What Is A Reverse Mortgage

A reverse mortgage is a type of loan that allows homeowners ages 62 and older, typically whove paid off their mortgage, to borrow part of their homes equity as tax-free income. Unlike a regular mortgage in which the homeowner makes payments to the lender, with a reverse mortgage, the lender pays the homeowner.

Homeowners who opt for this kind of mortgage dont have a monthly payment and dont have to sell their home , but the loan must be repaid when the borrower dies, permanently moves out or sells the home.

One of the most popular types of reverse mortgages is the Home Equity Conversion Mortgage , which is backed by the federal government.

Pros And Cons Of Mortgage Points

Mortgage points can potentially save you thousands of dollars in interest over the life of your loan. As long as you can afford to purchase them and will have your mortgage long enough to break even on the costs, theyre an option you should consider.

Here some pros and cons of purchasing mortgage points:

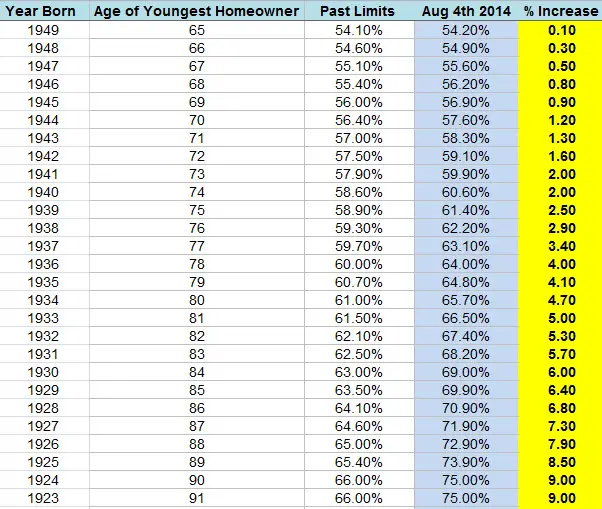

How Much Money Can You Get From A Reverse Mortgage

The amount of money you can get from a reverse mortgage depends upon a number of factors, according to Boies, such as the current market value of your home, your age, current interest rates, the type of reverse mortgage, its associated costs and your financial assessment.

The amount you receive will also be impacted if the home has any other mortgages or liens. If theres a balance from a home equity loan or home equity line of credit , for example, or tax liens or judgments, those will have to be paid with the reverse mortgage proceeds first.

Regardless of the type of reverse mortgage, you shouldnt expect to receive the full value of your home, Boies says. Instead, youll get a percentage of that value.

Also Check: How To Become A Certified Mortgage Underwriter

Recommended Reading: Can Student Loans Affect Getting A Mortgage

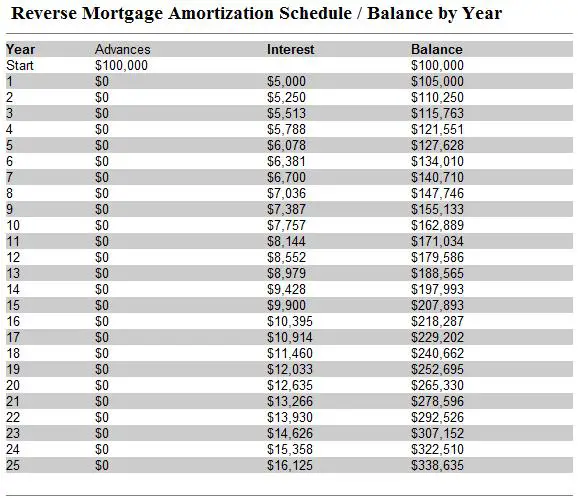

Is Interest On A Reverse Mortgage Compounded

Yes, interest compounds over a reverse mortgages lifetime. The longer you have a reverse mortgage, the more interest accrues on the loan. Each month, the unpaid interest is added to the principal balance of the loan, which means you could owe more than the value of your home if you live long enough.

Compounded interest isnt the only thing that can increase your loan balance. Youll also have servicing fees and an annual mortgage insurance premium payment. Read all the details of your loan to know what to expect.

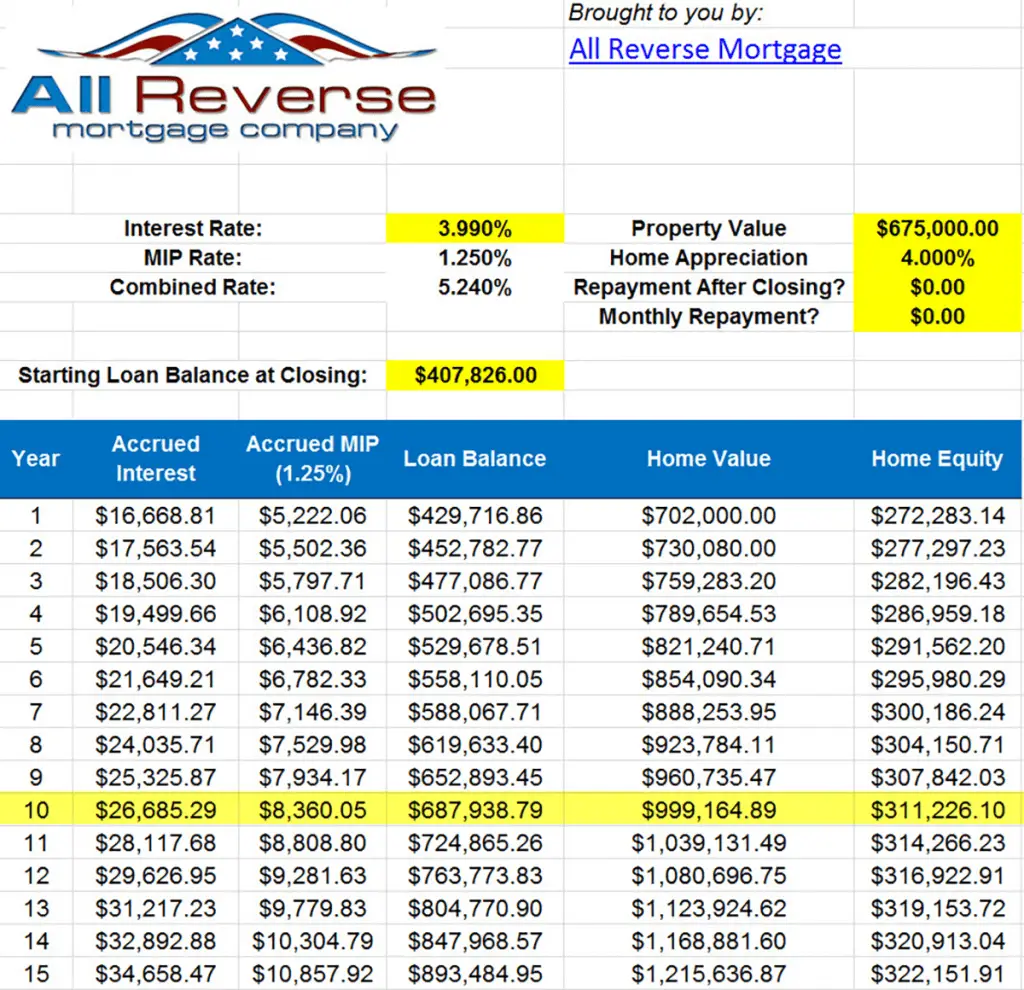

How Do Interest Rates Affect Me

There are a few reasons why choosing the best rate for your situation is important:

- A lower rate will lead to less interest charges over the loans life, and will thus directly affect how much equity could be left at the end of the loan.

- A lower Expected Interest Rate + a lower margin = a higher principal lending limit, which translates into more funds available to you.

Since there are no monthly mortgage payments, reverse mortgage rate increases wont make the loan unaffordable to you. When compared to traditional forward mortgages, the reverse mortgage loan holds an advantage in the sense that there is no threat of an unexpected mortgage payment increase due to inflated market rates.

There are also a few other factors that interact with your interest rates that determine how much money is available to you from a reverse mortgage:

- The amount of your remaining mortgage balance

- Your homes appraised value

- A financial assessment of your ability to pay property taxes and homeowners insurance

A solid combination of older age, lower mortgage balance, higher appraised home value, and lower interest rates will help garner you the most funds possible. Try our reverse mortgage calculator . It requires no personal information and estimates the total proceeds you may receive from a reverse mortgage.

Also Check: How Much Money Do You Get With A Reverse Mortgage

Equitable Bank Flex Flex Plus And Flex Lite

Equitable Bank offers three different types of reverse mortgages: Flex, Flex PLUS, and Flex Lite. Each has different eligibility requirements or maximum lending limits. The Reverse Mortgage Flex is Equitable Bank’s original reverse mortgage and is suitable for most homeowners looking for a reverse mortgage.

The Flex Lite is for homeowners that might not want to borrow as much money. In return for a lower borrowing limit, Flex Lite borrowers will have a lower interest rate, with them currently being the best reverse mortgage rates in Canada. However, Flex Lite also only allows for a single lump-sum advance at the beginning of your term, which means that you wont be able to schedule regular advances. For homeowners that want a higher borrowing limit, the Flex PLUS reverse mortgage grants a higher maximum limit but comes with a higher reverse mortgage rate and age requirement.

To learn more about Equitable Bank reverse mortgages, visit ourreverse mortgagepage.

What Is The Difference Between Jumbo And Proprietary Loans

Where jumbo reverse mortgages are proprietary by nature, proprietary reverse mortgages are not necessarily jumbo. Jumbo is a reference to a large loan amount. Some proprietary reverse mortgages are offered to home values as low as $400,000 where Jumbo programs usually benefit those high valued homes that are in excess of the HUD lending limit $970,800.

Additional Resources:

Also Check: Reverse Mortgage Mobile Home

Read Also: How To Look Up Mortgage Information On A Property

Homeequity Bank Chip Mortgages And Income Advantage

Each reverse mortgage product offers different features. The CHIP reverse mortgage provides a one-time lump-sum payment. CHIP Income Advantage lets you get regularly scheduled advances similar to a steady stream of tax-free income. CHIP Open is an open reverse mortgage that lets you repay without prepayment penalties. CHIP Max lets you access a larger portion of your home equity at a younger age.

To see how much you can borrow with a CHIP mortgage, visit ourreverse mortgage calculatorpage.

Be Wary Of Sales Pitches For A Reverse Mortgage

Is a reverse mortgage right for you? Only you can decide what works for your situation. A counselor from an independent government-approved housing counseling agency can help. But a salesperson isnt likely to be the best guide for what works for you. This is especially true if he or she acts like a reverse mortgage is a solution for all your problems, pushes you to take out a loan, or has ideas on how you can spend the money from a reverse mortgage.

For example, some sellers may try to sell you things like home improvement services but then suggest a reverse mortgage as an easy way to pay for them. If you decide you need home improvements, and you think a reverse mortgage is the way to pay for them, shop around before deciding on a particular seller. Your home improvement costs include not only the price of the work being done but also the costs and fees youll pay to get the reverse mortgage.

Some reverse mortgage salespeople might suggest ways to invest the money from your reverse mortgage even pressuring you to buy other financial products, like an annuity or long-term care insurance. Resist that pressure. If you buy those kinds of financial products, you could lose the money you get from your reverse mortgage. You dont have to buy any financial products, services or investment to get a reverse mortgage. In fact, in some situations, its illegal to require you to buy other products to get a reverse mortgage.

Dont Miss: How Does Rocket Mortgage Work

Read Also: How Do Mortgage Brokers Get Leads

Complete Your Loan Projection

ASIC’s MoneySmart Reverse Mortgage Calculator can provide you with an illustration of how a reverse mortgage impacts the equity in your home over time.

The calculator helps you look at:

- how much your debt will increase over time and what this means for your home equity

- how changes in interest rates and house prices could affect your equity over time

How Credible Mortgage Rates Are Calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

Recommended Reading: What Factors Into Mortgage Approval

What Will My Interest Rate Be

Your interest rate depends on the culmination of a few factors:

- Whether you are planning on getting a HECM reverse mortgage or a HECM for Purchase

- Any existing mortgage balance or liens

- Number of expected years in the house

- Your life expectancy

- The disbursement option is chosen

Using this information, a reverse mortgage professional can help you figure out what your reverse mortgage interest rate will be. The best way to understand your rates would be to speak with your AAG reverse mortgage professional and get a customized quote based on your individual situation. Call us today at 1-866-948-0003 to learn more from your friendly reverse mortgage professional.

Disclaimer notice: Interest rates mentioned are for illustrative purposes only and are not an offer to lend. Interest rates and amortization, mortgage insurance premiums , origination fees, lender margins, payment options and closing costs are subject to change and may vary. Amortization tables and APR calculations will be provided by your lender in the loan application package. A good faith estimate of closing costs, TALC disclosure and other disclosures will also be provided on the loan application as required by the Truth in Lending Act and Regulation Z.

18,2017

How To Pay Off A Reverse Mortgage Without Losing Your Home

In most cases, a reverse mortgage is paid off with the sale proceeds of the home when the borrower moves out or they pass away. There are some protections in place, including a non-recourse clause that prevents borrowers or their heirs from having to repay more than the value of the home when its sold.

Unfortunately, because reverse mortgages are usually paid off with the sale of the home, homeowners often arent able to get out of the loan or leave it to their heirs when they die. The only way to keep the home is to find another way to repay the loan.

Read Also: Does Applying For A Mortgage Affect Your Credit Score

An Overview Of Reverse Mortgage History

Rates will also affect the amount you can borrow and the amount of interest you will accrue over the life of the loan.

Lenders may charge an origination fee for setting up A. Generally, an origination fee reimburses the lender for processing a home equity conversion mortgage .

The lender cannot charge more than $2,500 or 2% of the first $200,000 of the home, plus 1% of the amount above $200,000. Note that there is a $6,000 cap on the total origination fee. For HECM.

The limit is set by law to keep closing costs reasonable for borrowers. In some cases, we may offer to waive or reduce the initiation fee for certain products.

Reverse Mortgage Fees Explained

Our retirement years should ideally be spent enjoying friends and family, cultivating hobbies, and relaxing. But with many behind in retirement contributions, cash flow can be a problem for some. If youre a homeowner, reverse mortgages may be a tool to add a little breathing room to the budget.

You May Like: How Long Is The Mortgage Process

Use A Broker To Find Your Lowest Rate

The Reverse Mortgage rate of interest on your loan is important, but it is only one factor of many that will determine the overall cost. Other factors include: whether you draw the funds as a lump sum, cash reserve or a regular instalment plan any ongoing Reverse Mortgage fees and your longevity risk how long you will need the Reverse Mortgage loan for.

Consult a Seniors First Reverse Mortgage broker to fully understand the interest charges associated with this credit product. Our team will help find your lowest rate from our panel of lenders.

How Mortgage Rates Have Changed Over Time

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of todays lower interest rates. When considering a mortgage refinance or purchase, its important to take into account closing costs such as appraisal, application, origination and attorneys fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

Are you looking to buy a home? Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Use Credibles online tools to compare rates and get prequalified today.

Thousands of Trustpilot reviewers rate Credible “excellent.”

Don’t Miss: What Are Jumbo Mortgage Rates

Adjustable Rates Offer Greater Flexibility

The adjustable-rate programs do allow you more flexibility in how you can receive your funds. The first option would be a cash lump sum. This is not advised on the adjustable product as a cash lump sum request is usually associated with fixed interest rates, however it is available.

The second option would be a line of credit. The HECM line of credit is not the same as the Home equity Lines of Credit or lines of credit that you can get at your local bank. The Reverse Mortgage line of credit funds grow based on the unused portion of your line and those funds cannot be frozen or lowered arbitrarily as the banks can, and have done, recently on the HELOCs.

This means that the line of credit grows based on the interest rate applied to the unused portion of your line. In other words, using that same $100,000 line we had above, if you used $45,000 to pay off an existing lien and for your closing costs, you would have $55,000 left on your line. For as long as you did not use these funds your line would grow by the same rate as your interest plus your MIP renewal rate on the loan.

If your interest rate was currently 5% and your MIP renewal was .5%, your line would grow at 5.5%. That would be roughly $3,025 in the first year . The credit line growth is not interest anyone is paying you. It is a line of credit increase and if you never use the money, you never accrued any interest owing on the growth.

The third option would be a payment plan.

Mortgage Rates Slightly Higher But Still Much Lower Than Most Of Last Week

If you’d like to get the quick scoop and be on your way, here you go: the big move in rates happened last Thursday when the average 30yr fixed dropped by a record amount in a single day to the mid 6% range. It hasn’t moved much since then.

If we shift focus from averages to individual lenders, there have been a few back and forth adjustments of moderate size, but all still pale in comparison to last Thursday. Most lenders are in line with or slightly higher than they were at the end of last week.

Notably, this has been the case despite ups and down in the bond market that would normally have more visible effects on lenders’ rate offerings. What’s up with that? In a nutshell, last Thursday’s move in the market was a lot for the mortgage world to adjust to all at once.

Lenders also tend to set rates at slightly more conservative levels heading into the holiday season as the most competitive offerings require a robust marketplace of buyers and sellers of mortgage-related debt. November and December tend to be less robust than normal–especially surrounding the Thanksgiving and Christmas holidays.

Also Check: How Much Is Left On My Mortgage Calculator

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

What Our Clients Say

Andrew Cate from Seniors First was amazing, he managed to arrange my reverse mortgage seamlessly. Working with him made the whole process completely painless and he explained every step along the way. I have no hesitation in recommending him to anyone thinking of this kind of mortgage Thank you so much Andrrw and Seniors First!

From the outset Andrew Cate was very helpful, considerate and very informative. He was available to answer questions at all times and we appreciated his professionalism and understanding of our needs during our application. Highly recommended. Thank you Andrew from Michael and Cherie Nikolaidis

Outstanding customer service received from Andrew Cate, Reverse Mortgage Specialist who expertly guided me through the loan process and kept me informed every step of the way. Sincere thanks to Andrew and Seniors First .. the loan has been life changing.

We recently completed a transaction through Seniors First and have been very impressed with the way it has been handled. we would have no hesitation in recommending them to anyone looking to secure their future requiements for finance. In particular we were looked after by Andrew Cate who gave us great help throughout the process.

Read Also: How To Get A Pre Qualification For Mortgage