How To Get Preapproved For A Home Loan

Get your free credit score. Know where you stand before reaching out to a lender. A credit score of at least 620 is recommended, and a higher credit score will qualify you for better rates. Generally a credit score of 740 or above will enable most borrowers to qualify for the best mortgage rates.

Check your credit history. Request copies of your credit reports, and dispute any errors. If you find delinquent accounts, work with creditors to resolve the issues before applying.

Calculate your debt-to-income ratio. Your debt-to-income ratio, or DTI, is the percentage of gross monthly income that goes toward debt payments, including credit cards, student loans and car loans. NerdWallets debt-to-income ratio calculator can help you estimate your DTI based on current debts and a prospective mortgage. Lenders prefer borrowers with a DTI of 36% or below, including the mortgage, though it can be higher in some cases.

Contact more than one lender. Comparing offers from multiple lenders can help you compare rates and fees and save you thousands of dollars over a 30-year mortgage. Going through the mortgage preapproval process shouldnt hurt your credit score. FICO, one of the largest U.S. credit scoring companies, recommends confining those applications to a limited time frame, such as 30 days.

Mortgage preapprovals can result in a temporary dip in your

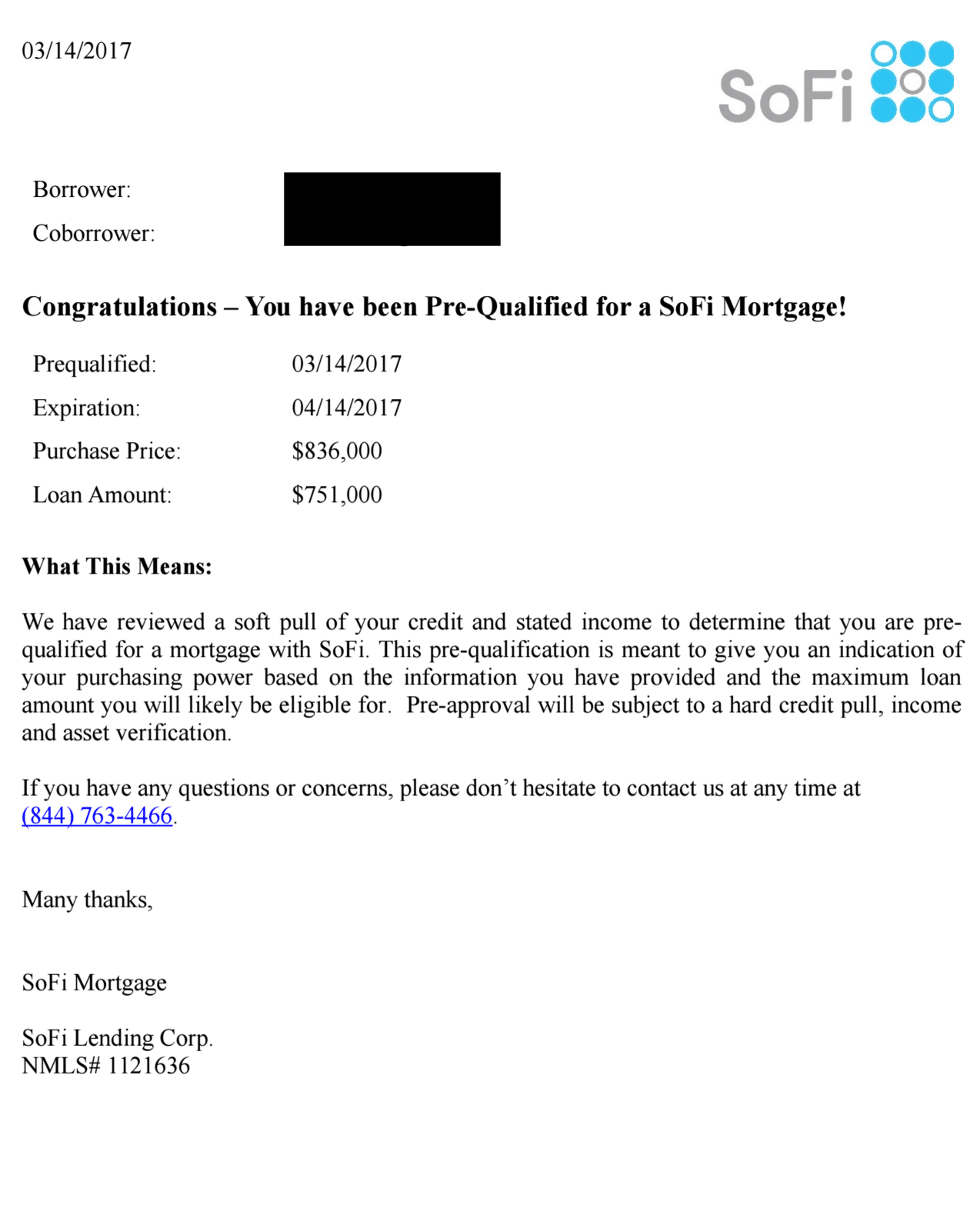

How Long Is A Home Loan Pre

The good-for period varies with the lender, but typically anywhere from a month to 90 daysand, in some cases, six months. Its good practice to keep track of the expiration date so that you dont run into a situation where you find a dream home that you can afford only to learn that your pre-approval has expired.

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Recommended Reading: How Much Is Average Mortgage A Month

How Much Mortgage Can I Get Approved For

Your loan potential is largely based on two basic financial components. How much you make and how much you already owe.

The industry term for this is debt-to-income ratio, or DTI. Its calculated by taking your total recurring monthly debt load and dividing it by your gross monthly income.

Say you make $5,000 a month in take-home pay and you spend $700 a month on rent $500 a month on an auto loan $200 a month on a student loan and $300 a month on credit cards.

You have $1,700 a month in debt compared to $5,000 in revenue, so your DTI is 34%. That could be troublesome if you replace the rent payment with a $1,000 mortgage payment. That would push your debt-to-income ratio up to 40%.

Most lenders want a clients DTI to not exceed 36%, so you could add only an $800-per-month mortgage and stay below the 36% DTI threshold.

That number is not written in stone, however. Credit scores also weigh heavily in the calculation, so its a good idea to check your credit reports beforehand to make sure they are accurate. Scores range from 300 to 850. The higher your score, the lower the interest rate will be on your loan. Knowing your credit profile and the lenders requirements will help you understand what kind of interest rate you qualify for.

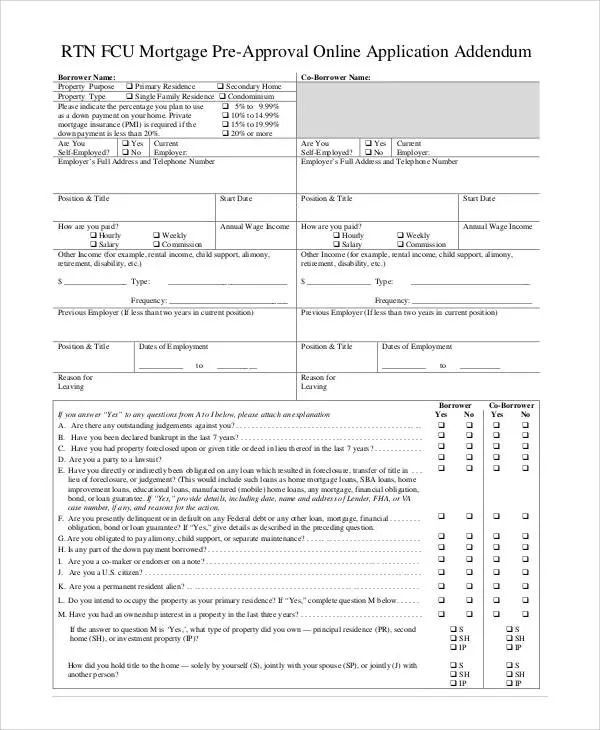

How To Fill Out And Sign A Form Online

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Feel all the benefits of completing and submitting legal documents on the internet. Using our service submitting MORTGAGE LOAN PRE-APPROVAL usually takes a matter of minutes. We make that possible through giving you access to our feature-rich editor capable of transforming/correcting a document?s original text, inserting unique fields, and e-signing.

Fill out MORTGAGE LOAN PRE-APPROVAL in just a few minutes by simply following the guidelines listed below:

Send your new MORTGAGE LOAN PRE-APPROVAL in an electronic form right after you are done with completing it. Your information is securely protected, since we keep to the most up-to-date security standards. Join numerous happy clients who are already filling in legal forms straight from their homes.

You May Like: Which Mortgage Lender Should I Use

Helping You Earn Through Partnerships

Our top priority is to help you learn and earn. Our articles are provided free of charge, and theinformation found here can help you build wealth for life. We offer an independent perspectiveon financial services, financial markets, and good practices for personal finance. Our main goalis to help you grow your money.Wealthy Millionaire helps you earn by recommending services through our carefully vetted list ofpartnerships. Our research and professional insight were built through years of financialindustry experience, and our recommended products are based on an independent analysis of thebest service providers in the market. These recommendations are objective we do not acceptspecial payments to recommend products and services from our partners.Loan offers that appear on this site are from companies from which Wealthy Millionaire receivescompensation. This compensation may impact how and where products appear on this site. Wealthy Millionaire does not includeall lenders or loan offers available in the marketplace.

Consider Other Associated Costs

As you go through the mortgage process, itâs important to think about the true cost of owning a home. Besides the costs required at closing and regular mortgage payments, there are other recurring costs such as property tax, home insurance, heating costs, condo fees and more. Even though pre-approval specifies an amount you may be approved for, consider a lower principal amount to reduce regular expenses while leaving money for other unforeseen expenses.

Also Check: Chase Recast

Also Check: What Is A Good Home Mortgage Rate

When Should You Seek Pre

Luckily, its a simple processjust one form to fill out and having your income verified. If everything looks good, you should be granted pre-approval within 24 hours. Pre-approved interest rates apply for a set amount of time. With ATB, its 90 days for a resale or 180 for a new build. With other financial institutions the rate holds anywhere between 90-120 days.

The Buyers Credit Score Dropped Below The Minimum

Mortgage pre-approvals are test runs for a buyers actual mortgage approval. So, if the buyers credit score drops before finding a home, the buyers pre-approval may be invalidated.

In general, the minimum credit score requirements are:

- FHA: 500 credit score

Learn more about how to fix your credit score to buy a home.

Read Also: How Much Is Mortgage Ins

When Should You Get A Mortgage Preapproval

You should get a mortgage preapproval if youre serious about looking for and making an offer on a home within the next two months. Preapproval letters are good for 30 to 60 days, according to the Consumer Financial Protection Bureau .

If it takes you longer than a month or two to find a home, the lender may need to update your preapproval with more recent pay stubs and bank statements. If your house hunt takes more than 90 days, the lender may also need to pull a new credit report, which may impact your credit score.

What To Do If Rejected For Pre

The first thing you should not do is take it personally since you are not alone. A 2016 Federal Reserve study found that one out of every eight applicants for a mortgage got turned down in 2015, the most recent year with available statistics.

The first thing you should do is ask for an explanation. You might find the lender made a calculating mistake or got some bad info. If there were no mistakes, ask for a second opinion from someone else in the company. Be prepared to explain the blemish that triggered the rejection.

Perhaps it was a one-time event like a medical emergency, natural disaster or death in the family. If so, have proof to back up your story. You can also try other lending institutions.

If that doesnt work, accept the problem isnt the lenders. The problem is you. The good news is you can do something about that.

Increase your income and cut expenses. Nobodys saying that will be easy, but millions of people figured it out well enough to eventually buy a house.

Repairing your credit is vital, and a lot of people have gotten help through debt-management programs. A nonprofit credit counseling company works with lenders to reduce interest rates on your monthly bills. The credit counseling company consolidates the bills into one payment, which is lower than total you were previously shelling out for all those different bills.

You May Like: What Is The Monthly Mortgage Payment Formula

If You Get Declined For Your Preapproval Dont Despair

- Find out why you were declined, so you can figure out what to do to improve your chances of getting a loan in the future.

- Ask the lender to explain why you were declined. Was your credit score too low? Was there specific negative information on your credit report?

- Ask to see a copy of the credit score the lender used. If the lender used your credit score to deny your preapproval request, the lender must send you a notice with the credit score they used to make the decision and instructions on how to get a free copy of your credit report.

- If there are errors on your credit report, get them corrected.

- If you need help improving your credit, contact a HUD-approved housing counselor. You can find a counselor online or by calling 1-800-569-4287.

Visit our page to learn more about the facts and numbers we reference.

The process and forms described on this page reflect mortgage regulations that apply to most mortgages.

How To Get Pre

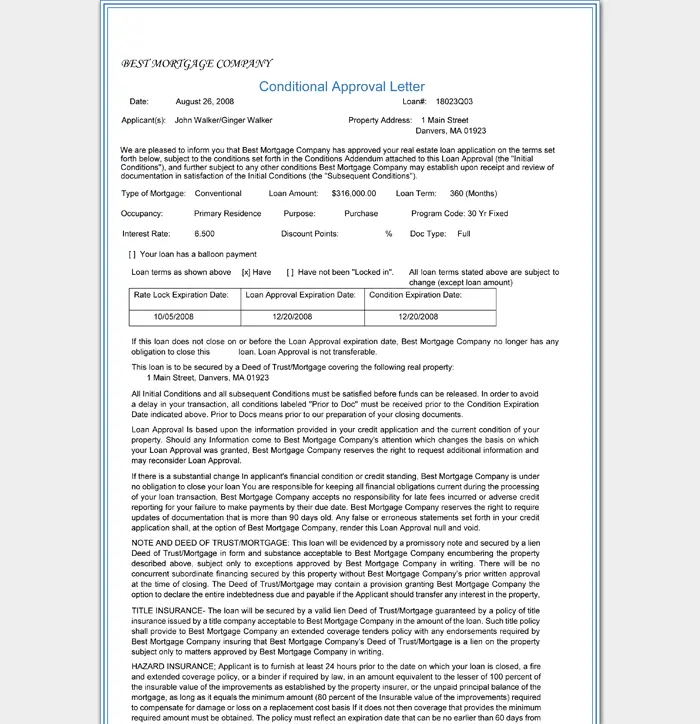

If you are in the market for a new home and require a mortgage, its essential that you get a pre-approval first. A mortgage pre-approval document proves that a lender has agreed to loan you a certain amount of money to buy your home.

Pre-approval can help streamline the home buying process and make your offers more competitive. Getting pre-approved also allows you to know your budget and house hunt accordingly.

However, to make sure your pre-approved mortgage goes through, you must ensure that your home meets specific criteria and that your financial situation does not change drastically during the home shopping period. Read on to find out how to get pre-approved for a mortgage.

Find The Best Mortgage Rates Today. Save in the Long Run.

Please select the Loan Type.

Read Also: What Does A Mortgage Payment Consist Of

Can I Get Mortgage Pre

Its unlikely. Initial qualification without a full credit check may be possible with some lenders at that point, they may be interested simply in whether you have both the income to pay back a mortgage and no credit red flags. But to get full-scale pre-approval will likely require a credit check.

Its important to know how long pre-qualification and pre-approval will be in effect. Different lenders assign different times for which their letters of pre-qualification or pre-approval are good, from 30 to as many as 120 days.

Remember that multiple checks for credit history can negatively affect your credit rating, so you dont want to have them repeated often. For the same reason, you shouldnt apply for it until youre ready to start seriously home shopping. Many lenders and real estate agents can help you get a range of what you can afford in a general sense, so that you can avoid going through the pre-qualification or pre-approval process only to learn that theres nothing in your market that you can realistically afford or want.

For Freelancers And Independent Contractors

Self-employed borrowers dont receive W-2 forms or pay stubs from an employer, so theyll need to produce the following pre-approval documents to show theyve earned a steady income for at least the past two years:

- Business and personal tax returns from the past two years

- A copy of current state or business licenses, if applicable

- IRS Form 4506-T, which allows lenders to access your tax records

- A profit-and-loss statement

- Asset account statements, such as retirement or investment accounts

- Any additional income, such as Social Security or disability

Don’t Miss: How To Remove A Co Borrower From A Mortgage

Whats The Difference Between Mortgage Pre

The difference between a pre-approval and pre-qualification is that mortgage pre-approvals get used to buy a home pre-approval cannot.

Home sellers accept pre-approvals as proof of a good offer because pre-approvals get backed by lenders and double-verified. They include credit verification and an assessment of monthly income. A pre-approved buyer can afford to buy a home.

They include no verifications or reviews by a lender. By definition, a pre-qualification is non-reliable as evidence of a buyers ability to buy. As a result, sellers dont accept offers from pre-qualified buyers.

Learn more about pre-approvals vs pre-qualifications.

Different Lenders May Request Different Levels Of Information And Documentation

Some lenders base preapproval letters solely on the information you provide. Other lenders dig into the details with you now to make certain you have all the documentation you need and prevent delays and surprises later. Ask questions. All lenders will require documentation at some point if you decide to apply for a loan. Its better to know now that you need an additional document than when youre about to close.

Read Also: Can You Sue Your Mortgage Company

How Long Does Pre

Although there is no definite duration for the validity of a pre-approval letter, the custom within the real estate industry is that pre-approval is good for between 90 to 180 days, says Reischer. But many may consider it too old after three months.

The reason? In three months, your financial life can change drastically. You could lose your job, buy a car, or do plenty of things that might affect your home-buying prospects. So, lenders and sellers alike will just have a hard time trusting a pre-approval letter thats more than a few months old.

Want to know how long your pre-approval is good for? The actual time frame will be on your letter. If you want a longer time frame, ask for that upfront.

You Dont Have To Take It All

Heres a tip that the lender probably wont tell you. You dont have to use every dollar they offer you. Sure, they crunched the numbers and came up with an amount that they are confident you can pay. However, that doesnt mean the amount wont leave you overextended or cash poor. Do you really want to live in a reality where you can only afford your home if you drive a 15-year-old car, eat Ramen noodles four times a week, and never take a vacation? Maybe that works for you. But maybe it shouldnt.

Just because your lender pre-approves you for $750,000 doesnt mean you cant look at houses in the $650,00 range. In fact, we recommend that you do. Its perfectly okay advisable, even to not use every bit of your pre-approval amount. As an added bonus, your down payment will now go a bit farther and your monthly payments will be a bit lower. Use those savings to invest more or pay down other debt. Or, you know, to buy a car that was built this decade.

Also Check: What Are The Chances Of Getting A Mortgage

How To Fill Out The Get And Sign Mortgage Loan Pre

By utilizing signNow’s complete service, you’re able to perform any essential edits to Get And Sign MORTGAGE LOAN PRE-APPROVAL Form, create your customized digital signature in a couple fast actions, and streamline your workflow without leaving your browser.

Create this form in 5 minutes or less

How To Create An Electronic Signature For Your Mortgage Loan Pre Approval In Chrome

The guidelines below will help you create an signature for signing mortgage loan preapproval in Chrome:

Once youve finished signing your mortgage loan preapproval, decide what you should do next save it or share the doc with other parties involved. The signNow extension provides you with a range of features for a better signing experience.

Don’t Miss: Does It Make Sense To Refinance My Mortgage