The Conservative Model: 25% Of After

On the flip side, debt-hating Dave Ramsey wants your housing payment to be no more than 25% of your take-home income.

Your mortgage payment should not be more than 25% of your take-home pay and you should get a 15-year or less, fixed-rate mortgage Now, you can probably qualify for a much larger loan than what 25% of your take-home pay would give you. But its really not wise to spend more on a house because then you will be what I call house poor. Too much of your income would be going out in payments, and it will put a strain on the rest of your budget so you wouldnt be saving and paying cash for furniture, cars, and education.

Notice that Ramsey says 25% of your take-home income while lenders are saying 35% of your pretax income. Thats a huge difference! Ramsey also recommends 15-year mortgages in a world where most buyers take 30-year mortgages. This is what Id call conservative.

Create An Mp4 To Gif Gui

PySimpleGUI is a cross-platform GUI framework that runs on Linux, Mac and Windows. It wraps Tkinter, wxPython, PyQt and several other GUI toolkits, giving them all a common interface.

When you installed PySimpleGUI earlier in this article, you installed the default version which wraps Tkinter.

Open up a new Python file and name it mp4_converter_gui.py. Then add this code to your file:

# mp4_converter_gui.pyimport cv2import globimport osimport shutilimport PySimpleGUI as sgfrom PIL import Imagefile_types = def convert_mp4_to_jpgs: video_capture = cv2.VideoCapture still_reading, image = video_capture.read frame_count = 0 if os.path.exists: # remove previous GIF frame files shutil.rmtree try: os.mkdir except IOError: sg.popup return while still_reading: cv2.imwrite # read next image still_reading, image = video_capture.read frame_count += 1def make_gif: images = glob.glob images.sort frames = frame_one = frames frame_one.savedef main: layout = , , , ] window = sg.Window while True: event, values = window.read mp4_path = values gif_path = values if event == "Exit" or event == sg.WIN_CLOSED: break if event in : if mp4_path and gif_path: convert_mp4_to_jpgs make_gif sg.popup window.closeif __name__ == "__main__": main

Pretty neat, eh?

How Credit Score And Down

Every lenders priority is to maximize its chances of getting its money back with as little expense as possible. They want to be as sure as they can that borrowers are ready, able and willing to make timely monthly payments.

Luckily, this protects most borrowers from taking on mortgages that they cant afford or are incapable of maintaining.

Don’t Miss: How To Change Mortgage To Rental Property

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

How Much Of Your Income Should You Spend On A Mortgage

The amount can spell the difference between living comfortably and struggling financially

One of the most important things to consider when buying a house is how much mortgage you can reasonably afford to pay off. This is because knowing how much you can allocate to your monthly repayments very often spells the difference between living comfortably and struggling to make ends meet.

Expert opinion varies on the exact amount, but the consensus is you should have enough left over to meet other financial obligations after making a home loan payment. So, what percentage of your monthly income should you dedicate to your mortgage? Lets take a closer look.

Read Also: What Is The Meaning Of Mortgage

Factors Affecting The Average Family Budget:

There is no cookie cutter formula for everyone. We all have our own experiences and influences that are going to affect our budget category percentages.

Just remember, the ideal household budget percentages are a guide.

For instance, the presence of debt is going to weigh heavily on any budget. Getting out of debt takes a plan and perseverance to happen. Other categories will suffer while tending to paying off debt. More reading on how to get out of debt fast.

These are the common effects on the average family budget:

How Much Of Your Income Should Go Towards A Mortgage Payment

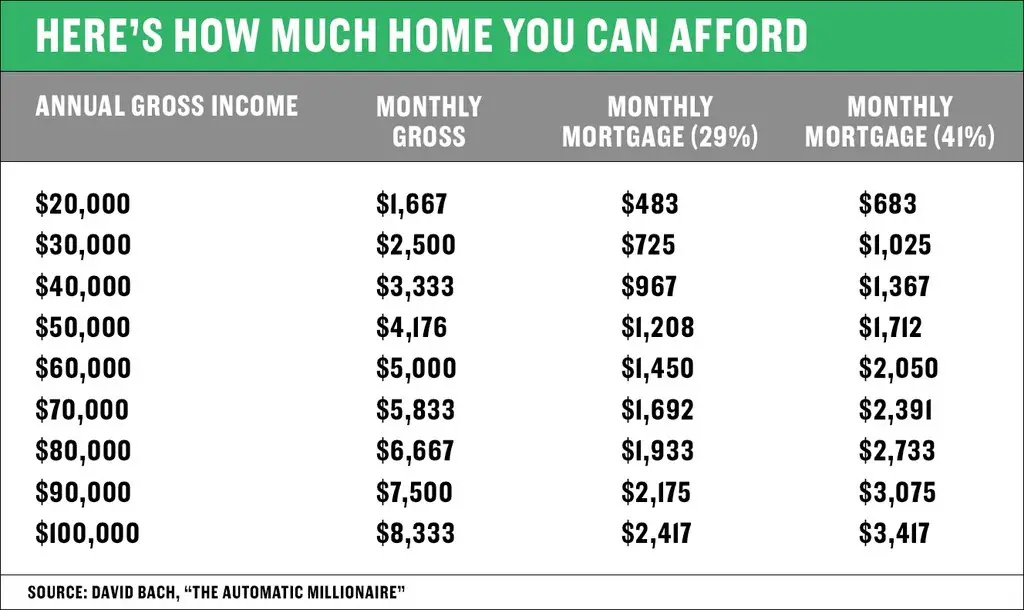

When considering how much you can spend on a mortgage, you will need to calculate your income. Find your monthly gross income and monthly net income, as you will need both these numbers to help with these calculations.

Its important to note that the amount of mortgage you can afford depends on more than just your income, so these are just guidelines to help. Youll notice that the numbers will end up being different depending on which calculation you use.

You May Like: Should I Refinance My 30 Year Mortgage

How Much Should Your Mortgage Be

Your mortgage should be a loan amount you can comfortably afford in your monthly budget.

So when determining the right size, you have to work backwards find the right monthly payment first, and calculate the home purchase price based on that number.

When it comes to monthly mortgage payments, one number is key in determining what you can afford: your debt-to-income ratio .

This number compares your monthly income against your monthly debts to see how much mortgage you could afford alongside your existing payments.

Keep in mind that your loan officer is going to qualify you on gross income. Therefore, if your gross DTI is 43% , you personally may want to consider what it is for your net , says Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

Of course, other factors matter too, like your credit score, mortgage rate, and down payment.

But DTI has a huge impact on affordability. So its important to understand how mortgage lenders look at this number.

How To Lower Your Monthly Mortgage Payment

Your monthly mortgage payment is going to take up a good chunk of your overall debt, so anything you can do to lower that payment can help. Consider some options, like:

- Find a less expensive house. While your lender might approve you for a loan up to a certain amount, you donât necessarily have to buy a home for the full amount. The lower the home price, the lower your monthly payments will be.

- Boost your down payment. The higher your down payment, the lower your monthly payment will be. So, if you can, save up so you can secure that lower payment.

- Get a lower interest rate. Most of the time, your interest rate is based on your credit score and DTI. Try to pay down outstanding debt, like credit cards, car loans or student loans. This not only lowers your DTI, but could also improve your credit score. A higher credit score means you could get a lower interest rate offered by your lender.

Read Also: What Is The Mortgage Rate In Florida

The Bottom Line: How Much Home Can You Afford

So, what percentage of your income should go toward your mortgage? The answer will vary depending on your income and how much debt you have. But your income is only one of the many factors that determine how much home you can afford. Lenders look at everything from your credit score to your liquid assets when they decide how much to offer you.

If youre ready to get started on your mortgage application, you can apply online or give us a call at 452-0335.

Other Mortgage Qualification Factors

In addition to your debt service ratios, down payment, and cash for closing costs, mortgage lenders will also consider your credit history and your income when qualifying you for a mortgage. All of these factors are equally important. For example, even if you have good credit, a sizeable down payment, and no debts, but an unstable income, you might have difficulty getting approved for a mortgage.

Keep in mind that the mortgage affordability calculator can only provide an estimate of how much youll be approved for, and assumes youre an ideal candidate for a mortgage. To get the most accurate picture of what you qualify for, speak to a mortgage broker about getting a mortgage pre-approval.

Read Also: How To Get Into Mortgage Processing

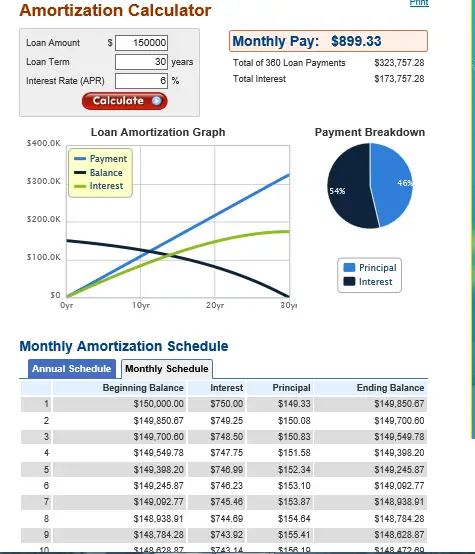

Use Our Mortgage Calculator To Determine Your Home Budget

Sure, you could crunch the numbers yourself by dividing a home price by 180 months and then multiplying the decreasing monthly principal balance by your interest rate. But if you’re anything like us, you probably broke a sweat just reading that formula.

To save yourself the time and headache of doing a ton of math, we built a mortgage calculator to do that for youphew!

Sticking with our example of an income of $5,000 a month, you could afford the principal and interest of these options on a 15-year fixed-rate mortgage at a 4% interest rate:

- $177,900 home with a 5% down payment

- $187,767 home with a 10% down payment

- $211,238 home with a 20% down payment

- $241,415 home with a 30% down payment

Remember: This is just a ballpark! Dont forget that grown-up stuff like property taxes and home insurance will top off your monthly payment with another few hundred dollars or so . Plus, if your down payment is less than 20%, thatll add PMI to your monthly payment. And if you think youll be buying a home thats part of a homeowners association , youll need to factor those lovely fees in as well.

For example, if you plug in a mortgage amount of $211,238 with a 20% down payment at a 4% interest rate, youll find that your maximum monthly payment of $1,250 increases to $1,515 when you add in $194 for taxes and $71 for insurance. To get that number back down to a monthly housing budget of $1,250, youll need to lower the price of the house you can afford to $172,600.

Why Calculate Mortgage Affordability

When youre looking to buy a home, its handy to know how much you can afford. Being able to calculate an estimate of how much youre able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understand how large a mortgage you can afford to borrow and the cash requirements will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Read Also: Should I Refinance With My Current Mortgage Company

Your Debt And Salary Limit What You Can Afford

Besides showing you how much income you need to afford the home you want, this calculator also shows how your debts can compromise your chance for a mortgage. You can see how paying down debts directly affects your buying power. The fewer debts you have, the more of your salary can go toward the home, allowing you to afford a more expensive property. At the same time, more debts mean less money available, based on your current salary, to pay for – and qualify for – the home you want.

You can use this calculator to visualize how a higher or lower salary could change your ability to afford the home of your dreams. What if you got a raise? Or took a weekend job? You can vividly see how you could afford different homes with more income, or less.

Mortgage Payment Percentage Example

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Rent: $500

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $300

In this example, your total monthly debt obligation is $1,250. With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Considering that you already spend $500 a month on rent, if you add that to the $900, you can estimate a maximum monthly mortgage payment of $1,400. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

Recommended Reading: How Are Mortgage Interest Rates Determined

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in total interest over time, it can free up monthly cash to keep your DTI low.

Also Check: How Do You Switch Mortgage Companies

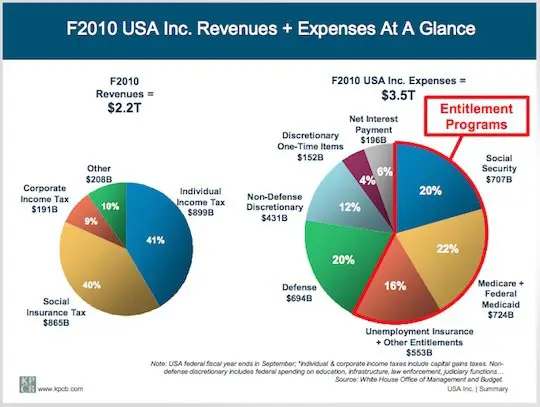

How Will My Debt

When you apply for a mortgage, lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a percentage.

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still be willing to approve you for financing. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make mortgage payments.

Additional Homeownership Costs To Consider

There may be additional costs that go along with owning and maintaining a home that you have not considered when calculating your monthly expenses, especially if you are a first-time home buyer. When trying to determine how much you can afford to spend on a mortgage, it is important to consider all of the expenses you may have, even if they dont apply yet. Some easily forgotten expenses that can accompany owning a home include:

- Lawn maintenance

- Home maintenance savings fund

Recommended Reading: Is Mortgage Interest Rate Going Up Or Down

What Lenders Like To See

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:

740850: Excellent credit Borrowers get easy credit approvals and the best interest rates.

670740: Good credit Borrowers are typically approved and offered good interest rates.

620670: Acceptable credit Borrowers are typically approved at higher interest rates.

580620: Subprime credit Its possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

300580: Poor credit There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

You May Like: Why Would A Mortgage Be Declined

How Might Your Circumstances Change In The Future

Once you’ve got your basic budget, you can play around with the inputs. If you’re planning on having children soon, think about how that will change your household finances.

Once you come up with an estimate, you can use a mortgage calculator which can give you an idea of about how much debt you can comfortably take on.

Also Check: What Are Mortgage Underwriters Looking For

When Buying A House Should I Use My Gross Income Or Net Income To Determine What I Can Afford

Theres a big difference between your gross income and your net income. Your gross income is the money you earn each month before taxes are removed. Your net income is that same income after taxes are removed.

No surprise, your net monthly income is usually much lower than your gross monthly income.

When its time to buy a house, though, which figure should you use when deciding how much home you can afford?

This is an interesting question. When you apply for a mortgage loan, your lender will rely on your gross monthly income to determine how many mortgage dollars to lend to you. This doesnt mean, though, that you should rely on gross income to determine how much of a house payment you can comfortably afford each month.

Look at it this way: Your net monthly income is your realistic income. This is how much money you are bringing into your house each month. If you want to make sure that you can afford a monthly mortgage payment of $1,500, $2,000 or $3,000, its more realistic to consider how much of your actual take-home pay your mortgage payment will consume each month.

Heres another tricky matter: Most mortgage lenders today say that your total monthly debt including your mortgage payment should total no more than 43 percent of your gross monthly income. Again, thats your income before taxes are removed.