Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

How Do Lenders Assess Your Income

Your income is a major factor when it comes to being approved for a home loan. Mortgage lenders prefer borrowers who have a stable, predictable income to those who don’t. While they look at your income from any work, additional income is included in their assessment.

Your debt-to-income ratio is also very important to mortgage lenders. It indicates how much of your monthly income goes to your debts, and gives lenders an overall sense of how you’re doing financially. If your ratio is high, it can show you’re overleveraged and possibly not in a position to take on more debt, so you might face a higher interest rate or be denied altogether.

Keep in mind that the income and employment you indicate on your application is often verified, so use accurate information. Lenders will likely view your income documentation and may even directly contact employers for verification.

What Is The Minimum Credit Score I Need To Get A Mortgage

There isnt a set number that will automatically make you eligible for a mortgage. This is partly because getting a mortgage depends on much more than your credit score, and partly because agencies and lender may use wildly different scoring systems, so the numbers simply arent comparable.

That said, its always the case that the higher your credit score, the better your chances are of securing a mortgage offer and getting access to attractive interest rates. However, if your credit score isnt considered at least decent, its likely youll struggle to get a mortgage.

Currently there are three major credit reference agencies : Experian, Equifax and TransUnion . Each of these uses their own unique credit scoring system. Experians system ranges from 0-999, and anything below 721 is considered poor. TransUnion scores borrowers from 0-710 and also has five rating bands , and any score less than 566 is considered poor. Equifax has a scale which runs from 0- 700 and anything below 380 is poor. So you can see how very different the scales are.

If youre below a particular threshold that is considered good, you should focus on building your score as much as possible before applying for a mortgage.

Don’t Miss: How To Get A Mortgage Preapproval

What Do Mortgage Lenders Look For On Your Credit Report

Because mortgages require borrowing so much money, lenders want to be sure they can really trust you to pay it back. If youve had bills go to collections or youve filed for bankruptcy, these could be red flags. Lenders also look for derogatory items and delinquent accounts.

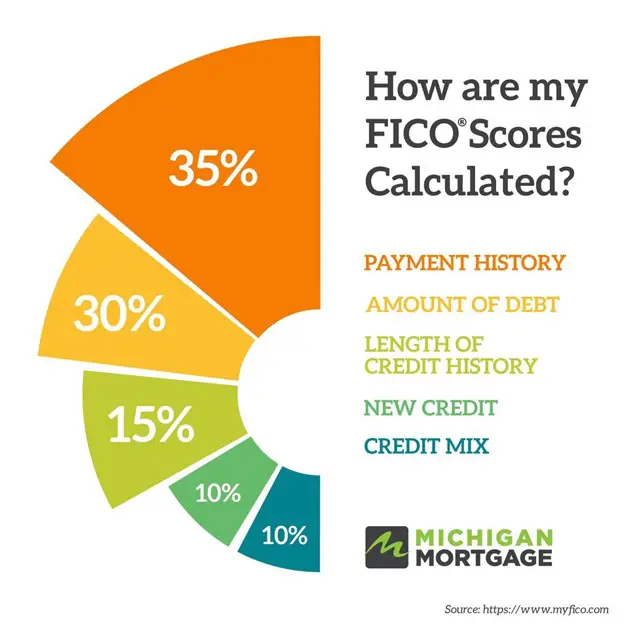

Your FICO score is based on information in your credit reports. This three-digit number provides lenders a snapshot of your financial habits. The more missed or late payments on your credit reports, the more likely it is that your FICO Score will be low, according to Rocket Mortgage.

Your credit report is a financial report card. Your credit score is the grade. It goes up or down based on how well youve paid back money youve borrowed in the past with credit cards, car loans and student loans, for example.

Your credit report is a financial report card. Your credit score is the grade.

These are the most critical factors in your credit score:

- Timeliness of payments

- New credit accounts

- Types of credit used

If you have a very low score, you might have a better chance of qualifying if youre able to offer a higher down payment . You can get advice from a housing counselor through the Department of Housing and Urban Development.

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and itll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Recommended Reading: Who Offers 50 Year Mortgages

Order Copies Of Your Credit Report

Get started by ordering copies of your credit report. This way, you can get an idea of everything a lender would see when reviewing your loan application.

First, check to make sure that all the information is 100% accurate. From there, look at where there are weaknesses on your report. Is the amount of debt you owe really high?

Work With A Trusted Mortgage Loan Officer

Your mortgage lender is the ideal resource for asking questions about any part of the homebuying process before you are even ready to apply.

The professional loan officers at home.com by Homefinity can get you pre-approved so you can solidify your budget and take the proper next steps. or apply now to get started.

Image by StartupStockPhotos from Pixabay

Also Check: How Do I Calculate Points On A Mortgage

Understanding Your Credit Score

Once you have a basic understanding of what credit score is needed for each type of loan, its time to take your own score into consideration. That means looking at your credit report.

Your credit report is an essential part of understanding your credit score, as it details your credit history. Any mistake on this report could lower your score, so you should get in the habit of checking your credit report at least once a year and report any errors to the credit reporting agency as soon as you find them. Youre entitled to a free credit report from all three major credit reporting agencies once a year.

If youd like to check your credit score, Rocket Homes, a sister company to Rocket Mortgage, can help. Rocket Homes helps you track and understand your credit profile. Rocket Homes allows you to view your TransUnion® credit report, which is conveniently updated every 7 days to ensure you get the most up-to-date information, as well as your VantageScore® 3.0 credit score.

Once you know your score, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

Do Lenders Only Look At Fico Score

But a score doesn’t tell lenders everything, so many also look at your credit reports from the three major credit bureaus. Credit reports contain your credit history, which is a record of how you’ve managed debt payments. Lenders may look for: Delinquent accounts, meaning those paid more than 30 days late.

Also Check: How To Obtain A Mortgage Broker License

Why Should I Check My Credit Score Before Applying For A Mortgage

Some soon-to-be borrowers make the mistake of applying for loan or mortgage products without knowing their credit score and their chosen lenders stance on whether theyll lend to someone with their circumstances.

Always check your eligibility before applying for any line of credit to avoid damaging your credit report. Lenders can see your previous loan applications when accessing your credit report and a recent rejection for credit can hinder your ability to get approved for a future loan.

How Do My Fico Scores Affect My Ability To Get A Mortgage

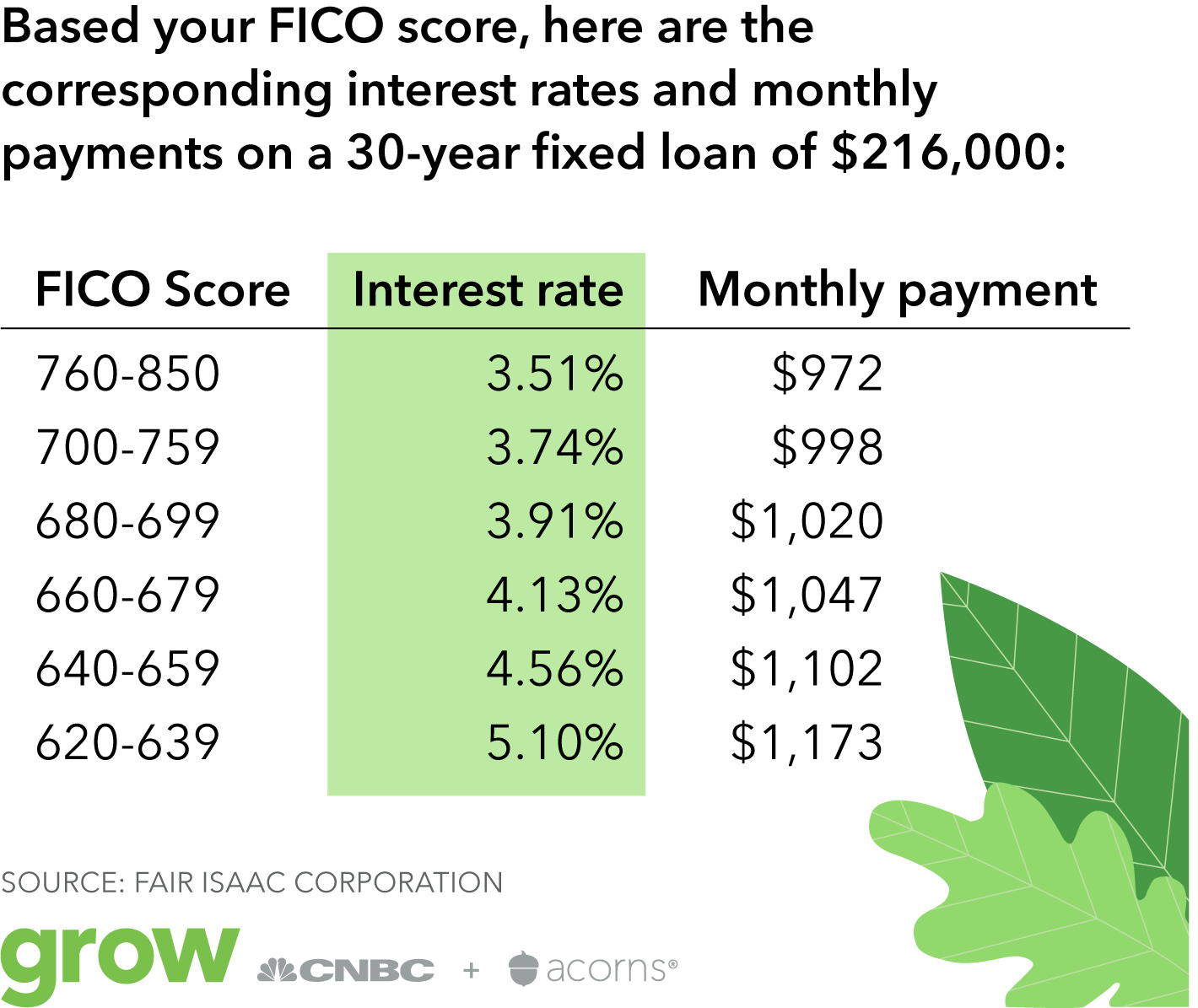

Lending a huge amount of money is risky business. Thats why mortgage lenders need a good way to quantify the risk, and your FICO® scores with all of the data and research that go into them fit the bill.

Different lenders have different requirements for their loans. And because there are many different types of mortgages from many different types of lenders, theres no one single minimum FICO® score requirement.

Read Also: What Is The Current Trend In Mortgage Rates

Check Your Credit Report And Correct Any Errors

Before applying for a mortgage, request a copy of your credit reports from the three major credit agencies: Experian, Equifax andTransUnion. Normally you can access your credit reports from each bureau for free once per year, but due to the COVID-19 pandemic, youre entitled to a free credit report from each of the agencies once a week through the end of 2022.

If you find inaccurate or missing information, file a dispute with the credit reporting agency and the creditor. Clearly identify each item youre disputing and be sure to include supporting documents.

What Credit Score Do Mortgage Lenders Use

October 25, 2021 by Barron Rothenbuescher

As you get ready to delve into the mortgage and homeownership process, you have likely come up with a number of questions about what impacts your ability to secure favorable terms for your mortgage or to be approved for a mortgage at all. One of the main areas a mortgage lender will consider when determining whether you qualify for a mortgage is your credit score.

However, the credit score that you view for yourself and the score that they analyze to determine your lending worthiness are not always the same. In order to present the best case for favorable terms on your loan, it is important to understand which credit scores mortgage lenders will examine during the approval process.

Don’t Miss: How Much Mortgage Can I Afford In Retirement

Can I Get A Mortgage With A Low Credit Score

It can be reassuring to know that having a low credit score doesnt rule out the possibility of a mortgage, especially if you have the help of a mortgage broker as they can quickly show you where the lenders are that may be able to offer you the finance you need.

Some lenders may even take the reason behind the bad credit into account, as well as the severity of the problem and if its been resolved.

In short – even with severe and recent issues on your report that have resulted in a low credit score, it may still be possible to obtain a mortgage. Ask a broker to check your credit score and source a choice of relevant lenders.

Proof Of Stable Income And Employment

A lender needs to see that someone interested in buying a home has stable, predictable income to afford monthly mortgage payments.

They will often request proof of income and employment, such as your pay stubs for at least the past month.

To verify this information, the proof of employment a lender will request can be quite extensive. It can include employment history for the past two years, contact information for former companies, an explanation of any employment gaps, and proof of employment from your current employer, confirming your hire date and employment status.

Don’t Miss: How To Get Second Home Mortgage

What Scores And Models Are Used When Applying For A Mortgage

FICO® created different scoring models for each credit bureauExperian, TransUnion and Equifax. The commonly used FICO® Scores for mortgage lending are:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO® Risk Score 04

Mortgage lenders will often get a single report that contains your credit reports from each of the three credit bureaus and the associated FICO® Scores. It may base the lending decision on your middle credit score or, if you’re applying jointly with a partner, the lower middle score.

Keep this in mind when you’re trying to figure out what . If you’re looking for a mortgage that requires a minimum credit score of 580, you may need your middle score to be at least 580 based one these specific FICO® Score models.

There are exceptions, though. Mortgage lenders could use different credit scoring models for loans that aren’t secured or bought by Fannie Mae or Freddie Mac. You might even be able to get a mortgage if you don’t have a credit history or score at all.

Additionally, there’s a review underway that could open up the use of different credit scoring models for mortgages, even if they’re secured or bought by Fannie Mae or Freddie Mac. However, until there’s a change, many mortgage lenders will continue to use these three classic FICO® Scores.

Determining A Qualifying Credit Score

Before we get into the credit score you need to qualify, you might be wondering how lenders determine your credit score. After all, your FICO® Score is reported by three different bureaus.

If you’re applying for a loan on your own, lenders get your from each of the three major credit rating agencies and use the middle or median score to qualify you.

If there are two or more borrowers on a loan, the lowest median score among all clients on the mortgage is generally considered the qualifying score. The exception to this is a conventional mortgage with multiple clients being backed by Fannie Mae. In that case, they average the median scores of the borrowers on the loan.

If you have a median score of 580 and your co-borrower has a 720 credit score, the average credit score would be 650. Because the minimum qualifying score for conventional loans is 620, this can mean the difference between qualifying for a mortgage and not.

One thing you should know is that for the purposes of your rate and mortgage insurance, the lowest median score is the one that gets reported, so your rate might be slightly higher. There are also certain situations in which Fannie Mae still uses the lowest middle score for qualification. We recommend speaking with a Home Loan Expert.

Read Also: What Factors Affect Mortgage Interest Rates

Why Is My Fico Score Different Than My Credit Score

Your score differs based on the information provided to each bureau, explained more next. Information provided to the credit bureaus: The credit bureaus may not receive all of the same information about your credit accounts. Surprisingly, lenders aren’t required to report to all or any of the three bureaus.

Providing The Right Down Payment

When youre ready to purchase a home, youll need to provide a down payment. This shows the lender you have a financial stake in the property.

A down payment can range from as low as 3% to as high as 20% of the cost of a home. For a home costing $200,000, the down payment could be between $6,000 to $40,000.

Paying more up front lowers the overall balance of your mortgage and shows the lender youre less of a financial risk. However, if youre unable to afford a large down payment, you may take on higher monthly mortgage payments that will include costs such as mortgage insurance premiums to safeguard the lender from a risky investment.

Gain a better understanding of what you can do to improve and maintain your credit here.

Also Check: What Banks Use Experian For Mortgages

Can I Check My Credit Score For Free

Yes. Sites like UK Credit Ratings let you see your monthly credit report for free. All you need to do is make an account and you can track how your actions are helping or hindering your credit score. Bear in mind that this score isnt definitive again, its just one agencys interpretation of your borrowing and repaying behaviours.

Do Lenders Look At Fico Or Credit Score

Asked by: Robin Gislason

For the majority of general lending decisions, such as personal loans and credit cards, lenders use your FICO Score. Your FICO Score is calculated by the data analytics company Fair Isaac Corporation, and it’s based on data from your credit reports. VantageScore, another scoring model, is a well-known alternative.

Recommended Reading: Who Do I Pay My Mortgage To

Which Fico Score Is Used For Mortgages

Most lenders determine a borrowers creditworthiness based on FICO® scores, a Credit Score developed by Fair Isaac Corporation . This score tells the lender what type of credit risk you are and what your interest rate should be to reflect that risk. FICO scores have different names at each of the three major United States credit reporting companies. And there are different versions of the FICO formula. Here are the specific versions of the FICO formula used by mortgage lenders:

- Equifax Beacon 5.0

- Experian/Fair Isaac Risk Model v2

- TransUnion FICO Risk Score 04

If you want to dig into the regulations for Freddie Mac and Fannie Mae to see the source of this information, you can do so here and here. But be warned, its like trying to drink water from a fire hose.

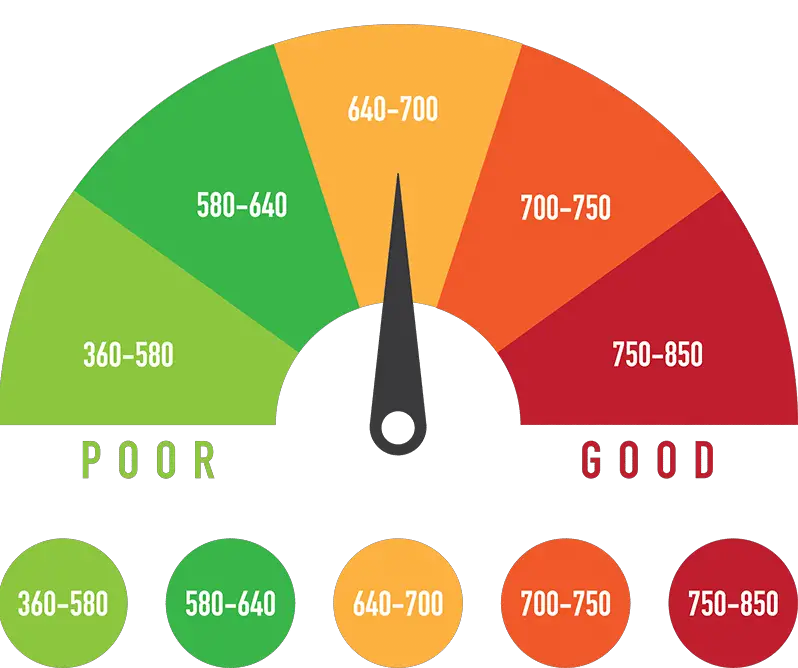

Lenders have identified a strong correlation between Mortgage performance and FICO Bureau scores . FICO scores range from 300 to 850. The lower the FICO score, the greater the risk of default.

Resource: Get all 3 FICO scores from the major bureaus directly from myFICO