Could Interest Rates Double Within A Year And Wholl Be Hit Worst

Another month where were left wondering: will there be another rise in the base rate? The Bank of Englands Monetary Policy Committee meets again on 15 September and many experts are predicting another increase to the base rate of interest will be announced.

Any increase would follow the announcement on 4 August which hiked interest rates from 1.25% to 1.75% their highest level since December 2008, as the Bank of England tries to curb surging inflation.

And it looks like further increases are on the cards with financial markets betting interest rates will more than double by next May to 4%.

Whenever interest rates are increased this has a knock on effect on mortgage rates so a rise to 4% would have a drastic impact if it happens. According to researchers at the IFS the impact of further interest rate rises may be felt worst by lower-income and older home owners, as they are more likely to be on a variable rate mortgage.

So it has never been more important to check how any increase will affect your mortgage.

How Is Todays Landscape Different From Two Years Ago

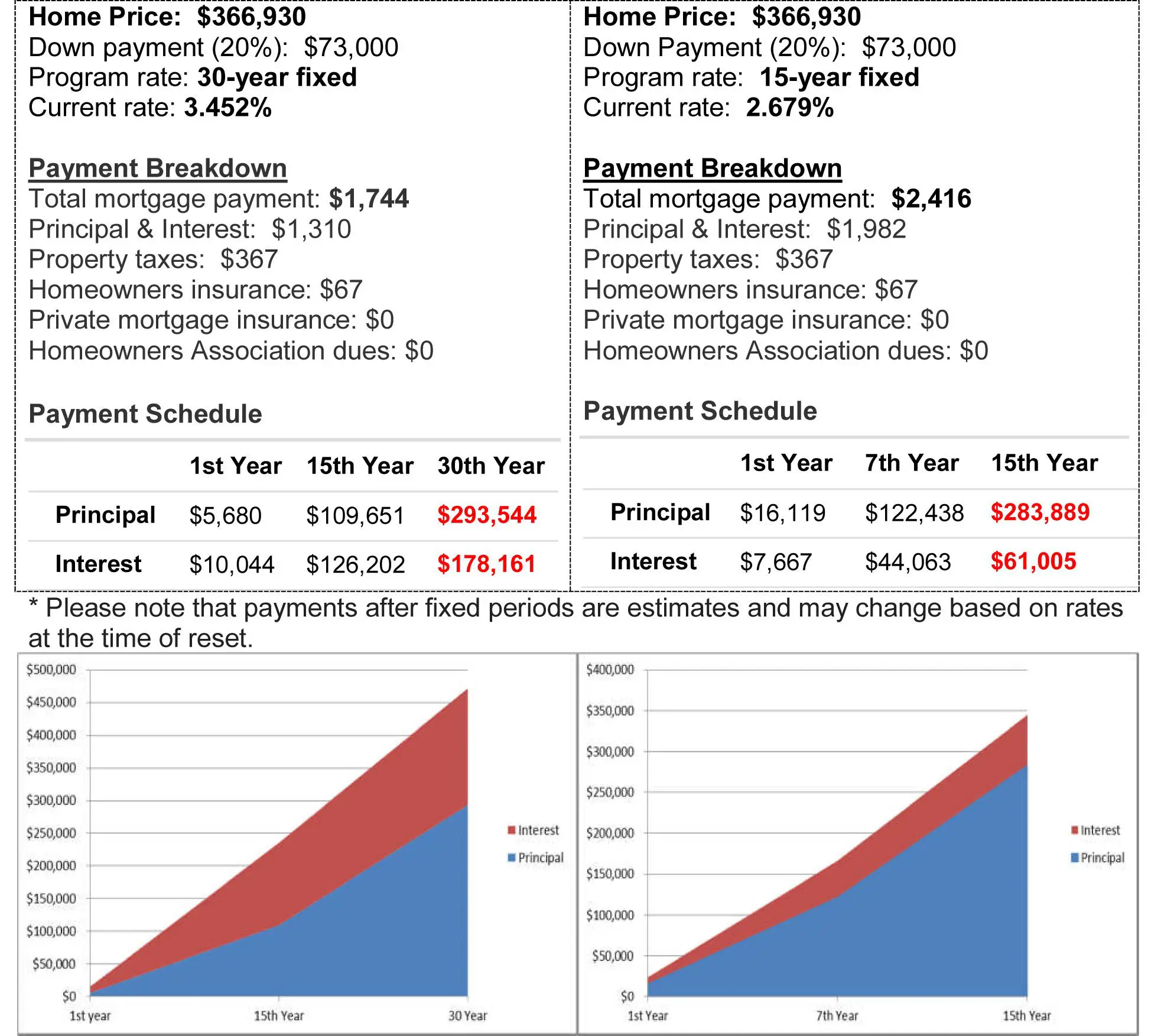

In 2020, the average list price on an American home was $374,500, with average interest rates on 30-year mortgages sitting at 3.11%.

Today, the average interest rate is 7.06%, with average home prices up to $525,000.

That means if you purchased a home two years ago with a 30-year mortgage and 20% down, the average purchase would have cost you $536,551 in principal and interest over the course of your loan.

The average purchase in the current market would cost you $1.11 million in principal and interest over the course of a 30-year mortgage with 20% down. Thats a difference of over half a million dollars by the time youre done paying off your mortgage.

Interest rates are higher today because the Federal Reserve is attempting to curb inflation. Prices are higher for a few reasons. First, the U.S. was in a housing shortage prior to the pandemic. This put us in an already bad position when things took a turn for the worse.

During the pandemic, many white-collar workers decided to relocate with the newfound freedom of remote work. Many moved to less expensive locales. This also increased demand and drove up prices via bidding wars.

Fixed Vs Arm: Monthly Payment Difference

For every $100,000 you borrow, heres what you may pay per month for different mortgage types based on the average interest rates of 6.99% for a 30-year fixed, 6.50% for a 15-year fixed, and 6.36% for the first five years on a 5/6 adjustable-rate mortgage , which were the average interest rates as of Sept. 29, 2022.

- 30-year, fixed rate mortgage: $913

- 15-year, fixed rate mortgage: $1,120

- 5/6 adjustable rate mortgage: $872 for the first 60 months

Looking only at the monthly payment, the adjustable rate mortgage seems like it might be the better choice, and you could save a significant amount in the long-term, depending on how the rates adjust.

But you must consider if the difference is worth the additional risks associated with an ARM, such as the risk interest rates will rise. If you plan to move within the initial 5-year term or expect to refinance if rates move lower, the risk may be worth it.

Also Check: Can I Combine My Mortgage And Home Equity Loan

Historical Mortgage Rates Chart

Despite recent rises, todays 30-year mortgage rates are still below average from a historical perspective.

Freddie Mac the main industry source for mortgage rates has been keeping records since 1971. Between April 1971 and August 2022, 30-year fixed-rate mortgages averaged 7.76 percent.

So even with the 30-year FRM above 5%, todays rates are still relatively affordable compared to historical mortgage rates.

Canada Vs Usa Mortgage Terms

Canadas mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners dont need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

Don’t Miss: What Is Your Mortgage Rate

Summary Of What Affects Your Mortgage Rate

- A short mortgage term will have a lower mortgage rate. A long mortgage term will have a higher mortgage rate.

- Variable mortgage rates are lower than fixed mortgage rates, but increases in the prime rate will cause variable rates to rise.

- Insured mortgages will have the lowest mortgage rates, followed by insurable mortgages, then uninsured mortgages.

- Making a larger down payment for insurable or uninsured mortgages will lower your mortgage rate.

- A low credit score will increase your mortgage rate. Agood credit scoregives you access to lower mortgage rates.

What Is The Best Type Of Mortgage Loan

The best type of mortgage loan depends on your personal financial profile, lifestyle goals and the type of property you want to own.

For example, a 30-year mortgage might be better for someone who prefers the lowest monthly payments and plans to live in the house for a long period of time. However, if you want to pay off the home quickly, you can opt for a 10-, 15- or 20-year mortgage. The monthly payments will be higher, but the house will be paid off faster.

If interest rate cost is an important factor for you, you might also consider an adjustable-rate mortgage . The most popular ARM is called the 5/1 ARM, which has a fixed rate for the first five years of the loan and then switches to an adjustable rate for the remainder of the 30-year loan term. When the loan hits the adjustable-rate period, it typically adjusts annually.

This can be a good option if you feel ARM rates are likely to stay lower than fixed rates in the future. For example, the 30-year fixed rate has dramatically increased since the start of 2022, which has made the ARM rate a lower, more attractive option right now.

Related: Current ARM Rates

However, if ARM rates exceed fixed rates in a couple years, it could mean you face higher mortgage payments when the 5/1 mortgage reaches the adjustable-rate period. So its important to be prepared for changes in mortgage costs when applying for a 5/1 ARM or other ARMs.

Read Also: What Do You Need To Provide For A Mortgage

How Are Mortgage Rates Determined

Mortgage rates, in general, are determined by a wide range of economic factors, including the yield U.S. Treasury bonds, the economy, mortgage demand and the Federal Reserve monetary policy.

Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates.

Related:How To Improve Your Credit Score

How Are Mortgage Rates Set

Lenders use a number of factors to set rates each day. Every lender’s formula will be a little different but will factor in the current federal funds rate , competitor rates and even how much staff they have available to underwrite loans. Your individual qualifications will also impact the rate you are offered.

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note.

Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

You May Like: How Mortgage Pre Approval Works

Historical Canada Mortgage Rates

Looking at historical mortgage rates is a good way to understand which types of mortgage attract higher rates. They also make it easier to understand whether weâre currently in a low or higher rate environment, relatively speaking.

Here are some of Canadaâs lowest mortgage rates of the year for different types of mortgages over the past five years.

Is The Lowest Ontario Mortgage Rate The Best Rate

Not always. The lowest rates usually come with more limitations. These restrictions can cost you much more than the small rate savings. Such terms are common with low frills mortgages and typically kick in when you try to port, break or increase the mortgage after closing. When comparing mortgage rates, dont be afraid to ask potential lenders questions to ensure you understand the terms and conditions of your mortgage.

Also Check: What Is A Non Qm Mortgage

How Does Your Credit Score Affect Your Rate

Your credit score measures your likelihood of making continuous, on-time mortgage payments. Homebuyers with higher credit scores seem less risky to lenders. So, in general, the higher your credit score, the lower your mortgage rate. But other factors such as your personal debt, down payment size, and loan program also influence your rate.

What Determines My Mortgage Interest Rate

Your mortgage rate is influenced by a variety of factors that fit into two categories:

- The current economic climate: Factors like inflation and the Federal Reserves benchmark rate can have a big influence on current mortgage rates

- The specifics of your financial life: Within the context of the mortgage market, your personal finances help determine your precise interest rate

While you cant control the federal funds rate or other economic conditions, you can do things to improve your personal finances before applying for a mortgage loan.

Any change to one of the following seven things can directly impact the specific interest rate youll qualify for.

Also Check: Why Do Banks Sell Mortgages To Freddie Mac

What Is A Mortgage Rate

A mortgage rate is a percentage of the total loan amount paid by the borrower to the lender for the term of the loan. Fixed mortgage rates stay the same for the term of the mortgage, while variable mortgage rates fluctuate with a benchmark interest rate that is updated publicly to reflect the cost of borrowing money in different markets.

What Is The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. , and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

The Federal Truth in Lending Act requires lenders to disclose the APR, but the fees can vary. When comparing APRs between lenders, ask which fees are not included for better comparison.

Also Check: What Credit Agency Do Mortgage Lenders Use

What Are Mortgage Rates

Mortgage rates are the rate of interest charged by a mortgage lender . The interest is charged by the lender as compensation for the money they have lent them in order to purchase a property.

Interest rates are determined by the lender in most cases, and can be either fixed or variable . Before you compare mortgages, you need to understand the different types. For more information see what type of mortgage should I get?

Your Rights And Responsibilities As A Borrower

Its important to know your rights as a mortgage borrower. When applying for a mortgage, your lender must provide information such as your mortgage principal amount, your mortgage interest rate, yourannual percentage rate , term, payments, amortization, prepayment privileges and charges, and other fees. This can be provided in an information box in your mortgage agreement.

Changes to your mortgage agreement will need to be made in writing within 30 days, or it can be disclosed electronically. Your lender must also give you a renewal statement at least 21 days before the end of your term, or let you know if they will not be renewing your mortgage. If your lender is a member of the Canadian Banking Association, which includes most major banks operating in Canada, your lender may have agreed to provide additional information, such asonline financial calculatorsor other information that can be used to calculate mortgage prepayment charges.

Your lender also has rights, such as the right to inspect your title or the right to sell your home if you dont make your mortgage payments.

You also have responsibilities as a mortgage borrower. It’s important to carefully read your mortgage agreement and ask your lender questions if you don’t fully understand any terms or conditions.

Recommended Reading: Can You Refinance A Mortgage After Bankruptcy

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

Mortgage Rate Predictions For September 2022

Rates for home loans are caught in a tug-of-war between rising inflation, which pushes rates higher, versus the Federal Reserveâs actions to maintain inflation, which indirectly moves mortgage rates lower.

The Federal Reserve began hiking its benchmark interest rate in March and then in July, it raised the rate by 75 basis pointsâthe largest increase since 1994.

âThe Federal Reserve has increased the target fed funds rate by 1.5 percentage points through the first half of 2022 and the markets have been pricing in more aggressive rate increases,â wrote Freddie Mac economists, in a July 20 forecast. âAs a result, mortgage rates have been volatile over the past few weeks.â

As a result of these market conditions and Fed actions, most housing-market experts think rates will essentially bob sideways for the rest of the year. Average rates for a 30-year, fixed-rate mortgage surged as high as 5.81% in late June, but have since leveled off at 5.55% as of August 25, according to Freddie Mac. Thatâs still nearly double the rate of 2.86% a year ago.

As of August 25, 2022, experts are forecasting that the 30-year, fixed-rate mortgage will vary from 5% to 6% throughout 2022:

Don’t Miss: How Can Hud Help Me With My Mortgage

Get Things Done With A Home Equity Line Of Credit

Our Versatile Line of Credit lets you leverage your home equity to renovate, contribute to your RRSP, save for the unexpected or carry out a project.

Rates are subject to change without prior notice. Rates may vary according to your credit rating, the amount borrowed, guarantees offered and other factors. Certain conditions may apply.

Rates may differ if the amortization of your mortgage is greater than 25 years. Please contact a Desjardins advisor for more information.

These interest rates are recommended by the Fédération des caisses Desjardins du Québec to all its caisses.

Fixed Or Variable Interest Rates

Once youve decided on a short or long term, the next step is to weigh the advantages of fixed and variable interest rates.

| Rate | ||

|---|---|---|

| Your payments will be the same every month. The amount of your payment applied to principal and interest will follow a pre-determined schedule. | Fixed interest rate mortgages are ideal for homeowners who want predictable payments without the need to monitor interest rates. | |

| Variable | Variable interest rates have traditionally lowered the cost of home ownership when rates are low and not fluctuating. | If you are concerned that interest rates will rise quickly, you may consider a variable interest rate mortgage that can be converted to a fixed rate at any time within your current term. |

Once youve decided on a short or long term, the next step is to weigh the advantages of fixed and variable interest rates.

| Rate | |

|---|---|

| Your payments will be the same every month. The amount of your payment applied to principal and interest will follow a pre-determined schedule. | |

| Considerations | Fixed interest rate mortgages are ideal for homeowners who want predictable payments without the need to monitor interest rates. |

| Rate | Variable |

| Advantages | Variable interest rates have traditionally lowered the cost of home ownership when rates are low and not fluctuating. |

| Considerations | If you are concerned that interest rates will rise quickly, you may consider a variable interest rate mortgage that can be converted to a fixed rate at any time within your current term. |

You May Like: How To Calculate Percentage Of Mortgage