The Graduated Payment Mortgage

The graduated payment mortgage or GPM has a fixed interest rate with adjusting payments. It typically has a low initial monthly payment that increases over time. These loans are sometimes used for student loans, but they can be found in real estate, too. This is a type of negative amortization loan. There is a risk that the person who purchased the home will be unable to make the later, higher payments.

Reputable Note Brokers: Find Notes For Sale

Although not always licensed as official brokers, the market makers below connect sellers with note buyers for a fee. Typically, a successful transaction earns the matchmaker ~3% of the contract price but as you will see with some of the new platforms, this can also be structured as a flat fee when leveraging the efficiency & automation potential of a self-serve online platform.

Mission Capital Advisors

When youve scaled your note business to take on larger portfolio these guys should be on your list. Mission Capital Advisors represents banks, mortgage companies, large institutions, government agencies and investors to liquidate portfolios of mortgage notes, REO & other real estate assets. Most of their trades are over $100MM of principal balance. See what they have currently available on the Mission Market.

MountainView Financial Services

Recently acquired by SitusAMC, MountainView has been a major player in the secondary market for whole loans and securitization for decades. As a portfolio company under SitusAMC, their loan sales will likely be reserved for large institutions and hedge funds. They are certainly worth a call when your note buying efforts scale past the smaller trades offered by the principal sellers on this list.

First Financial Network

Rincon Advisory Mortgage Services

SN Trading

Fha Loan Requirements Oregon

1. FHA Loan Limits for OREGON Lending Limits for FHA Loans in OREGON Counties $483,000, $618,300, $747,400 County Name1 Unit2 Units3 Units4 UnitsBAKER$420,680$538,650$651,050$809,150BENTON$483,000$618,300$747,400$928,850CLACKAMAS$598,000$765,550$925,350$1,150,000View 33 more rows Oregon FHA Lenders FHA Loans The down payment requirements for an FHA loan is the same in every state. The minimum requirement

You May Like: How Many Months Bank Statements For Mortgage

Who Holds The Original Mortgage Note

Because a mortgage note is a security instrument, it can be bought and sold on the secondary mortgage market. Therefore, mortgage lenders sometimes sell mortgage notes to real estate investors who are attracted to these relatively risk-free investments and the potential to earn passive income.

Because lending institutions sell mortgage notes, real estate investors technically own a mortgaged property. These investments are low-risk, because the only way investors will lose money is if a borrower defaults on their loan or avoids paying interest by prepaying their mortgage. Even in the latter situation they may not lose money but also wouldnt make much money because they wouldnt be earning interest.

Regardless of who holds the mortgage note, the borrower is obligated to follow the terms of the mortgage. The borrower wont be affected by any change in who holds the note because the payments will consistently be made to a third-party entity throughout the life of their loan.

The borrower wont have the original copy of their mortgage note until theyve paid off their loan. At closing, the borrower will receive a copy of the mortgage note.

This is part of the legal process and helps the borrower to understand what their responsibility is in paying back a loan. Once theyve paid off the entirety of the loan, theyll receive the deed to their home.

What Types Of Notes Are There

There are two broad categories of residential real estate notes you can invest in performing notes and non-performing notes. If you want to break it down further, though its beyond the scope of this guide, within each category investors can focus on senior or junior lien positions. A further breakdown into these categories is explained below:

1. Performing Notes these are notes where the borrower is making their scheduled payments. As an investor, the primary focus is on current income.

2. Non-Performing Notes these are generally sold by banks and other financial institutions and are sold at generally very deep discounts, perhaps between 50-90%. Since the borrower is not making their scheduled payments, the goal as an investor is to either modify the loan in conjunction with the homeowner, reach a lump-sum settlement with the homeowner, or foreclose on the property if needed. Returns can be higher, but often carry more risk.

Don’t Miss: Does Ally Bank Do Mortgages

How To Buy Performing Notes

Cash-flowing mortgage notes that are traded on the secondary market are generally Re-Performing, they were once in default but the borrower is back on track, typically after signing a modification agreement. Performing notes that are paying as-agreed with no default are also sometimes available for sale but are most likely privately-originated loans and are not from institutional sources. Performing, institutionally-originated loans are pretty much exclusively sold to other large institutional buyers for the highest prices .

The first thing to do when you are offered a Cash-flowing Note for sale

Before we get into the important steps of finding & vetting sellers and completing your full due diligence process, youll want to remember this valuable tip for when a seller sends you a loan for sale so you can reply to them quickly & get the ball rolling. Youll want to keep your sellers happy so they think of you first when they have loans for sale!

In order to avoid wasting your sellers time when they send you a potential asset to purchase there are a few things you can do in less than 5-10 minutes to determine whether you want to proceed with the trade:

Your pricing model doesnt have to be complicated. In fact, you can easily check the cash-on-cash return with this simple formula: * 12) / asking price.

*12 = $5,760 annual income / .15 = $38,400 purchase price

2. Confirm the loan is secured

The Risks Of Investing In Mortgage Notes

These notes are not FDIC insured. Instead, it is secured by a property whose condition may not be great. And youre not responsible for its upkeep. Yet you want to verify the condition of the property before you buy it, or else youre paying less than the property is worth. You run the risk of having to pay money to get what youre owed.

You will have to pay various legal fees to foreclose on the property. You may have to sue to get back mortgage payments, too. Know the foreclosure laws for the area where the property is located, especially if youre considering buying a non-performing loan. Non-performing assets also depreciate because while your expenses continue the property is most likely not be well kept. Even if there is some appreciation in the property value, it is usually offset by the expenses you are spending. They have a high risk of default which is bad for your cash flow.

The mortgage note investing industry is not very regulated as of now. Before entering the mortgage note investing space know the fact that this is a risky business. You can buy a mortgage note without the permission of the person who lives in the property. When you buy a note and mortgage from the lender, you’re buying the debt that remains to be paid on the note, secured by the asset outlined in the mortgage.

Summary

Don’t Miss: Who Offers 20 Year Mortgages

Note Buying Due Diligence

Mortgage note due diligence processes closely correlate with the note buying strategy youre pursuing. In all cases, youll want to see a title report.

Buying a multi-million dollar loan to own single, small-balance commercial note on which you intend to promptly foreclose requires a very different due diligence process than 100 non-performing junior liens that youre buying for six cents on the dollar and plan to rehab and modify.

Want to shortcut the note due diligence? Contact our expert residential note evaluations partner, Craig Everett, who will do it for you. Youre welcome.

EVALUATING NOTES WITH LASER LOAN ACQUISITION SUITABILITY AND EVALUATION RATING

LASER creator Pat Blount has been in the note business since the late 80s. Hes flown around the country to more than 2,000 banks and has sold many billions in non-performing notes. Pat put together the LASER system in response to a Request for Proposal from the FDIC for a note-evaluating system.

LASER is the Loan Acquisition Suitability and Evaluation Rating system. Theres a reason its called that and not the Loan Valuation System.

HOW DOES LASER HELP?

LASER asks you 25 or 30 questions about the note. You take the numbers of your ratings, and then use that figure to decide if the acquisition is appropriate based on your desired returns and investment criteria.

You start with a strategy. Then you ask a series of questions to evaluate whether the note purchase will help you achieve your investment objectives.

S To Start Buying Bank Direct Mortgage Notes

We cover these steps and their components in-depth in our free training webinar and our BankProspector software provides the prospect information including the list of banks and credit unions as well as decision-makers and their contact info.

Some of the banks you call today will have notes that they are looking to sell. The vast majority of them wont have something on their desk today but they might next week, next month, next quarter, or even next year. Unless youre a very short-term buyer, you can see how it makes sense to have a system of communication that keeps you in touch.

Don’t Miss: Can You Change Your Mortgage Rate After Locking

Benefits Of Mortgage Note Investing:

What To Know About Mortgage Notes

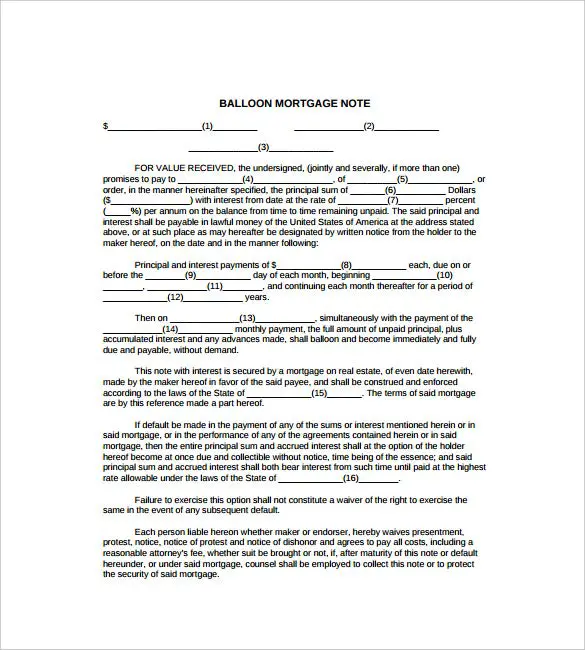

Your mortgage note lays out all the specifics of your loan, including the following:

- Rate of interest

- Terms of your loan

- Payment due dates

- Penalties and fees for not meeting your payment due dates or other terms of your loan

Your mortgage note is also a contract pledging your property as security for the money youre borrowing. It gives the lender the right to repossess the property if you dont keep your end of the bargain by making payments promptly and regularly, as spelled out in the contract.

As you can see, your mortgage note is an essential contract and an important legal document, so if youre buying a home for the first time, make sure you put your mortgage note in a safe place where you know youll be able to find it.

It would be a good idea to have a digital copy of it as well, in case your home is destroyed by flood or fire. However, if disaster strikes and youre unprepared, know that your lender has a copy as well.

Read Also: What’s Happening With Mortgage Interest Rates

Where Can You Invest In Mortgage Notes

There are many ways and sources to buy notes: including banks, crowdfunding sites, individual sellers, funds, online exchanges, and mortgage note online marketplaces like, Paperstac.

However, many investors prefer investing in a fund, a more passive approach to investing in this asset class. This eliminates many of the difficulties associated with the active management of these assets. Also, this allows investors the chance to leverage the expertise of industry experts.

How Do I Know Which Banks Are Selling Mortgage Notes

Identify note sellers by starting with local and regional lenders. Thousands of banks and credit unions sell notes throughout the U.S., but long-term note buying success usually involves doing business with lenders near you.

Finding banks with non-performing notes for sale requires research and efficient, effective communication.

Since there isnt a centralized list of banks selling notes, you may need to check a few sources for prospects. Top bank prospecting tools include:

Don’t Miss: What Mortgage Terms Are Available

What Is A Real Estate Note

A real estate note, also called a mortgage note, is a promissory note associated with a mortgage or deed in trust. The mortgage allows the lender to take possession of the real estate in the case of a default, while the note is the borrowers promise to pay back the loan.

Notes can be bought, sold, or otherwise transferred as long as there is an outstanding balance. When you purchase a real estate note, you acquire the right to receive the borrowers future mortgage payments.

Read Also: Chase Mortgage Recast Fee

Look At The Terms Of The Note

Many loans have fixed interest rates, meaning that youll pay each month regardless of how much money you save or borrow. Other loans have variable rates, which can change based on your balance and other factors.

The interest rate on a loan will be different than the interest rates on , so you want to make sure that the note youre considering has a fixed rate and will still be there in the future.

Also Check: What Percentage Of Household Income Should Go To Mortgage

Note Investing Crowdfunding Websites

If you want the income from mortgage notes, but do not necessarily want to commit to the steep learning curve, time, effort and resources it takes to buy individual mortgage notes, you can instead look to one of many crowdfunding platforms that offer notes for sale.

The Title III of the JOBS Act the Crowdfund Act was finally adopted by the SEC in October, 2015. This new law allowed companies to use crowdfunding to issue securities, something that was not previously permitted.

Crowdfunding is especially prevalent in the real estate industry. There are a number of fairly well-established crowdfunding website offering small partial investments in single family homes, multifamily properties, industrial real estate and real estate debt.

Faster Contracts With Sony Bank

When Sony Bank was first established in 2001, the Tokyo-based institution often finalized contracts and loans in weeks. After digitizing their workflow and introducing e-signatures into their loan-processing system, contracts and documents that once took weeks could be processed in as little as an hour, benefiting borrowers and lenders alike.

You May Like: How To Fill Out A Pre Approval For Mortgage

Note Brokers And Funds

We have already covered a bunch of online note investing platforms, and some of the best note crowdfunding website. Now, lets talk about brokers and funds.

Note brokers typically buy mortgage notes wholesale from banks and other large investors, some of these notes they will keep, others they will offer for sale. You will find that brokers offer a range of notes for sale to the general public, including re-performing notes they have worked out, to straight up flipping the trash notesthey do not want or have not been able to work out themselves.

Note funds are collective investments that offer shares, units or memberships in a fund. The fund will use investor capital to will buy mortgage notes, and the fund manager will then work out those loans to the most appropriate exit strategy . Often these funds offer a fixed return to their investors, with excess profits going to the fund manager.

How To Find Your Own Sources To Buy Mortgage Notes

All the above sources are more-or-less publicly accessible to qualified note buyers. That means pricing will be higher & competition for the best assets will be fierce. That doesnt mean that deals found through these sources wont be profitable note investing is significantly less competitive than other asset classes and even at the highest pricing, returns are higher than in most other investments. To take your note business to the next level, follow these strategies for a competitive advantage as you find off-market sellers for exclusive acquisition opportunities.

Reverse Inquiries to Foreclosing Lenders & their Counsel

When a lender enforces their interest in a borrowers collateral through the foreclosure process, the process is documented in the courts & public records. This give savvy note buyers a window into the operations of the lenders & attorneys that are working through portfolios of defaulted mortgage notes.

Don’t Miss: How Much Is A 150 000 Mortgage Per Month

Private Mortgage Note Buyers

Both traditional and private mortgages include a mortgage note, but traditional mortgage payments are sent to a bank. This differs from private mortgage payments, where the borrower instead pays a private person or institution.

The owner of a private mortgage note can decide to keep the note and receive the monthly payments from the borrower or sell the note to a mortgage note buyer. If the owner of the private mortgage note decides to sell it, the amount of money they will receive varies on a few different factors.

These factors may include:

- The amount and interest rate of remaining payments

- The length of mortgage term

- The down payment made on the note

Reasons Consumers Choose Private Mortgages

Stricter lending requirements and bruised credit scores led to an influx of private mortgage notes after the recent recession.

During the recession, many homes were left abandoned and fell into disrepair, making getting traditional mortgages next to impossible. Because homes must pass an inspection as part of a bank-based mortgage, a home that needs extensive repairs or renovations may only be able to be purchased through a private mortgage.

Those with less-than-perfect credit and those who are self-employed can turn to private mortgages when they might not qualify for traditional bank options.

Others use private mortgages to keep an asset in the family. If one family member is selling a home and another family member needs a home, it can make sense to pay the interest on a home loan to a family member rather than a faceless bank.

Recommended Reading: Do You Have To Pay Fees To Refinance A Mortgage