Is It Important To Compare Mortgage Rates

Comparing mortgage rates is one way to save money on your home loan. If you accept the first offer you see, you may regret it later. With so much competition in the lending industry today, you can usually find a lower rate if you do a little price comparison.

The easiest way to find low rates is to shop around. This is really easy in todays internet-driven world. There are loan calculators, comparison tools, lender portals, and more all designed to help you line up offers to see which is giving you the right deal.

How Does Your Credit Score Affect Your Rate

Your credit score measures your likelihood of making continuous, on-time mortgage payments. Homebuyers with higher credit scores seem less risky to lenders. So, in general, the higher your credit score, the lower your mortgage rate. But other factors such as your personal debt, down payment size, and loan program also influence your rate.

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower rate and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

Also Check: How Long Is A Credit Report Good For Mortgage

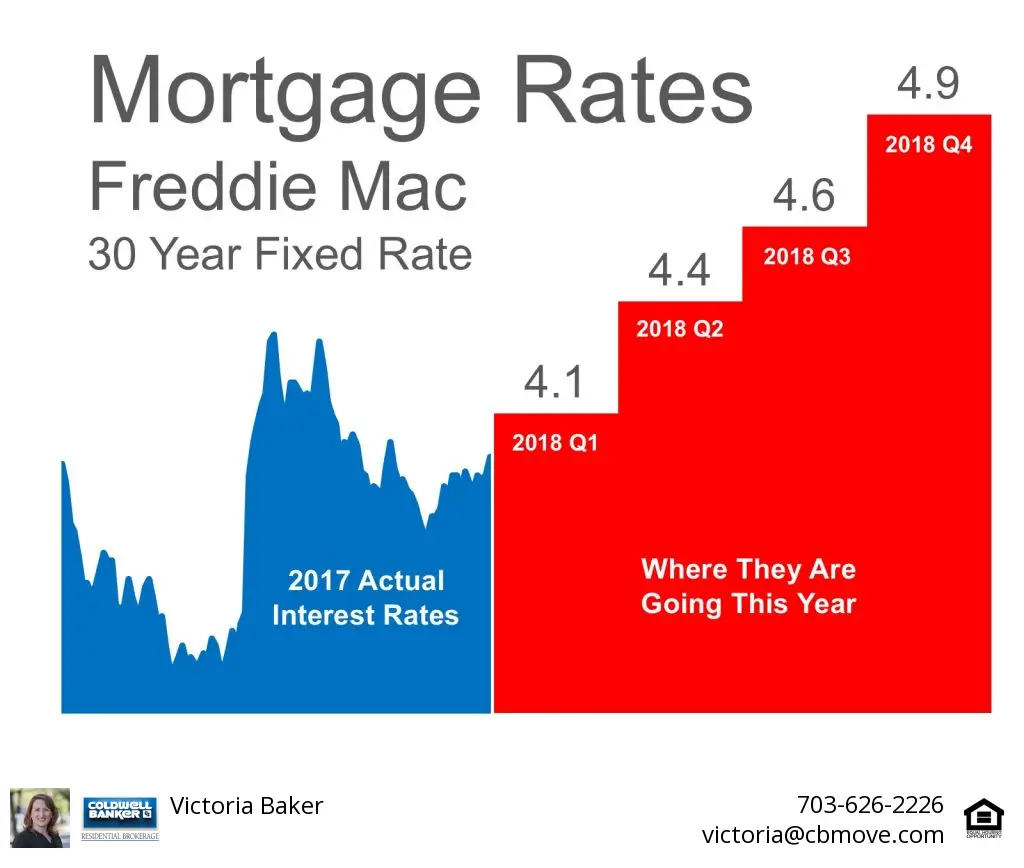

When Should I Lock My Mortgage Rate

Its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, ask your lender for a float down. With this option, you get the lower of the two rates. Pay attention to the fine print, though. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

Open Vs Closed Mortgages

If youâre wondering whether to get an open or closed mortgage, the answer is, while an open mortgage may make sense in certain circumstances, the overwhelming majority of Canadians opt for a closed mortgage. While open mortgages have extra flexibility that you might need, closed mortgages are by far the more popular choice not only due to their lower rates, but also because most home buyers do not intend to pay off their mortgages in the short term. Moreover, fixed-rate open mortgages do not exist and variable-rate mortgages are very rare. The most common type of open mortgage is the Home Equity Line of Credit . Below are some quick facts about the differences between open and closed mortgages, and you can also find more detailed information on our blog about open vs. closed mortgages.

Read Also: A 30 Year Mortgage Payment Chart

What Do Mortgage Lenders Consider When Reviewing Applications

Each lender has its own requirements for loan approval. However, most mortgage lenders require a debt-to-income ratio of no more than 43% and a credit score of at least 580 depending on the type of mortgage. You must also account for your down payment funds and show a work history of at least two years. The property must meet the lenders appraisal requirements.

Qualifying For A 30 Year Fixed Mortgage

Those applying for a 30 year or 15 year fixed mortgage will first be required to be preapproved.

Why you should have a credit preapproval:

You May Like: When Are Daily Mortgage Rates Released

How Do You Calculate A Mortgage Payment

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much youll pay over time.

Whats The Difference Between An Adjustable And A Fixed

A fixed-rate mortgage has the same interest rate for the life of the loan. Adjustable-rate mortgages have a low fixed rate for an initial period, often one year. The terms of your loan indicate how and when the rate will adjust. For example, a 5/1 ARM has a low fixed rate for five years and then changes every year. It can go up or down.

Also Check: How Much Mortgage Protection Insurance Cost

Make A Larger Down Payment

Simply put, the more money you put down towards your mortgage, the less you will owe on the loan. If you can make a larger down payment, you could have more equity in your home from the start. Not only will you need to repay less principal , you’ll also pay less interest over the life of the loan since it is calculated on the principal owed.

While some loans have low down payment options, the ability to pay more can reduce mortgage rates and monthly payments. The smaller the down payment, the riskier lenders view your loan, and the higher the interest rate you may have to pay.

How Do Loan Types Affect Mortgage Rates

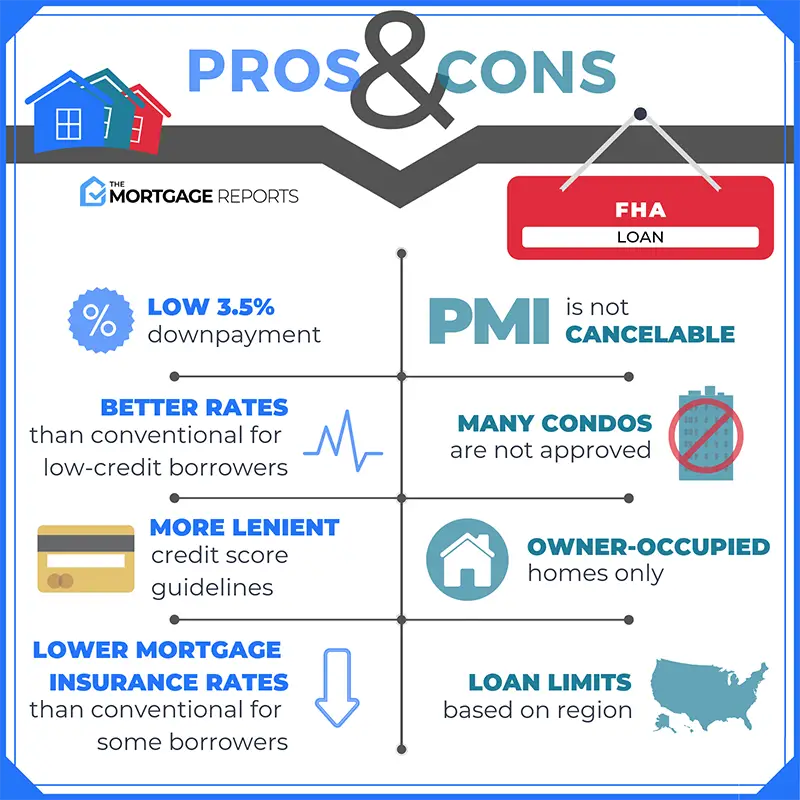

Just as your financial history can have an impact on mortgage rates, the type of loan you choose when purchasing your home can do the same. While the answer to what is a good mortgage rate for first-time homebuyers may not have one simple answer, you can find loans that are better for first-time homeowners. There are many loan options out there, and some of the primary ones are as follows.

Remember, these loans come with other costs from lender fees to mortgage insurance that may offset the lower mortgage rates. Ultimately, the interest you pay depends on the other factors weve explained above. Still, knowing the different loans out there can help you when you evaluate what else mortgage rates are based on as you search.

You May Like: How To Estimate Your Mortgage Payment

How Do I Refinance A 30

Refinancing is when you replace your existing mortgage with a new home loan. When 30-year refinance rates are significantly lower than your existing mortgage rate, you may be able to save money with a refinance. Keep in mind that the potential savings will need to outweigh the upfront closing costs youll pay to refinance, which are typically 3% to 6% of the loan balance.

Another factor to consider when you refinance is, how many years have you been paying off your current mortgage? If youre 10 years into a 30-year loan, taking out a new 30-year mortgage adds those 10 years back onto your repayment term. Even though you may be lowering your monthly payment and rate in that scenario, you could end up paying more interest over the long term even if you have a lower rate.

For more information on how to refinance a mortgage, see NextAdvisors refinance page.

What Is The Best Type Of Mortgage Loan

The best type of mortgage loan depends on your personal financial profile, lifestyle goals and the type of property you want to own.

For example, a 30-year mortgage might be better for someone who prefers the lowest monthly payments and plans to live in the house for a long period of time. However, if you want to pay off the home quickly, you can opt for a 10-, 15- or 20-year mortgage. The monthly payments will be higher, but the house will be paid off faster.

If interest rate cost is an important factor for you, you might also consider an adjustable-rate mortgage . The most popular ARM is called the 5/1 ARM, which has a fixed rate for the first five years of the loan and then switches to an adjustable rate for the remainder of the 30-year loan term. When the loan hits the adjustable-rate period, it typically adjusts annually.

This can be a good option if you feel ARM rates are likely to stay lower than fixed rates in the future. For example, the 30-year fixed rate has dramatically increased since the start of 2022, which has made the ARM rate a lower, more attractive option right now.

Related: Current ARM Rates

However, if ARM rates exceed fixed rates in a couple years, it could mean you face higher mortgage payments when the 5/1 mortgage reaches the adjustable-rate period. So its important to be prepared for changes in mortgage costs when applying for a 5/1 ARM or other ARMs.

Also Check: How To Calculate Your Monthly Mortgage Payment By Hand

When Is The Right Time To Get A Mortgage

Before you apply for a mortgage, you should have a proven reliable source of income and enough saved up to cover the down payment and closing costs. If you can save at least 20% for a down payment, you can skip paying for private mortgage insurance and qualify for better interest rates.

The best time to apply is when youre ready. But there are other details to consider when timing your home purchase. Home sales slow down during the winter and competition heats up in the spring which can affect prices. However, general nationwide trends dont always apply to every real estate market. Talk with local experts in your home shopping area to get a better sense of the market.

How Does The Federal Reserve Affect Mortgage Rates

Home loans with variable rates likeadjustable-rate mortgages andhome equity line of credit loans are indirectly tied to the federal funds rate. When thefederal funds rates increase, it becomes more expensive for banks to borrow from other banks. The higher costs for the bank can mean a higher interest rate on your mortgage. ARM loans that are in their fixed period are not impacted by this increase. However if you suspect a federal increase is about to happen or it has just happened, you’ll want to move fast if you’re looking to make changes or have yet to lock in a fixed-rate mortgage.

Read Also: What Does A Mortgage Attorney Do

What 000% Federal Interest Rates Mean For Homeowners

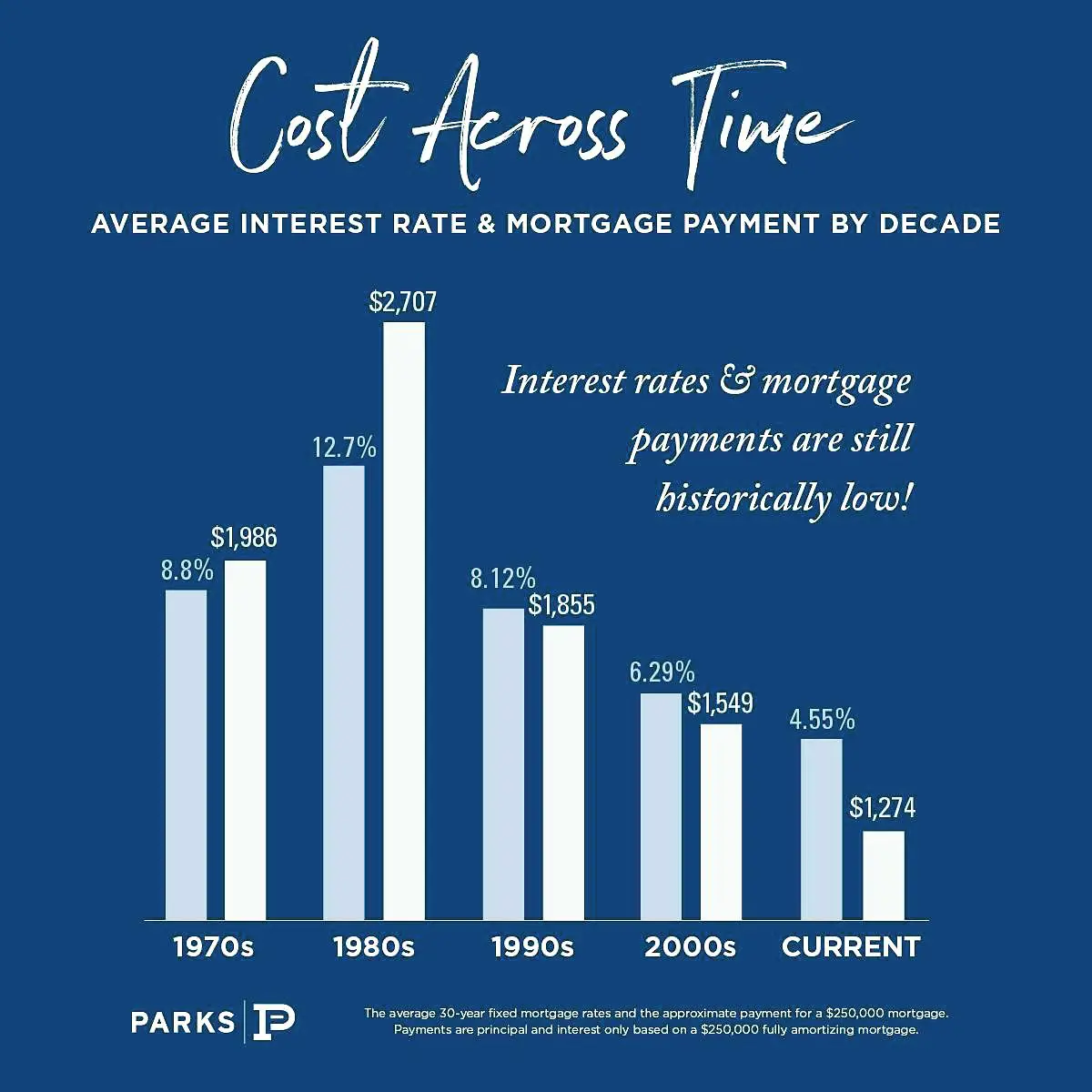

If you have a mortgage, experts say now is a good time to lock in low refinance rates. Relatively speaking, rates are still near a historic low. Realistically, with the Federal Reserves FOMC forecast, rates are going to rise for the next 6 months, so not locking in low rates now could cost you in the future.

Simply put, at this point in time, because Federal interest rates are still low, if you dont think about locking in your mortgage loan now, youll likely miss out, because it is unlikely for rates to stay near 0.25% forever.

Best Help To Buy Mortgage Rates

While if youre looking for a Help to Buy mortgage Barclays offers the 5 year Fixed London Help to Buy Equity Loan Scheme mortgage at 3.14%. It has an arrangement fee of £749.

However if youre not in London Barclays offers the 5 Year Fixed Help to Buy Equity Loan Scheme mortgage at 3.45%. It also has a £749 arrangement fee.

Recommended Reading: When Refinancing A Mortgage What Is Tax Deductible

Tips To Get The Lowest Mortgage Rate

If you want the lowest mortgage rate available, you have to shop around. Thats the number one rule. But there are other strategies you can use to get lower offers from the lenders you talk to.

- Try for a last-minute credit boost. See what you can do to improve your credit before buying or refinancing. Your credit score makes a big difference in your mortgage rate, and improving it just a few points could lead to real savings

- Consider discount points. If you can afford it, you can pay more upfront for a better mortgage rate over the life of the loan. This could be smart if you plan to keep your home a long time. A discount point costs 1% of the loan amount and typically lowers your rate by 0.25%

- Negotiate your rate. Negotiating with a lender might sound intimidating, but trust us when we say it can be done. Mortgage lenders have flexibility with the rates they offer, and they want your business. A lower interest rate from a different company might be the only leverage you need to negotiate a better offer with the lender you want

- Negotiate your closing costs. Some closing costs are non-negotiable, like the third-party appraisal and credit reporting fees. But the fees your lender charges can sometimes be negotiated to save you money on the front end

- Know when to lock your rate. Mortgage rates move up and down every day. If you want to get the lowest possible rate, keep an eye on daily rate movements and be ready for a rate lock when they fall

How Do I Qualify For A Mortgage

While itâs important to think about qualifying for the best rates, you should also give some thought to the basics that youâll need to qualify and get approved for your mortgage. To qualify for a mortgage, here are some of the most important things that prospective lenders will want to see.

A good credit score – You should have a credit score of 680 or higher to qualify for the best mortgage rates, but to qualify for a mortgage at all, youâll need a credit score of at least 560. In addition to looking at your credit score, prospective lenders will also consider any derogatory information from your credit report, such as any missed payments . If you have bad credit, generally defined as a credit score of less than 660, you are unlikely to qualify for the best mortgage rates, and instead youâll need to use a sub-prime mortgage lender like Equitable Bank or Home Trust. If your credit score is even less than 600, you will most probably need to use a private lender like WealthBridge. Sub-prime mortgage lenders are happy to work with people with a poor credit history, but they will charge higher mortgage rates. It’s a good idea to have a detailed understanding of how your affects your ability to obtain a mortgage.

Recommended Reading: How Soon Can You Lock In A Mortgage Rate

Canada’s Most Popular Mortgage: The 5

There were $1.4 trillion CAD in outstanding residential mortgages in May 2022. Out of this, the 5-year fixed rate mortgage accounted for over $624 billion, or 44%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

Improve Your Credit Score

Your credit score may affect the mortgage rate that the lender offers you. Generally, the higher your credit score, the lower the interest rate will be on your home loan. Before applying for a mortgage, review your credit score and get it in the best shape possible.Learn more about how to improve your credit score.

Read Also: How Do I Find My Mortgage Interest Rate

Which Mortgage Term Is Best

If you choose a 30-year mortgage, you will have lower monthly payments. However, the loan will cost more in interest by the time you pay it off. A 15-year mortgage has higher monthly payments but less expensive interest over the life of the loan. The answer depends on your individual situation and financial goals.

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners’ insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Don’t Miss: How To Report Mortgage Payments To Credit Bureau