Interest Rates And Fees If You Refinance Your Home

The interest rate on the refinanced part of your mortgage may be different from the interest rate on your original mortgage. You may also have to pay a new mortgage loan insurance premium.

You may have to pay administrative fees which include:

Your lender may have to change the terms of your original mortgage agreement.

What Are The Most Important Factors That Help Determine How Much House I Can Afford

Figuring out how much you can spend on a home comes down to a few key figures: How much money you earn, how much money you can contribute to a down payment and how much money youre spending each month on other debts. When you apply for a mortgage, a lender will scrutinize every aspect of your personal finances to assign a level of risk on whether youll be able to pay the loan back. The more you can lower your debt-to-income ratio and increase the size of your down payment, the better.

Calculator: Start By Crunching The Numbers

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

Don’t Miss: How To Become A Mortgage Underwriter With No Experience

Don’t Be Fooled By The 5

Kaplan says homeowners usually need to stay put for at least five years to make the closing costs of buying a home worthwhile. That’s a useful rule of thumb, but if you’re thinking of staying that long, you may be tempted to opt for a mortgage that’s higher than you can comfortably afford now. Be careful. Predicting future income isnt as easy as it may seem. Kaplan cautions that stretching your budget can backfire if you become unemployed for an extended period.

When they’re planning for the long term, many homebuyers may also see their home as an investment for the future, which can be an excuse for spending more today than they can easily afford. But real estate can be volatile, as we saw in the 2008 housing crash. Having too much of your net worth tied up in your home can be risky.

Can You Put A Home That Has A Mortgage In A Family Trust

Related Articles

Putting your home in a trust keeps your most valuable asset out of probate court that can take up to a year and require your heirs to spend their vacation days tied up in hearings. When you have a mortgage on the home you want to place in a trust, itâs important to notify your lender first to make sure your trust contains all the necessary ingredients to satisfy their standards. Otherwise, you could end up triggering your noteâs due-on-sale clause.

Tip

Yes, you can put a home that has a mortgage into a family trust. However, the crucial first step is to contact your lender to determine its requirements.

You May Like: What Does It Mean Points On A Mortgage

Read Also: What Is The Current Mortgage Rate In Ny

How To Use The Maximum Mortgage Calculator

Not sure where to start? Let us help you:

The Risks And Alternatives

As a second mortgage works very much like your first mortgage, your home is at risk if you dont keep up the payments. Like any mortgage, if you get into arrears and dont pay it back, additional interest can mount up.

If you sell your home or its repossessed, the first mortgage gets cleared in full before any money goes towards paying off the second mortgage. However, be aware that the second mortgage lender can pursue you for any shortfall.

Recommended Reading: Rocket Mortgage Vs Bank

You May Like: How Much Mortgage Could I Qualify For

Confirm You Meet The Cash

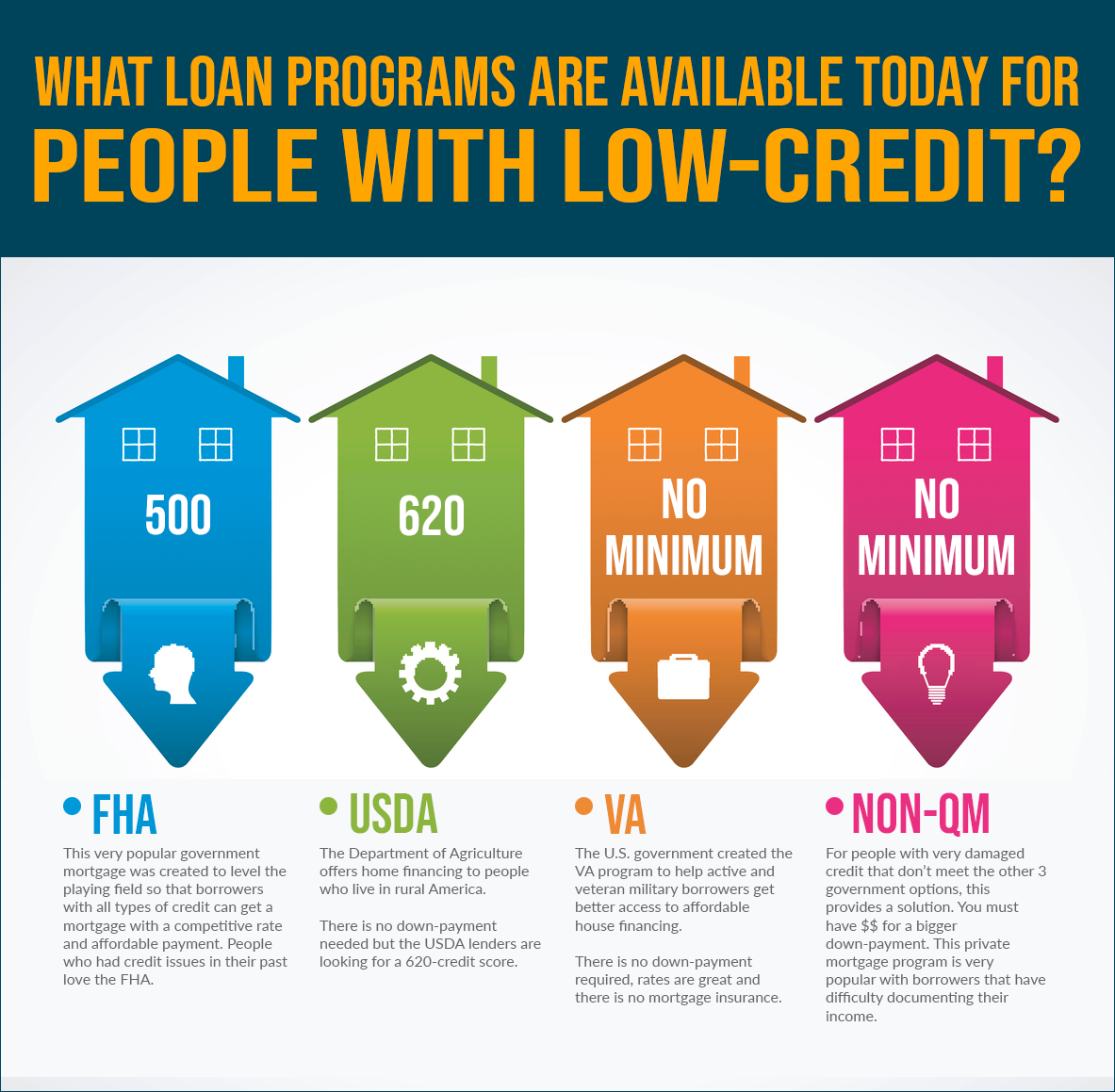

The first step is ensuring you qualify for a cash-out refinance. Lenders each have their own cash-out refinance requirements, but there are some general guidelines they typically look for. The minimum cash-out refinance credit score for a conventional loan is 620. Its 580 for FHA and VA loans. Some lenders will work with borrowers with lower scores.

Youll also need a debt-to-income ratio of less than 50%. And, as previously mentioned, youll need enough equity in your home that youll still have 20% after your new loan closes. Youll also need to meet the minimum seasoning requirement for length of home ownership, which is the amount of time youve lived in your home. Its usually a minimum of six to 12 months.

At-a-glance cash-out refinance qualifications:

- More than 80% LTV before the refinance

- Ownership of 6-12 months, depending on loan type

Bringing It All Together

As you can see, there are a number of factors that determine how large of a mortgage you can get. If you get access to your FICO score and crunch some numbers, you can get a rough idea of your borrowing capacity. You can also seek assistance from your bank or a mortgage broker.

All of this, however, still leaves one important question.

Recommended Reading: How To Get Your Mortgage Credit Score

Standard Refi Vs Cash

A standard refinance, or rate-and-term refinance, changes your interest rate, the number of years you have to repay your mortgage or both. The most popular reason to do a standard refinance is to lower your interest rate.

Sometimes, homeowners who are getting a lower rate through a refinance will also move from a 30-year mortgage to a 15- or 20-year mortgage. This way, they dont start all over on paying off their home, and they may even shave off years of payments. That means theyll spend less money on interest in the long run. You can get a shorter term with either type of refi.

Other times, homeowners are motivated to refinance by financial constraints. A standard refi that restarts the 30-year payment clock can give you a lower monthly payment, especially if youre getting a lower interest rate. A cash-out refi will usually increase your monthly payment because you owe more overall on the mortgage.

Work Out How Much You Can Borrow How Long Does Mortgage Approval Take Ireland 2022

The first step is to work out how much mortgage you can get, you might not need to borrow up to your limit, but it will help you to understand your maximum budget in case you find yourself in a bidding war for your new gaff.

To help avoid a credit bubble like the one that went pop back in 2008 the Central Bank sets some absolute maximum limits that no lender can go beyond.

If you are buying your home to live in, the limit is the lower of either

- Income 4.5 times your joint gross income per year

- Deposit 10 times your deposit

Wait a minute before you rush off and bid on that dream home, the Central Bank only allows 20% of all borrowers in any year borrow up to these limits.

The lenders are therefore very picky about who gets these exceptions only putting forward people with squeaky clean credit histories and very high levels of disposable income.

If you fall outside the top 20% of applications then the limits are

- Income 3.5 times your joint gross income per year

- Deposit 10 times your deposit for first time buyers and 5 time for others

As part of the application process the lenders will also run the rule over your ability to repay the loan. Based on this they may lend you less than the limits above or indeed nothing at all.

Also Check: What Does Mortgage Insurance Do

Also Check: What Is Tip In Mortgage

How To Release Equity From Your Home

If you dont want to move home or downsize, you can remortgage to borrow against the value contained in your equity. This works by taking out a new mortgage that is larger than your existing mortgage.

For example, if the value of your home has increased from £150,000 to £200,000 since you took out your old mortgage, remortgaging enables you to cash-in on this increase in value without moving.

If you owed £100,000 to your existing mortgage lender, but you get a new mortgage of £120,000, you would be left with £20,000 extra, although there are various fees that will eat into that .

Because of the increase in value of the home, your loan to value ratio has still dropped, but youre borrowing and paying interest on a higher amount.

How Long Does A Cash

The timeline for a cash-out refinance ranges from one to two months depending on steps including the application process, waiting to lock the rate, completing the appraisal, underwriting, document signing, and a three-day mandatory waiting period during which the borrower can change their mind. Like other loan closing processes, the standard timeframe is 30-45 days.

You May Like: What Would My Mortgage Be With Taxes And Insurance

Why Use The Maximum Mortgage Calculator

Once you input your monthly obligations and income, the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment that you can afford, based on your current financial situation. This calculator will also help to determine how different interest rates and levels of personal income can have an effect on how much of a mortgage you can afford.

Calculate The Exact Amount You Need

If youre considering a cash-out refinance, youre likely in need of funds for a specific purpose. If you arent sure what that is, it can be helpful to nail that down so you borrow only as much as you need. For instance, if you plan to use the cash to consolidate debt, then gather your personal loan and credit card statements or information about other debt obligations, and add up what you owe. If the cash is to be used for renovations, consult with a few contractors to get estimates for both labor and materials ahead of time.

You May Like: How Many Mortgages Can I Have

Read Also: What’s The Mortgage Rate

Prepare A Detailed Budget

The oldest rule of thumb says you can typically afford a home priced two to three times your gross income. So, if you earn $100,000, you can typically afford a home between $200,000 and $300,000.

But thats not the best method because it doesnt take into account your monthly expenses and debts. Those costs greatly influence how much you can afford. Lets say you earn $100,000 a year but have $1,000 in monthly payments for student debt, car loans, and credit card minimum payments. You dont have as much money to pay your mortgage as someone earning the same income with no debts.

Better option: Prepare a family budget that tallies your ongoing monthly bills for everything — credit cards, car and student loans, lunch at work, day care, date night, vacations, and savings.

See whats left over to spend on home ownership costs, like your mortgage, property taxes, insurance, maintenance, utilities, and community association fees, if applicable.

Qualifying For Mortgages Beyond Four

Lenders impose stricter qualifications when you want to qualify for more than four mortgages.

In fact, underwriting guidelines tighten considerably when you want more than four mortgages. You may need to provide proof of some or all of the following items:

- 25% down payment on each investment property

- 30% down on duplexes, triplexes and quads

- Minimum credit score of 720

- No late mortgage payments on any property

- 2 years of tax returns showing all rental income from all properties

- 6 months of cash reserves for principal, interest, taxes and insurance coverage on all properties

Ask your lender for any other guidelines you need to finance loans five through 10.

Don’t Miss: Are Mortgage Rates Predicted To Go Up Or Down

What Does The Mortgage Qualifying Calculator Do

This mortgage qualifying calculator takes all the key information for a mortgage and lets you determine any of three things: 1) How much income you need to qualify for the mortgage, or 2) How much you can borrow, or 3) what your total monthly payment will be for the loan.

To do this, the calculator considers your mortgage rate, down payment, length of the loan, closing costs, property taxes, homeowners’ insurance, points you want to pay and more. You don’t need to input all information to receive a ballpark figure.

You can also enter information about your current debts, like your car payments, credit cards and other loans to figure out how those affect what you can afford. This Mortgage Qualifying Calculator also gives you a breakdown of what your monthly mortgage payments will be, shows how much you’ll pay in mortgage interest each month and over the life of the loan, and helps you figure how you might allocate your upfront cash on hand toward closing costs. On top of that, it also lets you easily adjust any of the figures by using a sliding scale, making it simple to see how changing one or more affects the result, so you can identify where how reducing one thing or increasing another affects the final result.This Mortgage Qualifying Calculator also summarizes all your information in a detailed report, including an amortization table, for easy reference.

How Do I Use The Mortgage Qualifying Calculator

The mortgage qualifying calculator allows you to calculate the amount of mortgage you may qualify for in several ways. To select how you’d like to calculate, select one of the options from the drop-downs on “Calculate for.” Your options are:

- Total monthly payment: Calculates the total mortgage you may qualify for to hit a desired monthly payment.

- Annual income: Calculates the total mortgage you may qualify for based on your yearly income.

- Purchase price: Shows how much income you’d need to make to qualify for a mortgage at a specific purchase price.

Recommended Reading: Can I Get A Mortgage With A 575 Credit Score

Loans From An Irrevocable Trust: How To Do Them Right

Loans from a trust can be a great financial tool but they can be complicated and tricky!

getty

So, you have an irrevocable trust and you want to take a loan from the trust. While that might sound simple it really may not be as simple and you think, and you should discuss the decision with your trust attorney, CPA, and the trustee before you pull the loan trigger. Listed below are some of the many points you might want to consider before you have an irrevocable trust make a loan.

The Monthly Income Rule

If you want to focus your search even more, take the time to think about your monthly spending. While the Consumer Financial Protection Bureau reports that banks will qualify mortgage amounts that are up to 43% of a borrower’s monthly income, you might not want to take on that much debt.

“You want to make sure that your monthly mortgage is no more than 28% of your gross monthly income,” says Reyes.

So if you bring home $5,000 per month , your monthly mortgage payment should be no more than $1,400.

“With a general budget, you want to have 50% of your income going toward utilities, mortgage and other essentials,” says Reyes. Keeping your mortgage payment under 30% of your income ensures you have plenty of room for the rest of your needs.

Also Check: How To Pay Down Your Mortgage Faster

What Are My Options If The Result Is Less Than I Need

In this case, you may find that adjusting the loan term enables you to meet your requirements. Although it will mean repaying more in total over the course of your loan, the lower monthly repayments could help you to afford more than your initial result suggests.

Alternatively, you can experiment with different interest rates â to get the best options delivered directly to you, click the Get the FREE Quote button to get in touch with lenders who will be able to assist you.

I Want To Consolidate High

If youve already paid off your first mortgage, you probably have enough equity to pay off all your high-interest debts, like credit card debt or personal loans. This is typically done using a cash-out refinance. You tap your home equity, use it to pay off existing debts, and then effectively repay them to your mortgage lender at a much lower interest rate.

This can be a very smart way to save money on interest, especially when your mortgage interest is tax-deductible. But experts warn that using a cash–out refinance for debt consolidation has risks, too.

Remember that the new loan is secured against your home. So if you run the debts back up and cant make loan payments, there could be a risk of foreclosure. Also, youd be using a long-term asset, the value of your real estate, to pay for shorter-term needs.

Don’t Miss: How Much Is The Average Mortgage Insurance