Using Online Mortgage Calculators

If you dont want to calculate your mortgage by hand, you can find a free payment calculator to use online there are many to choose from. These work by asking for a certain amount of variables and instantly providing you with a fixed monthly cost. Theyre usually easy to use and very convenient since you dont have to do any math by hand.

Keep in mind that an online mortgage calculator is only as helpful as the inputs you provide. You wont be able to go back and check the math, so if you make a mistake with the numbers you provide, it could be hard to catch an incorrect output.

Furthermore, it could be hard to find a customizable mortgage calc that uses all the variables youd like to include. You may have a unique scenario that the calculator mortgage doesnt take into account.

Some expenses that most mortgage calculators dont take into account include your monthly home maintenance costs, such as pest control and security, and your monthly utilities . You may also have a monthly HOA fee, property taxes, and homeowners insurance. These are all monthly costs that are separate from your mortgage but still need to be considered well ahead of time, so you understand the full scope of your budget.

Paying Your Mortgage Weekly Vs Monthly

There isn’t a large difference between paying your mortgage weekly or monthly, if we’re looking at non-accelerated weekly payments. That’s because the total amount paid per year is the exact same for both payment frequencies. You’ll just pay a smaller amount with a weekly payment, but you’ll be making more frequent payments. The real difference is when you choose accelerated weekly payments. Accelerated payments can shave years off of your amortization, and can save you thousands of dollars.

How Much Will My Monthly Mortgage Payment Be

Once you find the home you want to buy, its time to break down the costs to see how it will fit into your monthly budget. Many people turn to mortgage calculators for a quick answer, but they often get a vague estimation that doesnt consider everything.

At OVM, we get many questions about how a mortgage payment works and what the magic number will be for each of our clients. Here are the key factors and tips you should know to help you understand how to calculate a mortgage payment accurately.

Don’t Miss: Which Credit Report Do Mortgage Lenders Use

How To Lower Monthly Mortgage Payments

Maybe you have your dream home but cant afford the mortgage payments. There are a few ways to lower the monthly payments for your mortgage.

Here are some of the best ways to lower your monthly payments:

-

Pick a cheaper home: A less expensive house means lower payments. You might be able to find your dream home in a different location or in a different style.

-

Invest in a better down payment: The higher the down payment, the lower the monthly cost. Aim for at least 20% to ensure you get better rates for the other mortgage fees.

-

Look for a lower interest rate: Interest builds over time, so the lower the rate, the better. However, some need you to pay upfront.

-

Look out for PMI: Pay at least 20% on your down payment to steer clear of PMI. The more you pay, the safer you can be on that front.

-

Pick a longer loan: The longer the loan, the lower each monthly payment. It might mean paying more in the long run.

These can all help lower the monthly payment and make your mortgage more afordable.

If you cant afford the loan, it doesnt make sense to buy out of your price range. You may lose your home.

Length Of A Home Loan Term

The loan term refers to how long you have to pay off a loan. Shorter terms mean higher monthly payments with less interest. Longer terms flip this scenario, meaning more interest is paid, but the monthly payment is lower.

When youre looking at monthly payments, its important to balance dueling goals of affordability while at the same time trying to pay as little interest as possible.

One strategy that might be helpful is to put extra money toward the monthly principal payment when you can. This will result in paying less total interest over time than if you just made your regular monthly payment.

You can also take a look at recasting your mortgage to lower your payment permanently. When you recast, your term and interest rate stays the same, but the loan balance is lowered to reflect the payments youve already made. Your payment is lower because the interest rate and term remain.

One thing to know about recasting is that sometimes theres a fee, and some lenders limit how often you do it or if they let you do it at all. However, it can be an option worth looking into because it might be cheaper than the closing costs on a refinance.

Also Check: Can You Refinance 1st Mortgage Only

How To Choose The Right Mortgage Lender

Choosing the right lender takes a fair amount of research and requires a thorough review of your situation before you even start your search. For example, if you are a first-time buyer, some lenders might be better than others for your situation. Other factors that can help determine the right lender for your situation might include:

- Do you have a high credit score, or are there issues here?

- Are you looking for a 30-year mortgage or perhaps one with a 15-year term?

- Are you a veteran?

The key factors to consider when starting your search include:

- Your credit score

- The amount of your down payment

- The loan term you are seeking

- Extra fees and closing costs associated with the mortgage

- The interest rate

The types of lenders you might consider include:

In some cases, it might make sense to work with a mortgage broker who can help you look across the mortgage lender spectrum and can often help you obtain a suitable deal. Some online mortgage sites offer access to several different lenders, much like a traditional mortgage broker.

Read Also: What Determines Your Mortgage Interest Rate

How Much Interest Do You Pay

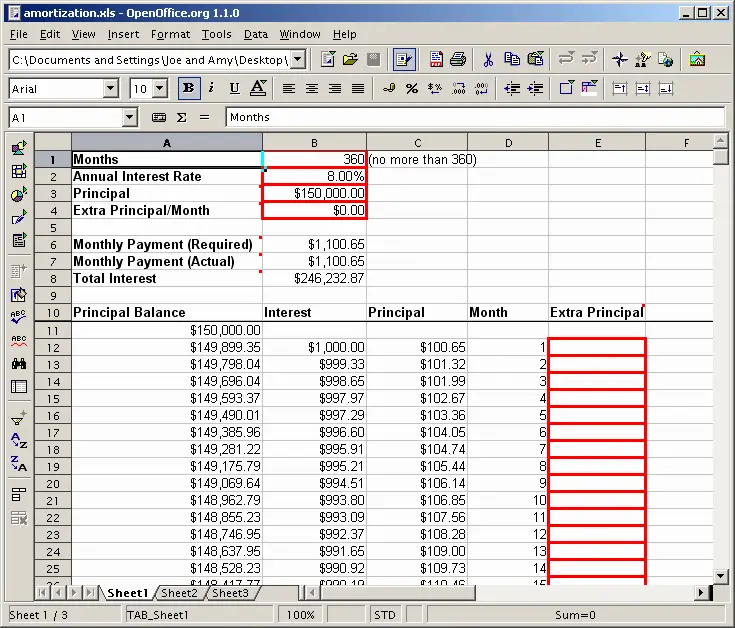

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Paying extra each month

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Read Also: Who Offers 50 Year Mortgages

Determining The Right Down Payment Amount

A purchase calculator can help you determine the down payment you need. There are minimum down payments for various loan types, but even beyond that, a higher down payment can mean a lower monthly payment and the ability to avoid mortgage insurance.

On the flip side, a higher down payment represents a more significant hurdle, particularly for first-time home buyers who dont have an existing home to sell to help fund that down payment. The calculator can show you options so that you can balance the amount of the down payment with the monthly mortgage payment itself.

Skip A Mortgage Payment

Many mortgage lenders offer flexible mortgage payment options, such as the ability to skip a payment or to defer your mortgage payments. Most of Canadas major banks allow you to skip a mortgage payment, with the exception of CIBC and National Bank.

Generally, you won’t be able to skip mortgage payments for mortgages that are insured. Having a CMHC-insured mortgage means that your amortization cannot go over 25 years. For insured mortgages, you’ll need to have made a mortgage prepayment that would be equivalent to the amount that you want to skip for you to be able to skip a mortgage payment in the future.

Lenders also have conditions in order to be able to skip a mortgage payment. Your mortgage must not be in arrears, and your current mortgage balance must not be more than your original mortgage balance at the start of your term.

Read Also: What’s Refinancing A Mortgage

What Controls A Variable Interest Rate

Variable interest rates change based on your lendersprime rate, which is controlled by your lender. If your lender increases their prime rate, then your variable interest rate will increase.

Lenders will usually only change prime rates to match movements in theBank of Canadas policy interest rate. If the lenders funding cost increases, such as through the Bank of Canada increasing their policy rate, then the lender will in turn increase variable mortgage rates. Prime rates are generally similar or identical between different lenders, with all Canadian banks currently having a prime rate of 2.45% as of July 2021.

Yourvariable mortgage rateis priced at a discount or a premium to your lenders prime rate.

The Best Home Loan Option For You

Any good calculator will help determine what might be a good loan product for you based on what you might qualify for. Youll usually see several options.

Its worth noting that you must qualify, so dont take what the mortgage calculator says as gospel. A Home Loan Expert will better be able to tell you what you qualify for when they take a more detailed look at your financial history. However, it does give you a starting point in terms of things to think about.

Read Also: How Much Money Do I Need To Get A Mortgage

Should I Include Projected Repair Costs In My Monthly Payment Calculation

Repair costs arent something that you should include in your monthly payment calculation, but you absolutely should keep them in mind. If the property that you are considering is in need of significant repairs or renovations, then you absolutely will need to consider how you will cover those costs before you sign on to a mortgage on the home.

Provide Details To Calculate Your Affordability

Total income before taxes for you and your household members.

Payments you make for loans or other debt, but not living expenses like rent, groceries or utilities.

City or ZIP code you are searching in.

Money that you can spend on the down payment and closing costs.

Yes, I or my spouse served in the U.S. Military

0% down for veterans and their spouses, no mortgage insurance required.

Total income before taxes for you and your household members.

Payments you make for loans or other debt, but not living expenses like rent, groceries or utilities.

You May Like: What Is Wells Fargo Current Mortgage Rates

The Major Part Of Your Mortgage Payment Is The Principal And The Interest The Principal Is The Amount You Borrowed While The Interest Is The Sum You Pay The Lender For Borrowing It Your Lender Also Might Collect An Extra Amount Every Month To Put Into Escrow Money That The Lender Then Typically Pays Directly To The Local Property Tax Collector And To Your Insurance Carrier

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, you’ll have an additional policy, and if you’re in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the home’s purchase price, you’ll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

View Affordability From Two Perspectives:

- Your overallmonthly paymentswhich included household expenses,mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

Also Check: How Much Mortgage On 200k

What Is A Mortgage Buydown Lower Interest Rates With This Strategy

When you decide to buy a house, youre not only committing to paying for the purchase price of the home but also the interest rate on your mortgage loan the cost of borrowing money from your mortgage lender.

With todays high mortgage rates, many homebuyers are seeing their purchasing power plummet as their potential monthly payments skyrocket. And while it may be tempting just to wait to buy until mortgage rates are low again, thats not always an option. Luckily, one option to consider is to buy down your mortgage.

By paying a bit more upfront, you can ensure a lower mortgage rate and keep more money in your pocket each month.

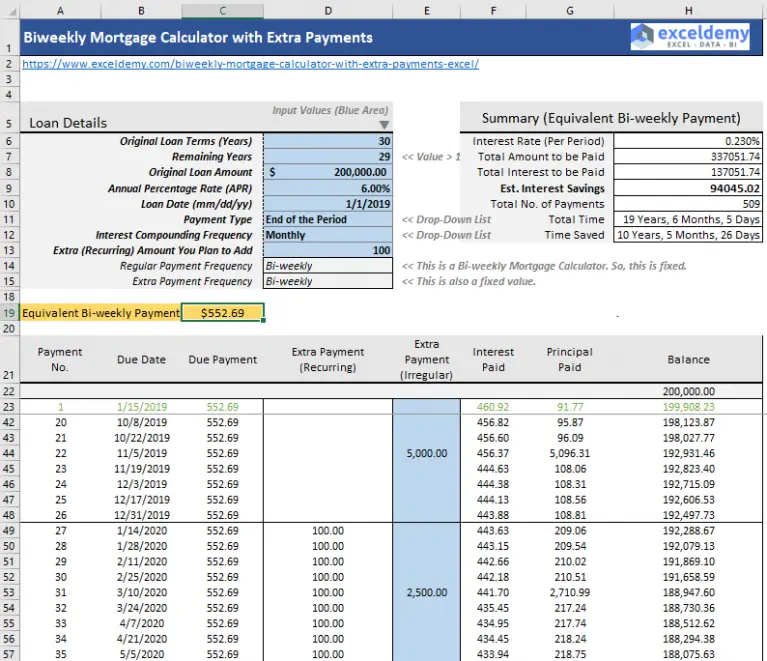

How Can I Calculate My Mortgage Repayment In Excel

Use Excel to get a handle on your mortgage through determining your monthly payment, your interest rate, and your loan schedule. You can take a more in-depth look at the breakdown of a loan with excel and create a repayment schedule that works for you.

How is the principal of a mortgage calculated?

The mortgage principal is $400,000. If you have a fixed-rate mortgage, youll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

You May Like: Can You Have Two Mortgage Loans

How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if youre in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Dont Miss: Reverse Mortgage For Condominiums

Also Check: How Much Is A Habitat For Humanity Mortgage

How To Lower Your Monthly Mortgage Payment

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

How Does The Interest Rate Affect The Cost Of My Mortgage

Your regular mortgage payments include both principal payments and interest payments. Having a higher interest rate will increase the amount of interest that you will pay on your mortgage. This increases your regular mortgage payments, and makes your mortgage more expensive by increasing its total cost. On the other hand, having a lower mortgage interest rate will reduce your cost of borrowing, which can save you thousands of dollars. While interest rates play a large role in determining the cost of your mortgage, there are other factors too. This includes the size of your mortgage, how long it will take to pay your mortgage off, and if you require CMHC insurance. This all affectshow much mortgage you can afford.

Don’t Miss: What Will My Mortgage Interest Rate Be