Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Calculating Mortgage Payments With An Equation

How To Figure Mortgage Interest On Your Home Loan

cristinairanzo/Getty Images

All homeowners should know how to figure mortgage interest. Whether you are financing the purchase of a home or refinancing your existing mortgage loan with a new loan, you will prepay interest.

How much interest is prepaid will determine when you want your first regular payment to begin. Many borrowers prefer to make a mortgage payment on the first of every month. Some prefer the 15th. Sometimes, lenders will choose that payment date for you, so if you have a preference, ask.

Also Check: How To Figure Out Mortgage Budget

How To Qualify For The Mortgage Interest Deduction

Only homeowners whose mortgage debt is $750,000 or less can deduct their mortgage interest. If you are married filing separately, you can only deduct mortgage interest if the mortgage debt is $375,000 or less.

The limit used to be $1 million, but that changed after the passage of the 2017 Tax Cuts and Jobs Act.

Whether The Home Is Too Expensive

Another thing a mortgage calculator is very good for is determining how much house you can afford. This is based on factors like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering emergency funds and any other financial goals. You dont want to put yourself in a position where youre house poor and unable to afford retiring or going on vacation.

Recommended Reading: How Much Is A Mortgage On A 350k House

How Much Should You Save For A Down Payment

Save up a down payment of at least 20% so you wont have to pay private mortgage insurance . PMI is an extra cost added to your monthly payment that doesnt go toward paying off your mortgage. If youre a first-time home buyer, a smaller down payment of 510% is okay toobut then you will have to pay PMI. No matter what, make sure your monthly payment is no more than 25% of your monthly take-home pay on a 15-year fixed-rate mortgage. And stay away from VA and FHA loans!

Saving a big down payment takes hard work and patience, but it’s worth it. Here’s why:

- Youll have built-in equity when you move into your home.

How Much Mortgage Interest Can You Deduct On Your Taxes

Everyone wants to save on taxes, and one of the best ways is to maximize every possible deduction.

The mortgage interest deduction used to be a mainstay for consumers, but the past few years have changed that. Some homeowners may be better off not claiming that deduction.

If you do want to claim it, read below to figure out how it works – and if it makes sense for you.

You May Like: What Does A Mortgage Cover

How Is Mortgage Interest Calculated

Interest on your mortgage is generally calculated monthly. Your bank will take the outstanding loan amount at the end of each month and multiply it by the interest rate that applies to your loan, then divide that amount by 12.

Assuming you have an outstanding loan amount of $500,000 and an interest rate of 5% APR, your interest payment for one month would be calculated using the following formula:

÷ 12 = $2083.33

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

Recommended Reading: Should I Refinance My Mortgage With My Current Lender

Interest Rates Vs Apr

Its worth explaining that the above calculation doesnt tell the whole story. Perhaps more relevant to would-be property owners is APR . This includes the interest rate plus any other costs associated with taking out the loan, such as insurance, closing costs, and broker costs. Heres an example, using the same figures from previous calculation:

“FIRST HOUSE PURCHASE.Went through my first house purchase in June. Vilma was extremely helpful throughout the whole negotiation, recommending the best mortgage options, promptly communicating updates and managing the entire process. Absolutely recommended!”

Daniele Sulis , Sep 2021

“We recently remortgaged with Vimi, who made the process very straightforward. Vimi was very pro-active in contacting us way before our mortgage was due for renewal, which helped us achieve a better mortgage rate prior to the recent interest rate increases. Thank you for all your help!”

Ross F , Nov 2022

Why Is It So Complicated

It would be easy to figure out a mortgage payment if the numbers didnt change over time. Unfortunately for us, they doquite a bit. Banks need to make money off the money they lend, so they charge interest on a loan. Mortgage interest is basically the fee the bank charges you to borrow money.

Theres an old story that Albert Einstein called compound interest the most powerful force in the universe. While were not sure if its worthy of that much praise, it is quite powerful. The word compound makes things more difficult for us. If you borrow £10,000 for 10 years at 2% simple interest, youll pay £200 in interest each year: that’s quite simple. However, if you borrow with compound interest, we have to calculate the interest every time you make a payment.

Mortgages in the UK use compound interest, so the math goes like this:

You May Like: Who Offers 50 Year Mortgages

Explanation Of Mortgage Terms

Mortgage terminology can be confusing and overly complicatedbut it doesnt have to be! Weve broken down some of the terms to help make them easier to understand.

Learn about

Home Price

Across the country, average home prices have been going up. Despite the rise in home prices, you can still find a perfect home thats within your budget! As you begin to house hunt, just make sure to consider the most important question: How much house can I afford? After all, you want your home to be a blessing, not a burden.

Learn about

Down Payment

The initial cash payment, usually represented as a percentage of the total purchase price, a home buyer makes when purchasing a home. For example, a 20% down payment on a $200,000 house is $40,000. A 20% down payment typically allows you to avoid private mortgage insurance . The higher your down payment, the less interest you pay over the life of your home loan. The best way to pay for a home is with a 100% down payment in cash! Not only does it set you up for building wealth, but it also streamlines the real estate process.

Learn about

Mortgage Types

15-Year Fixed-Rate Mortgage

30-Year Fixed-Rate Mortgage

5/1 Adjustable-Rate Mortgage

Learn about

Interest Rate

Learn about

Private Mortgage Insurance

Learn about

Homeowners Insurance

Learn about

Homeowners Association Fees

Learn about

Monthly Payment

Learn about

Property Taxes

Mortgage Calculator Uses

How Do I Calculate A Monthly House Payment For A 30

Related Articles

Calculating a 30-year fixed-rate mortgage is a straightforward task. In order to find out what your monthly payments might be, you can use a mortgage formula or a calculator. This will give you a good estimation of whether you can afford the mortgage. Home loans are amortized over 30 years with monthly payments that are the same each month. As you begin to pay your mortgage, you will actually pay more in interest. Over time, as the loan decreases, more of your money goes toward the principal.

Also Check: What Would My Mortgage Payment Be On $90000

You May Like: How Much House Can I Afford Based On Mortgage Payment

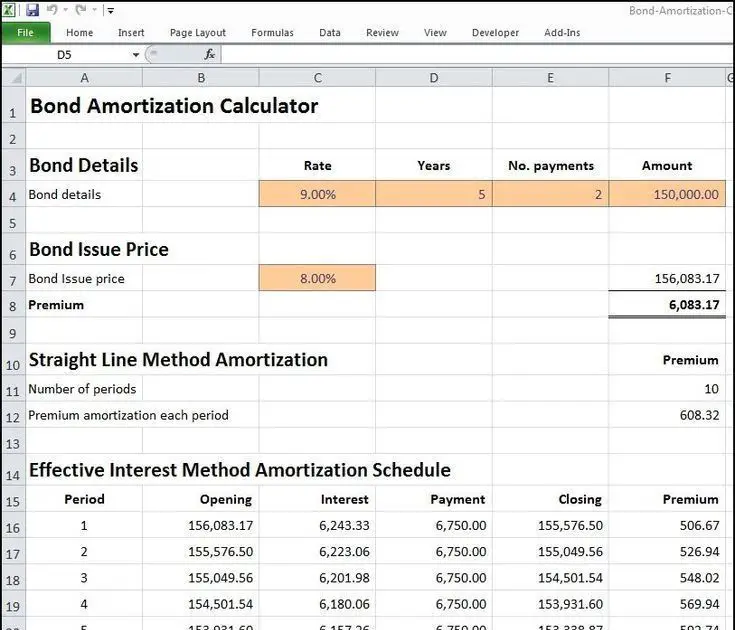

Using Excel Formulas To Figure Out Payments And Savings

Managing personal finances can be a challenge, especially when trying to plan your payments and savings. Excel formulas and budgeting templates can help you calculate the future value of your debts and investments, making it easier to figure out how long it will take for you to reach your goals. Use the following functions:

-

PMT calculates the payment for a loan based on constant payments and a constant interest rate.

-

NPER calculates the number of payment periods for an investment based on regular, constant payments and a constant interest rate.

-

PV returns the present value of an investment. The present value is the total amount that a series of future payments is worth now.

-

FV returns the future value of an investment based on periodic, constant payments and a constant interest rate.

Figure out the monthly payments to pay off a credit card debt

Assume that the balance due is $5,400 at a 17% annual interest rate. Nothing else will be purchased on the card while the debt is being paid off.

Using the function PMT

=PMT

the result is a monthly payment of $266.99 to pay the debt off in two years.

-

The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year.

-

The NPER argument of 2*12 is the total number of payment periods for the loan.

-

The PV or present value argument is 5400.

Figure out monthly mortgage payments

Using the function PMT

How To Save Interest On Your Mortgage

Now that you know a bit more about how interest is calculated lets look at the ways you can actually pay less of it.

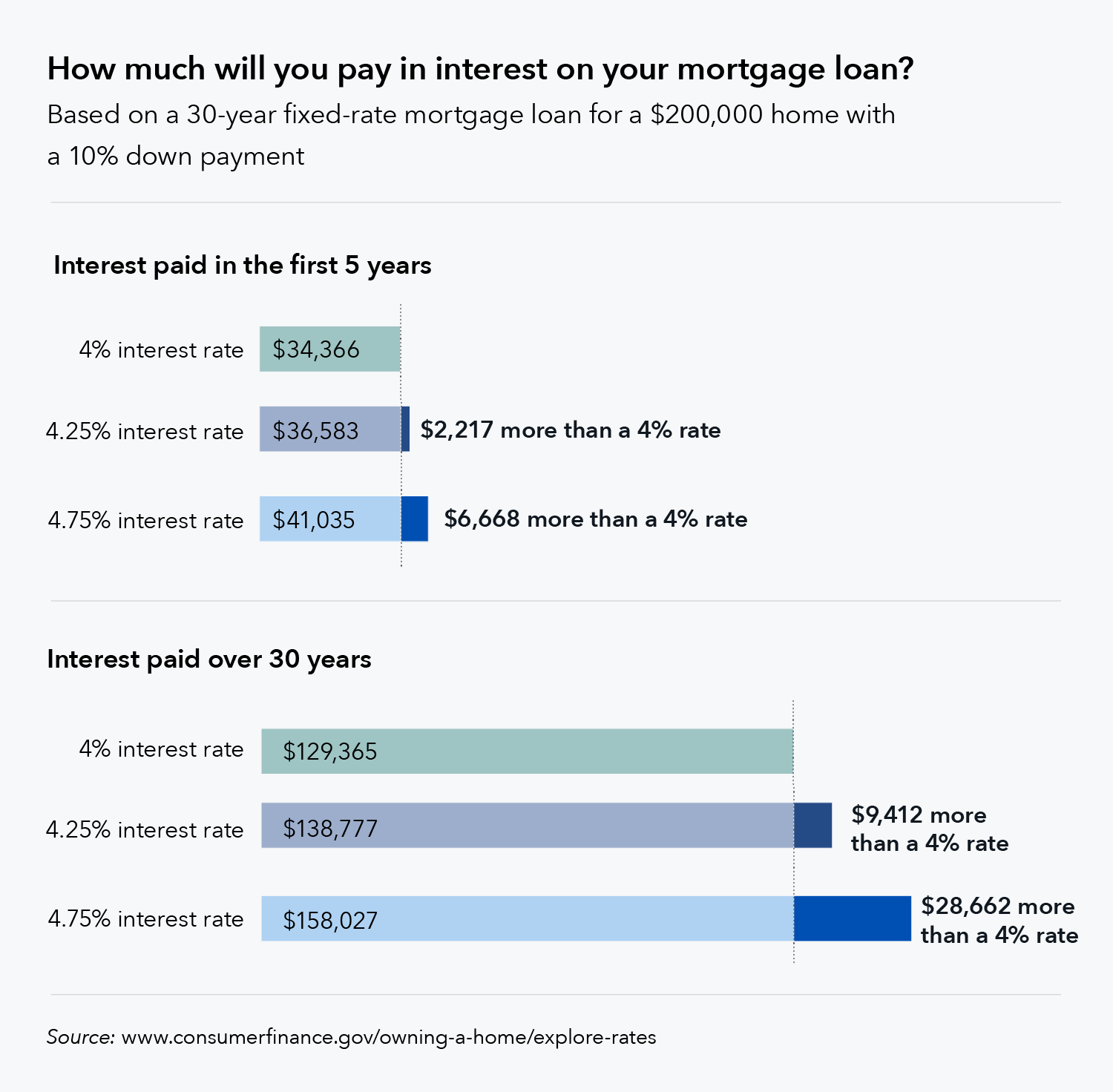

- Get the best rate. Shopping around for a better interest rate can save you thousands of dollars. If you already own a home, you may want to consider refinancing with your current lender or switching to a new lender.

- Make frequent payments. Because there are a little over four weeks in a month, if you make biweekly instead of monthly mortgage repayments, youll end up making two extra payments a year.

- Make extra payments. The quicker you pay down your loan amount, the less interest youll need to pay on your smaller outstanding loan amount. If you have a variable interest rate, you can save even more by making extra payments when interest rates are low.

- Choose a shorter loan term. The longer you take to pay off your loan, the more interest youll end up paying. Remember, banks calculate interest on your loan amount daily, so choosing a 25-year loan term instead of 30 years can make a big difference.

Recommended Reading: What Experian Credit Score Do I Need For A Mortgage

See How Much You Might Be Able To Borrow

This fixed-rate mortgage calculator provides customized information based on the information you provide. But, it assumes a few things about you. For example, that youâre buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lenderâs fees and other costs, which can be significant.

Estimated monthly payment and APR example: A $464,000 loan amount with a 30-year term at an interest rate of 6.500% with a down payment of 25% and no discount points purchased would result in an estimated principal and interest monthly payment of $2,933 over the full term of the loan with an Annual Percentage Rate of 6.667%.1

Mortgage Interest Calculator Canada

When you make amortgage payment, you are paying towards both your principal and interest. Your regular mortgage payments will stay the same for the entire length of your term, but the portions that go towards your principal balance or the interest will change over time.

As your principal payments lower your principal balance, your mortgage will become smaller and smaller over time. A smaller principal balance will result in less interest being charged. However, since your monthly mortgage payment stays the same, this means that the amount being paid towards your principal will become larger and larger over time. This is why your initial monthly payment will have a larger proportion going towards interest compared to the interest payment near the end of your mortgage term.

This behaviour can change depending on your mortgage type. Fixed-rate mortgages have an interest rate that does not change. Your principal will be paid off at an increasingly faster rate as your term progresses.

On the other hand,variable-rate mortgageshave a mortgage interest rate that can change. While the monthly mortgage payment for a variable-rate mortgage does not change, the portion going towards interest will change. If interest rates rise, more of your mortgage payment will go towards interest. This will reduce the amount of principal that is being paid. This will cause your mortgage to be paid off slower than scheduled. If rates decrease, your mortgage will be paid off faster.

Don’t Miss: How Many Years Can I Knock Off My Mortgage Calculator

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward paying interest.

Read more:The average monthly mortgage payment by state, city, and year

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

You May Like: Are 10 Year Mortgages Available