Proof Of Assets And Liabilities

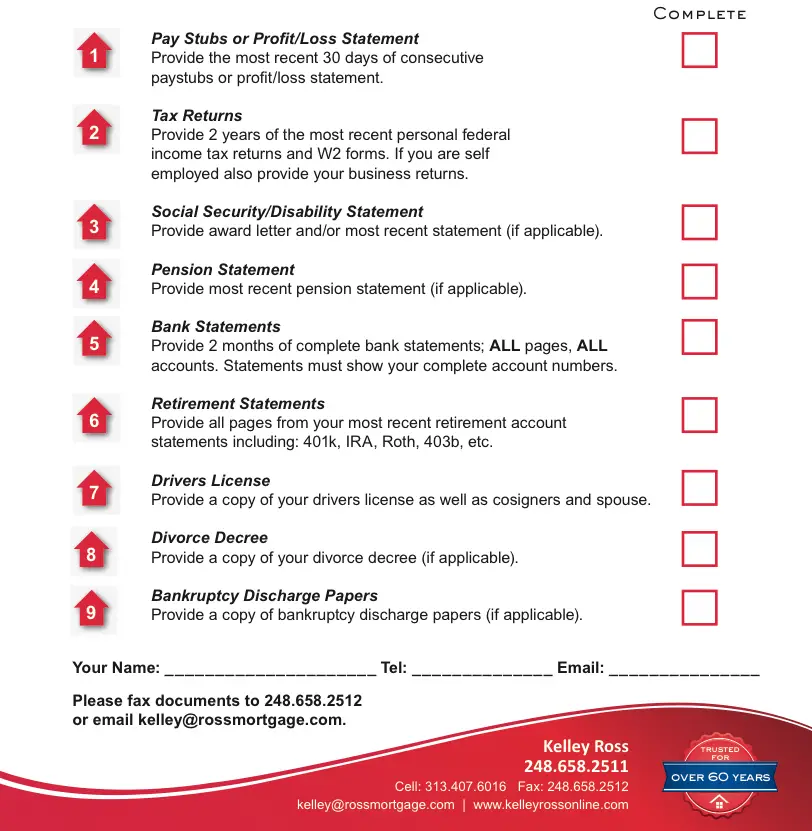

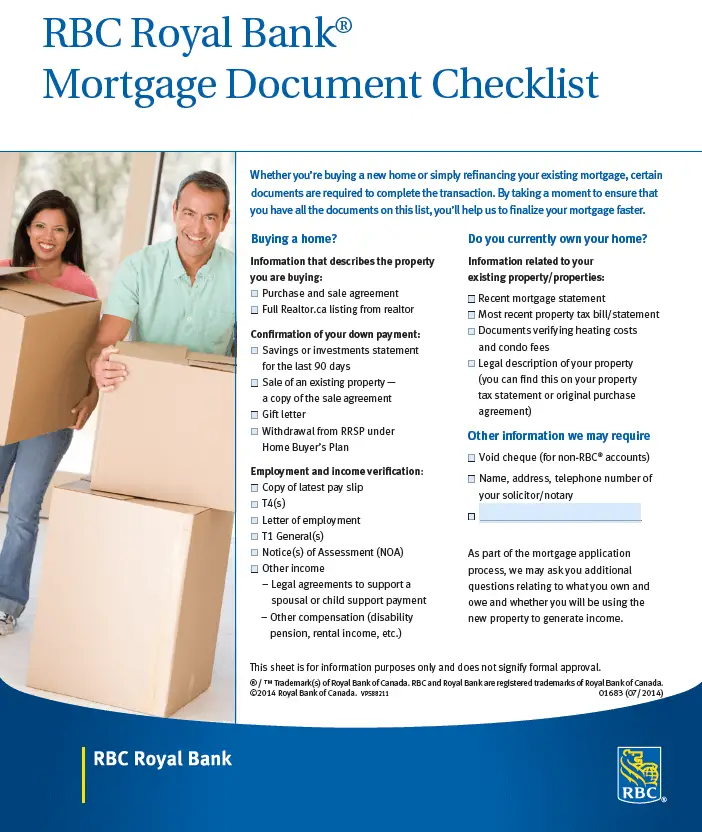

Your lender might ask you for some or all of the following when they verify your assets:

- Up to 60 days worth of account statements that confirm the assets in your checking and savings accounts

- The most recent statement from your retirement or investment account

- Documents for the sale of any assets you got rid of before you applied, such as a copy of the title transfer if you sold a car

- Proof and verification of any gift funds deposited into your account within the last 2 months

Your lender may also ask you for supplemental information on any debts you owe, like a student loan or an auto loan. Cooperation with your lender only makes the mortgage loan process easier, so be sure to provide any requested information as soon as possible.

How Can I Find Out How Much Is Owed On A House

Whether you’re a real estate investor looking for a bargain or curious about how much a current owner paid for a home when they bought it, the process to find the outstanding balance on a home can be accomplished in several ways–from simply asking to examining real estate records.

Tips

-

There are several ways to find out how much is owed on a home. You can ask the homeowner directly, speak with the lender or search the local newspaper for foreclosure amounts.

Pick The Right Type Of Mortgage

You have a choice of several types of mortgage. One is a conventional loan. Of those, you can choose between a fixed-rate loan and an adjustable-rate loan. There are also government-insured loans, such as a Federal Housing Administration loan or a Veterans Affairs loan. Each varies in terms of interest rates, down payment requirements, and other factors. Your mortgage lender can help you pick the best type for your situation.

Don’t Miss: Can You Get A Mortgage In A Different State

Is The Lowest Rate Always The Right Option

As a matter of fact, the lowest rate doesnt always indicate the right mortgage for you. There are various other factors to consider, such as the reputation of the lender, length of repayment plan, customer service, and other terms that apply to the loan. The combination of all of these factors will give you a good mortgage loan in general, and more importantly, the right loan for your specific situation. For example, someone who wants to take out a loan and pay it off over 30 years will not be well-served by a company that only offers 20-year repayment terms, even if it is offering competitive interest rates. Consider all the factors involved in the loan and not just the interest rate before deciding on a lender.

By using our content, products & services you agree to our Terms of Use and Privacy Policy.

Don’t Sell My Personal Information

Reproduction in whole or in part is strictly prohibited.

Honestly It Is Very Easy To Find Out Mortgage And Other Related Information On Properties Read Below To Know

Now that everything is online and the world literally worships the internet, it comes as no surprise that technical information is publicly available on the web.

Mortgages are public documents that are available for everyone to see. If you like a house and see a mortgage note on it, you can find out which company owns it by simply browsing through the internet. In this article were going to tell you ways to find out if there is a mortgage on the property.

Also Check: Should I Refinance My Mortgage With My Current Lender

Why Does My Coe Say This Veterans Basic Entitlement Is $0

This line on your COE is information for your lender. It shows that youve used your home loan benefit before and dont have remaining entitlement. If the basic entitlement listed on your COE is more than $0, you may have remaining entitlement and can use your benefit again.

On your COE, in the table called Prior Loans charged to entitlement, we list the amount of your entitlement youve already used under the Entitlement Charged column. Your entitlement can be restored when you sell your property and pay your VA-backed loan in full, or repay in full any claim weve paid.

What Is An Fha Case Number

An FHA case number is a unique 10-digit identifier given to a borrowers loan file. This number is assigned by the Federal Housing Administration and used by participating lenders throughout the mortgage process. The case number allows lenders to access the financial and credit history of the borrower, as well as any prior FHA-insured loans. It also provides important information about the property being purchased, such as the appraised value and loan limits.

The FHA case number must be included on all documents related to the loan application, including the Loan Estimate and Closing Disclosure forms. Borrowers can ask their lender for their FHA case number, or they can find it on their credit report. When applying for an FHA loan, its important to have all the required documentation ready, including the FHA case number. This number helps lenders verify your identity and pull your credit history.

When transferring your appraisal to a different lender when you got denied or you are not happy with your current lender you will need the FHA case number as well.

Recommended Reading: How Are 30 Year Mortgage Rates Determined

Which Lenders Will Do Loans With No Credit

Mortgage companies get to set their own credit minimums. And many want to see a traditional FICO score and healthy credit report.

But there are mortgage lenders who will accept loan applications with no credit history. You just might have to look a little harder to find them.

Local banks, credit unions, and specialized mortgage lenders are often more flexible than big-name banks. So those are a good place to start.

Or, contact a mortgage broker. These lending professionals work with multiple companies and have access to many different loan products. Theyll know which lenders offer the right programs and are willing to consider applications with no credit history. They can also help you find the best mortgage rates for someone with your creditworthiness.

How Does Your Debt

Lenders will also look at your debt-to-income ratio, or DTI, to get a clear picture of how risky it is to loan you money. Simply put, the higher your debt-to-income ratio, the more the lender will doubt your ability to pay the loan back.

Lenders have maximum DTIs in place that could stand in the way of getting approved for a mortgage. On conventional loans, for example, lenders usually like to see debt-to-income ratios under 43 percent, although in some cases, 50 percent is the cutoff. If you want to shrink your debt-to-income ratio before applying for a mortgage which is a good idea pay off your credit cards and other recurring debts like student loans and car payments.

Here’s how to figure out your DTI:

Add up your total monthly debt and divide it by your gross monthly income, which is how much you brought home before taxes and deductions. Heres an example:

- Add up your monthly debt: $1,200 + $200 + $150 + $85 = $1,635 total

- Now, divide your debt by your gross monthly income : 1,635 ÷ 4,000 = .40875. By rounding up, your DTI is 41 percent.

- If you get rid of the $85 monthly credit card payment, for example, your DTI would drop to 39 percent.

Recommended Reading: How Much To Save For A Mortgage

How Mortgage Records Are Used

Public mortgage records can tell you a lot about a home and its owner. Potentially, your clients could leverage this information to get a better price. For example, mortgage records may show if the sellers are divorcing. Using this information, your client could offer a lower price, knowing that the sellers are motivated to get rid of the property.

You also can find out how many times the home has been listed, removed, and relisted. This gives you peek into the listing and potential problems: Did the owner remove it because the market was slow or because something was wrong with the house? Was the seller just testing the market the first time? If so, it may mean the owner is motivated to sell, again giving your client an opportunity to offer a lower price.

What Is Cmhc Insurance

CMHC insurance protects lenders from mortgages that default. CMHC insurance is mandatory for all mortgages in Canada with down payments of less than 20% . This is an additional cost to you, and is calculated as a percentage of your total mortgage amount. For more information on mortgage default insurance rates, please read our guide to mortgage default insurance .

You May Like: How To Get Approved For Mortgage With Low Income

The Major Part Of Your Mortgage Payment Is The Principal And The Interest The Principal Is The Amount You Borrowed While The Interest Is The Sum You Pay The Lender For Borrowing It Your Lender Also Might Collect An Extra Amount Every Month To Put Into Escrow Money That The Lender Then Typically Pays Directly To The Local Property Tax Collector And To Your Insurance Carrier

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, you’ll have an additional policy, and if you’re in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the home’s purchase price, you’ll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

How To Use A How Much Can I Borrow Mortgage Calculator

With this calculator, you can run some what-if scenarios. For example, you may consider:

-

How long will I live in this home? That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. The longer term will provide a more affordable monthly payment, but youll pay a lot more interest over the long term. A 15-year fixed-rate mortgage will cost you way less interest over the life of the loan, but your monthly payment will be considerably more.

-

Is an adjustable-rate mortgage a better option for me? If you plan on being in this home for just a few years, a 5/1 ARM could be a good option. Youll enjoy a lower initial interest rate thats fixed for five years, but the rate changes annually after that.

-

Am I trying to buy too much house? Sure, lenders may be more than happy to put your name on a big loan, but how do you feel about it? Are you comfortable with how it may impact your monthly budget, or are you feeling a bit stretched? Consider how your new home costs may impact your other spending goals, such as travel and savings.

-

How much of a down payment should I make? Its always the big question. Are you putting down as little as possible and having to make up for it with larger monthly payments and possibly having to pay mortgage insurance?

You May Like: How To Lower Your Mortgage Payment Without Refinancing

Things A Title Search Can Tell You About A Property

InfoTrack

12 December 2018

There are many circumstances in life when you may need to conduct a title search to get a Certificate of Title buying or selling property, proving ownership, refinancing your mortgage and the list goes on. But what exactly is a Certificate of Title and what can it tell you about a property?

Invest In Technology That Performs

Real estate professionals already know all too well just how much work goes into closing a deal. Theres a lot of hands-on effort that has to be invested from start-to-finish in order for buyers and sellers to walk away happy. Taking the DIY approach is only going to wear you out. Whether youre working independently, with a brokerage, or even with your own team, having the right tools and technology at your side can save you substantial time and energy.

Here at paymints.io, we believe the best real estate solutions are built by individuals who understand the industry and thats why were backed by real estate, tech, lending, and title company professionals who know just what agents and brokerages need to perform. When you choose paymints.io, youre choosing a highly reliable, highly secure, and highly flexible platform that will grow with you as you gain clients and continue upping your sales volume.

Interested in learning more about what paymints.io can do for your real estate transactions? Schedule a demo today and well walk you through all the things that make our platform great.

Also Check: What Is A Mortgage Rate Lock

House Prices And Stamp Duty

As well as more expensive mortgages, those looking to buy or move home are grappling with asking asking prices that are 7.2% higher than 12 months ago, according to Rightmove. Its latest House Price Index found that the average cost of property coming to market in November stands at £366,999.

However, it also reported further signs of a slowing market, with asking prices dropping by 1.1% compared to last month, while the annual rate of inflation slowed from 7.8%.

Stamp Duty cuts announced in Septembers ill-fated Mini Budget which raised the nil-rate band on the purchase of a property from £125,000 to £250,000 means that a third of all homes listed on Rightmove are also now exempt from the tax. While u-turns were made on the other tax breaks announced under former Prime Minister Liz Truss, this one will remain in place.

Mortgage Records And Promissory Notes Are Not The Same Thing

Many clients confuse promissory notes and mortgages or think they’re the same thing. They arent. While a promissory note is the borrower’s promise to the lender, the mortgage is what secures that promise. When one buys a house, the purchaser signs a promissory note, essentially an IOU. This is the promise to repay the loan.

A promissory note contains:

- The names of the borrowers,

- The location of the property,

- The value of the loan,

- The terms of the loan, and

- The interest rate, whether its fixed or adjustable.

As with an IOU, the lender keeps the promissory note on file until it is paid. Once paid in full, the note is returned to the homeowners. The mortgage gives the lender the power to ensure the loan is repaid and the power to reclaim the property it if need be. Essentially, the mortgage document allows lenders to demand payment and foreclose on property if the terms of the mortgage arent met.

The public record of a mortgage document shows:

- The names of the borrowers,

- The location of the property,

- The property description in legal terms,

- Whether the loan is in good standing, and any

- Assignments or endorsements on the loan.

The mortgage becomes a public record soon after it is signed and remains a public record for the loans duration. Once the mortgage is fully paid, the lender releases the mortgage.

Don’t Miss: How To See If You Qualify For A Mortgage

What Is A Mortgage Discharge

A mortgage is a loan secured by property, such as a home. When you take out a mortgage, the lender registers an interest in, or a charge on, your property. This means the lender has a legal right to take your property. They can take your property if you dont respect the terms and conditions of your mortgage contract. This includes paying on time and maintaining your home.

When you pay off your mortgage and meet the terms and conditions of your mortgage contract, the lender doesnt automatically give up the rights to your property. There are steps you need to take. This process is called discharging a mortgage.

What A How Much Can I Borrow Calculator Does

The NerdWallet How much can I borrow? mortgage calculator utilizes an easy step-by-step process:

To begin, input:

-

Your annual income

-

The mortgage term youll be seeking

-

Your monthly recurring debt

If you dont know how much your recurring debt payments add up to in a month, click the No. Help me! button. Well walk you through typical debts, like car loans and student debt.

At this point, well estimate your property taxes and insurance. You can also adjust those numbers if you have specific estimates.

Enter monthly HOA dues if you know what theyll be. If not, you can always come back to this later.

Now, your results will appear, including:

-

An estimate of the maximum mortgage amount that NerdWallet recommends

-

A ballpark of your monthly mortgage payment

-

The maximum amount a lender might qualify you for

-

And how much your monthly mortgage payment might be for that amount

Don’t Miss: Can I Buy Another House If I Have A Mortgage

How To Figure Mortgage Interest On Your Home Loan

Elizabeth Weintraub is a nationally recognized expert in real estate, titles, and escrow. She is a licensed Realtor and broker with more than 40 years of experience in titles and escrow. Her expertise has appeared in the New York Times, Washington Post, CBS Evening News, and HGTVâs House Hunters.

All homeowners should know how to figure mortgage interest. Whether you are financing the purchase of a home or refinancing your existing mortgage loan with a new loan, you will prepay interest.

How much interest is prepaid will determine when you want your first regular payment to begin. Many borrowers prefer to make a mortgage payment on the first of every month. Some prefer the 15th. Sometimes, lenders will choose that payment date for you, so if you have a preference, ask.