What Are 10 Year Fixed Rate Mortgages

With a 10 year fixed rate mortgage, the interest rate you pay is fixed for the first 10 years of your mortgage. Fixing your rate for 10 years offers peace of mind and allows you to budget well into the future.

The problem is that youll lose out if interest rates go down, which may mean that you are stuck on a relatively expensive rate for the remainder of the fixed-rate period. Thats because if you want to switch to a new deal during the 10-year period, youll be forced to pay early repayment charges to exit your current mortgage contract.

Although the Bank of England base rate, which affects the cost of mortgages, started to go up at the end of 2021, historically speaking, its still relatively low so it could be a good time to fix your rate.

The Bottom Line: Is A 10

A 10-year fixed-rate mortgage is a great option for those who want to pay off their mortgage quickly and have the funds to do so. Its important to remember that 10-year fixed-rate mortgages shouldnt be confused with 10/1 or 10/6 ARMs, which are 30-year mortgages that have an introductory fixed interest rate period of 10 years.

If you can afford to make a large down payment and a high monthly payment, a 10-year fixed-rate mortgage can save you big-time on interest when compared to a 30-year mortgage. The greater the amount the mortgage is, the more you can save in interest.

Of course, a high monthly payment is not necessarily sustainable for every homeowner. Its important to remember you have options and can always refinance to a 10-year mortgage later when you have the income to support a higher payment.

Are you ready to move forward with a refinance to a 10-year mortgage? Take action today and apply online.

Get approved to refinance.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

You May Like: How To Get Approved For A Higher Mortgage

What Are The Disadvantages Of Fixing A Rate For 10 Years

You are stuck with this rate for 10 years if you want to switch within that time, you will generally have to pay exit fees to do so. These can be hundreds, or even thousands, of pounds. So interest rates will have to become a lot cheaper to make it worth paying these charges to switch to another mortgage deal.

Youre therefore likely to end up paying over the odds for several years if rates go down during the 10 year term of your deal.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

About These Rates: The lenders whose rates appear on this table are NerdWallets advertising partners. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a lenders site. The terms advertised here are not offers and do not bind any lender. The rates shown here are retrieved via the Mortech rate engine and are subject to change. These rates do not include taxes, fees, and insurance. Your actual rate and loan terms will be determined by the partners assessment of your creditworthiness and other factors. Any potential savings figures are estimates based on the information provided by you and our advertising partners.

Trends and insights

You May Like: How Long To Pay Off 70000 Mortgage

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

What To Know About Loans Fees

Anytime you take out a home loan, your decision should factor in the loans closing costs. The closing costs can be anywhere from 3-6% of the loan amount, including origination fees, prepaid interest, and property taxes.. Choosing a higher interest rate in exchange for lender credit can reduce your upfront costs. There is a possibility that you will be selling your home or refinancing in five to eight years, so this strategy could save you money in the short-term.

You May Like: Can You Pay Off Mortgage Early Without Penalty

Will I Be Approved

A successful mortgage application will depend on your eligibility criteria such as your income and that of your partner if its a joint mortgage.

Lenders will also look at how much other debt you have outstanding from, say credit cards or loans. Your credit rating is also vital as an indicator of your reliability to repay a loan in the future.

Some mortgage brokers, such as Trussle, carry out a soft credit check which wont be visible to other lenders. This provides an indication of whether youre likely to be accepted for the deal before you formally apply. It avoids a scenario in which you make multiple applications as a result of being turned down for previous ones.

Shopping For The Best Fixed Rate

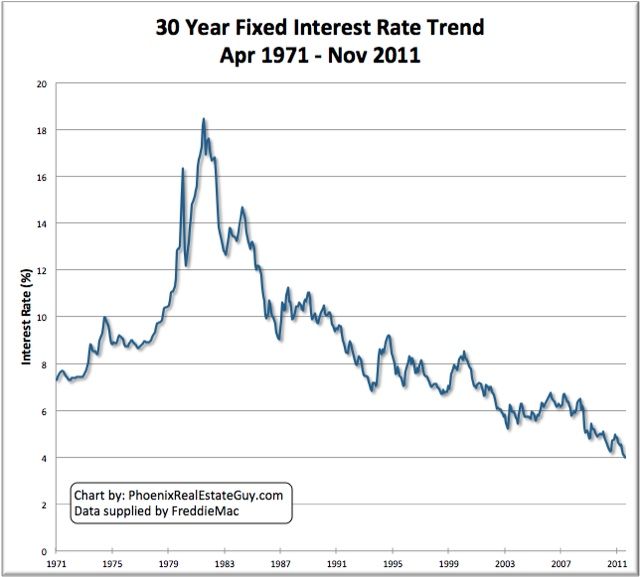

There are so many websites that provide online quotes and advise you on the current rates. Since the rates vary regularly, it is better to check them regularly and go for the one that you can afford. Currently the interest rates have come down to historically low levels, encouraging homeowner’s to choose various fixed rate options.

Compare 10-Year Fixed Mortgages vs Other Home Loans

Estimate your payments with this free calculator, or compare loans side by side.

Also Check: How To Get Approved For A Second Home Mortgage

Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their forever home have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thats why its so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

Whats The Difference Between A 10

A 10-year fixed mortgage and a 10/1 ARM may both have the number ten in the name, but theyre two very different products. With a 10-year fixed mortgage, the loan term is 10 years and the interest rate is fixed for the life of the loan. After ten years, the loan will be paid off completely.

A 10/1 ARM, on the other hand, is a 30-year mortgage whose interest rate is fixed for the first ten years and then changes yearly based on the market rate afterwards. After the first ten years, you will still have 20 years left on your loan. However, the interest rate for the rest of those 20 years may be different from the interest rate you paid the first ten years.

A 10-year mortgage will likely have a significantly higher monthly payment than a 10/1 ARM, because youre paying off the loan in a much shorter period of time. A 10-year mortgage typically offers lower interest rates than a 10/1 ARM, although the exact rate youll get may vary depending on the lender you use, your credit score, and other financial factors.

Don’t Miss: Do Mortgage Inquiries Hurt Your Credit

Current Mortgage Rates Are Shooting Up Again

Leslie CookKristen Bahler19 min read

Mortgage rates continued trending higher this week. Freddie Mac’s average rate on a 30-year fixed-rate mortgage increased 0.23 percentage points to 5.89%, which is the highest that rate has reached since 2008.

This is the third straight week of increases, following a seesawing rate that carried through the better part of July and August.

For homebuyers, there is a bright side. Different lenders are now offering a variety of competing rates, and applicants can save anywhere between $1,500 and $3,000 per year on their mortgage payments by getting multiple quotes, noted Sam Khater Freddie Mac’s chief economist in a statement

As a result, “Borrowers can benefit from shopping around,” Khater said.

Both the 15-year fixed-rate loan and the 5/1 adjustable-rate mortgage also saw higher rates this week, according to Freddie Mac’s weekly survey. Rates for those loan categories are now averaging 5.16% and 4.64%, respectively.

If you are offered a rate that is higher than you expect, make sure to ask why, and compare offers from multiple lenders.

How We Chose The Best 10

In order to assess the best 10-year mortgage rates, we first needed to create a credit profile. This profile included a credit score ranging from 700 to 760 with a property loan-to-value ratio of 80%. With this profile, we averaged the lowest rates offered by more than 200 of the nations top lenders. As such, these rates are representative of what real consumers will see when shopping for a mortgage.

Keep in mind that mortgage rates may change daily and this data is intended to be for informational purposes only. A persons personal credit and income profile will be the deciding factors in what loan rates and terms they are able to get. Loan rates do not include amounts for taxes or insurance premiums and individual lender terms will apply.

You May Like: What Score Is Needed For A Mortgage

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

What Are The Benefits

Staying on the same interest rate means youll know exactly what youll be paying out for the next ten years.

If interest rates were to rise, your repayments wouldnt increase.

You also wouldnt need to worry about remortgaging within the next couple of years or paying any of the fees that come with it.

A 10-year fixed-rate mortgage can provide security for you through times of financial instability too.

It’ll give you the security of knowing you can afford your mortgage for the foreseeable future, because you’re guaranteed to avoid any future rate rises during the 10-year term.

But if you’re considering a long-term product, you’ll need at least 40% deposit or equity to secure the best rates.

Realistically, you should only take this type of mortgage out on a house you see yourself living in for a while.

Don’t Miss: How Late Can You Be On Your Mortgage

Should I Switch To A 10 Year Fixed Rate Mortgage

If you still have a substantial amount to repay on your mortgage, remortgaging to a 10 year mortgage could be a very wise move especially if and when mortgage rates start going up again. However, if you only have a few years and a small amount left to repay on your mortgage, it may not be worth remortgaging once you take into account the fees and hassle involved.

Find out more about the costs of remortgaging with our guide to home buying costs.

Mortgage Rates Top 6% For The First Time Since 2008

Mortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

The 30-year fixed-rate mortgage averaged 6.02% in the week ending September 15, up from 5.89% the week before, according to Freddie Mac. That is significantly higher than this time last year, when it was 2.86%.

Stubbornly high inflation is pushing rates up, said Sam Khater, Freddie Macs chief economist.

Mortgage rates continued to rise alongside hotter-than-expected inflation numbers this week, exceeding 6% for the first time since late 2008, he said.

After starting the year at 3.22%, mortgage rates rose sharply during the first half of the year, climbing to nearly 6% in mid-June. But since then, concerns about the economy and the Federal Reserves mission to combat inflation have made them more volatile.

Rates had fallen in July and early August as recession fears took hold. But comments from Federal Reserve Chairman Jerome Powell and recent economic data have pulled investors attention back to the central banks fight against inflation, pushing rates higher.

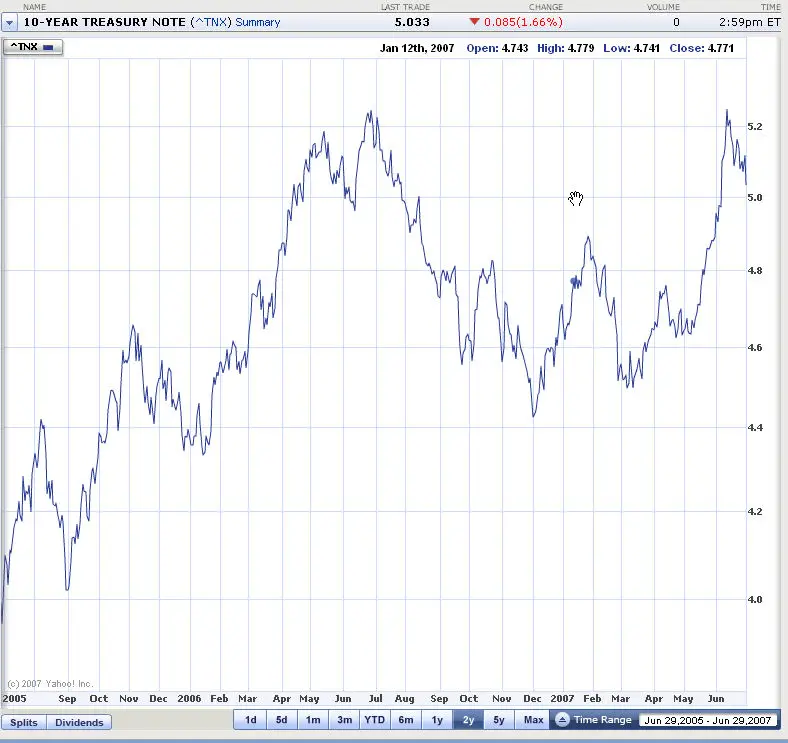

The 10-year Treasury yield moved higher last week as markets prepared for further monetary tightening by the Fed, said George Ratiu, manager of economic research at Realtor.com.

Investors reacted to Augusts inflation numbers, which showed that consumer prices continued to rise at 1980s levels, said Ratiu.

Read Also: What Is A Mortgage Bond

How Long Can You Lock In A Mortgage Rate

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesnt process the loan before the rate lock expires, youll need to negotiate a lock extension or accept the current market rate at the time.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- A new down payment amount

- The home appraisal came in different from the estimated value in your application

- There was a sudden decrease in your credit score because you are delinquent on payments or took out an unrelated loan after you applied for a mortgage

- Theres income on your application that cant be verified

Talk with your lender about what timelines they offer to lock in a rate as some will have varying deadlines. An interest rate lock agreement will include: the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but its wise to get it in writing as well.

What To Know Before Getting A Mortgage

A mortgage is a type of secured loan used to purchase a home. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.

How much you can borrow for a mortgage depends on the limits for the type of loan you’re getting, your lender’s limits, and your financial situation: your credit, your income, and the amount of cash you have available for a down payment. For a conforming mortgage , a 20% down payment allows you to avoid paying mortgage insurance. On a $400,000 home, a 20% down payment would mean you need $80,000 up front. You can potentially get a conforming mortgage with a down payment as low as 3%.

Note that this calculation may be different if you qualify for a different type of mortgage like an FHA or VA loan, which require down payments of at least 3.5%, or if you’re looking for a “jumbo loan” over $647,200 in most parts of the US in 2022 .

You don’t have to go with the first bank to offer you a mortgage. Like anything else, different servicers offer different fees, closing costs, and products, so you’ll want to get a few estimates before deciding where to get your mortgage.

You May Like: What Makes Mortgage Rates Change