Consider An Fha Loan For A Home Refinance

Check out todays Federal Housing Administration refinance rates below.

| Term |

| Rate |

| APR

Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after the closing date for adjustable-rate mortgage loans. |

| Points Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. One mortgage point is equal to about 1% of your total loan amount, so on a $250,000 loan, one point would cost you about $2,500. |

| Term | Rate | APR

Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after the closing date for adjustable-rate mortgage loans. |

Points Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. One mortgage point is equal to about 1% of your total loan amount, so on a $250,000 loan, one point would cost you about $2,500. |

|---|---|---|---|

| 30-year fixed – FHA |

When Is A Refinance Worth It

Whats most important to focus on is, what are the monthly and lifetime savings of the loan? What are the costs? And how long will it take you to recover those costs with the savings youll earn? says Ralph DiBugnara, president of Home Qualified.

Gay Cororaton, Senior Economist for the National Association of Realtors, says best candidates for refinancing are:

- Those with high mortgage rates relative to a new lower rate

- Those who intend to stay for a long time in their home

- Those who have the cash ready to pay for closing costs

Alternatively, many lenders can roll the closing costs into your mortgage principal or cover them in the form of a higher interest rate so you dont have to pay upfront.

That higher interest rate may still be far below your current rate, and it comes with no closing costs from your pocket or added to the loan balance.

Dropping your rate with no associated costs makesthe decision to refinance an easy one.

Can I Sell My House After Refinancing

Selling your home after a mortgage refinancing is a possibility, but there are some requirements to follow that you should be aware of. Find out what provisions in your mortgage contract to look out for, and if selling your home after refinancing is a wise financial decision in this informative article.

Also Check: How To Start A Mortgage Company

Fha Cash Out Refinance Guidelines 2022 How To Qualify

Qualifying for an FHA cash out refinance is nearly the same as qualifying for any FHA loan. However, there are a few slight modifications which only apply to cash out refinances. These are the minimum requirements to qualify for an FHA cash out refinance:

- Employed for a minimum of 2 years

- Minimum credit score of 500

- No recent bankruptcies

- Maximum debt to income ratio of 56%

- Maximum total loan amount of 80% loan to value

- Need to have made at least 6 monthly payments on existing mortgage before applying

- Cannot have any late mortgage payments

These are just the basic requirements. We can help you to determine exactly how much you can qualify for and provide a rate quote without running your credit.

Should You Refinance An Fha Loan

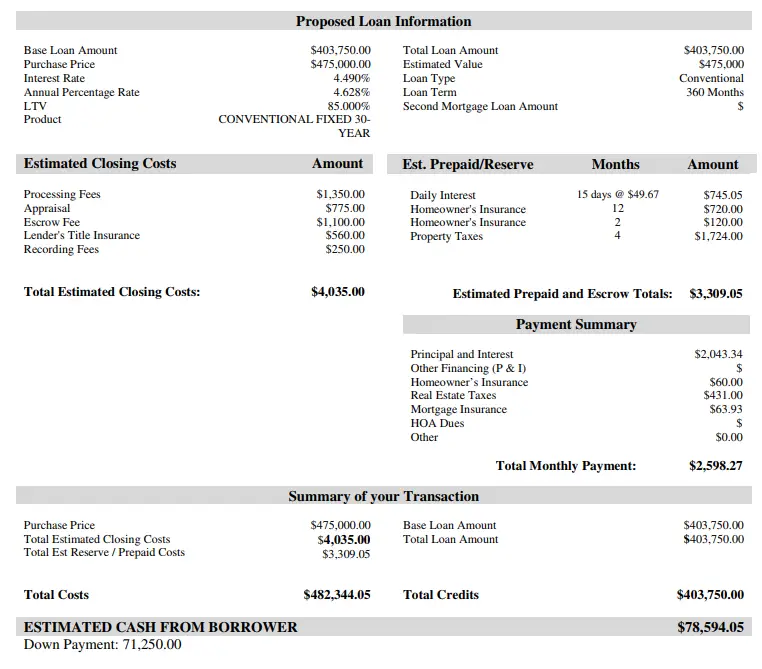

Now the big question is whether you should refinance an FHA loan. This is a personal decision. Does it make sense to refinance? Do you save money by doing so? Think of all aspects of the process. Youll pay closing costs unless you negotiate a no-closing cost loan. The closing costs could equal between $5,000 and $10,000. You must take this into consideration. Before you jump onto the bandwagon, figure out your break-even point. Heres how you do it:

Closing costs/monthly savings = Break-even point

Heres an example:

Your closing costs equal $6,000. Refinancing will save you $150. Your break-even point equals 40 months. This means you wont see the savings until 3 1/3 years.

Of course, if you take cash out of the equity, your break-even point will be different.

Once you know your break-even point, you can determine if the refinance is worth it. Consider your plans. Will you stay in the home for the long-term? Lets say in the above example, you planned on moving in 3 years. Refinancing wouldnt make sense in that situation. On the other hand, if you planned to move in 10 years or more, it would be worth it.

Another main factor is determining fi you can afford the closing costs as well. Most loans require you to pay the costs up front. There are some cases where you can get help. For example, a relative that gives you gift funds can help. You can also take a slightly higher interest rate and let the lender pay the closing costs. This takes away from your savings, though.

Recommended Reading: Is 730 A Good Credit Score For Mortgage

What Are The Rules For Refinancing Conventional Loans

If you want to use a conventional loan to refinance your existing mortgage, there usually isnt any waiting period. So, if your FOMO is rising while interest rates are dropping, a conventional mortgage might be the right option for you.

To score a conventional mortgage refinance, youll usually need:

- A good credit score: The conventional wisdom is to have a credit score of 620 or higher.

- A qualifying debt-to-income ratio: To calculate your DTI, you need to add up all of your recurring, monthly bills, including your estimated mortgage payment, and divide it by your gross monthly income. The result should be no more than 43% of your gross monthly income.

- Proof of income: Lenders will want paperwork that confirms that you have enough income coming in to make your monthly mortgage payments.

Depending on the lender, you may have to get your home appraised. This is an out-of-pocket cost , so you should factor the cost of an appraisal into your total costs to refinance.

When Can You Refinance A Jumbo Loan

You can refinance a jumbo mortgage at any time. However, you must first find a lender thats willing to do it, as many avoid financing them. You will also be held to higher standards to qualify, just like you were for your first jumbo mortgage.

Typically, a lender will be looking for a high credit score , a low DTI , an 80/20 LTV and enough cash reserves to cover the monthly mortgage payments.

Jumbo loans can also be eligible for cash-out refis, but options vary by lender. Jumbo loans, as the name implies, are for loan amounts that exceed standard requirements and therefore require extra assurances for the lender, since they are riskier loans overall. Today, a jumbo loan is one that is over $548,250 in most of the U.S. and cannot be insured by Freddie Mac or Fannie Mae.

Read Also: What Kind Of Mortgage Can I Afford On 70k

Drop Mortgage Insurance Premiums

When you get an FHA loan, you must pay an FHA mortgage insurance premium no matter how much you put down. There are two payments: an upfront MIP that you pay at closing and an annual payment thats broken down and added to your monthly mortgage payment.

How long you pay the MIP will depend on the amount you put down.

- If your down payment is at least 10%, youll pay the MIP for 11 years.

- If your down payment is less than 10%, youll pay the MIP for the life of the loan.

With a conventional loan, you must also pay insurance if your down payment is less than 20%. This is called private mortgage insurance and its also a monthly payment. Unlike an FHA loan, you can get rid of your PMI once you have enough equity in the home. You can request that your servicer remove PMI once you have at least 20% equity based on the original payment schedule or wait for it to automatically cancel once you meet the servicers equity requirement typically around 22%.

If you have an FHA loan and have at least 20% equity, youll still need to pay insurance until the 11 years are up or for the rest of your loan term. But, if you refinance FHA to conventional, you could get rid of that monthly fee.

What Should I Watch Out For

Always read the fine print. Some obstacles you may come across are:

Conventional refinance

- Closing costs. At 2% to 5% of the homes value, this is the most significant upfront expense. Lets say youre refinancing a $200,000 loan with 3% closing costs. Youll need to bring $6,000 cash to the closing table.

- Private mortgage insurance. If you havent built up 20% or more equity in your home, youll still have to pay PMI when you refinance. PMI can run anywhere between 0.3% to 1.2% of the loan amount annually. This may override any savings youre scoring with a new interest rate, so weigh the costs.

- No MIP refunds. The FHA wont reimburse homeowners who refinance to a non-FHA-insured mortgage for their upfront mortgage insurance premium payments. If you refinance to another FHA loan, you may get a prorated refund.

Streamline refinance

- MIP. You cant escape these payments with a streamline refi. They will be with you for the entire loan.

- Closing costs. You must be able to cover the closing costs and you cant roll the fees into the loan amount.

- Limits on cash out. You cant take out more than $500 cash from the refinance.

Cash-out refinance

- Owner-occupancy. For an FHA cash-out refinance, you must prove that youve occupied the property as your principal residence for the last 12 months.

Also Check: Who Owns Prosperity Home Mortgage

Im Not Sure How Much Cash Out I Need How Do I Determine That

Your FHA loan will be limited both by the 80 percent loan-to-value ratio as well as your local loan limits established by FHA. With that limitation in mind, figure out how much cash you need for your specific goal. Tell your loan officer that number, and he or she will work backward, figuring in closing costs, to come to a sufficient loan amount .

If you only want to pull cash out of your property, but want to avoid the extra costs of a full refinance, consider obtaining a home equity loan instead. Many local and national banks are now offering second mortgages, which are a cheaper option than refinancing.

Is There A Limit On How Many Times You Can Refinance Can I Refinance Right Away

There’s no preset number of times you’re allowed to refinance you can do so as many times as it makes sense given your financial situation. However, if you’ve recently signed your mortgage, you may need to wait a bit as generally, your existing lender won’t let you refinance in the first six months. That said, some lenders will waive that waiting period, so if rates have dropped significantly since you closed on your home, or your has improved tremendously, it pays to contact your lender and see whether refinancing is possible.

Another option is to refinance with a different mortgage lender. Many lenders will let you refinance even if you recently signed your mortgage with someone else. You’re more likely to snag a great offer if you shop around to find the best mortgage refinance lenders.

If you’re interested a cash-out refinance, you’ll generally need to wait at least six months from when you originally closed on your mortgage, regardless of whether you’re using the same lender or a different lender. With a cash-out refinance, you borrow more money than what you owe on your existing mortgage. You can then use that cash for any purpose — home improvements, paying down debt, or even taking a vacation.

If you want to refinance an FHA loan with an FHA Streamline Refinance , you’ll be subject to a 210-day waiting period. Also, if your original mortgage was already modified to make your payments more affordable, you may need to wait up to two years to refinance it.

Also Check: What Are The 3 Types Of Mortgages

Don’t Rush To Refinance

Tempting as it may be to refinance soon after closing on your mortgage, make sure you’re doing it for the right reasons. Don’t chase small interest rate drops — if refinancing means going from a rate of 3.755% to 3.50%, it’s probably not worth it. Rather, wait until you have a chance to capitalize on a substantial rate reduction before applying to refinance.

Heres How Soon You Can Refinance

If you have a conventional mortgage, you can typically refinance into a lower interest rate as soon as you want. However, youll have to wait six months if you want a cash-out refinance or a Streamline Refinance.

- Conventional refinance : No waiting period

- Cash-out refinance: 6-month waiting period

- FHA or VA Streamline Refinance: 210-day waiting period

- USDA refinance: 6-12 month waiting period

Below, we take a closer look at the rules for each type of refinance loan.

Recommended Reading: What Happens To My Mortgage If I Die

What Are The Rules For Refinancing Jumbo Loans

In general, all the rules that apply to conventional loans apply to jumbo loans. Because these are large loans for properties that cost hundreds of thousands or even millions of dollars, stricter underwriting guidelines may apply.

MoneyTermUnderwriting

The detailed process of reviewing your credit, financial and other documents for loan approval and setting interest rates and terms.

Closing Costs And Down Payment Assistance

When you need payment assistance, you can expect:

- FHA: The seller can contribute up to 6% of the closing costs with an FHA loan. The borrower can also get down payment assistance of up to 100% with an FHA loan, which means a family member or other source can give them the money for the down payment.

- Conventional: The seller can usually contribute up to 3% of the closing costs on a conventional loan.

Don’t Miss: How Many Mortgage Lenders Should I Apply To

What Is A Conventional Loan

A conventional loan is a mortgage that is not guaranteed by a federal agency such as the FHA. Since conventional loans dont offer lenders the guarantee that the loan will get paid, they often have stricter requirements compared to FHA loans. Despite that fact, the majority of home buyers use conventional loans to purchase a home. In 2020, 69% of new houses sold using a conventional loan as the source of financing.

Usually, if a person is interested in applying for a conventional loan, they need to make a down payment of at least 3% and have a credit score of at least 620. The more a person can put down, the better the terms of the mortgage. The higher a persons credit is, the lower the interest rate. While you can get a conventional loan with a lower credit score, many lenders offer the best rates to people with scores in the 700s.

You might have heard the traditional advice to put down at least 20% of the value of the home when you apply for a conventional mortgage. Generally, making a down payment of at least 20% eliminates the need to pay private mortgage insurance each month.

Rules For Refinancing Usda Loans

The U.S. Department of Agriculture offers two mortgage programs for rural home buyers: guaranteed loans and direct loans. To refinance a guaranteed loan, you must have had the mortgage for at least 12 months. For direct loans, there is no waiting period for refinancing.

The USDA offers three options for refinancing into another USDA loan. If you get a streamlined refinance or non-streamlined refinance, you must have made on-time payments in the last 180 days. For the streamlined assist program, you must have been current on your mortgage payments in the last 12 months.

Read Also: What Qualifies As A Jumbo Mortgage

Pro: Reduce Your Monthly Payment

Depending on the amount of your new loan and the term of the loan, you might get a lower monthly payment after refinancing. For instance, if you refinance from a 15-year term to a 30-year term, your monthly payment will drop. Eliminating mortgage insurance premiums after refinancing will also help you reduce your monthly mortgage payment.

How Soon Can You Refinance A Mortgage

Maybe you just bought a house, or even refinanced recently. But it might not be too soon to refinance again.

Many homeowners can refinance into a lower-rate loan with no waiting period. And others need to wait as little as six months. So theres a good chance youre eligible to refinance at todays rates.

In this article

Also Check: Who Should I Get A Mortgage From

When Is It A Good Time To Refinance An Fha Loan To A Conventional Loan

Just because you can be approved for a new loan doesnt mean you should refinance. Here are a few cases when it might make sense to move from an FHA to a conventional mortgage:

- Your credit score has improved significantly since you applied for your FHA loan. Lets say your credit score was 600 when you took out your first loan. Four years later, its now 670. Thats a huge difference that can help you qualify for a more affordable loan.

- Interest rates have dropped significantly. If youre paying 5.1 percent on your current loan, for example, and you can score a new rate of 4 percent, that can be a huge savings over the lifetime of a loan. Look at the market now versus when you applied, and use Bankrates refinance calculator to estimate your savings with a lower rate.

- Youre going to stay there long enough to recoup your closing costs. If there are no plans of moving in your future and you still have a long time left on your current loan, a conventional refinance can be a smart decision. However, if youre planning to move in the next couple of years, refinancing might not be wise, because you might not have enough time to hit the break-even point where your savings outweigh the upfront closing costs on a new loan.