When You Take Out A Mortgage Your Lender Offers You An Interest Rate Based On Several Factors Including Market Rates And Your Credit Profile

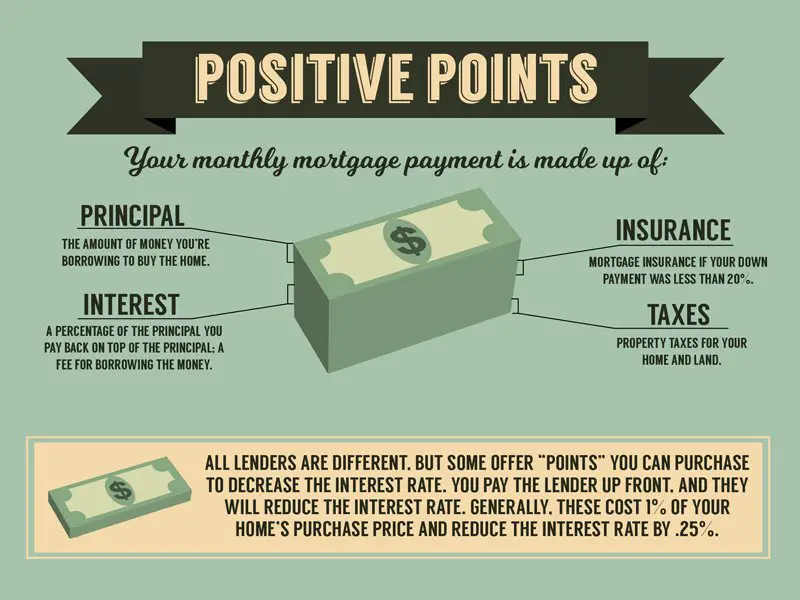

Lenders also offer you the opportunity to pay for a lower your mortgage rate by buying mortgage points, sometimes called discount points.

Points are priced as a percentage of your mortgage cost. Each point you buy reduces your interest rate by a certain amount that will vary by lender. Buying points makes financial sense when you stay in your home long enough, because you can save more on interest over time than you paid for the point.

Keep reading to learn how mortgage points work so that you can decide if buying points makes sense for you.

Comparing Mortgage Loan Offers

Understanding how points work is just one important factor in your decision. Its also important to know how they work when comparing loan rates. Thats because if two lenders offer you the same interest rate but one is charging a point and the other isnt, the lender that isnt charging the point is offering a better deal.

While youre loan shopping, if two lenders offer you a fixed-rate loan of $200,000 at 4.25%, but one is charging a point for that rate, youd be paying an extra $2,000 upfront with that lender to get the same rate from the other lender for free. Thats why its so important to comparison shop carefully and understand loan terms before you decide on a lenders offer.

Lets Use A Quick Example To Explain How This Might Work:

- Lets say your points cost $6,000

- You save $87.81 in monthly mortgage payments

- Divide the $6,000 of paid mortgage points by the $87.81 in monthly savings which equals 68 months to recoup your initial investment.

What you must now determine is the time you expect to remain in the home for you to at least reach the break-even point. If you decide to sell your home before your break-even point of 5 years and 6 months , then you would not have saved money by buying mortgage points when you took out the loan.

Recommended Reading: Chase Mortgage Recast Fee

Mortgage Discount Points Faqs

Discount points are paid to reduce the amount of interest you pay on the loan.

How Much Do Points Cost?

Every point on the loan is equal to 1 percent of the total loan cost. For example, 1 point on a $200,000 loan would be $2,000. If you paid 4 points, you would pay $8,000.

Can You Buy Partial Points?

Yes. Some lenders showcased in the above mortgage rate table list whole-number points while others may offer loans with no points or fractions of a point like 0.79 points.

How Many Discount Points Can I Buy?

The maximum number of points varies by lender, but it is uncommon for consumers to pay more than 4 discount points.

How Much Does a Point Lower Interest Rates?

The amount you can save on your interest rate by paying for points will vary by lender. However, for each loan point you purchase, you can typically reduce the interest rate on your loan by 1/8 percent or 1/4 percent. 25 basis points or a quarter of a percent is the most common value associated with a discount point.

How Are Points Treated for Tax Purposes?

Discount points are used to buy a lower interest rate throughout the loan. From a tax persepctive they are treated as pre-paid interest. Provided your mortgage document states the number of discount points which were purchased and the number of points you purchased is within the normal range where you live then you may deduct the cost of discount points from your income taxes.

Who Should Buy Points?

Who Should Avoid Points?

Can You Have Negative Points?

What Is The Break

The break-even point is when the interest you saved is equal to the amount you paid for mortgage points. They sort of cancel each other out.

Alright, its time to go back to math class again. Lets calculate the break-even point from our example we used before. To do this, just divide the cost of the mortgage point by the amount youd be saving per month . And there you have it, that answer is the break-even point.

$2,400 / $36 = 67 months

In other words, in 67 months, youd have saved over $2,400 in interestthe same amount you paid for the mortgage point. After reaching the break-even point, youll pocket that $36 each month, which will be the money you save on interest because of the mortgage point you bought.

Read Also: How Does Rocket Mortgage Work

Some Lenders Also Offer Negative Mortgage Points

You also have the option with some lenders to apply negative points to your mortgage. Essentially, this means you increase your interest rate in order to get a credit you can use to cover closing costs.

For example, if you were taking out a $250,000 mortgage and you applied a negative mortgage point, your interest rate might rise from 3.00% to 3.25% — but you would get a $2,500 credit to cover costs at closing.

While negative points make your home cost more over time, they can sometimes make it possible to afford to close on a home when you otherwise would be tight on cash. Just be aware that it’s a costly option.

In the above example where you raised your rate from 3.00% to 3.25%, your $250,000 loan would result in a monthly payment of $1,088 and the total cost of your mortgage would be $391,686.

Compare that with a monthly payment of $1,054 and a total cost of $379,444 if you hadn’t applied negative points. You’d pay $34 more each month and $12,242 more over 30 years in exchange for having gotten $2,500 up front.

When You Should Buy Mortgage Points

Only consider buying points if you know youll keep your loan longer than the breakeven period.

Of course, life is unpredictable, so its hard to make plans for years down the road. You could score your dream job two years from now, but it might require you to move out of state. You might get divorced in three years, and your spouse could get the house in the divorce settlement. Or in four years, you might need more money than your emergency fund can cover, and do a cash-out refinance to pull out home equity.

And what about the opportunity cost of investing that money instead of buying down your interest rate? In the example above, it would take around six years to break even and start coming out ahead. But that ignores what you could have earned had you invested that $2,000 in the stock market. At an average historical return of 10%, that $2,000 would have transformed into $3,543 after six years, making it the better investment.

The upfront cost of discount points particularly make no sense for adjustable-rate mortgages . These loans are designed for refinancing into fixed-rate mortgages, once the low-interest period ends.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Should You Pay For Mortgage Points

It seems odd to say, but buying mortgage points to lower your interest rate could actually be a complete rip off. Say what? How can a lower interest rate be a bad deal?

For starters, it could be years before you really save any money on interest because of your mortgage points. To see what this would look like, youd first need to calculate whats known as your break-even point.

How To Raise Your Credit Score By 100 Points In 45 Days

Insurance carriers use credit scores as part of their calculations to determine the level of risk you would pose to them as an insured. They have found a direct correlation between credit scores and claim activity. Knowing that, its important to keep your credit scores in good shape so that your insurance premiums stay in line.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

How Paying Mortgage Points Works

A mortgage point or discount point is equal to one percent of your loan amount. Thats $4,000 for a $400,000 mortgage. Essentially, you prepay interest upfront in exchange for a lower mortgage payment.

The rate reduction you get per point depends on your loan and market conditions. Typically, for a 30year fixedrate loan, a discount point gets you a .125 percent to .25 percent lower mortgage rate.

However, the relationship between discount points and interest rate reduction is not perfectly symmetrical. Even for the same loan.

What Are Discount Points

First, lets explain what discount points are and how they work. Points are essentially prepaid interest . They are paid at closing and allow you to buy down the overall interest rate on your mortgage. Paying points is often a great idea if you are planning to stay in the home for a long time because you will save more money on your interest payments over the long run.

However, if your goal is to keep your closing costs as low as possible or you dont plan to be in the home very long, you may prefer to pay the fewest points available on the loan. Basically, paying points is a trade-off of paying more now in order to save more later.

Recommended Reading: Reverse Mortgage For Mobile Homes

Mortgage Points: How They Work And When To Pay Them

Modified date: Nov. 4, 2021

Among the many terms you hear thrown around during the mortgage process, just one is mortgage points.

Lenders will often mention these points, but rarely do they actually mention what they are and how much theyll cost you.

Thats at least partially because points are typically included with total closing costs . After all, borrowers are often more concerned with the bottom line than they are with specific details.

But since points are typically the largest of the closing costs charged, they definitely rate a dedicated discussion.

Whats Ahead:

Source: Yurii_Yarema/Shutterstock.com

Mortgage points, or discount points, are fees that you pay to the lender upfront for discounted interest rates.

Generally speaking, one point costs about 1% of your mortgage loan amount.

For example: if you have to pay one point on a $200,000 mortgage, you will owe $2,000.

Over time, mortgage points can save you a bunch of money on interest payments! So, you will want to pay attention.

First, it is important to understand that there are two different types of mortgage points.

The Downside Of Paying Mortgage Points

Paying mortgage discount points is not the best use of your money.

Here are some reasons why:

- You may not have the mortgage for 11.5 years. Most people either refinance their mortgage or move to a new home within that timeframe. If you do either before you reach the 11.5-year mark, you will have lost money by paying the discount points.

- If money will be tight when you purchase the home. Paying discount points may be a needless extravagance .

- If the seller is paying the discount points but insists that the final sales price be adjusted upward to compensate for the cost of the points, you will be trading a higher sales price and mortgage for a lower interest rate. Dont fall for this offer its a bad deal for you.

- Paying discount points out of your own pocket can leave you with less cash after closing cash youll probably need as you prepare to move into your new home.

You May Like: Rocket Mortgage Qualifications

Should You Buy Points

If you can afford them, then the decision whether to pay points comes down to whether you will keep the mortgage past the “break-even point.”

The concept of the break-even point is simple: When the accumulated monthly savings equal the upfront fee, you’ve hit the break-even point. After that, you come out ahead. But if you sell the home or refinance the mortgage before hitting break-even, you lose money on the discount points you paid.

The break-even point varies, depending on loan size, interest rate and term. It’s usually more than just a few years. Once you guess how long you’ll live in the home, you can calculate when youll break even.

» MORE:‘Should I buy points?’ calculator

Can You Negotiate Points On A Mortgage

You can decide whether or not to pay points on a mortgage based on whether this strategy makes sense for your specific situation. Once you get a quote from a lender, run the numbers to see if its worth paying points to lower the rate for the length of your loan.

Sometimes, origination points can also be negotiated. Homebuyers who put 20 percent down and have strong credit have the most negotiating power, says Boies.

A terrific credit score and excellent income will put you in the best position, Boies says, noting that lenders can reduce origination points to entice the most qualified borrowers.

You May Like: Who Is Rocket Mortgage Owned By

When Does A Zero

Unfortunately, there is no straightforward rule of thumb to use to decide whether to get a zero-points home loan. The scenario can change from lender to lender, and even from day to day as mortgage rates change.

The only way to know for sure is to do the math on the offer youve been given, ideally working with your lender to understand all of the possible savings and outcomes.

Generally speaking, though, zero-point mortgages tend to make the most sense when you plan to sell the home, refinance or otherwise pay off the mortgage within a few years. If youll only be in the house for three or four years, you may not reach a break-even point at which you would recoup the upfront cost for the points.

Conversely, the longer you think youll hold on to your home, the more likely it is that you will save money if you buy down your interest rate.

How Points Work On A Loan

A point is an optional fee you pay when you get a home loan. Sometimes called a “discount point,” this fee helps you secure a lower interest rate on your loan. If you would benefit from a lower interest rate, it might be worth making this type of upfront payment. However, it may take several years to recoup the benefits of paying points.

You May Like: Reverse Mortgage Manufactured Home

How Paying Off Your Mortgage Affects Your Credit Score

Congratulations! Youve just finished paying off your mortgage probably the largest debt youll ever have in your life. Should you expect your credit score to increase as a result? Not necessarily.

Your credit score is calculated from your , a history of all of your borrowing and payment activity. While your mortgage was probably a huge part of that history, its just one part. Credit reports also consider other installment loans, your credit card payments, and any payments for non-borrowing related charges that have gone into collections. Every account matters and contributes to your credit score.

Consider the factors that go into calculating a credit score, starting with payment history the most influential factor. Mortgages require regular payments for a long time. With those payments removed, thats one less regular payment that proves youre handling credit responsibly. Your credit score may dip slightly as a result. If youve been less responsible with other payment paths, your score could drop further.

Paying your mortgage off early will save on interest charges, while making payments on your regular schedule could keep your credit score up. However, your credit score shouldnt play much of a role in deciding whether to pay a mortgage off early. Calculate the economic tradeoff between interest savings versus other uses of your money .

When Will You Break Even After Buying Mortgage Points

To determine if it’s a good idea to pay for points, compare your cost in points with the amount you’ll save with a lower interest rate and see how long it will take you to make your money back. If you can afford to pay for points, then the decision more or less boils down to whether you will keep the mortgage past the time when you break even. After you break even, you’ll start to save money. The break-even point varies, depending on your loan size, interest rate, and term.

Example. As in the example above, let’s say you get a 30-year loan of $300,000 with a 3% fixed interest rate. Your monthly payment will be $1,265. However, if you buy one point by paying $3,000, and your rate goes down to 2.75%, the monthly payment becomes $1,225. So, divide the cost of the point by the difference between the monthly payments. So, $3,000 divided by $40 is 75, which means the break-even point is about 75 monthsmeaning you’d have to stay in the home for 75 months to make it worth buying the point.

As you can see, the longer you live in the property and make payments on the mortgage, the better off you’ll be paying for points upfront to get a lower interest rate. But if you think you’ll want to sell or refinance your home within a couple of years , you’ll probably want to get a loan with few or no points. Check the numbers carefully before you pay points on a loan because you might not recoup the cost if you move or refinance within a few years.

You May Like: What Does Gmfs Mortgage Stand For

Payback With Points In

With Payback with Points In-Store, you can now use an eligible wallet app to redeem your RBC Rewards points for purchases you make in stores.

Learn how to use Payback with Points In-Store

Please note: With every purchase made through Payback with Points In-Store, at the time of purchase, the full purchase amount of the transaction will be charged to your credit card at first. For the portion of the points redemption, a credit will be applied to your credit card account within 2-3 business days from the date of your purchase.

iOS

- You can redeem points towards your last purchase made with Apple Pay by logging into the RBC Launch app and selecting the transaction banner at the top.

Samsung

- Get started by selecting the Samsung Pay app icon or by swiping up from the bottom of your screen.

- Select Pay with RBC Rewards Points and choose how many points youâd like to use towards your purchase.

- Tap to pay and complete your mobile purchase transaction in store.