What Can You Not Do After Mortgage Pre Approval

What Not to Do During Mortgage Approval

- Don’t apply for new credit. Your credit can be pulled at any time up to the closing of the loan. …

- Don’t miss credit card and loan payments. Keep paying your bills on time. …

- Don’t make any large purchases. …

- Don’t switch jobs. …

- Don’t make large deposits without creating a paper trail.

Can You Get Denied After Pre

Getting pre-approved is the first step in your journey of buying a home. But even with a pre-approval, a mortgage can be denied if there are changes to your credit history or financial situation. Working with buyers, we know how heartbreaking it can be to find out your mortgage has been denied days before closing.

Mortgage Prequalification: A Good First Step

Getting prequalified at the start of your home-buying journey is a quick, easy way to see how much you may be able to qualify to borrow for a mortgage. All you need to do is give your lender some basic financial information like your estimated household income and debt and youâll get your estimated price range in minutes online.

And depending on the type of prequalification the information you provide may not go through the process of getting verified by the lender, so it may not affect your credit score. But itâs also wise to recognize that the amount you may qualify to borrow may be more than youâll want to spend .

Recommended Reading: How To Get Approved For A Higher Mortgage

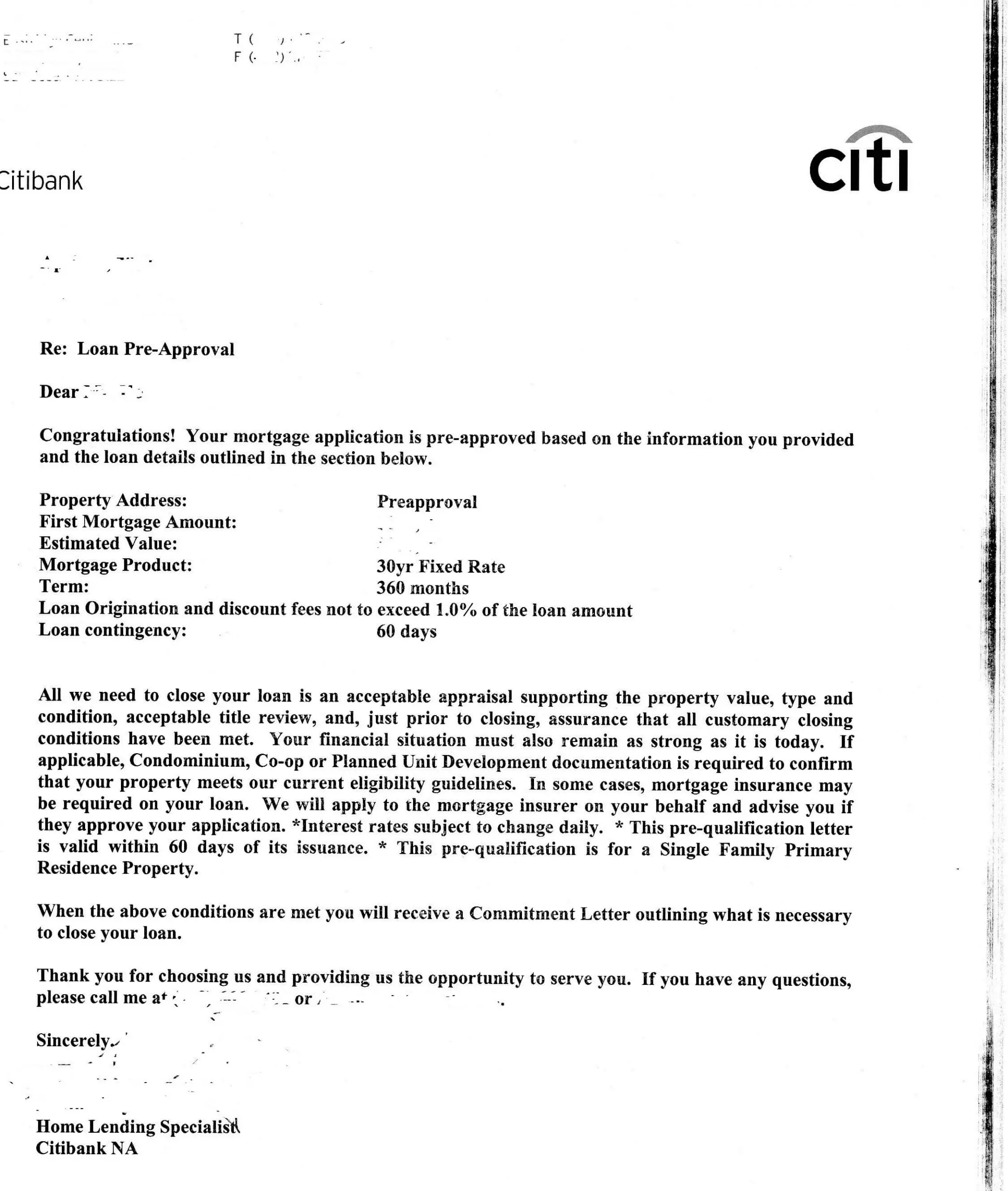

Will I Get A Mortgage Commitment In Writing

Your loan officer will issue your mortgage commitment in the form of a letter.

The commitment letter generally includes your loan amount, loan type and terms, approval confirmation and the expiration dates for the interest rate lock and commitment.

The letter proves to sellers that you have financing secured and can close and purchase the home in a quick time frame.

Armed with a mortgage commitment letter, your offer will stand out from standard pre-approvals because the letter proves you have the money to make the purchase.

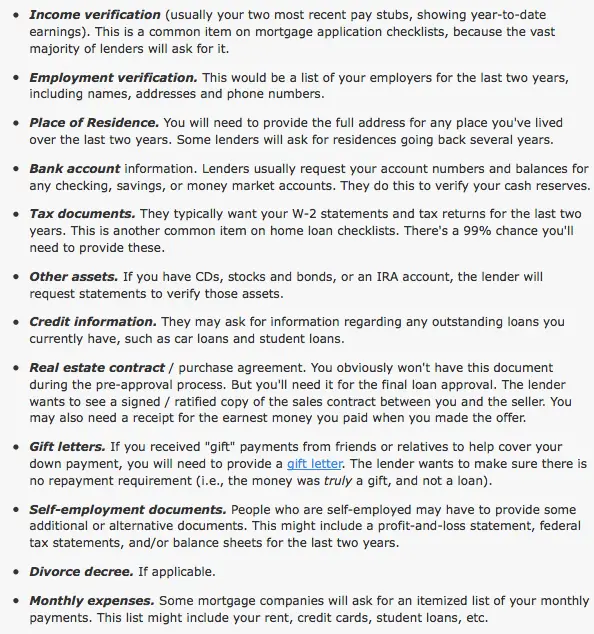

Federal Tax Returns & Bank Statements

Other documents needed for mortgage pre-approval are federal tax returns and bank statements.

Lenders will usually request these documents going back at least two years.

For many filers, these come in the way of Form 1040s. You may also have different documents like Schedule C, Schedule C-EZ, Schedule SE or others, depending on your filing status.

For many borrowers, these are some of the easier files to gather among the documents needed for mortgage pre-approval.

Also Check: Does My Husband Have To Be On The Mortgage

Also Check: Which Credit Report For Mortgage

Ways To Increase Your Mortgage Pre

While you never want to be approved for a bigger home payment than you can handle, you dont want to miss out on funding unnecessarily either. Here are ways that you can increase your pre-approval amount.

1. Improve Your Credit Score

One way to make sure you receive the full financing possible is to improve your credit score. Your credit score is a numbertypically between 300 and 850that gives your financier an idea of your history of paying other obligations. It is based on your credit history, which takes into account factors like how many accounts you have open, how much you owe, and how promptly you pay your bills. If you find your credit score is low, check out these tips on how to get your credit ready for a mortgage.

2. Consider All Sources of Income

There are other ways beyond improving your credit score to increase the amount of financing you can qualify for. Dont forget income sources such as child support and regular bonuses. Also consider the pros and cons of tapping into a 401K, stocks, or bonds.

3. Increase Down Payment

If your down payment equals at least 20 percent of the purchase price, you wont have to pay for Private Mortgage Insurance each month. By getting rid of this monthly bill, you may qualify for more financing.

4. Add a Co-Applicant

Proof Of Employment And Income

A regular source of income is a must if youre looking for a pre-approved mortgage. You have to show that you are steadily, consistently employed: typically by remaining an employee of the same company for a certain amount of time, and that you are paid regularly.

For those who are self-employed, things might be a little different, as youll have to prove youre financially stable by showing documentations of your business and/or freelance activities despite not being an ordinary employee. Some ways you can show this include:

- Pay slips/Invoices

Recommended Reading: What Is A Payment On A 200k Mortgage

Seller May Request Proof Of Financing

There are many additional reasons, aside from time savings, why real estate agents request their clients obtain pre-approval before showing them homes. One of the most common is because the seller often requires it, as they dont want non-qualified buyers walking through their home. This is most common with luxury real estate, although this seller preference is seen with budget-friendly homes as well. For these reasons, dont take it personally when you are requested to have pre-approval done before youre allowed to view a home.

An added benefit of having this done is that youll be in a better position to present an offer on a home that you would like to buy.

Sellers take buyers who have pre-approval letters readily available much more seriously because they have shown their ability to pay. Without this, the seller would never know if you would be able to get financing for their home or if the deal with go through.

Why Should I Get Preapproved

If a preapproval doesnt get you a loan right away, why get one? Preapprovals have several benefits:

- Its easier to shop: Many real estate agents require you to get preapproved before you shop for a home. Preapprovals make the house hunting process easier for you and your real estate agent.

- It makes your offer stronger: If youre shopping in a competitive housing market, a preapproval can be crucial to getting your offer accepted. Sellers arent just looking for the highest offer. Theyre also looking for offers that arent likely to fall through. A preapproval tells buyers you can get financed for the amount youve offered.

- It gives you time to sort out issues: There are reasons both buyers and sellers may need to get to closing fast. Getting preapproved means youre getting the bulk of the mortgage process done upfront. That way, once youve had an offer accepted, you can just focus on getting ready for your move.

Read Also: How To Get Approved For Mortgage With Low Income

Proof Of Current Debts

Be honest when you declare your additional debts. Lenders take pre-existing debt into consideration when deciding if you are an ideal candidate for a home loan. As such, billing statements from credit cards and other loans should be submitted so that the lender will have a birds eye view of your expenses.

Top 5 Reasons A Mortgage Is Denied After Pre

Kyle Hiscock

Kyle Hiscock | Greater Rochester NY Real Estate | Pittsford NY Realtor at RE/MAX Realty Group

Have questions about buying or selling a home?

Popular Ways A Mortgage Is Denied After Pre-Approval

Top 5 Reasons A Mortgage Is Denied After Pre-Approval

One of the most important steps to successfully purchase a home is to get pre-approved for a mortgage before shopping for homes. The primary reason to get pre-approved for a mortgage before shopping for homes is to ensure youre looking at homes that are within the price range that you can afford.

Even though a buyer will get pre-approved for a mortgage before shopping for homes doesnt mean there is a guarantee they will successfully obtain the financing. Certainly the hope is the if a lender pre-approves a buyer that the buyer will successfully obtain the financing, however, its possible a mortgage can get denied even after pre-approval.

A mortgage that gets denied is one of the most common reasons a real estate deal falls through. When a buyers mortgage is denied after pre-approval, its in most cases the fault of the buyer or the lender that pre-approved them.

Many of the reasons a mortgage is denied after pre-approval are actually fairly common. Below you will find the most common reasons a mortgage is denied after pre-approval and if youre aware of what they are, youll greatly reduce the chance that your mortgage is denied even after a pre-approval!

Change Of Employment

Negative Item On Credit

Final Thoughts

You May Like: Is Mr Cooper A Legitimate Mortgage Company

The Buyer Lost Income Or Piled On Debt

A home buyers ability to repay its mortgage gets based on Debt-to-Income. DTI is the amount of debt a buyer has compared to their income.

Mortgage approvals cap a buyers debt-to-income ratio near 50 percent.

If the buyers debt rises but their income stays the same, the pre-approval may get revoked at the point of purchase.

Understand The Difference Between Pre

A mortgage pre-qualification is often a basic financial evaluation. A TD mortgage pre-approval on the other hand, is in-depth. It includes a more thorough assessment of your finances. It also offers a rate hold of up to 120 days , while a pre-qualification does not. Plus, if you apply for a TD mortgage pre-approval online, it has no impact on your credit score. These benefits make a pre-approval an important part of the mortgage process.

Also Check: What Is A 15 Year Jumbo Mortgage

How Long Does Mortgage Pre

The wait for an answer depends on the lender. Some lenders advertise same-day approval, while others may take a few days or a week. Keep in mind that the terms pre-qualified and pre-approved may have different meanings among lenders and may be used largely interchangeably, so how long they take can also vary. Its important to make sure what the lender is actually doing: pre-qualification, or the deeper pre-approval.

How Long Does Preapproval Last

Preapproval doesn’t last forever. Check your expiration date and keep it in mind as you look at homes. Though it varies from lender to lender, preapproval is typically valid for 60 90 days. If you haven’t settled on a house, you can request a renewal by giving your lender your most up-to-date financial and credit information.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

What Is Mortgage Pre

When you start the homebuying process, you want to be as prepared as possible. With the right documents in hand, you can make compelling bids on homes in your desired area. By preparing to complete the mortgage process ahead of time, you can move seamlessly toward the closing process and help your lender with any information they need.

One major step in the lending process is getting pre-approved for a mortgage. With a pre-approval letter and a proof of funds document, you can make offers on homes and convince sellers that you are the best bid out there.

Learn more about the mortgage pre-approval process so you can begin working with your lender

Also Check: Can My Mom Cosign On A Mortgage

There’s No Need To Choose A Lender Just Yet

Getting preapproved is important because it helps you shop for a home. But at this stage, lenders arent in a position to give you enough information for you to make a decision about which lender offers the best deal. Getting a preapproval doesnt commit you to using that lender for your loan. Wait to decide on a lender until you’ve made an offer on a house and received official Loan Estimates from each of your potential lenders.

Also Check: How Much Does A Mortgage Payment Increase For Every 100000

Questions To Ask Your Lender Or Broker When Getting Preapproved

When getting preapproved, ask your broker or lender the following:

- how long they guarantee the preapproved rate

- if you will automatically get the lowest rate if interest rates go down while youre preapproved

- if the pre-approval can be extended

Ask your lender or broker about anything you dont understand.

Start The Preapproval Process

If youre ready to start house hunting or even considering it in the near future its time to start the mortgage process by getting preapproved for a home loan. The approval process will help lock in your borrowing power and give you an advantage in a competitive housing market. Itll also turn up relevant issues, like a low credit score, that you might fix before beginning your homeownership journey.

You May Like: How To Take A Mortgage Loan

Build Trust & Win Multiple Offer Situations

The real estate market is always changing, therefore you can never anticipate whether or not a home is going to attract offers from multiple buyers at the same time. However, its important to be prepared just in case this situation does occur.

A pre-approval letter from your lender is just what you need, as this will make you stand out. Sellers see this letter as security, not only because you have proven that you can obtain financing, but also because youve proven that youre serious about buying the property. As a result, you will be one of the top candidates they consider accepting an offer from.

How To Get Pre Approved For A Mortgage Step : Check Your Credit

At least three months before you reach out to a lender for a pre-approval, its a good idea to review your credit report. This way, youll have an idea of what your lender will see and how that might influence your odds of obtaining a pre-approval.

Look for any errors or inaccuracies that could be hurting your credit score. Take steps to dispute the errors, and then follow up one to three months later to verify that they have been corrected. Disputes can take time to resolve.

Recommended Reading: What Is My Monthly Payment On A 250 000 Mortgage

How The Mortgage Preapproval Process Works

There are five basic steps in the mortgage preapproval process.

Other Documents Showing Income

When you apply for pre-approval, your lender should have an accurate look at your finances.

One of the ways you do this is by providing proof of other income that you may have.

Do you receive Social Security benefits, pension payments, child support or alimony payments?

If you have any of these, you should gather documents that provide proof of this for presentation to your prospective lender.

If you receive dividend income from stocks you own or checks from trust funds, these are also things to consider outside of your brokerage accounts.

If you have a lot of different accounts, a helpful tip is to pull out a sheet of paper and write down all the accounts that you can think of that are in your name.

This way you are being careful not to overlook accounts that your prospective lender needs to know about as part of the pre-approval process.

Read Also: Can You Use Home Equity To Pay Off Mortgage

How Much Mortgage Can You Afford

With most buyers, theres a considerable difference between what they think they can afford and what they actually can afford. Getting the mortgage pre-approval will point you in the right direction, as it will give you the best idea of what you can realistically afford.

However, its important to be aware that some lenders approve buyers for less than they want to spend while others will approve buyers for more. This is when its important to be self-aware of your finances and what youre genuinely comfortable with spending on this significant purchase.

The hard numbers you receive from the lender will be a great starting point that allows you to narrow down your search for homes. Knowing your price range will give you an idea of how many rooms you can afford, which area you might want to live in and if you can genuinely afford what you want. For most people, this is when shopping for a home becomes more real and they can finally picture themselves as homeowners.

For instance, knowing your financial position can help you avoid looking at homes that you simply cannot afford.

When youre ready to start looking, analyze the approval letter and monthly payment information provided by your lender. Once youve determined the maximum that youre content with, the down payment and closing costs can be calculated so you can look at homes within your ideal budget.

Documents Needed For Salaried Employed

As a salaried employee, you will be asked to provide two documents:

- Letter of Employment, dated within 30 days

- Recent Pay Stub, dated within 30 days.

The Letter of Employment should be on company letter head. The letter should include the following details:

- Your Rate of Pay, specifically how much you earn yearly or monthly or how ever you are paid.

- Your Position, that is, your job title

- Your Tenure, when you started with the company

- Should be signed, by an HR Representative or Manager

- There should be a contact number for the person signing

Don’t Miss: What Is A Non Qm Mortgage Loan