly payments later on

- Lenders adjust 10/1 ARM variable rates and mortgage payments on an annual basis using market index and margin calculations

Who Is An Arm Mortgage Better For

For whom are ARM loans a good idea? If lower rates and payments in the short term are your primary concern, you may want to look into an ARM. If you dont think interest rates are likely to rise a great deal over the next 10 years, or in the five to 20 years after that, you may find an ARM worth considering.

Read Also: What Credit Score Do You Need For A Mortgage Loan

How Arm Loans Work

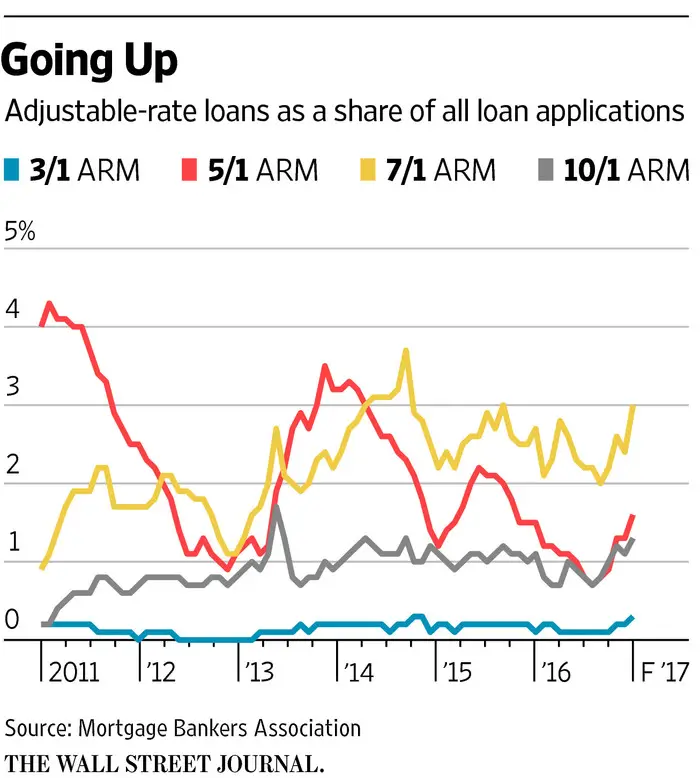

Adjustable-rate mortgages are named for how they work, or rather, when their rates change. As an example, the most popular type of loan is a 5/1 ARM.

- A 5/1 ARM has a fixed interest rate during the first five years. Thats what the 5 indicates

- Afterward, the interest rate changes each year. Thats what the 1 indicates

Keep in mind that a 5/1 ARM still have a total loan term of 30 years. So after the 5-year fixed-rate period, your rate can adjust once per year for the next 25 years, or until you refinance or sell the home.

Similarly, the rates of a 10/1 ARM are fixed for the first 10 years and will adjust annually for the remaining life of the loan. Whereas a 5/6 ARM has a fixed interest rate for the first five years but will adjust every six months.

Lenders generally offer 3/1 ARMs, 5/1 ARMs, 7/1 ARMs, and 10/1 ARMs.

What Are The Different Types Of Arms

There are different types of ARMs that lenders offer. The name of these ARMs will indicate:

- The duration of the initial period.

- How often in a year your rate can adjust during the adjustment period.

Lets look at an example: The most common adjustable-rate mortgage is a 5/1 ARM. This means you will have an initial period of five years , during which the interest rate doesnt change. After that time, you can expect your ARM to adjust once a year .

Most ARMS will also typically offer a rate cap structure, which is meant to limit how much your rate can increase or decrease.

There are three different caps:

- Initial cap: Limits how much your rate can increase when your rate first adjusts.

- Periodic cap: Limits how much your rate can increase from one adjustment period to the next.

- Lifetime cap: Limits how much your rate can increase or decrease over the life of your loan.

Lets say you have a 5/1 ARM with a 5/2/5 cap structure. This means on the sixth year after your initial period expires your rate can increase by a maximum of 5 percentage points above the initial interest rate. Every year thereafter, your rate can adjust a maximum of 2 percentage points , but your interest rate can never increase more than 5 percentage points over the life of the loan.

When shopping for an ARM, you should look for interest rate caps you can afford.

Read Also: How Much Mortgage Do I Qualify For

What Is A 10/1 Arm Refinance Loan

Adjustable-rate mortgage loans are usually referred to as ARMs. These loans are typically offered with a 30-year or 15-year term. A 10/1 ARM has a fixed rate for the first 10 years of the loan. The rate then becomes variable and adjusts every year for the remaining life of the term.

A 30-year 10/1 ARM has a fixed rate for the first 10 years and an adjustable rate for the remaining 20 years. A 15-year 10/1 ARM is similar. The rate is fixed for 10 years and then adjustable for the remaining five.

In addition to 10/1 ARM loans, U.S. Bank also offers 5/1 ARM options. Check out todays rates for 5/1 ARM refinance loans.

Arm Rates And Rate Caps

Mortgage rates are influenced by a variety of factors. These include personal factors like your credit score and the broader impact of economic conditions. Initially, you may encounter a teaser rate thats much lower than the interest rate youll have at some point later on in the life of the loan.

The benchmark named in an ARM contract is the basis of an ARMs rate. For example, the contract may name the U.S. Treasury or the secured overnight finance rate as a rate benchmark. Essentially, the benchmark will serve as the starting point of any reset calculations.

U.S. Treasury and SOFR rates are among the lowest rates possible for short-term loans to their most creditworthy borrowers, generally governments and large corporations. From that benchmark, other consumer loans are priced at a margin, or markup, to these cheapest possible loan rates.

The margin applied to your ARM depends on your and credit history, as well as a standard margin that recognizes mortgages are inherently riskier than the types of loans indexed by the benchmarks. The most creditworthy borrowers will pay close to the standard margin on mortgages, and riskier loans will be further marked up from there.

The good news is that rate caps may be in place, indicating a maximum interest rate adjustment allowed during any particular period of the ARM. With that, youll have more manageable swings with each new rate change.

Recommended Reading: How Do Mortgage Officers Get Paid

General Advantages And Disadvantages

The initial interest rates for adjustable rate mortgages are often lower than a fixed rate mortgage, which in turn means your monthly payment is lower. If you only plan to stay in your home for a short period of time, an ARM loan might be advantageous to you because you plan on moving or selling your home before your initial mortgage rate adjusts. If you expect your income to increase in the future, you might feel comfortable with the idea of saving money now by having a lower monthly payment but be comfortable with having to make higher payments in the future when your income rises and your ARM adjusts.

ARMs are generally considered riskier because your interest rate can go up after the initial fixed-rate period ends.

Can I Convert My Arm To A Fixed

Lets say you love what you thought would be your starter home and have decided you want to stay there indefinitely. If you have a convertible ARM, it contains a provision granting you this option. However, if youre considering an ARM now, be aware that itll cost you more upfront, which may defeat the whole point of choosing the ARM.

With that said, even if your loan doesnt contain a specific conversion clause, you can refi into a fixed-rate loan if you qualify.

You May Like: How To Find Mortgage Payment

You’ll Be More Disciplined

Think of an ARM as a money coach who pushes you stay on top of your finances.

Since you have a shorter timeline to reduce debt, you’ll be more motivated to pay extra principal every month, quarter or year. The goal is lower your balance by as much as possible before your introductory fixed-rate period is over.

A 30-year fixed mortgage, on the other hand, is like your neighborhood gym: You hardly ever go, even though you know you should. When you have three decades to pay off debt, the natural tendency is to sit back and take your time.

Arms Can Affect Your Buying Power

If you plan to buy a house or refinance a mortgage in the near future, you should consider ARM loans along with fixed-rate mortgages. The right ARM could increase the loan amount you qualify for or make it easier to buy when home prices are increasing.

Understand, however, that lenders qualify ARM borrowers differently than they do fixed-rate borrowers.

Oftentimes, lenders check your ARM eligibility based on the loans fully-indexed rate, which is the highest it could go after adjusting. This protects you as a borrower because it helps ensure you can afford your payments if the rate increases later on. But it also means you dont get the benefit of qualifying at the ultra-low intro rate.

Still, that low rate equates to lower mortgage payments for the first three to 10 years of your mortgage loan. And with fixed rates on the rise, many borrowers can benefit from the low intro payments on an ARM.

Read Also: Does It Make Sense To Refinance My Mortgage

/1 Arm Calculator Disclaimer

You should consider the 10/1 ARM calculator as a model for financial approximation. All payment figures, balances, and interest figures are estimates based on the data you provided in the specifications that are, despite our best effort, not exhaustive.

For this reason, we created the calculator for instructional purposes only. Still, if you experience a relevant drawback or encounter any inaccuracy, we are always pleased to receive useful feedback and advice.

Disadvantages Of An Adjustable

Just like with any mortgage type, an ARM has some potential downsides. The biggest risk of taking out an adjustable-rate mortgage is the probability that your interest rate will likely increase. If this happens, your monthly mortgage payments will also go up.

It can also be difficult to project your financial standing if and when interest rates and monthly payments fluctuate. Its possible that if rates shift upward, you could struggle to afford the higher monthly payments. This instability may discourage home buyers from taking out an ARM.

Read Also: How To Work For A Mortgage Company

Wrapping It Up Is A 10/1 Arm Loan Right For Me

If you plan to sell or refinance your home within the first 10 years you own it, a 10/1 ARM loan might be the perfect choice for you. If youre able to make extra payments or can handle variable payments later on, a 10/1 ARM loan can save you major money, even if you stay in your home longer than 10 years.

Keep in mind that this loan comes with more risk-tolerance requirements than a 15- or 30-year fixed-rate mortgage. If you are currently shopping for mortgages, remember that lenders are looking at your credit history and financial health. Great credit can help you get the best rates regardless of which mortgage you choose.

How Do Arms Work

An adjustable-rate mortgage is a loan with an interest rate that will change throughout the life of the mortgage. This means that, over time, your monthly payments may go up or down.

This is different from a fixed-rate mortgage , which has a fixed interest rate that is set when you take out the loan and does not change. With this type of loan, your monthly payments will not change.

ARMs have two distinct periods:

- Initial period: Also known as the fixed-rate period, during this time, the interest rate on your loan doesn’t change. The initial period can range from six months to 10 years. The most common ARM terms will have an initial period of 3, 5 or 10 years.

After the initial period, most ARMs adjust. Simply put, when your loan adjusts, your interest rate may change.

- Adjustment period: All ARMs have adjustment periods that determine when and how often the interest rate can change. Your adjusted rate will be based on your individual loan terms and the current market.

You need to make sure you are financially prepared for rate adjustments if you are considering an ARM.

Read Also: How Many Times Can Refinance A Mortgage

How Adjustable Rate Mortgages Are Calculated

The method for calculating interest rates on ARMs is based on a simple mathematical formula: index rate + margin = interest rate.

The index rate typically is based on one of three indexes: the London Interbank Offered Rate the one-year Treasury Bill or the Cost of Funds Index . Some lenders have their own cost of funds index so its important that you ask what index is being used and where it is published so you can keep track of it.

Your lender chooses which index to base your rate on when you apply for the loan, but the LIBOR is the most popular index used.

Your lender also determines the margin you will pay, which is the number of percentage points added to index. The margin percentage varies from one lender to the next and should be a focal point of your research when applying for an ARM. That margin should be constant throughout the life of your loan.

In the spring of 2018, the LIBOR index was 2.66%. The common margin rate was around 2.75%. Using the formula above index rate + margin = an interest rate of 5.41%.

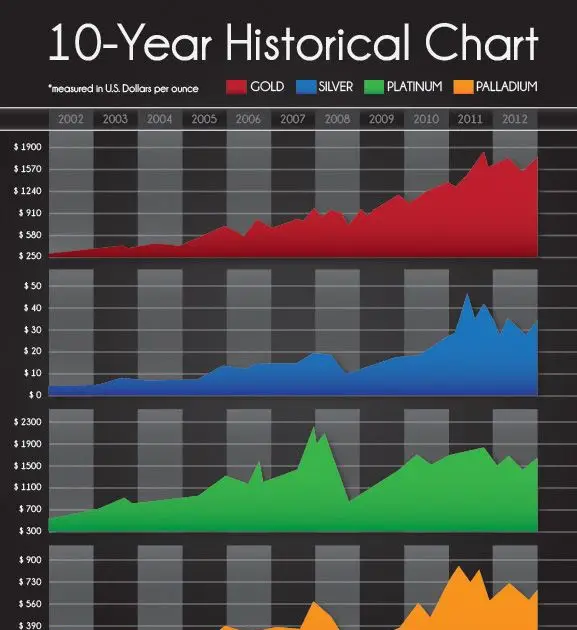

How Do Historical Mortgage Rates Compare

When obtaining an ARM make sure to ask what the Annual Percentage Rate is on the loan. If the initial rate is lower than that rate one might expect payments to increase significantly even if the reference rate the loan is indexed against does not change.

Currently the spread between FRMs & ARMs is quite low, which makes fixed-rates a relatively better deal. As interest rates rise, typically the spread between fixed & adjustable loans increases significantly, which can make ARM loans a more attractive option.

Here are historical average annual interest rates for popular home loan products.

| Year |

|---|

| $160,776.42 |

Read Also: What Is The Best Way To Apply For A Mortgage

What Is A 5/1 Arm Loan

A 5/1 ARM is a type of adjustable-rate mortgage that has a fixed rate for the first five years. After that period, 5/1 ARM rates fluctuate based on your loan terms. A 5/1 ARM may also be called a hybrid mortgage, which means it combines a temporary fixed-rate mortgage with an adjustable-rate mortgage.

The 5 in the 5/1 ARM is the number of years your rate is temporarily fixed. The 1 is how often the rate can adjust after the initial fixed-rate period ends in this case, the 1 represents one year, so the rate adjusts annually.

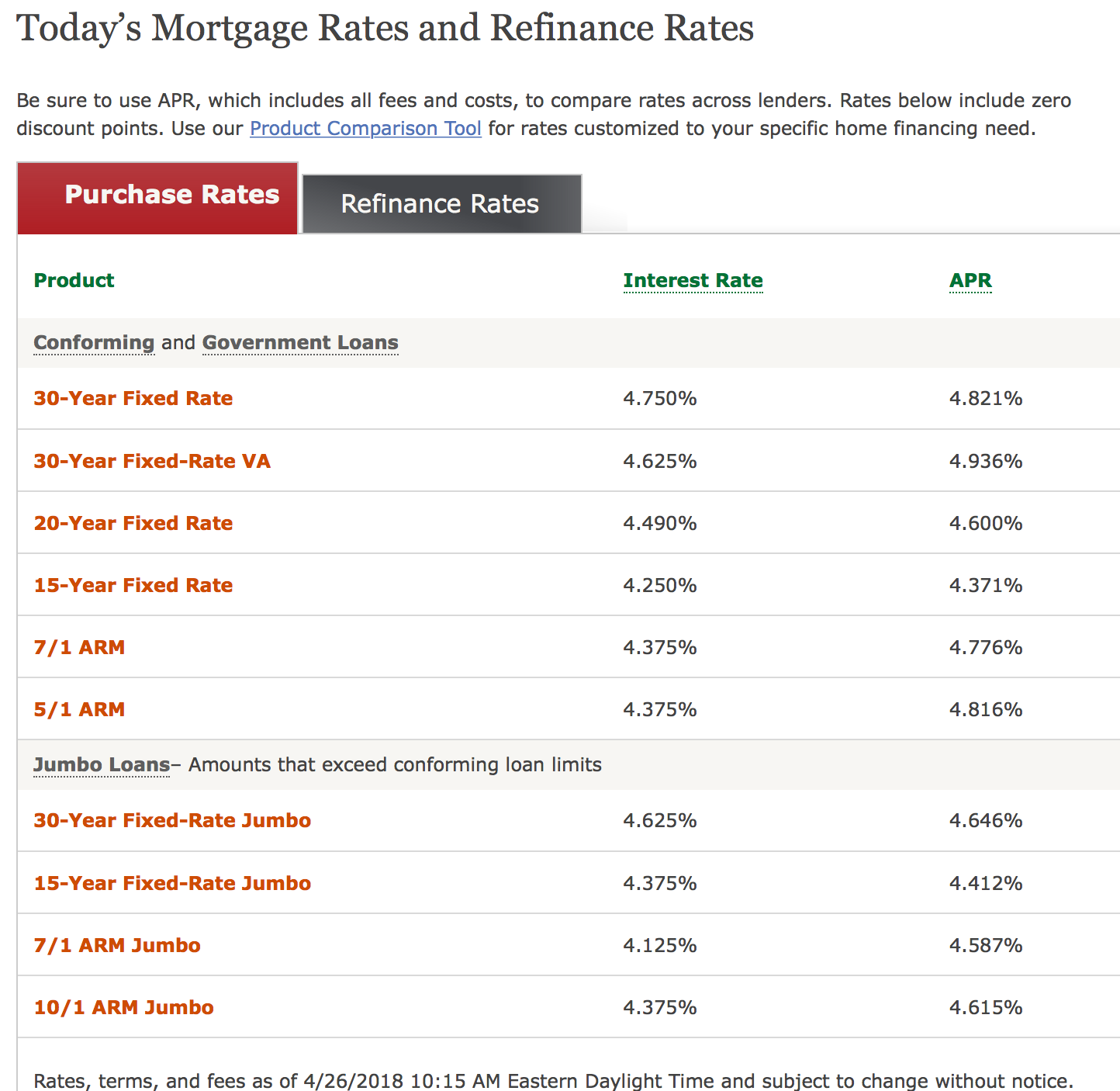

What Are Todays Arm Rates

ARM intro rates are typically much lower than fixed interest rates. With todays rates on the rise from their historic lows, ARMs are becoming more attractive to home buyers and homeowners alike. Talk to a mortgage lender about your home buying plans and find out if a low-rate ARM is the right decision for you.

Don’t Miss: How To Watch Rocket Mortgage Classic

How Do 10/1 Arm Mortgage Rates Compare To Fixed Mortgage Rates

The value of a 10/1 ARM interest rate depends largely on the overall rate difference with fixed-rate mortgages. Sometimes, the difference between the two isnt significant enough to justify the variable period later on.

In some cases, you could pay more on interest with a 10/1 ARM after the rates adjust than you would with a 30-year fixed-rate mortgage, even if you get to enjoy lower payments earlier on.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Also Check: Can You Wrap Closing Costs Into Mortgage

Advantages Of An Adjustable

Adjustable-rate mortgages can be the right move for borrowers hoping to enjoy the lowest possible interest rate. Many lenders are willing to provide relatively low rates for the initial period. And you can tap into those savings.

Although it may feel like a teaser rate, your budget will enjoy the initial low monthly payments. With that, you may be able to put more toward your principal loan balance each month.

This added wiggle room to your budget can be the right option for those planning to move to a new area fairly shortly after buying a home. For example, if you intend to sell the home before the interest rate begins to adjust, any adjustments wont be a problem for your budget assuming the home sale goes through as planned and the mortgage is no longer yours to pay.

If youre a buyer seeking a starter home, you can also enjoy these benefits because youre planning to upgrade to a larger home when you can. If that plan allows you to sell the original home before the interest rate begins to fluctuate, the risks of an ARM are relatively minimal.

The flexibility you can build into your budget with the initial lower monthly payments offered by an ARM gives you the chance to build your savings and work toward other financial goals. Although theres the looming chance of an interest rate hike after the initial period, you can build savings along the way to safeguard your finances against this possibility.