What Is Interest Rate

Your interest rate is the percentage you pay to borrow money from a lender for a specific period of time. Your mortgage interest rate might be fixed, meaning it stays the same throughout the duration of your loan. Your mortgage interest rate might also be variable, meaning it might change depending on market rates.

Youll always see your interest rate expressed as a percentage. Youre responsible for paying back the initial amount you borrow plus any interest that accumulates on your loan.

Lets consider an example. Say you borrow $100,000 to buy a home, and your interest rate is 4%. This means that at the start of your loan, your mortgage builds 4% in interest every year. Thats $4,000 annually, or about $333.33 a month.

Your principal balance is high at the beginning of your loan term, and youll pay more money toward interest as a result. However, as you chip away at your principal through monthly payments, you owe less in interest and a higher percentage of your payment goes toward your principal. This process is called mortgage amortization.

Watch Out For Aprs On Arms

So far weve only been working with fixed-rate loans in our examples. But APR calculations become more complicated and more limited in their utility when dealing with adjustable-rate mortgages . With ARMs, interest rates will vary over the life of the loan, and at the beginning, they typically have lower interest rates than 30-year fixed-rate mortgages.

How ARM interest rates work

ARMs are structured so the lower APR is only fixed for an initial period, usually between one month and 10 years and once its over, the loan will adjust according to a benchmark interest rate known as an index. The lender will then also add a margin a set amount of percentage points to the index in order to calculate your interest rate. The timetable associated with an ARMs fixed and adjustable periods will be right in its name: in the case of a 5/1 ARM, for example, the rate is fixed for the first five years of the loan and then adjusts annually thereafter.

Calculating the APR on an ARM is a bit like trying to hit a moving target, as its very improbable that in five years, when the interest rate on a 5/1 ARM begins to adjust, the index rate will be at the exact same level it was on the day you closed. Its also practically impossible that the index rate will stay the same for the remainder of the loan term, when the rate adjusts annually.

Closing Costs & Loan Fees

Anytime you take out a home loan, youll want to be aware of the closing costs. These fees include loan origination fees, prepaid interest, and property taxes, and can range from 3 to 6% of the loan amount.. One way to reduce your out of pocket costs, if to accept a higher interest rate in exchange for lender credits. The strategy can save you money in the short-term, so its worth considering if you plan to sell or refinance your home within five to eight years.

Don’t Miss: What Is A 5 1 Arm Mortgage Loan

How Apr Is Determined

Its important to remember that, unlike interest rates, APR is set by individual lenders in the sense that they choose how much to charge for additional fees on top of the interest rate. For example, some lenders charge more for closing fees than others. As a result, two lenders offering the same nominal interest rate might actually offer different APRs.

Because APR rolls variable costs and fees into a single figure, its often a more useful way to compare mortgages than interest rates. Essentially, without APR, it would be much more difficult to assess the true cost of a loan, because borrowers would have to manually calculate fees and APR. Fortunately, the Truth in Lending Act of 1968 requires lenders to disclose APR to borrowers. This ensures greater transparency in lending and a clearer sense for what a borrower can expect to pay.

What Is An Annual Percentage Rate For Mortgages

While interest is charged on the principal loan balance owed monthly, the APR also includes the other charges or fees and is calculated by spreading your upfront costs over the life of the loan and expressing this as a percentage of the loan amount that you pay each year.

That matters because if you pay off a loan early, your true APR may be higher than the one on your loan documents since those costs will be spread over a shorter time period. If your loan includes prepayment penalties, then your actual costs will be even higher, so in some cases the APR your lender provides will be a poor gauge of your actual expenses.

While this may cause the APR to be higher when recalculated based on the shorter period of time you have the loan, you will most likely save a lot of money by paying down your mortgage or paying it off early. You will pay less in actual interest than if you take the full term of the loan to pay it off.

Remember, the amount of your mortgage payment each month that is applied to interest is calculated on the actual principal balance owed. The lower the principal balance the interest is calculated on, the greater the portion of your monthly payment that gets applied back to that principal balance.

You May Like: What Is Bank Of America’s Mortgage Interest Rate

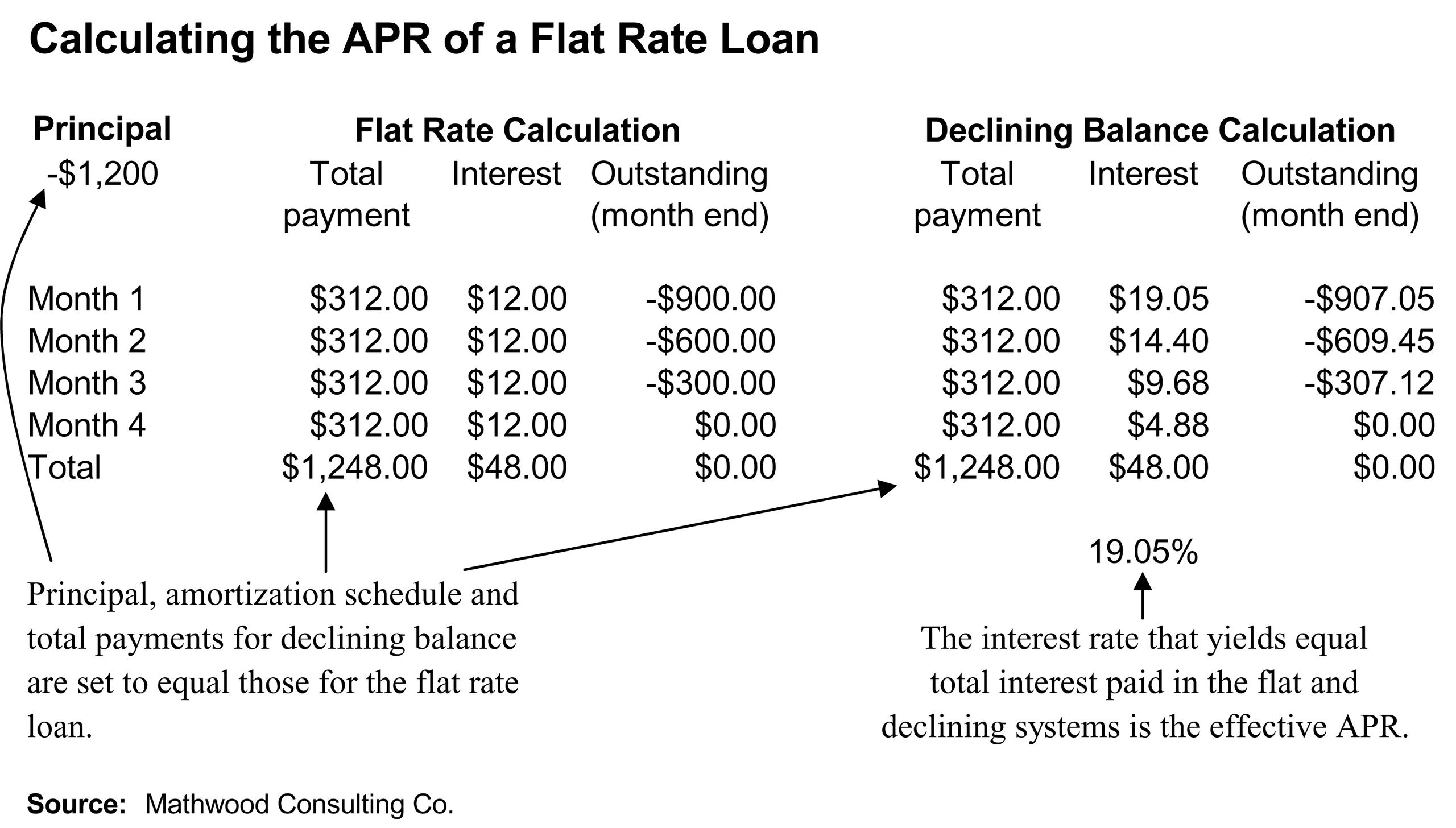

What Is The Formula For Calculating Apr

Calculating APR isnt as difficult as you might think. Heres the formula you would use to calculate the APR of a loan with fees. Note: If a loan doesnt have fees , you can simply replace the fees placeholder in the formula with a zero.

If that sounds confusing, take a look at how we break it down in the following example.

Lets say you take out a $1,000 loan. And over a 180-day loan term, youll end up paying $75 in interest and a $25 origination fee to take out the loan.

Lets do the math to calculate your APR.

$75 + $25 = $100

$100 / $1,000 = 0.1

0.1 / 180 = 0.00055556

0.00055556 x 365 = 0.20277778

0.20277778 x 100 = 20.28%

Using Apr To Shop For A Mortgage

As noted above, APR provides a more accurate indication of the true cost of a mortgage than simply looking at the mortgage rate. In some cases, mortgage lenders may charge higher fees to offset an unusually low rate they may be offering. APR can help you detect that.

By law, the APR must be disclosed in any loan estimate, including mortgages, and in any advertising for loans that specifies an interest rate. Such advertising for mortgage rates must also include the number of discount points the rate is based on, the more discount points that are included, the larger the difference there will be between the rate and the mortgage APR.While mortgage APR is a useful guide for comparing the costs of different loan offers, it does have some shortcomings. Because it is based on annualized cost of fees amortized over the full length of the loan, it will not give a fully accurate picture of costs if you sell or refinance before the loan is paid off. As a rule of thumb, it’s often better to accept higher fees in return for a lower rate on a long-term loan, where you have more time to amortize their cost. But if you’re only going to have the loan for a few years, it’s often better to minimize fees even if you’re paying a higher rate.

FAQ: See FAQ above under section Mortgage Loan APR Explained for APRs on an Adjustable Rate Mortgage .

Don’t Miss: How To Use Rental Income To Qualify For Mortgage

Which Rate Should You Focus On When Shopping For A Mortgage Loan

When shopping for a mortgage loan, its important to compare the interest rate and the APR. Both rates tell you, as a homebuyer, a lot about the mortgage loan youre taking out. A reasonable interest rate combined with higher-than-normal fees can result in a high APR.The bottom line:

When comparing loans, be sure to look at both the interest rate and the APR.

The Bottom Line On Interest Rate Vs Apr

While your interest rate is the percentage of interest you pay on a loan, your APR includes your interest rate along with any other fees or expenses youll pay your lender. Some of the most common additional fees are brokerage fees, private mortgage insurance and discount points. You can think of your APR as the effective interest rate youll actually pay once you have your loan.

Lenders must tell you both your interest rate and APR before you close on a loan. You can lower your interest rate by controlling your credit score and, possibly, by choosing a government-backed loan. However, you have less control over your APR because the lender sets many of these costs. That said, the best way to find a lower APR is to compare similar loan programs from different lenders.

Understanding your APR and interest rate is crucial when taking out a mortgage to purchase or refinance a home. Are you ready to calculate your potential interest rate and APR for a home loan? Get started online today.

Save money with a lower interest rate.

Lock in your rate today before they rise.

Also Check: What Is A Mortgage Holder

The Limitations Of An Apr

For starters, lenders arent required to include all of their fees in an APR, meaning theres no standardization across the industry. Consequently, fees included in an advertised APR will vary across lenders and some of your options may even include fees you may not even want or need, like discount points . Therefore, its imperative to understand what fees are included when you shop around. To put it simply, dont automatically assume that the lowest APR is the best deal available.

An APR also doesnt work very well with adjustable-rate mortgages since the APR calculation for these loans is based on somewhat arbitrary assumptions about future interest rate adjustments. Because these assumptions arent certain, a variable-rate APR is also uncertain especially when you take into consideration that its impossible to predict the future direction of interest rates.

There are also some scenarios in which an APR can be lower than your interest rate. The most common examples are when the lender is rebating all of their fees as well as third-party fees such as appraisals and title insurance or due to assumptions the lender makes when calculating their adjustable-rate mortgage products.

What Fees Are Apr Fees

The following fees are generally included in the APR:

- Points- both discount points and origination points. 1 point equals 1% of the loan amount

- Pre-paid interest- The interest paid from the date the loan closes to the end of the month. If you close on August 10th, you will pay 21 days of pre-paid interest

The following fees are sometimes included in the APR:

- Loan-application fee

The following fees are normally not included in the APR:

- Title or abstract fee

- Document preparation

- Home-inspection fees

Don’t Miss: How Much Work History For Mortgage

How Does Apr Work On A Mortgage Loan

Understanding how an APR affects your home loan is an important part of the decision-making process. You may choose one option over another based on the APR a lender offers.

When it comes to the APR of a mortgage loan, there is more involved than just interest. Along with interest, the APR can include processing and underwriting fees, mortgage points and private mortgage insurance. The APR determines the total annual cost of borrowing money from a lender. It’s important to learn as much as you can about your loan before you accept and sign because APR fees can vary from lender to lender

Can I Lower The Apr On My Credit Card

Most credit cards use a variable interest rate, which means that it changes based on a number of factors. However, sometimes you can negotiate a lower APR with your credit card company by calling them and making a formal request. This option can be extremely beneficial if youre trying to pay off your outstanding balance or reduce a significant amount of credit card debt.

Recommended Reading: Can You Refinance A Mortgage More Than Once

How To Compare Loans Using Apr

The simplest way to compare mortgage APRs is with the loan estimate, which lenders must provide you within three business days of your application.

Steps to compare loan offers using APR:

Comparing the APRs of loans without fixed rates

Be cautious when comparing the APRs of adjustable-rate mortgage loans because they donât represent the loan’s maximum interest rate. A closed-end loan that includes fees and a home equity line of credit that does not, for example, won’thave comparable APRs.

You should also be more vigilant when comparing fixed-rate APRs with various adjustable-rate loan APRs.

ð¡ Editor’s tip: Check for prepayment penalties

Your mortgage type and loan conditions determine whether thereâll be a prepayment penalty for paying off your mortgage early. You can sometimes find the prepayment penalty terms in an “addendum to the note” section of your loan papers.

Those fees may add up quickly, particularly if you refinance an adjustable-rate mortgage before rates rise. However, many states have restrictions for the dollar amount or length of time that these penalties are applied.

Which Closing Costs Are Included In Apr

| Closing costs typically included in APR | Closing costs typically NOT included in APR |

|---|---|

|

|

Most closing costs are included in the APR. But some, like the loan application fee, may or may not be part of the equation. You can view an itemized list on your loan estimate.

You should ask your lender to identify any additional fees that arenât factored into the APR. In some cases, for instance, lenders pay the borrowerâs closing costs for a fee.

Do closing costs affect APR?

Yes. Higher closing costs typically mean a higher APR, while lower closing costs bring the APR down. The wider the gap between interest rate and APR, the higher the closing costs and loan fees.

You May Like: How To Become A Reverse Mortgage Specialist

Does Apr Affect Your Monthly Payment

Yes, your APR affects your monthly payment. With loans like a mortgage, youll pay a monthly interest payment in addition to your principal for the duration of your loan term. The higher your APR, the more youll pay in interest each month and the longer it will take for you to start making a significant dent in your principal balance.

Depending on the type of loan you choose, a fixed or variable APR can also impact how much interest youll pay each month over the life of the loan. At first, youll pay more toward the interest every month, since your interest is a percentage of the principal balance owed. As you move through your monthly payments, youll pay less and less in interest each month and more in principal, lowering your overall loan balance. To get an estimate of your monthly mortgage payments over time, use our amortization calculator.

The Limitations Of Apr

While APR can be a helpful tool to determine the rough cost of borrowing money, itâs not a foolproof way to calculate the total amount youâll pay over the life of your loan.

Here are a few limitations of APR:

- Some fees arenât always included and can vary from lender to lender. For example, an APR could exclude home appraisal, notary, or title fees. Lenders may also roll certain fees into other charges to offer a lower APR.

- A variable APR or ARM cannot predict fluctuations in the market. A borrower with an ARM may budget using the rate they were offered at the start of their mortgage term however, if the interest rate changes, then that estimate will no longer be accurate.

- When compound interest is calculated, it includes the additional interest that has accumulated on the principal of the loan. So, with longer loan terms, borrowers end up paying more in interest.

Here are the answers to some common questions when it comes to APR.

What is a good APR?

A good APR is dependent on several factors, including the prime rate, the loan amount, the loan term, and the buyerâs finances. The interest and fees on your mortgage should be affordable and fit into your long-term financial plan.

What factors affect my APR?Why is my APR so high with good credit?

Also Check: Can I Get A Mortgage If Self Employed

Looking At Todays Mortgage Refinance Rates

If youre in the market for a 15-year fixed-rate refinance, know that those nationwide rate averages stay the same. However, we did slid down in rates for 30-year fixed refinance loans . If youve been considering a 10-year refinance loan, just know average rates decreased.

Check out mortgage rates that meet your distinct needs.

Where Are Refinance Trending

The annual inflation rate came in it at 8.5% in July, according to the latest data from the Bureau of Labor StatisticsAnd thats not good for refinance rates.

With high inflation lingering longer than initially expected the Federal Reserve has raised interest rates three times. Because of all of this, we could be stuck with high inflation for much longer than we want, which makes it more likely that the Fed will have to raise interest rates aggressively.

Also Check: How Much Is Mortgage Payment On 95000 House