Duties Of A Mortgage Broker

Banking activities can be divided into the following:

- Retail banking: dealing directly with individuals and small businesses

- Business banking: providing services to mid-market business

- Corporate banking: directed at large business entities

- Land mortgage banking: it specializes in originating and/or serving land mortgage loans

- Private banking: providing wealth management services to high-net-worth individuals and families

- Investment banking: relating to activities on the financial markets

Most banks are profit-making, private enterprises, however, some are owned by government, or are non-profits. Central banks are normally government-owned banks, which are often charged with quasi-regulatory responsibilities, e.g. supervising commercial banks, or controlling the cash interest rate. Central banks generally provide liquidity to the banking system and act as the lender of last resort in the event of a crisis.

The work undertaken by the broker will depend on the depth of the broker’s service and liabilities.

Typically the following tasks are undertaken:

How To Become A Licensed Mortgage Broker

Steps to Getting Your Mortgage Broker LicenseTake a pre-licensure mortgage program. The best way to start the process of getting a mortgage broker license and to increase your chances of succeeding in the NMLS exam is Pass the National Mortgage License System exam. Get your mortgage broker license and surety bond. Keep your mortgage license current. Take continuing education courses.

How To Become A Mortgage Broker In Florida

How To Become A Mortgage Broker In Florida Mortgage Loan Officers need to be licensed by the state in which they do business, which means they must complete the pre-licensing education requirements, pass the state and national SAFE / NMLS exam, then take eight hours of annual continuing education courses to maintain their license.

Also Check: What Credit Score Do I Need For A Mortgage

Safe Mortgage Licensing Act

The Secure and Fair Enforcement for Mortgage Lending Act requires national registration of all Residential Mortgage Loan Originators in addition to applicable state licenses.

The SAFE Mortgage Licensing Act is designed to enhance consumer protection and reduce fraud by encouraging states to establish minimum standards for the licensing and registration of state-licensed mortgage loan originators and for the Conference of State Bank Supervisors and the American Association of Residential Mortgage Regulators to establish and maintain a nationwide mortgage licensing system and registry for the residential mortgage industry.

The SAFE Act sets a minimum standard for licensing and registering mortgage loan originators. Specific state licensing requirements can be found at the Nationwide Mortgage Licensing System and Registry .

Mortgage loan originators employed by a federally regulated depository or a regulated subsidiary can learn the registration requirements on the NMLS website or from their employers federal bank regulator.

Uniform State Test: The OCCC has adopted the NMLS Uniform State Test, effective October 1, 2013. The SAFE Act requires mortgage loan originators to pass the test before they can be licensed through NMLS. The Uniform State Test replaces the previous national and state tests. For more information, please contact the OCCC at 936-7612, or visit the NMLS Resource Center.

Dont Miss: How Big Of A Mortgage Would I Qualify For

Do Mortgage Brokers Make More Than Realtors

Mortgage brokers are paid slightly more on average than real estate agents, mostly due to the additional education requirements. Mortgage brokers make an average of $95,209 per year , whereas real estate agents make an average of $92,450 per year. Both brokers and agents make their income on commission.

Can mortgage brokers work remotely?

You can work remotely and if youve got your laptop and basic office equipment you can work from home, your clients home even a café. Does a career as a mortgage broker sound appealing to you.

Can you work part-time as a mortgage agent?

Mortgage Brokers and Agents Job Types: Full-time, Part-time. Part-time hours: 20-40 per week. You earn from mortgages, credit cards, insurance, banking, investments and credit reporting products.

Recommended Reading: What Changes Mortgage Interest Rates

How To Obtain A Mortgage Broker License: Costs Associated With Opening Your Own Mortgage Brokerage Office

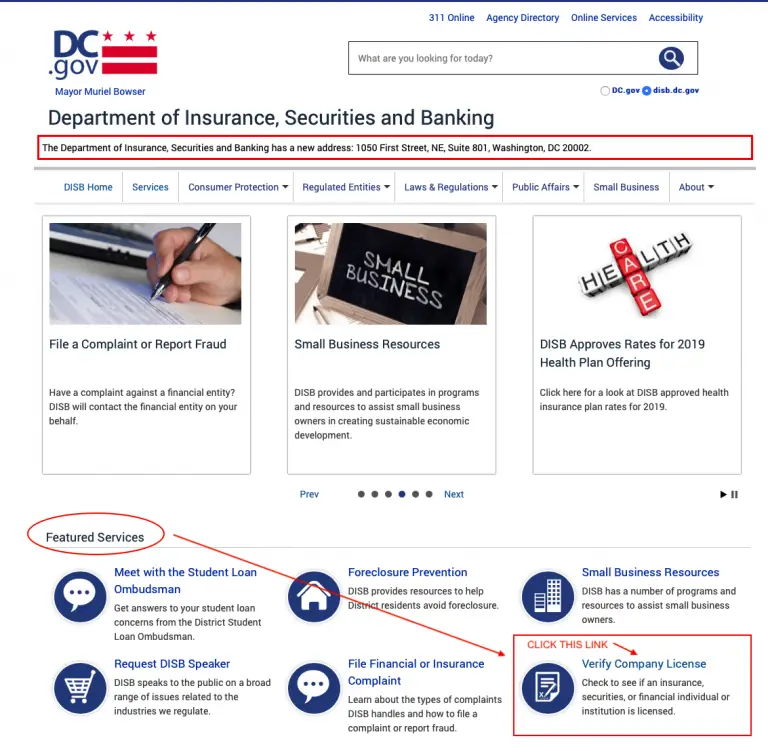

Running a mortgage brokerage company is not cheap. One of the major costs is the cost of licensing. Each state has its own rules and regulations on fees and costs in getting licensed. You cannot originate loans in states you are not licensed. If you are a mortgage broker originating loans in just one or two states, the costs may not be too bad. However, if you intend in getting licensed in dozens of states, you can easily spend tens of thousands of dollars in getting licensed and renewals each year. All states require mortgage broker applicants to complete the mortgage broker application process through the Nationwide Mortgage Licensing System .

Below is the list of the costs associated with applying for a mortgage broker license:

- NMLS processing fee

- Criminal background check fee

- Surety bond fee

Fees and costs in getting your mortgage broker license depends on the individual states. Costs can vary from under $1,000 to over $4,000 per state. This is without the cost of hiring a third-party licensing agency to assist with licensing. Some states allow you to have your new mortgage brokerage company at your home. Other states will require a brick a mortar office for the headquarters and others will require a brick-and-mortar branch office for offices license outside the headquarters home office.

How To Open Your Own Mortgage Broker Company

Many mortgage loan officers want to take the next step in the mortgage industry and open up their own mortgage broker shop. You can do that. However, you need to get your new mortgage broker shop licensed in all states you and your loan officers want to originate loans. Every state has its own individual NMLS licensing requirements for becoming a mortgage broker. If you are a mortgage broker, you can hire loan officers to expand your business and have the mortgage broker be the sponsoring company. In the following paragraphs, we will discuss and cover how to open up your own mortgage broker company and become your own boss. You can hire loan officers and collect an override over their production. However, as the mortgage broker, you will need to be responsible for all expenses including office expenses, payroll and benefits, processors, office expenses, rent, credit reporting fees, and support staff.

Don’t Miss: Can You Get Help With Mortgage Payments

Your Guide To Getting A Mortgage Broker License In 2022

- What is a Mortgage Broker License?

- How do I Get a Mortgage Broker License?

- What Are the General Mortgage License Requirements?

- What Are the Mortgage Broker License Requirement in My State?

- What Are the Steps to Getting Mortgage Broker License?

- How Long Does It Take to Get a Mortgage Broker License?

- How Much Does It Cost to Get a Mortgage Broker License?

Continue Your Education On Mortgage Lending

Once you have your mortgage broker license, its your responsibility to keep up on the latest developments on mortgage lending in your area.

To keep your license current, youll be required to take a certain number of hours of continuing education courses each year. Its similar to what accountants, doctors, and lawyers go through, and it ensures that you can do your job accurately and will give your clients the most up-to-date mortgage loan information.

Brokering mortgages is a job that demands constant attention to the changing real estate and lending landscape.

You May Like: Is Ally Bank Good For Mortgages

Mortgage Brokers Vs Loan Officers

So, you’ve decided you want to work in the mortgage industry. You just dont know if youre going to be a mortgage broker vs. a mortgage lender or even a loan processor. Lets take a look at a few key differences.

Loan officers, mortgage consultants, loan originators, or loan processors are all terms for specialists who work for a bank or lending institution. These are the people who can originate loans for borrowers.

Mortgage brokers, on the other hand, are independent parties who do not work for anyone specifically. As a broker, you connect borrowers with lenders. Essentially, you shop around to find the best deal for your clients.

Interested in becoming a mortgage consultant? American Financing is hiring! Check out our careers page to apply for open positions.

Why Start A Career In The Mortgage Industry

A career as a mortgage broker can be a great fit for those who want to help home buyers get through the mortgage loan process from start to finish. If you have a desire to lend a hand to buyers or those refinancing, or you simply have a passion for the real estate industry, being a mortgage broker can be a good career choice. Also, starting a mortgage broker career or business does not require a lot of time or energy. Given the current economic environment, now may also be a good time to pursue this goal.

Over the last decade, the housing market has experienced a steady upward movement, recouping some of the losses incurred during the market downturn of 2008 and 2009. With a more optimistic outlook on the economy as a whole, consumers are more likely to pursue their dreams of owning a home sooner rather than later. Strong jobs reports and relatively low interest rates create an opportunity for mortgage brokers to assist clients ready to make a move.

Read Also: Are Cash Out Mortgage Rates Higher

Don’t Miss: How Is Home Mortgage Interest Calculated

Mortgage Brokerage In Singapore

The mortgage brokerage industry is still new compared to the situation in the US and the UK Not all of the banks in Singapore are tied up with the mortgage brokerage firms. The mortgage brokers are mostly regulated by the Singapore Law of Agency.

A study undertaken by Chan & Partners Consulting Group shows that the mortgage brokering industry is still largely a new concept to the Singapore financial consumers. However this will set to change as more consumers realize that taking up a housing loan with the mortgage broker does not increase the consumer’s cost at all, and can in fact aid them in making a more informed decision.

Mortgage brokers in the country do not charge borrowers any fee, rather profits are made when the financial institutions pay the broker a commission upon successful loan disbursement via the broker’s referral.

Mortgage Brokerage In The United Kingdom

Mortgage brokers in the UK are split between the regulated mortgage market, which lends to private individuals, and the unregulated mortgage market, which lends to businesses and investors. Many UK brokerages mediate both types of business.

The role of a mortgage broker is to mediate business between clients and lending institutions, which include banks, building societies and .

You May Like: How To Create A Rocket Mortgage Account

You May Like: How Much Does Paying Mortgage Bi Weekly Save

What Are Licensed Mortgage Broker Skills

Licensed mortgage broker skills are the various abilities an individual has to work as a licensed mortgage broker. These skills comprise both hard and soft skills. Specific hard skills such as number skills can help research loan options and determine valuable deals for borrowers. Soft skills like verbal communication and organisation can help licensed mortgage brokers explain the loan process to customers in an understandable, straightforward manner they will understand.

Related:

Submit Your Mortgage Broker Application

After receiving your bond certificate, you will then sign it and send it along with your license application to the state. The mortgage broker application requires you to provide information about your business name and location, any web address you may use in the operation of your business, your registered agent of the business, and answers to specific disclosure statements per your state guidelines. You will also be subjected to a criminal background check.

New mortgage brokers may also need to provide details about their business, including a business plan, an organizational chart, and a list of executives or managers who are part of the business structure. These details and the application forms can be found on NMLS.

You May Like: How To Determine Ltv Mortgage

How To Pick A Good Mortgage Broker

Bring your notes,application material,and all interview information to your meeting with your financial advisor.It is a good idea to have a rate and fee quote from each broker,prepared for the same program,loan amount,and particular days pricing. Dont fall for low rate high fee tricks compare all of the data and take it all into account.

Do I Need Good Credit To Get Licensed As A Mortgage Loan Officer

Getting licensed does require training, meeting specific prerequisites, and adhering to specific rules. Because qualifications can vary, sometimes people rule themselves out of an opportunity based on requirements they think are in place that arent. While there are national licensing requirements, as well as state requirements, in place for mortgage loan officers, there are no requirements for a minimum credit score to become licensed.

A poor credit score or other concerns dont have to define your career future. If you’re worried about how your past credit issues may alter your ability to get licensed, give your state’s licensing team a call. Typically, its not the instance itself, but rather, if that instance became a pattern that will have an impact on consumers.

If all of this sounds exciting to you, youre probably ready to pursue a career as a mortgage loan officer!

Our team at BeAMortgageBroker.com is here to help you every step of the way.

You May Like: What Are The Interest Rates On A Mortgage

How To Obtain A Mortgage Broker License In Multiple States

This Article Is About How To Obtain A Mortgage Broker License In Multiple States

Individuals who want to become mortgage loan officers need to meet certain educational requirements and become licensed in the state they want to originate mortgage loans. Becoming a full-time mortgage loan originator can be very rewarding. One of the great benefits of becoming a loan officer is that you can work remotely. You normally do not have to meet clients face to face like real estate agents. You can also represent clients out of state as long as you are licensed in the state. A loan officer can do business in all 50 states remotely as long as they are licensed in the state they originate from. In order for the loan officer to be able to get licensed in the individual state to do business, the sponsoring mortgage company of the loan officer needs to be licensed as a company as well.

In this article

Can I Be A Real Estate Agent And Mortgage Loan Officer At The Same Time

Both real estate agents and mortgage loan officers play an essential role in the home buying process. From start to finish, homebuyers should work with both professionals to find and finance a home.

Because their services go hand in hand, it is often recommended that independent mortgage professionals build strong relationships with real estate agents to offer a fast and easy experience for their clients and build a referral network. As such, however, it’s also a common misconception that working as both a real estate agent and a mortgage loan officer at the same time is a conflict of interest and not allowed. You can certainly do both, given your state and lender programs allow it along with providing the required disclosures to ensure you are in compliance with regulations.

In states like California and Florida, for example, many real estate agents are also licensed mortgage loan officers. They often choose to extend their services and expertise to streamline the home buying and financing process, ultimately, positioning themselves to also be more competitive in their market and ensure their clients’ overall experiences are the best they can be.

If you are interested in becoming a dual-licensed professional, check with your state to find out more about their specific approach and requirements before moving forward.

Read Also: Should I Buy Down Mortgage Rate

Complete Your Virginia Pre

Before you can get your Virginia mortgage license, you need to take required pre-license courses. These help you learn mortgage laws and procedures. Each state has different mortgage education requirements for doing business. If you work for a non-bank institution , you must get licensed in each state that you want to do business in. The SAFE Act requires that you take 20 hours of pre-license education at a minimum. Some states have additional mortgage licensing requirements. Visit the NMLS website for a complete list of state requirements.

Virginia does NOT require state-specific education. This means that you only need to take the standard 20-hour licensing course. You can sign up for this class right now!

Also Check: How To Budget For Mortgage

Ohio Mortgage Licensing Requirements

Each state has its own unique requirements when it comes to mortgage licensing. To obtain your mortgage license in Ohio, youll need to complete 20 hours of nationally required mortgage education, and an additional 4 hours of Ohio specific education. After securing your Ohio loan originator license, you will need to complete regular continuing education courses to keep your license valid. We are your one-stop source for mortgage education resources, offering all of the new license and continuing education courses necessary.

Pre-license mortgage education requirements can be fulfilled in one of three ways with an online instructor-led course, via a live webinar, or in a live classroom. We find that the majority of new loan officers elect for the flexible online course bundle, which consists of pre-recorded video lectures supported by slideshow presentations, and quizzes that ensure content retention. As you complete your mortgage education, we will report all completed hours of education to the NMLS.

Also Check: How Much Does A Loan Officer Make On A Mortgage