How Do You Calculate A Mortgage Payoff

Youâll need to know the mortgage payoff amount if you want to refinance or sell your home. Your lender will have the exact sum, which will be date specific, but you can get an idea of what youâll owe.

| ð° Save thousands on commission. Try Clever Real Estateâs free agent matching service. Compare top local realtors, get full service for a 1% listing fee. Learn more. |

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

What Is Pmi And How Is It Calculated

Private mortgage insurance, or PMI, is a type of insurance typically required by the mortgage lender when the borrowers down payment on a home is less than 20% of the total cost of the home. Private mortgage insurance rates are typically 0.5% to 1.0% of the value of the mortgage. In the United States, the borrower can generally ask to stop PMI payments when the loan to value ratio reaches 80%. If the request is denied or never made, the payments will usually be stoped automatically by the lender when the loan to value ratio reaches 78%.

In our example above, the purchaser made a down payment of only 18.2% of the total cost of the home, so the lender of the mortgage could require PMI payments until the borrower reaches an equity stake in the home of 20%, which is the same as a loan to value ratio of 80%. If the lender required PMI of 1.0% of the value of the loan annually, then the borrower would have to pay 1.0% of $450,000, which is $4,500 per year. To make this a monthly value, divide $4,500 by twelve, which is $375 per month. This value would simply be added to the base mortgage payment.

Read Also: Are Current Mortgage Rates Good

Whats The Difference Between Interest Rate And Apr

The interest rate is the amount that the lender actually charges you as a percent of your loan amount. By contrast, the annual percentage rate is a way of expressing the total cost of borrowing. Therefore, APR incorporates expenses such as loan origination fees and mortgage insurance. Some loans offer a relatively low interest rate but have a higher APR because of other fees.

Explanation Of Mortgage Terms

Mortgage terminology can be confusing and overly complicatedbut it doesnt have to be! Weve broken down some of the terms to help make them easier to understand.

Learn about

Home Price

Across the country, average home prices have been going up. Despite the rise in home prices, you can still find a perfect home thats within your budget! As you begin to house hunt, just make sure to consider the most important question: How much house can I afford? After all, you want your home to be a blessing, not a burden.

Learn about

Down Payment

The initial cash payment, usually represented as a percentage of the total purchase price, a home buyer makes when purchasing a home. For example, a 20% down payment on a $200,000 house is $40,000. A 20% down payment typically allows you to avoid private mortgage insurance . The higher your down payment, the less interest you pay over the life of your home loan. The best way to pay for a home is with a 100% down payment in cash! Not only does it set you up for building wealth, but it also streamlines the real estate process.

Learn about

Mortgage Calculator Uses

Read Also: How To Get Rid Of Escrow On Mortgage

How Long Does The Approval Process Usually Take

The length of the approval process will depend on the lender type. For credit unions and banks, the approval process can take anywhere between a few days to a few weeks. Banks normally have stricter loan processes and higher approval standards than nonbank lenders.

If applicants opt to lend from peer-to-peer lenders, loans can get approved within a few minutes up to a few business days. Approvals tend to be faster if the applicant has already prepared all of the needed documents and other information beforehand. Repeat borrowers are likely to be approved quickly if they repaid on time during previous loans.

Online direct lenders tend to have the fastest processing periods. The application process usually takes a few minutes, and if applicants submit all of the needed documents, financing can be approved almost immediately.

How To Calculate Monthly Principal Payment

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like Ame

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Terms apply to offers listed on this page. Read our editorial standards.

- You can calculate a monthly mortgage payment by hand, but itâs easier to use an online calculator.

- Youâll need to know your principal mortgage amount, annual or monthly interest rate, and loan term.

- Consider homeowners insurance, property taxes, and private mortgage insurance as well.

More often than not, a homeowner who borrowed money to buy a house is making one lump-sum monthly payment to their mortgage lender. But while it may be called the monthly mortgage payment, it includes more than just the cost of repaying their loan and interest.

For many of the millions of American homeowners carrying a mortgage, the monthly payment also includes private mortgage insurance, homeowners insurance, and property taxes.

Itâs possible to estimate your total monthly payment by hand using a standard formula, but itâs often easier to use an online calculator. Either way, hereâs what youâll need:

Don’t Miss: What Is Gift Money For A Mortgage

Calculate Your Down Payment

Considering what to offer on a home? Change the home price in the loan calculator to see if going under or above the asking price still fits within your budget.

You can also use our mortgage payment calculator to see the impact of making a higher down payment. A higher down payment will lower your monthly payments not only because it reduces the amount of money you borrow, but also because it can help you qualify for a lower interest rate. In some cases, a down payment of at least 20% of the homes purchase price can help you avoid paying private mortgage insurance .

Ready to take the next step?

Shopping for a house is easier with a vetted professional on your side. Our Endorsed Local Providers are ready to help.

Recommended Reading: How Does A Reverse Mortgage Work When The Owner Dies

Consider Other Monthly Costs

You can incorporate additional variable into this calculation by tweaking the equation slightly. If youre paying an up-front down payment, this will affect the P in your equation or the total amount of your loan.

Perhaps youre paying a 20% down payment in the very first month of your payment period. Using the same numbers as above, thats $16,000. Your equation will change to:

M= 80,000-16,000 /.

We simply adjusted P to account for the $16,000 that would be taken off after the down payment is made, and we also adjusted N , so that your monthly rate would begin after the initial down payment.

Also Check: Should I Get 15 Year Mortgage

How Is Monthly Mortgage Interest Calculated Uk

Interest on fixed-rate mortgages is calculated by multiplying the loan amount by the interest rate. This can be broken down into the annual or monthly interest for the mortgage. First, turn the interest rate into a decimal . Then for the annual interest, times the mortgage loan amount by the decimal.

How To Manually Calculate Mortgage

When you begin paying a mortgage, you’re usually paying a fairly big portion in interest payments. Later in the life of the loan, you’ll usually pay a smaller amount in interest, since there will be less loan balance to incur those interest charges. You can calculate the portion of mortgage principal and interest by knowing your monthly interest rate and the balance on the loan.

TL DR

Multiply your outstanding mortgage balance by your monthly interest rate to see how much interest you are paying that month. The rest of your monthly payment is principal.

Don’t Miss: How 10 Year Treasury Affect Mortgage Rates

How To Calculate Your Mortgage Payments

The calculus behind mortgage payments is complicated, but Bankrate’s Mortgage Calculator makes this math problem quick and easy.

First, next to the space labeled “Home price,” enter the price or the current value of your home .

In the “Down payment” section, type in the amount of your down payment or the amount of equity you have . A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. You can enter either a dollar amount or the percentage of the purchase price you’re putting down.

Next, you’ll see Length of loan. Choose the term usually 30 years, but maybe 20, 15 or 10 and our calculator adjusts the repayment schedule.

Finally, in the “Interest rate” box, enter the rate you expect to pay. Our calculator defaults to the current average rate, but you can adjust the percentage. Your rate will vary depending on whether youre buying or refinancing.

As you enter these figures, a new amount for principal and interest will appear to the right. Bankrate’s calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts or even ignore them as you’re shopping for a loan those costs might be rolled into your escrow payment, but they don’t affect your principal and interest as you explore your options.

What Are The Requirements I Need To Secure For My Application

The following are the common requirements that lenders look for:

- Income and employment-related documents

- Bank statements

Lenders will want to make sure that applicants are capable of fulfilling their obligations, and one way to reduce the risk of non-payment & fraud is to ensure of this is by securing documents that show proof of income/employment.

Some kinds of loans such as mortgages and auto loans are secured by the title on the property. Lenders can also use other assets to secure financing, lowering their risk & giving consumers lower rates.

You May Like: Wells Fargo Car Loan Interest Rate

You May Like: What Changes Mortgage Interest Rates

Deferred Payment Loan: Single Lump Sum Due At Loan Maturity

Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

Read Also: What Is Mortgage Insurance For Fha Loan

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youâll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

Recommended Reading: How Much Interest You Pay On A Mortgage

How A Larger Down Payment Impacts Mortgage Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment calculations above do not include property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

The Major Part Of Your Mortgage Payment Is The Principal And The Interest The Principal Is The Amount You Borrowed While The Interest Is The Sum You Pay The Lender For Borrowing It Your Lender Also Might Collect An Extra Amount Every Month To Put Into Escrow Money That The Lender Then Typically Pays Directly To The Local Property Tax Collector And To Your Insurance Carrier

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, you’ll have an additional policy, and if you’re in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the home’s purchase price, you’ll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

Recommended Reading: What Happens To Second Mortgage After Foreclosure On The First

How Lenders Decide How Much You Can Afford To Borrow

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio.

Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

Read Also: How Do You Assume A Mortgage

Understanding Mortgage Loan Basics

When you buy property, youll often take out a mortgage loan to pay for some of the cost. You will give the lender a right to auction off or take possession of the property if you dont pay back the money and usually commit to making a monthly payment over a certain loan term, such as 30 or 40 years.

Each payment will include a mix of paying back loan principal, or the amount you initially borrowed, and interest, the extra percentage you pay to the lender in exchange for being able to take out the loan. As you continue to make payments, the percentage of each payment going toward principal will rise. As less principal is owed, less interest will be charged.

There may be other items paid through your mortgage payments, including homeowners insurance premiums, property tax and fees paid to a condo or homeowners association.

Read Also: Can You Prequalify For A Mortgage Without Credit Check

Don’t Miss: What Is The Average Mortgage Rate In Florida

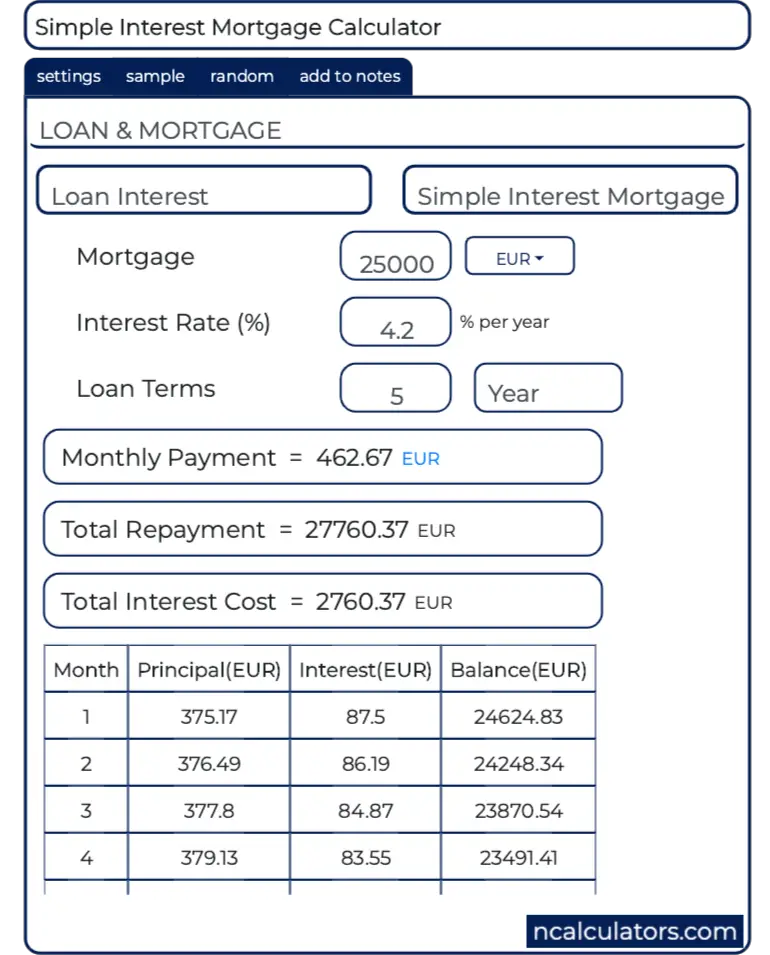

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans like 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

Read Also: Why Do I Pay Escrow On My Mortgage

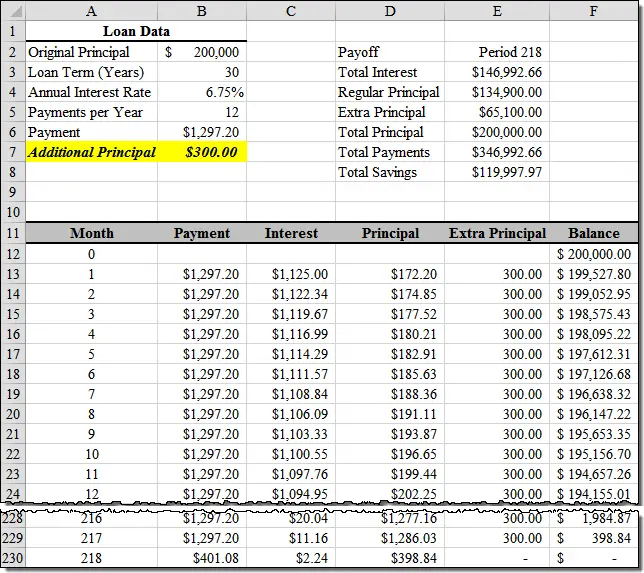

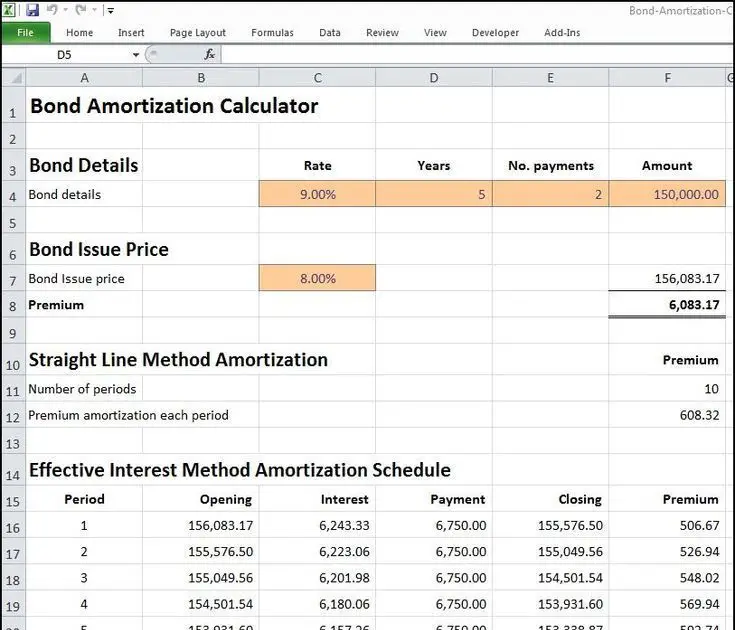

What Is An Amortization Schedule

Initially, most of your payment goes toward the interest rather than the principal. The loan amortization schedule will show as the term of your loan progresses, a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of your term.

A mortgage amortization schedule is a table that lists each regular payment on a mortgage over time. A portion of each payment is applied toward the principal balance and interest, and the mortgage loan amortization schedule details how much will go toward each component of your mortgage payment.

Also Check: Does My Husband Have To Be On The Mortgage

Also Check: How To Remove A 2nd Mortgage Lien