How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Finding Out Whether Your Deed Was Actually Recorded

Few people are aware that there could be a problem with their deed until they attempt to sell their property or refinance a mortgage. To find out earlier rather than later, contact your attorney or escrow agent and ask for a copy of the recording page for your deed.

The recording page lists the date the deed was recorded and also the volume and page number where your deed can be found. Many counties provide access to real property records online and free of charge.

Are Car Loans Public Record

- Post published:December 15, 2019

- Post category:Loans

When it comes to creditworthiness, consumers are rightfully confused. Does a car loan constitute a public record? Who can access such information? And how do public records impact your credit score? Fortunately, weve researched the topic in-depth and can help set you straight on car loan concerns on your credit report.

Car loans are technically not part of your public record. Typically, your loan information is only available to you and the lender, plus the credit reporting agencies that follow such transactions. However, a car loan could become a public record if the loan falls under a bankruptcy case or court judgment.

Yes, thats a lot to take inbut well cover the details here, including what records are public, how they can become public, and how to remove them from your record when applicable.

Read Also: How Do I Become An Underwriter For Mortgage

Car Loans As Part Of A Judgment

Typically, a car loan isnt a public record. It shows up on your credit report, which indicates whether you pay on time and if youve paid late, by what margin . But your coworker or neighbor cant view those records by putting in a request at the courthouse or searching online.

However, anyone who has legal access to your credit report can view your loan status. This includes any other lenders with whom you apply for credit, a mortgage, or any other financial packageincluding a bank account. Even car insurance companies can check your credit to decide whether youre a risk.

However, when it comes to your car loan, the agreement between you and the lender is a legally binding document. Therefore, if you dont pay, the lender could file a judgment against you. Court judgments are different than car loansand much more severe.

What To Do If Your Deed Was Not Recorded

If the deed to your property has not been recorded, inform your attorney or title insurance company immediately. Request that it take action to have your deed recorded as soon as possible. You should also inform your mortgage lender, as it might be able to assist you with recording your deed.

It is relatively easy to confirm that your deed has been recorded. If there is a problem, discovering it before something worse has arisen could save you from expense and enormous inconvenience. Contact your attorney, title insurance agent, or real estate broker to learn more.

Also Check: How Quickly Will I Pay Off My Mortgage

What Is A Mortgage Note

A mortgage note is the legal document that requires a borrower to repay a home loan and secures the home as collateral. The note has two parts:

Your mortgage note spells out all your loan details: how much you put down on your home purchase, the specific repayment terms, and discloses what will happen if you fail to uphold your end of the bargain.

» NEED AN EXPERT?Try Clever Real Estate! Match with top local realtors, who can help you set your budget, refer you to trusted local mortgage lenders â and much more!

Where Is A Mortgage Note Recorded

county land recordsThe mortgage or deed of trust is recorded in the county land records, usually shortly after the borrowers sign it. If the loan is fully repaid, the lender will record a release of mortgage or a reconveyance of deed in the county land records.

How do I find mortgage documents?

Go to the county recorders office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorders office. Check with the tax assessor or other municipal office where you live for more details.

How do I find my mortgage records online?

The mortgage records you need to access will be filed with the county the property resides in. You can either visit that countys public records or clerks office in person, or check their website to see if a search can be conducted online.

What is a copy of note on mortgage?

At closing, the borrower will receive a copy of the mortgage note. This is part of the legal process and helps the borrower to understand what their responsibility is in paying back a loan. Once they have paid off the entirety of the loan, they will receive the deed to their home.

Don’t Miss: How To Get A Mortgage Loan With No Credit

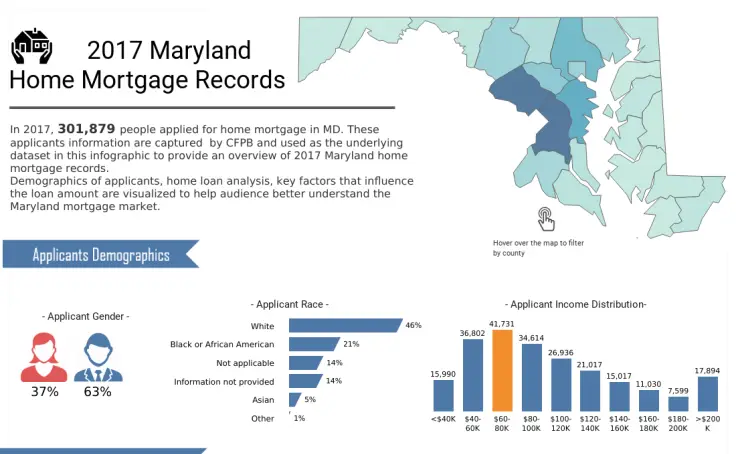

When Do Mortgage Records Become Public

When a homeowner receives a home deed, he or she must file the original deed with the appropriate government office. This is often the duty of the escrow agent or title agent. The home deed proves that ownership has transferred from one owner to another. The process of bringing the deed to the recorders office is called recording the deed. This is the only way the transfer is legally recognized. Deeds that are properly recorded reach the office within two weeks to three months after the house closes.

Each state has different laws, called recording statutes, regarding home deeds and mortgage documents. Although the requirements vary from state-to-state, each state requires the formal recording of real property in a county office in order to be valid. This means that almost every properly recorded property will have a mortgage record on public file .

Soon after the homeowner closes a mortgage, the information becomes part of the public record. The public can access these documents from the state recorders office or using an online public records search for the duration of the loan. Once the homeowner pays the full amount of the mortgage, the lender releases it. After this time, the lender can no longer sell the mortgage to another lender.

Is The Land Registry Proof Of Ownership

The land registry comes with some key pieces of information for a property, including the property address, a description of the property, the purchase price, and the current owners. It generally proves ownership by removing any claims against adverse possession by unintended inhabitants like squatters.

You May Like: How Long Will Mortgage Interest Rates Stay Low

How Long Does A Public Record Remain On Your Credit Report

Public records can remain on your credit report for three to ten years. The amount of time depends on what the public record is exactly. While public records can stay on your credit report for a long time, the impact it generally has fades with time. Moreover, it will eventually be removed from your credit report.

| Negative Remark |

| 2 |

A Bankruptcy On Credit Reports

A credit report reflects only public record information covering bankruptcy. Both types of bankruptcy can remain on your credit report for up to ten years, potentially affecting your creditworthiness.

Chapter 7, bankruptcy is the most common and involves selling your possessions to settle with creditors. It stays on your credit report for up to ten years. Chapter 13 includes you keeping your property but paying the debt you owe. This type typically drops off your credit report in seven years.

Don’t Miss: How Much Would Payments Be On A 70000 Mortgage

Do You Have To Disclose A Foreclosure

It is necessary to disclosed foreclosures for record purposes. Notices are already placed on various channels as soon as the borrower files for foreclosures in any home. Many people will be aware of foreclosure homes as soon as the foreclosures have been brought to the notice of the court, so it can not be secreted.

Search Local Public Records

While you can find mortgage information on a property in any state, the department you need to contact may be different. Look for a county clerk’s office, office of public records or a public recorder’s office. Middlesex County, NJ holds its public mortgage records at the county clerk’s office. The office has mortgage records dating all the way back to 1683. You can use its online system seven days a week, but only between the hours of 5 a.m. and 11 p.m.

Georgia’s Department of Revenue provides links to each county’s board of assessor’s office, which is where you’ll be able to conduct a search to find someone’s mortgage balance. For example, Chatham County’s Consolidated Tax Commissioner & Board of Assessors allows you to search by entering either the property address, the property ID number or the owner’s name. Although the physical office is open from 8 a.m. to 5 p.m. every weekday, you can use the website anytime.

You May Like: Why Are Reverse Mortgages A Bad Idea Dave Ramsey

Benefits Of Public Information

While each of us as individuals want our privacy respected, we also want to be able to have information about others to determine their creditworthiness to find out if they belong on our family tree to contact them to complain about their barking dogs or to sell them something and, if we are a candidate, to know if they are registered to vote in case we want to influence them. Many times we want organizations to be able to find out about us: our marital status for Social Security or pension purposes our birth data for a passport or little league death certificates for clearing title to property or obtaining benefits payable on death.

As custodian of these records, the Assessor-Recorder/County Clerk/Registrar is neutral on whether the information is public or confidential since that decision is left to the legislature and the courts. However, in making decisions about the electronic dissemination of records, the custodian is in the middle of the conflict between the goal of an open society based on easy communication and the concern of individuals to protect their privacy.

What Can You Learn From Public Property Records

Public property records contain several pieces of information that you might find valuable as you look to buy a house, including:

- Sales history, including who owned the home and what they paid for it

- Tax history, including current tax liens

- Deed history, including encumbrances and other liens

- Size of the lot

- Number of bedrooms and bathrooms

- Zoning information

Shopping around for a home can be stressful. Fortunately, Credible simplifies the mortgage process and makes comparing multiple lenders easy. You can see prequalified rates from our partner lenders and generate a streamlined pre-approval letter in just a few minutes.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

You May Like: How Much Is A Home Mortgage

What Recording Protects You From

Maguire notes that failure to record the deed can lead to bad outcomes.

It can make it impossible for you to obtain title insurance or borrow money from a lender. And it can invite challenges to the validity of your ownership of the property, he says.

The latter scenario is the most worrisome.

What if your homes seller conveyed the deed to you and another buyer? Now you have two different buyers with a claim on the same property, says Swan. Assume you never recorded the deed. And say buyer two never knew that you also had a deed. Buyer two actually has a better chance of being awarded the property in most jurisdictions.

The good news? Your lender requires you to buy title insurance. This protects you if a title defect, lien or claim of ownership arises before or after you buy your home.

If there is a title defect, the title company must correct it or pay you damages, Whitman says. But even with title insurance, its still important for you to pay attention to your real estate records.

Locate Information On The Property

Before searching public mortgage records, you need to obtain a few basic pieces of information about the property. Chances are you already know the property’s street address, which is typically displayed on the MLS listing. Real estate listings may not contain the name of the mortgage holder, however. All you need to do to get the name of the mortgage holder is contact the listing agent. If you aren’t familiar with which county the property resides in, you can ask the listing agent for that information as well, or do an internet search.

Sites like Realtor.com and Zillow are easily accessible and can give you information on homes that are for sale, as well as houses that are off market. Once you type the address in the search bar, you’ll be able to see a map of the property, lot size, year built, property tax information for the past several years and how much the home previously sold for.

Also Check: Does Debt To Income Include Mortgage

Lawsuits On Credit Reports

Lawsuits can also show up on credit reports as public records because they are public knowledge via the court system. However, credit reports only indicate the judgment of the case is the judgment includes specific identifying information, such as your name, address, and social security number or birthdate.

Is Zillow Foreclosure Information Accurate

To ascertain whether or not a property is one of the foreclosures in any state either by the bank, companies, or individual lenders, it is necessary to search on the Zillow website.

It also provides individuals and real estate agents with properties that are in foreclosure. It gives you a list of properties that are not dept free.

But in some situations, Zillow would publish inaccurate information. For instance, if the borrower has filed for pre-foreclosure to a court of law, that does not mean that the property will be placed on sale.

Recommended Reading: Can My Parents Cosign A Mortgage

What Is A Public Record

A public record is any municipal, provincial, or federal documentation that is accessible to the general public. Broadly speaking, public records refer to all legal and government matters which are too vast to discuss entirely in this article. In relation to credit reports, you can expect to see the following types of public records:

Bankruptcies

Bankruptcy is a legal procedure in Canada that absolves you of most, if not all your debt. However, you may lose your assets in the process. Bankruptcy is filed through a Licensed Insolvency Trustee and is considered a last resort. When you file for bankruptcy, the credit bureaus will be notified and it will become part of the public records. These records will be accessible to anyone who wishes to see it.

Consumer Proposals

A consumer proposal is another legal process that can absolve you of your debts, however, your debt should be no more than $250,000 and you must have the financial capability to repay a percentage of your debts. Consumer proposals generally last between 2 5 years, with 5 years being the maximum time you must repay your debt. Like bankruptcy, this program is filed through a Licensed Insolvency Trustee and will be reported to the credit bureaus. This information will also become part of the public records and will be accessible to anyone who requests it.

Debt Management Programs

Liens

Dont Ignore Your Debt Problems

Although tax liens and judgments might not appear on your credit reports today, there are still plenty of reasons to avoid them.

Its true you probably didnt wake up one morning and decide you were no longer going to pay your bills. Thats not the way financial and credit problems start for most people.

Still, even if youre struggling with bills you cant pay, you can avoid many tax liens and judgments simply by communicating with the agency or company to whom you owe the debt. The IRS, for example, offers payment plans for taxpayers who cant afford to pay their tax bills in full. Your creditors might be willing to settle your debt for less, as well.

One fact is clear. When youre in over your head financially, ignoring your problems isnt the answer.

Talk to your creditors or consider getting legal help or credit counseling. In extreme cases, bankruptcy might be your best option. Whatever financial challenge youre facing, youll be far better off to face it head on and deal with the consequences, rather than ignoring your problem and allowing it to grow.

Recommended Reading: Will I Prequalify For A Mortgage