Can You Pay Off A 10/1 Arm Early

You can sometimes pay off a 10/1 ARM early by taking advantage of the fixed-rate period. While youre paying lower interest, you can put extra cash toward the principal amount. That way, variable interest rates later on are based on a lower principal amount, which would bring your monthly payments down.

Even contributing an extra $50 per month or making biweekly payments can make a major impact on how much interest you pay in the end.

Keep in mind that some mortgage agreements include penalties for over or early payment. If these penalties are steep enough, it might not be worth making the extra payments. Make sure you understand the conditions of your mortgage before making any extra payments.

Special Considerations For Interest

Some interest-only mortgages may include special provisions that allow for just paying interest under certain circumstances. For example, a borrower may be able to pay only the interest portion on their loan if damage occurs to the home, and they are required to make a high maintenance payment. In some cases, the borrower may have to pay only interest for the entire term of the loan, which requires them to manage accordingly for a one-time lump sum payment.

What Are The Disadvantages Of A 10/1 Arm

While ARMs can come with lower initial interest rates and a reasonable fixed-rate period, there are also drawbacks to think about, like:

- Rate uncertainty: With a fixed-rate loan, you know exactly what your interest rate will be throughout the life of your loan. ARMs even one with a longer fixed period, such as a 10/1 ARM are different. After the fixed period ends, your rate will adjust. This change could mean a higher mortgage payment if your rate rises. You need to be prepared for that uncertainty.

- The pressure to sell or refinance: Many homeowners take out ARMs with the goal of either selling their home or refinancing to a fixed-rate mortgage before the fixed period of their ARMs expire. Thats a good plan, but it might not always work. You might try to sell your home but not find any good offers. You might want to refinance, but maybe your income levels have dropped, and you cant get approved, or maybe you dont have enough equity in your home to close a refinance. When taking out a 10/1 or 10/6 ARM, you need to be prepared in case your plans to sell or refinance fall through.

Also Check: What Are Mortgage Underwriters Looking For

How Mortgages Work

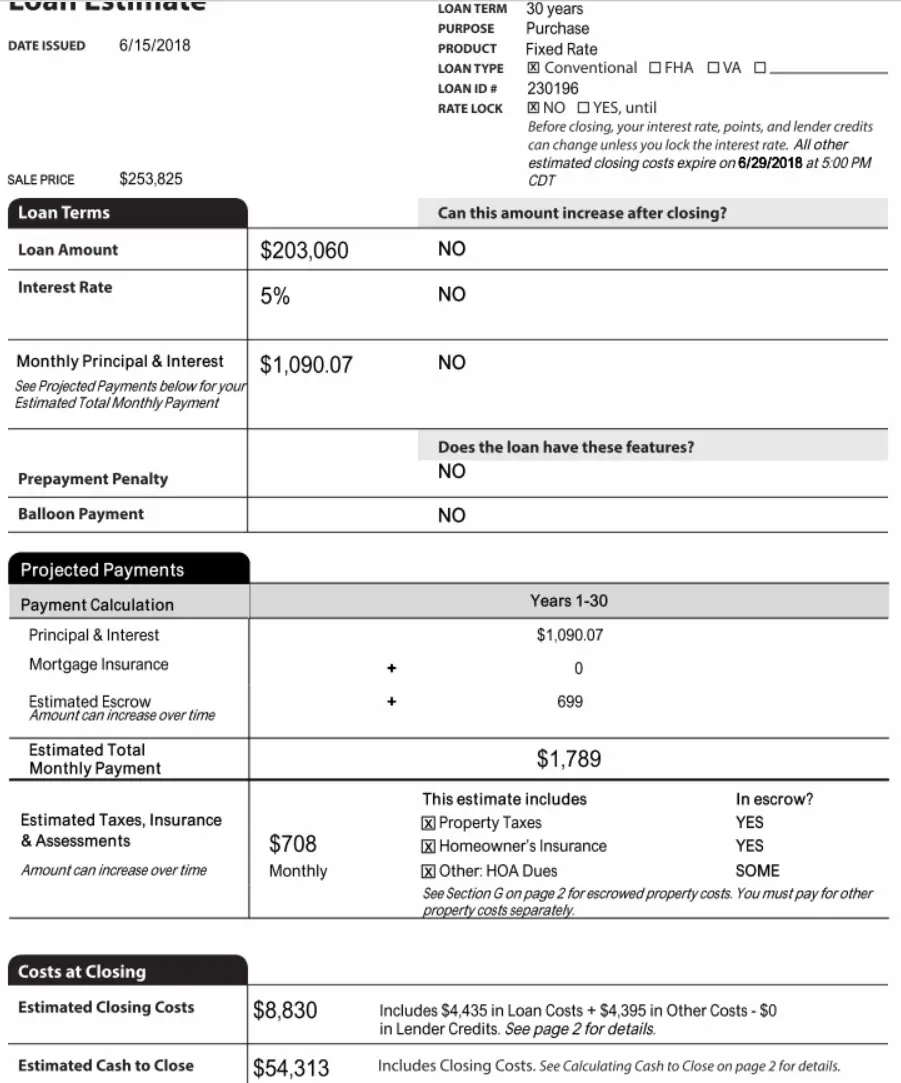

Individuals and businesses use mortgages to buy real estate without paying the entire purchase price up front. The borrower repays the loan plus interest over a specified number of years until they own the property free and clear. Most traditional mortgages are fully-amortizing. This means that the regular payment amount will stay the same, but different proportions of principal vs. interest will be paid over the life of the loan with each payment. Typical mortgage terms are for 30 or 15 years.

Mortgages are also known as liens against property or claims on property. If the borrower stops paying the mortgage, the lender can foreclose on the property.

For example, a residential homebuyer pledges their house to their lender, which then has a claim on the property. This ensures the lenders interest in the property should the buyer default on their financial obligation. In the case of a foreclosure, the lender may evict the residents, sell the property, and use the money from the sale to pay off the mortgage debt.

How Does A 10

A 10/1 ARM is a hybrid mortgage that is, a mortgage with a fixed period and a variable period. For the first 10 years, you will always pay the same interest rate on your mortgage. After that, your rate can fall or rise, depending on the general interest-rate trends.

ARM interest rates are composed of two parts. There is a margin rate, which is a base rate that always stays the same. To this is added an index rate, which will go up or down depending on the prevailing interest rates.

Competitive ARM lenders often offer limits as to how much your interest rate can increase during your variable period. Youll often see this stated as three numbers 2/2/5, for example. Each number represents the maximum increase over your initial rate your lender is allowed to charge at various points in your mortgage:

- The first number is the maximum increase allowed when your lender first adjusts the rate .

- The second is the maximum your rate can increase each time your lender adjusts the rate. With a 2/2/5 ARM, if you are at 6 per cent, your lender cant raise this above 8 per cent in one step.

- The final number is the maximum your lender will ever charge in interest, again above your initial rate. If you have an initial rate of 5 per cent, and have a 2/2/5 ARM, you will never pay more than 10 per cent interest.

Read Also: Is Phh A Good Mortgage Company

Your Credit Score Income And Assets

As weve noted, you cant control current market rates, but you can have some control over how the lender views you as a borrower. Be attentive to your credit score and your DTI, and understand that having fewer red flags on your credit report makes you look like a responsible borrower.

To qualify for the loan, you must meet certain eligibility requirements. Therefore, a person who gets a mortgage will most likely be someone with a stable and reliable income, a debt-to-income ratio of less than 50% and a decent .

What Are The 10/1 Arm Pros And Cons

We summarized the main 10/1 ARM pros and cons in the following points.

Pros of 10/1 ARM:

- Lower interest rates than their fixed-rate counterparts in the first ten years

- Easier to qualify for a larger loan due to the lower starting payments and

- Flexible constructions: best for people who are only planning to hold them for the initial term.

Cons of 10/1 ARM:

- Uncertain interest cost after ten years

- Complex and usually larger payments over time and

- Prepayment penalty.

Don’t Miss: How Much Does 1 Extra Mortgage Payment Save

Who Qualifies For A 10

A 10-year fixed-rate mortgage is a good option if you can make a sizable down payment and have enough income to cover the monthly payment. Plus, youll likely need at least a 620 FICO® to qualify for this type of mortgage.

While you may have the funds and the credit to qualify, you need to realize that a 10-year fixed-rate mortgage has substantially higher monthly payments than a 30-year. Thats because youre paying off the mortgage three times faster.

With that, youll need a more substantial income to qualify for a 10-year mortgage. The good news is that lenders will look at other reliable sources of income beyond your salary. A few examples might include military benefits, side hustle income, overtime, commissions and more. But keep in mind that most lenders will only consider a particular stream of income if it has continued for at least 2 years.

If youre concerned a 10-year mortgage may make you house poor, but still want to pay off your mortgage quickly, consider a 15-year loan. The slightly longer loan will still help you achieve your goal of being mortgage-free relatively soon without putting too much of a pinch on your budget.

How To Decide If A 10/1 Arm Or 10/6 Arm Is Right For You

Alliant Mortgage Loan Officer Nick Safis says when he works with people on a new mortgage or refinance mortgage, he wants to lay out all of their financing options. Often, he says, people will find that the 10/6 ARM is the best of both worlds, giving them a lower interest rate than fixed rate loans such as a 30-year fixed but with more stability than a 5/6 ARM.

Safis also recommends that people ask a few questions to help them decide if a 10/6 ARM is right for them.

- Dont ask, How long am I going to live in this home? Instead, ask yourself, Realistically, how long am I going to have this mortgage?

- Only a small percentage of home owners have the same mortgage for more than 10 years. Ask your parents and friends if theyve had a mortgage for more than 10 years before moving or refinancing. Their answers could surprise you.

- Finally, ask yourself how much money you could save with a 10/6 ARM vs. a 30-year fixed mortgage.

Read Also: Can You Take Out Two Mortgage Loans At Once

How Pension Account Holders Can Apply For Mortgage Using 25% Of Rsa Balance

The National Pension Commission has released a guideline specifying how RSA account holders can access part of their RSA balances as equity for residential mortgages.

The guidelines are in line with the provisions of Section 89 of the Pension Reform Act , which allows RSA holders to utilize part of their retirement savings as equity contributions to secure a residential mortgage.

Limit for equity contribution: According to PenCom, the maximum amount RSA holders can apply as equity contribution for a residential mortgage is 25% of the total RSA balance as of the date of application. This will be irrespective of the percentage of equity contribution required by the Mortgage Lender.

- However, in situations where the value of 25% of the RSA balance is more than the required equity contribution, it added that the RSA holder can only access an amount equivalent to the equity contribution required by the Mortgage Lender.

- Also, In the case whereby the value of 25% of the RSA is lower than the equity contribution required by the Mortgage Lender, the RSA holder would need to deposit the difference with the Mortgage Lender before 25% of the RSA balance can be applied as equity contribution.

Eligibility Criteria for RSA Holders: Applicant must be active in service either as a salaried employee or as a self-employed person. Also, the application for equity contribution for residential mortgage shall be in person and not by proxy.

How RSA holders can apply

What Is A 10/1 Arm And How Does It Work

A 10/1 ARM is an adjustable rate mortgage loan with a fixed rate for the first 10 years. After that, it has an adjustable rate that usually changes once each year for the remaining life of the loan. There is a cap on the rate adjustment per year and a limit to how much the rate can go up total. The loan usually amortizes over a total of 30 years.

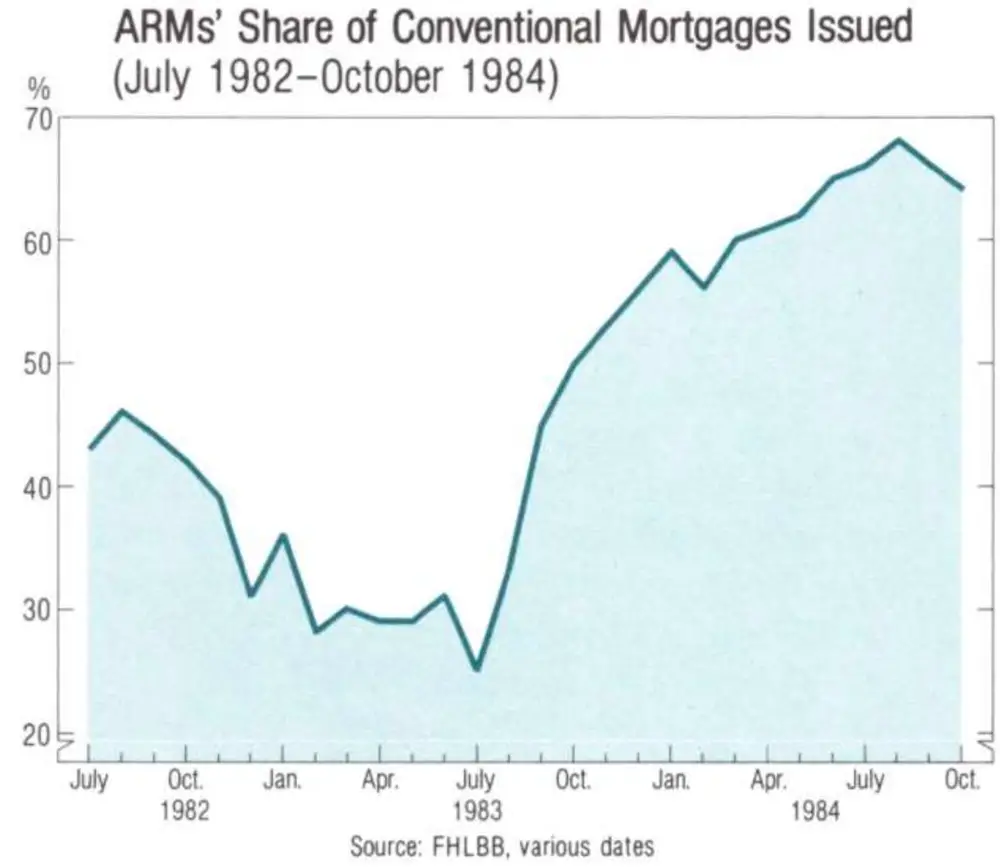

ARM stands for Adjustable Rate Mortgage as opposed to a 30-year fixed rate mortgage. Since interest rates have been steadily coming down since the late 1980s, ARMs have become more and more popular over time compared to 30-year fixed rate mortgages that have higher interest rates.

If the interest rate goes up after 10 years, the borrowers payment could go up. But not necessarily since during this 10 year period, the borrower has been steadily paying down principal. But if the interest rate goes down after 10 years, the borrowers payment will most certainly go down.

Homebuyers who take out a 10/1 ARM are essentially taking a view on the future of interest rates.

Recommended Reading: How Much Mortgage Can I Get Usa

Advantages Of An Adjustable

Adjustable-rate mortgages can be the right move for borrowers hoping to enjoy the lowest possible interest rate. Many lenders are willing to provide relatively low rates for the initial period. And you can tap into those savings.

Although it may feel like a teaser rate, your budget will enjoy the initial low monthly payments. With that, you may be able to put more toward your principal loan balance each month.

This added wiggle room to your budget can be the right option for those planning to move to a new area fairly shortly after buying a home. For example, if you intend to sell the home before the interest rate begins to adjust, any adjustments wont be a problem for your budget assuming the home sale goes through as planned and the mortgage is no longer yours to pay.

If youre a buyer seeking a starter home, you can also enjoy these benefits because youre planning to upgrade to a larger home when you can. If that plan allows you to sell the original home before the interest rate begins to fluctuate, the risks of an ARM are relatively minimal.

The flexibility you can build into your budget with the initial lower monthly payments offered by an ARM gives you the chance to build your savings and work toward other financial goals. Although theres the looming chance of an interest rate hike after the initial period, you can build savings along the way to safeguard your finances against this possibility.

/1 Arm Vs 10/1 Arm: Which Is Right For You

When deciding between a 5/1 adjustable rate mortgage and a 10/1 ARM, the distinction between the two is the initial fixed interest rate period. Both of these loans combine a variable-rate feature and a fixed-rate feature into one home loan. For example, for the 5/1 ARM, the 5 indicates that the interest rate for the loan remains fixed for the first years, and the 1 indicates that after the five years are over, the rate will adjust once every year until the loan is repaid.

What is a 5/1 ARM loan? A 5/1 ARM mortgage, also known as a hybrid adjustable rate mortgage is a loan with a fixed rate for the first five years that has a rate that changes once a year for the remaining years that are left on the loan. This loan option can be used if youre buying a home, refinancing or wanting a cash-out refinance and is also an option for FHA, VA, Conventional, and Jumbo loans.

What is a 10/1 ARM loan? Similar to the 5/1 ARM, a 10/1 ARM mortgage is a loan that offers an initial fixed rate period of 10 years, then the rate will adjust once a year for the remaining years that are left on the loan. The 10-year ARM is an option for Conventional and Jumbo Loans and can be used if youre buying a home, refinancing or interested in a cash-out refinance.

Also, you could end up paying a lower interest rate once the fixed-payment period is over, but it all depends on the state of the market, and in certain instances, an ARM could save homeowners a lot of money.

Read Also: What Is A Prepayment Penalty On A Mortgage

How Are Interest Rates Set By Lenders

Interest rates are the charges for the mortgage youre seeking. Mortgage rates are determined by analyzing a wide variety of factors, some of which have nothing to do with either the lender or the borrower.

Theinterest rate is determined by two factors: current market rates and the level of risk the lender takes to lend you money. You cant control current market rates, but you can have some control over how the lender views you as a borrower. The higher your credit score and the fewer red flags you have on your credit report, the more youll look like a responsible borrower. In the same sense, the lower your debt-to-income ratio , the more money youll have available to make your mortgage payment. These all show the lender that you are less of a risk, which will benefit you by lowering your interest rate.

If youre shopping around Freddie Macs research shows that soliciting even one additional offer can save borrowers $1500 on average youll want to get the best rate possible for your mortgage. But lenders sometimes offer very low rates but charge a number of fees. To meaningfully compare mortgage offers, youll need to look at their annual percentage rate .

The amount of money you can borrow will depend on what you can reasonably afford and, most importantly, the fair market value of the home, determined through an appraisal. This is important because the lender cannot lend an amount higher than the appraised value of the home.

You Have The Ability To Take Action

Let’s say you get unlucky and interest rates rise aggressively during the fixed-rate period of your ARM and it stays high after your fixed-rate period expires.

Before your ARM floats, you can do a number of things:

- Pay down more principal to lower future mortgage payments

- Refinance your mortgage before the rate floats

- Sell your property

- Generate income by renting out a room, a floor or the entire property

Basically, you’ll have plenty of time and options to make a smart financial move before your ARM resets to a higher rate.

You May Like: How Do Mortgages Work In Australia

Disadvantages Of 10/1 Arms

As the above table shows, people using adjustable rates can pay a lot more interest over the life of the loan if interest rates rise significantly. That table shows the worst case scenario to show how much things can change, but for people who plan on living in their home for many years to come it probably still makes sense to lock in the current historically low rates with a 15 or 30 year fixed rate mortgage. The potential for the loan to cost ~ $500 more per month to save $30 per month upfront is not a particularly compelling risk/reward ratio for people who intend to live in the home for 30 years.

The vast majority of Americans are choosing FRMs over ARMs & this will likely remain the case until interest rates rise significantly from their current historically low rates. There is much less liquidity in the 10/1 ARM market than there is in shorter duration ARM loans & far less than there is in the highly-liquid 30-year FRM market.

| Year |

|---|