Look Closely At All Your Expenses

You’ve got to put food on the table, clothes on your back and gas in your car â and have a little fun now and then. You also need to be ready for emergencies.

Your mortgage specialist will help you make sure you have money left over to pay for your day-to-day needs, as well as some of your lifestyle choices. Most lenders use the below ratios as guides to figure out the most you should spend on your housing costs and other debts:

If your monthly housing and housing-related costs don’t leave you enough money for your other expenses, you have a few options.

You and your mortgage specialist may also need to think about future expenses. Maybe you’ll need to replace your car within the next year. Or if you’re expecting a baby, child-related costs as well as parental leave may affect your budget.

The Percentage We Recommend

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the maximum amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

Dont Miss: How To Get A Mortgage Lien Release

How Much Of A Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Don’t Miss: Do Multiple Mortgage Applications Hurt Credit

How Secure Is Your Income

You should also bear in mind how secure your earnings are.

You likely dont want to be saddled with the biggest mortgage possible if youre in a job where firings are commonplace or if you plan to change jobs soon and youre not sure youll earn the same amount.

Lenders have these questions in mind, too. Thats why they typically want to see two years employment history on your mortgage application. They also want to know any income youre using to qualify for the loan will continue for at least three years.

How Much Will A Bank Lend On A Property

Generally, we can expect a lender to lend up to 80% of the value or price of a house .

Often, lower percentages are loaned on properties outside urban areas and on apartments. These figures are sometimes called the loan to value ratio, or LVR.

It is possible to borrow up to 95% of a propertys value in some cases. But thats a big risk for both the borrower and the lender.

You May Like: What Will My Monthly Payment Be Mortgage

Working Out The Size Of Your Deposit

To understand how much you can afford to spend on buying a home, the first step is to draw up your overall budget and understand how much money you have at your disposal to pay for everything. This will depend on the capital or savings you have at your disposal, and how much you can borrow against the property as a mortgage given your income and the size of your deposit.

Eliminate Private Mortgage Insurance

If your down payment is less than 20% , youll make extra payments to protect your lender. This is called private mortgage insurance . However, eliminating PMI reduces your mortgage payment.

Lenders typically allow you to request PMI cancellation when your principal loan balance reaches 80%. By law, your lender must remove it when your principal loan balance reaches 78% of the original value of your home.

Recommended Reading: Should I Get 15 Year Mortgage

Getting Flatmates To Help With Bills

Planning to get flatmates in to help pay the mortgage? Some lenders will count 70% to 80% of their rent towards your income. Other lenders won’t include any.

The easiest way to find out how much you can borrow through a lender is to give them your income and spending details and ask them to make the calculation. Or, you could ask a mortgage broker to do this.

Based on the details you give them, a lender may give pre-approval of the amount they are willing to lend. The key is to treat this as an upper limit rather than a starting point!

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That’s because salary isn’t the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

You May Like: How Much Money Do You Get With A Reverse Mortgage

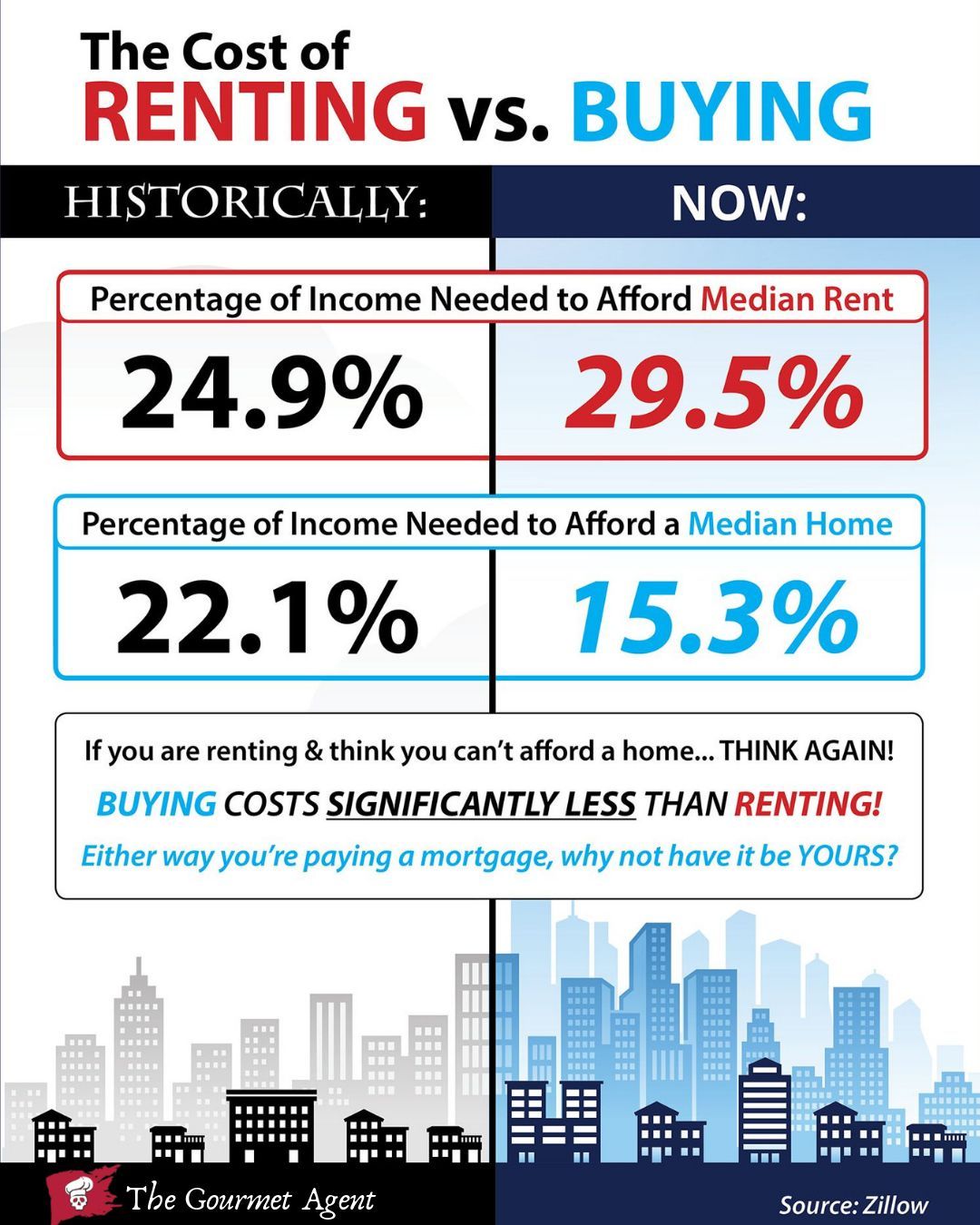

How Much Of Your Income Should You Spend On A Mortgage

The amount can spell the difference between living comfortably and struggling financially

One of the most important things to consider when buying a house is how much mortgage you can reasonably afford to pay off. This is because knowing how much you can allocate to your monthly repayments very often spells the difference between living comfortably and struggling to make ends meet.

Expert opinion varies on the exact amount, but the consensus is you should have enough left over to meet other financial obligations after making a home loan payment. So, what percentage of your monthly income should you dedicate to your mortgage? Lets take a closer look.

Read Also: What Is The Meaning Of Mortgage

How Much Of Your Salary Should Go On Mortgage Payments

When you’re looking to buy a home, knowing how much of your salary should go towards the purchase is important. The amount of money you should spend on your mortgage depends on several factors, including your income, mortgage size and term. Other important expenses such as saving for retirement further add to the importance of answering this question.

This article helps you understand how much of your salary should go on mortgage so you can buy your dream house while keeping your finances balanced.

You May Like: Do Mortgage Lenders Make Commission

Create An Mp4 To Gif Gui

PySimpleGUI is a cross-platform GUI framework that runs on Linux, Mac and Windows. It wraps Tkinter, wxPython, PyQt and several other GUI toolkits, giving them all a common interface.

When you installed PySimpleGUI earlier in this article, you installed the default version which wraps Tkinter.

Open up a new Python file and name it mp4_converter_gui.py. Then add this code to your file:

# mp4_converter_gui.pyimport cv2import globimport osimport shutilimport PySimpleGUI as sgfrom PIL import Imagefile_types = def convert_mp4_to_jpgs: video_capture = cv2.VideoCapture still_reading, image = video_capture.read frame_count = 0 if os.path.exists: # remove previous GIF frame files shutil.rmtree try: os.mkdir except IOError: sg.popup return while still_reading: cv2.imwrite # read next image still_reading, image = video_capture.read frame_count += 1def make_gif: images = glob.glob images.sort frames = frame_one = frames frame_one.savedef main: layout = , , , ] window = sg.Window while True: event, values = window.read mp4_path = values gif_path = values if event == "Exit" or event == sg.WIN_CLOSED: break if event in : if mp4_path and gif_path: convert_mp4_to_jpgs make_gif sg.popup window.closeif __name__ == "__main__": main

Pretty neat, eh?

The Traditional Model: 35% Or 45% Of Pretax Income

In an article on how the mortgage crash of the late 2000s changed the rules for first-time homebuyers, the New York Times reported:

If youre determined to be truly conservative, dont spend more than about 35% of your pretax income on mortgage, property tax, and home insurance payments. Bank of America, which adheres to the guidelines that Fannie Mae and Freddie Mac set, will let your total debt hit 45% of your pretax income, but no more.

I would hardly call 35% of your pretax income conservative, let alone truly conservative.

Lets remember that even in the post-crisis lending world, mortgage lenders want to approve creditworthy borrowers for the largest mortgage possible. So when you obtain mortgage pre-approval, lenders will likely approve you for a loan amount with payments of up to 35% of your pretax income. That may tempt you to take on more home than you should. But dont just assume that because the bank approved it, you can afford it. They are two very different things.

Remember: The more you spend on your home, the less you have available to save for everything else. You may be able to afford a housing payment that is 35% of your pretax income today, but what about when you have kids, buy a new car, or lose your job?

Don’t Miss: What Is Mortgage Rate Vs Apr

Percentage Of Income That Should Go Towards Your Mortgage

December 22, 2017 by Barron Rothenbuescher

As a general rule of thumb, your monthly housing payment should not exceed 28 percent of your income before taxes. When determining what percentage of income should go to mortgage, a mortgage broker will typically follow the 28/36 Rule. The Rule states that a household should not spend more than 28 percent of its gross monthly income on housing-related expenses. In addition to mortgage payments, housing expenses include property taxes, home insurance and similar expenses. While this is the standard, this percentage is not right for everyone. Some individuals are able to spend more or less depending on their individual circumstances.

Work With A Buyers Agent We Trust

For more guidance on buying a house you can afford, work with a real estate agent. A good agent will help you set the right expectations when shopping for a home in your price rangethey may even be able to find you a home for sale that other buyers dont know about.

For a quick and easy way to find a RamseyTrusted agent, try our Endorsed Local Providers program. We only recommend agents who truly care about your financial path and wont push you to overspend on a house so they can bring home a bigger commission check. Find your real estate agent today!

Read Also: What Is A Mortgage Advisor

Factors That Influence How Much You Can Spend On A House

Several factors influence how much you can afford to spend on a house. Here are the most important factors youll need to consider:

- Income: You can use your income as a starting point when calculating how much you want to spend on a house.

- Debt: Your debt and monthly expenses factor into how much you can spend on bills each month.

- Cash reserves: Youll need cash on-hand to pay for your down payment and closing costs. It also helps to have a little bit left over so you can show you can make a certain number of mortgage payments in the event of temporary income loss.

- Your credit profile, including your credit score and payment history, will impact how much a lender is willing to let you borrow.

Now that you know the key factors that come into play when deciding how much you should spend on a house, lets walk through the decision-making process.

How Might Your Circumstances Change In The Future

Once youve got your basic budget, you can play around with the inputs. If youre planning on having children soon, think about how that will change your household finances.

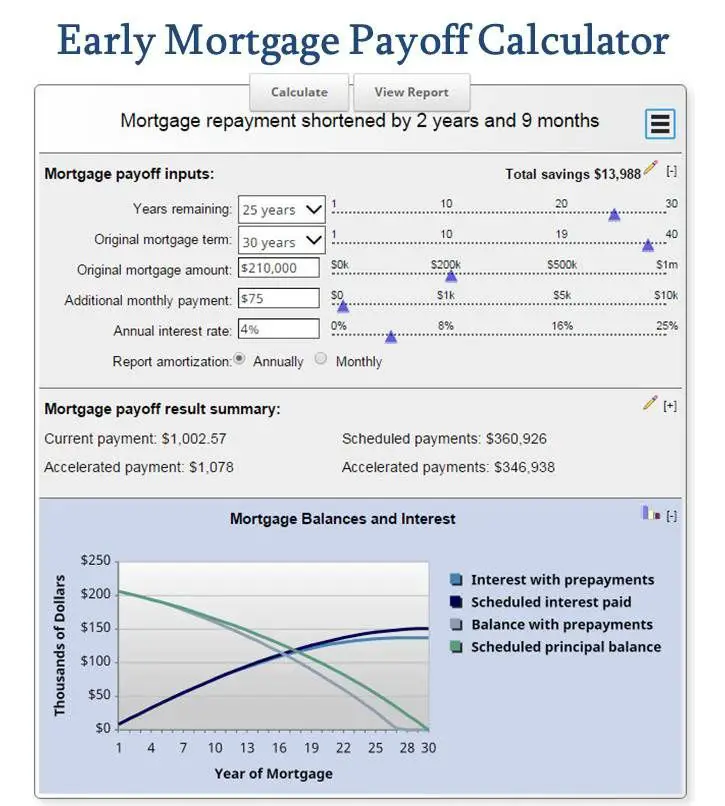

Once you come up with an estimate, you can use a mortgage calculator which can give you an idea of about how much debt you can comfortably take on.

Also Check: What Are Mortgage Underwriters Looking For

Don’t Miss: What Are The Rates On A 30 Year Fixed Mortgage

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums. In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

Recommended Reading: What Should I Bring To A Mortgage Pre Approval

Our Recommended Percentage Of Income For Mortgage

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the ideal amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

How Much House Can I Afford On $80 000 A Year

For the couple making $80,000 per year, the Rule of 28 limits their monthly mortgage payments to $1,866. Ideally, you have a down payment of at least 10%, and up to 20%, of your future home’s purchase price. Add that amount to your maximum mortgage amount, and you have a good idea of the most you can spend on a home.

Also Check: What Are Bank Mortgage Rates

My Take: Somewhere In Between

Not everybody is as debt-averse as Ramsey. And his one-size-fits-all advice might shut out a huge segment of Americans from ever realizing their homeownership dreams.

Good luck finding a mortgage in California that you can pay off over a 15-year term, with monthly payments at less than 25% of your after-tax income. That approach will be unrealistic in a number of regional American housing markets with high home prices.

If I had to set a rule, it would be this:

- Aim to keep your mortgage payment at or below 28% of your pretax monthly income.

- Keep your total debt payments at or below 40% of your pretax monthly income.

Note that 40% should be a maximum. I recommend striving to keep total debt to a third of your pretax income, or 33%.

As some commenters have pointed out, while it may be possible to buy a decent home in a small midwestern town for $100,000 , buyers in New York or San Francisco will need to spend five times that amount just to get a hole in the wall. Yes, people tend to earn more in these high-cost-of-living areas, but not that much more. Does it mean they shouldnt buy a home? Not necessarily. Theyll simply have to make trade-offs to buy in those areas.

What Is A Mortgage

Amortgage is a kind of loan that is used to finance a property. Amortgage is a secured loan, which means that the person whoborrows promises some kind of collateral in the event they cannotrepay that loan in a timely manner. In the majority of cases, thecollateral for a mortgage is the property itself.

Both individuals and businesses use mortgages to finance properties.

The benefit of a mortgage is that it gives you a way to buy some property without having to shell out the entire cost upfront.

Over many years, the borrower pays back the loan plus interest in a series of installments.

In the case when the borrower cannot repay the loan, the mortgage owner has the right to foreclose the property and sell it off to make up the debt.

A mortgage is a specific type of loan, but not all loans are mortgages. The key aspect of mortgages is that they are secured loans and come with some kind of collateral.

Even when you have the funds to pay for the property upfront, it can still be a good idea to secure a mortgage. For example, securing a mortgage can free up funds that you can put into other real estate investments.

There are two major payment components to a mortgage. The monthly principal is the main amount you owe each month and is determined by the amount of the mortgage and the length of the loan terms.

Principal + interest + homeowners insurance + taxes = total monthly payment

Read More: 4 CRUCIAL Things To Look Out For When Buying A Property

Also Check: How To Determine My Mortgage Payment