If Not Repaid You Risk Of Foreclosure

One of the biggest problems with a second mortgage is that you have to put your home on the line. If you stop making payments, your lender will be able to take your home through foreclosure, which can cause serious problems for you and your family. For that reason, it rarely makes sense to use a second mortgage for “current consumption” costs. For entertainment and regular living expenses, it’s just not sustainable or worth the risk to use a home equity loan or line of credit.

Advantages And Disadvantages Of Getting A Second Mortgage

The advantages of taking out a second mortgage include:

- Itâs separate from your existing mortgage, so itâs not a direct risk to your âmainâ home

- If you are confident you can afford the repayments, a second mortgage is likely to be cheaper than a secured loan

However, there are some disadvantages:

- Paying for two mortgages can be expensive and could lead to debt problems

- The âaffordability checksâ for second mortgages are becoming increasingly harder to pass

- A second mortgage puts your âmainâ home at risk â indirectly â as you may have to sell your home if you canât keep up with repayments

To Fund Home Improvement Projects

Cant wait to add the backsplash in the kitchen? Always wanted a swimming pool but never had the cash? Homeowners sometimes take out a second mortgage to renovate their houses.

The idea is that if you renovate your house, youll increase the market value of your home, getting you more equity. But that idea assumes the market value of your home will go up. However, if the value of the homes in your area goes down, youd have a major problemand no equity.

Recommended Reading: What Does Points Mean Mortgage

What Do I Need To Qualify

The more home equity you have available, the greater your chances are of qualifying for a second mortgage. Lenders will also want to verify that you have a steady source of income and are able to meet your monthly payments for both your first and second mortgage. Some key factors theyâll be looking at include:

What Are The Interest Rates For Second Mortgages

Second mortgage interest rates are typically a little higher than primary mortgage rates. And the rates youre offered by a lender will depend heavily on your and debt-to-income ratio.

While youd likely pay a higher rate for your second mortgage, these rates are almost always lower than the rates youd get for personal loans or credit cards.

Recommended Reading: How To Lock In Mortgage Rate For 6 Months

Potentially High Loan Amount

Second mortgages allow you to borrow significant amounts. Because the loan is secured by your home , you have access to more than you could get without using your home as collateral. How much can you borrow? It depends on your lender, but you might be able to borrow up to 80% of your homes value. That maximum would count all of your home loans, including first and second mortgages.

Cisn 1039 Grand Gesture

CISN in the Mornings love to give back to those in need. Chris, Jack & Matts Grand Gesture with the Collin Bruce Mortgage Team!

Know a school in need of books or sports equipment?A community charity doing great work, but needing more help?Someone that just needs a hand?

Nominate below and once a month, well come to the rescue with a $1,000 donation!

Don’t Miss: What Would The Repayments Be On A 100k Mortgage

Bottom Line: What Is A Second Mortgage

A second mortgage can help you tap into your homes equity and put the money to good use. Some people dont like to leave equity in their home. Theyd rather use it to invest or pay for expenses in other areas of their life.

Before you take out a second mortgage, make sure you know the terms, costs and that you can afford the payment so you dont put your house at risk of foreclosure.

Kim Pinnelli is a Senior Writer, Editor, & Product Analyst with a Bachelors Degree in Finance from the University of Illinois at Chicago. She has been a professional financial writer for over 15 years, and has appeared in a myriad of industry leading financial media outlets. Leveraging her personal experience, Kim is committed to helping people take charge of their personal finances and make simple financial decisions.

The Value Of The Tax Deduction

So the tax deduction that second mortgage interest potentially brings is one major advantage of second mortgages over other financing alternatives. With a fixed-rate second mortgage, you have the certainty of knowing exactly what your payments will be over the life of the loan, whether it be 10 or 15 years.

Thats in contrast to an adjustable-rate second mortgage or a home equity line of credit where the interest rate adjusts, depriving you of that certainty.

Dont Miss: What Is A Mortgage Holder

You May Like: How Much Is Mortgage On 1 Million

The Benefits Of Second Mortgages

Whats great about second mortgage loans is that you can use them to fund a variety of projects. The kind of second mortgage thats best for you depends on how much money you need and what you plan to use your loan for.

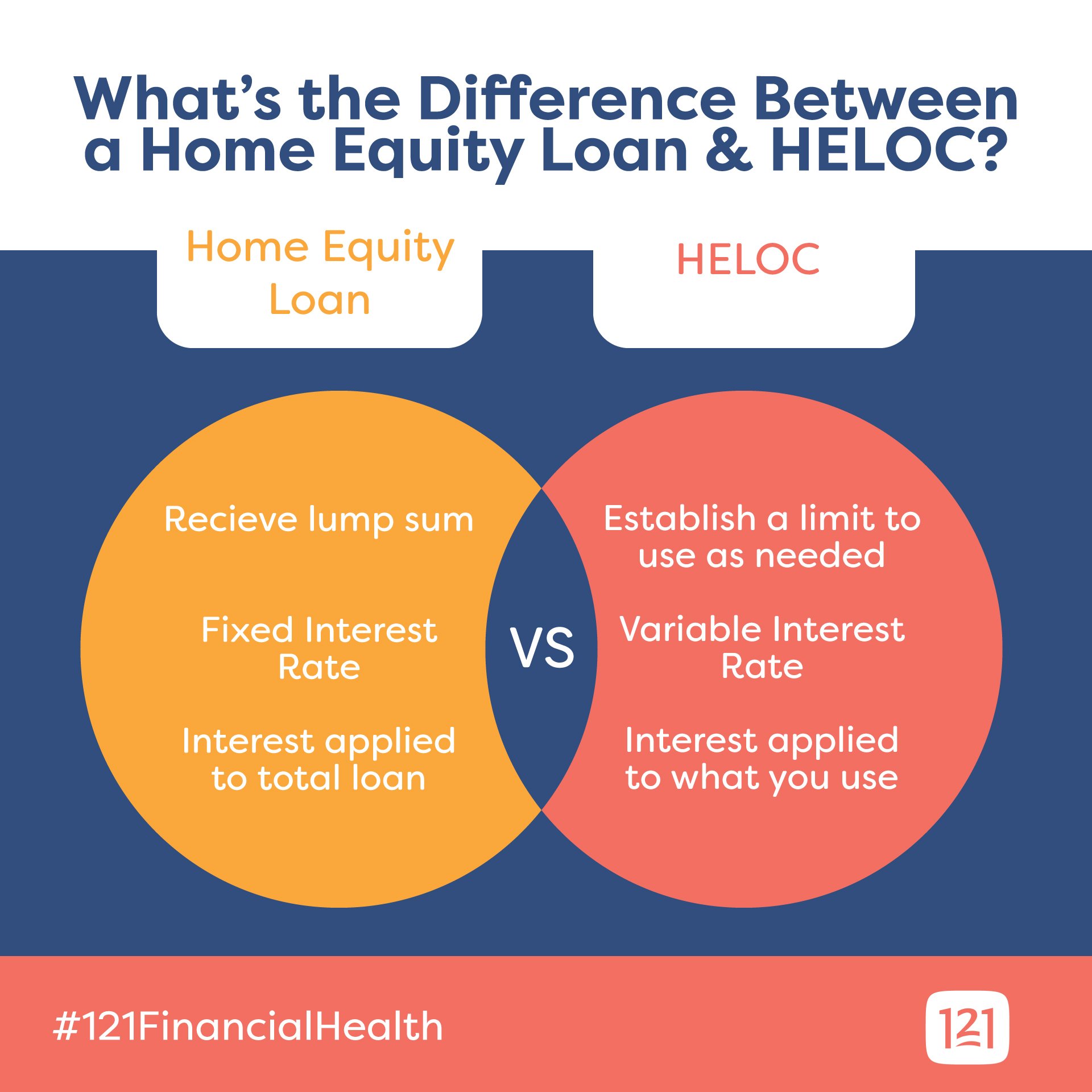

If you need a specific amount of money for a one-time expense like $6,000 for a family members retirement party it might make more sense to get a home equity loan rather than a HELOC. Home equity loans are also useful for homeowners who need a large amount of financing to consolidate other loans or help their kids pay for college.

But if youre not exactly sure how long you might need financing or youd like to borrow different amounts of money from month to month, youd probably be better off with a HELOC. You can use a HELOC to make payments over time if youre working on a small home renovation project or you have to pay for a series of emergencies.

Another advantage of having a second mortgage is the fact that your mortgage interest can be tax-deductible. If you have a home equity loan or a HELOC, you might be able to get a deduction for up to $100,000 of that debt or the amount of equity you hold in your home .

When Should I Get A Second Mortgage

Second mortgages arent for everyone, but they can make perfect sense in the right scenario. Here are some of the situations in which it makes sense to take out a second mortgage:

- You need to pay off credit card debt. Second mortgages have lower interest rates than credit cards. If you have many credit card balances spread across multiple accounts, a second mortgage can help you consolidate your debt.

- You need help covering revolving expenses. Do you need revolving credit without refinancing? Unlike a refinance, HELOCs can give you access to revolving credit, as long as you keep up with your payments. This option can be more manageable if youre covering a home repair bill or tuition on a periodic basis.

- You cant get a cash-out refinance. Cash-out refinances, compared to home equity loans, usually have lower interest rates. But if your lender rejects you for a refinance, you may still be able to get a second mortgage. Consider all of your options before you get a second mortgage.

Read Also: How Do I Find The Best Mortgage Rate

Cons Of A Second Mortgage

- Second mortgages have higher interest rates. Second mortgages often have higher interest rates than refinances. This is because lenders dont have as much interest in your home as your primary lender does.

- Second mortgages might put pressure on your budget. When you take out a second mortgage, you agree to make two monthly mortgage payments: one to your original lender and another to your secondary lender. This obligation can put a strain on your household finances, especially if youre already living paycheck to paycheck.

Some Things To Consider Before Taking Out A Second Mortgage

Before you take out a second mortgage, check if you can get a further advance on your existing mortgage first and get advice from a suitably qualified adviser.

Theyll be able to help you find the loan best suited to your needs and financial situation.

Theyll have to follow the rules set out by the Financial Conduct Authority when dealing with you. These rules are designed to protect you.

If you choose not to get formal advice, you run the risk of taking out an unsuitable loan for your circumstances. If this happens, you might find it difficult to make a successful complaint.

When youre looking into a second mortgage, make sure you:

- shop around make sure you get the best rate by comparing lenders APRC , the duration of the loan and the total amount youd have to pay back

- find out the exact mortgage terms, fees, early repayment charges and rates of interest.

To see if a firm is regulated, check the Register on the Financial Conduct Authority Register website

Find out more in our guide Mortgage advice should you use a mortgage adviser?

Read Also: Can You Get Mortgage With 550 Credit Score

How To Qualify For A Second Mortgage

Since a second mortgage is another loan, youll need to qualify before you are approved. The following information is what lenders will consider.

- Equity built. Youll need to provide your primary mortgage details so the second mortgage lender can see how much equity you have.

- Income verification. Lenders will want to see that you have steady employment this could be in the form of a letter of employment or recent pay stubs.

- Lenders will check your credit history during the qualification process. The higher your credit score, the better.

- Property value. You will need an appraisal to determine the current property value.

Should You Get A Second Mortgage

Tapping into the equity of your home can be the ideal solution to pay for renovating your kitchen or reducing high interest debt, but a second mortgage can be costly and may require you to pay closing costs, as well as all the typical fees and expenses associated with closing a loan, which means paying thousands of dollars in upfront costs if you choose to take out a HELOC.

When interest rates are higher, as they are now, a homeowner should consider a home equity loan because the installments are fixed. A HELOC can sometimes be a better option because interest rates fluctuate. For example, in a low interest rate environment, your payments could be lower, but they likely won’t be this year as rates are expected to keep rising.

Both HELOCs and home equity loans can be lengthy loans, so determine how long you will live in your current home before signing up for more debt, because if you sell your home there is no asset left to secure your loan, which means you are responsible for paying the entirety of your HELOC loan balance immediately.

You May Like: What Are The Drawbacks Of A Reverse Mortgage

Requirements For Applying For A Second Mortgage

Applying for a second mortgage requires a lot of paperwork and the steps involved are similar to obtaining a traditional mortgage.

Lenders check for the same requirements to qualify for either a HELOC or a home equity loan. Each lender has its own set of criteria when qualifying people for a home equity loan or HELOC, but the following checklist provides general criteria to help you get started. To qualify, you should have:

- Equity in the home of at least 15% to 20%

- A loan-to-value ratio, or LTV ratio, of 80% or less

- Debt level shouldn’t exceed 43% of your gross monthly income

Whats Required To Get A Second Mortgage

Remember, second mortgages are risky for lenders because if your home is foreclosed, the lender of your first mortgage gets dibs on your house. So, when it comes to issuing second mortgages, heres what lenders will want to know:

- You have good credit. If youve had trouble paying off your first mortgage, good luck getting a second one. You must prove to your lender that you consistently pay your mortgage paymentsotherwise, they wont consider your application.

- You have equity. In most cases, lenders want an appraiser to look at your house and calculate your equity. While you can get a rough estimate based on how much mortgage remains and how many payments youve made, an appraiser will take a closer look at the market value of your home to give an accurate number.

- You dont have a lot of debt. Just like when you applied for your first mortgage, lenders want to know you have a steady income and youre not up to your neck in debt. Your lender will want to review your pay stubs, tax returns and bank statements.

Don’t Miss: Does Mortgage Insurance Decrease Over Time

How To Use A Second Mortgage

When you take out a second mortgage, you have ultimate freedom in deciding what to do with it. However, financial advisors strongly recommend that you use this money wisely for items that have lasting value, such as making a home improvement, investing in education and funding major expenses. Second mortgages can also be used to consolidate debt, to reduce interest payments or to avoid the need to pay PMI on your first mortgage. Borrowers are cautioned to avoid using second mortgages for everyday expenses or for paying off outstanding debt without having a clear plan to reduce spending and prevent building more debt. Its important to remember that you could lose your home if you are not able to make regular loan payments on your first or second mortgage.

Need Help With A Mortgage

For more help in making a smart decision when it comes to mortgages, talk to a good home loan specialist. For an easy way to find one we trust, connect with our friends at Churchill Mortgage. Like us, they actually care about helping you pay off your house as fast as possible.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

Read Also: How To Know If I Should Refinance My Mortgage

Qualifying For A Second Mortgage

To qualify for a second mortgage, you generally need to be employed or have a steady source of income, a good-to-excellent credit score, a low debt-to-income ratio, and an established track record of paying off your debt.

Youll likely need to meet a particular loan-to-value ratio as well, which compares the amount borrowed for the home with the appraised value of the home. You need a tremendous amount of equity, says Michael Foguth, president and founder of Foguth Financial Group. Typically, that means 20% equity, or an LTV ratio lower than 80%. The more youve paid off the house, the better

What Is A Second Mortgage And How Do I Qualify For One

A second mortgage is essentially a home equity loan that allows you to borrow money from the equity in your home without having to refinance your current mortgage. Equity is defined as the difference between the appraised value of your home and the amount owed on the first mortgage. The amount that is available as a loan is based on the equity in the home.

The benefits to taking out a second mortgage are:

- Being able to consolidate debt that has high interest into a monthly payment that has a low interest rate.

- A second mortgage can be used to pay for home improvements and other major purchases.

- A second mortgage can also be put towards paying college or university tuition for your child.

To qualify for a second mortgage, you must have over 20% equity in your home and you must be able to pay the monthly payments on your second mortgage without exceeding your Total Debt Service Ratio . If you have a low credit score, you may still be able to acquire a second mortgage, though it will be at a higher interest rate than those with a better credit score. Besides your credit score, lenders will also look at the length of time you have been working with one employer, which will provide them with a sense of security, making it easier for you to qualify for the second mortgage.

Also Check: How Do You Get Out Of A Mortgage With Someone

What Is A Second Mortgage Used For

Home equity loans and HELOCs can be used for pretty much any purpose you want. There are usually no restrictions on how can be used. Second mortgages are typically pursued for major expenses like home renovations, medical bills, or college tuition, says Alex Shekhtman, CEO and founder of LBC Mortgage.

How Much Can I Borrow On A Second Mortgage

The maximum second mortgage you can get depends on the amount of equity youve built up in your home .

A second mortgage allows you to use any equity you have in your property as security against another loan.

It means youll have two mortgages on your property.

Equity is the percentage of your property owned outright by you, which is the value of the home minus any mortgage owed on it. The amount a lender will allow you to borrow will vary. However, up to 75% of the equity in your property will give you an idea.

Read Also: What Questions Do Mortgage Lenders Ask Employers