What Happens If The Gift Giver Dies

If youre accepting a lump sum gift as a type of living inheritance from an older relative, theres a few things you need to be aware of. If they die within seven years of providing you the gift, you may have to pay inheritance tax on it. Of course, this risk lies with a gift provided by someone of any age, but statistically older people are more likely to pass away during the seven-year inheritance tax period.

They also cannot be seen to be depriving themselves of capital. For example, if by giving you the gift, they would then qualify for certain state benefits, this could cause significant complications.

The Borrowers Responsibility When It Comes To Down Payment Gifts

While its nice to be gifted some or all of your down payment, the borrower still needs to be in good financial standing to receive a conventional mortgage . That means having a good credit score and the ability to make mortgage payments.

Getting help with a down payment is a great thing but lenders want to make sure that the money is a gift and you can pay your mortgage. That does come with a little bit of paperwork, but it will make the process of securing a mortgage that much easier.

Down Payment Gift Guidelines

According to a National Association of Realtors survey in 2020, 26% of first-time buyers and 7% of repeat buyers cited saving a down payment as the most difficult part of the homebuying process. But before accepting a mortgage down payment gift, there are a few rules to know:

- Only certain entities can make down payment gifts.

- Down payment gift amounts may be limited based on the type of loan.

- The money must be a gift. It can’t be treated as a loan.

- It must be documented with a down payment gift letter.

In terms of who can make down payment gifts, the same rules apply as when gifting money to family members. You may receive down payment gift funds from your parents, siblings, or other relatives, or you can receive a gift through an approved organization. That can include mortgage down payment assistance programs offered by state governments or non-profit organizations.

Read Also: Do You Pay Interest On A Mortgage

How Do Gift Letters Affect Mortgage Underwriting

Say youve just gotten married and received a considerable down payment gift. Although you may be excited to get that cash in the bank, you dont want these deposits to cause problems when youre trying to qualify for a mortgage. Lets go over some additional details on how gift money affects mortgage underwriting.

Donor Letter Outlining The Gifted Down Payment

Your donor will need to sign a letter stating that the down payment is a gift. Therefore, meaning they dont intend to receive it back. The letter would state their relationship, the amount gifted, the donors contact details and the property being purchased. Another way to strengthen the application is if your parents sign as a guarantor for your mortgage.

Read Also: Which Mortgage Lenders Use Fico Score 2

What Are The Tax Rules For Down Payment Gifts

Since tax laws may change, its a smart idea to speak with a tax professional or your financial advisor to ensure youre following the latest rules and regulations.

Typically, the borrower wont be required to pay any taxes on gift funds. In other words, gift funds dont necessarily count as your taxable income. However, the donor might have to pay taxes even if not, its a good idea to be aware of IRS regulations. You can pay the taxes for the donor instead, but it can be a complex situation, and its best to seek the help of a tax professional.

For a donor to be required to pay gift taxes, the amount given needs to be over the annual exclusion stipulated by the IRS. The annual exclusion for 2018 and beyond is $15,000 per person who was gifted money, and in 2022, this amount jumps to $16,000. For instance, if a donor gave you $12,000 and your brother $13,000 in 2020, both amounts fall under the annual exclusion amount.

If the amount given exceeds the IRS exclusion amount, then the donor needs to file a gift tax return and disclose the exact amount given. It still may not mean that the donor has to pay taxes. Rather, it will go towards the donors lifetime gift tax exclusion, which is currently at $11.7 million.

Again, its best to seek the help of a tax professional to see what the tax implications are before your donor gifts a down payment for your new mortgage.

Contact a Finance of America Mortgage Advisor today who can help you prepare for the mortgage process.

Prove The Source Of Your Down Payment

Cant prove the money youre using for your down payment is a gift and not a loan? Your lender might deny you a mortgage.

The solution is to ask for a gift letter to accompany any large financial gift you use for your down payment. A gift letter is a statement that ensures your lender the money that came into your account is a gift and not a loan. The person who gave you the money must write and sign the gift letter as well as provide their personal information.

Read Also: How Much Do You Save By Paying Off Mortgage Early

People Who Cant Give You Gift Money

No matter what kind of loan you have, you cant receive gift money from anyone who would profit from your home purchase, such as the builder or the real estate agent.

The exception to this is closing cost assistance. The seller can pay some or all of the closing costs, depending on state laws and the type of mortgage. This is most commonly seen in slow markets as a way to attract buyers.

What Is A Gifted Deposit

A gifted deposit is a deposit used for a property purchase that is wholly or partly formed of cash given to you as a gift by a friend or family member.

Its important to follow the correct procedure for gifting a deposit to avoid delaying your purchase, as there will likely be a hold up in the conveyancing process otherwise.

In many cases, you will also need the right evidence and legal documents to prove the money is indeed a gift that the family member or friend does not expect to be paid back to get your mortgage approved.

Gifted deposits that come from family members are more common and are generally preferred by lenders, so you may end up facing further delays if someone else is providing your deposit.

Don’t Miss: What Are The Home Mortgage Rates

Va Loans Down Payment Gift Rules

VA lenders do not require down payments or mortgage insurance. If you receive a down payment gift, you could put the money towards the home and borrow less. Or the gift might go towards closing costs.

Here are the VA rules for down payment gifts:

- Who can make a gift: Anyone who is not an interested party. Examples of interested parties include real estate agents and lenders.

- Maximum down payment gifts: There are no restrictions on the amount.

Fannie Mae Gift Guidelines

Lenders follow Fannie Mae guidelines to offer conventional loans, the most common type of home loan taken out in the United States. Conventional loans require a minimum 3% down payment that can come entirely from a gift if youre buying a single-family residence.

Gift funds for a conventional loan can come from a relative, employer, close long-time friend, government down payment assistance program or a charitable organization.

Also Check: Can You Get Reverse Mortgage With Bad Credit

Using Gift Money With Va Loans

The Department of Veterans’ Affairs offers zero-down mortgage options for military veterans in certain circumstances. There are few restrictions on who can give you a gift toward your home purchase, but there is one major stipulation: the gift cannot be from someone who is an interested party.

An interested party would be someone who has a role in your transaction, such as a builder or developer, another broker, a real estate agent or the seller. Aside from that, you can use gift money for your down payment with a VA loan.

Documentation Requirements For Mortgage Down Payment Gifts

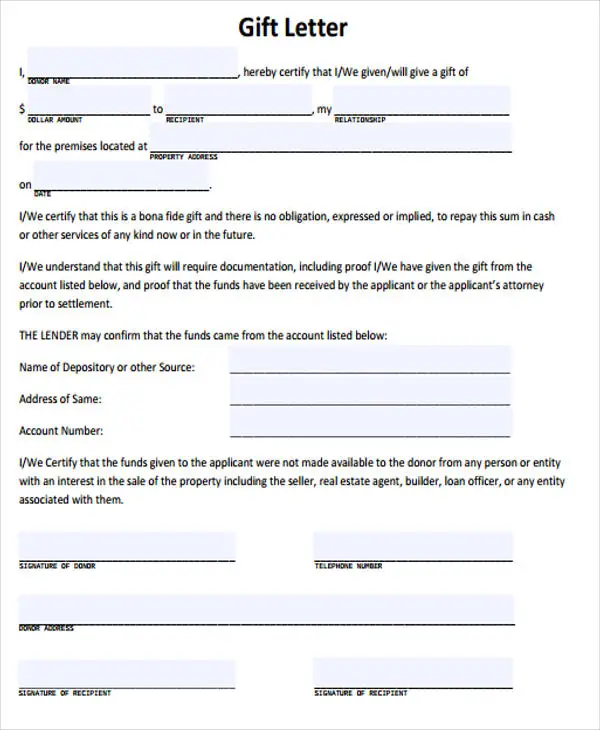

Before your mortgage lender accepts gift money, youll likely need to provide a down payment gift letter. When you speak with your lender, ask them for a copy of their specific gift letter template. The information requirements for down payment gift letters vary depending on the lender, but they typically include:

- The name, address, and phone number of the person giving the gift.

- The amount thats been gifted.

- The date that the donor transferred the money.

- The address to the house you plan on buying.

- The nature of the relationship between the donor and the borrower.

- The nature of the relationship between the donor and the buyer.

- A statement from the donor that they do not expect repayment.

- The signature of both the donor and the gift recipient.

When you receive money for your down payment, the most important thing to remember is that youll need a clear, traceable paper trail that details the movement of the funds from the donor to the recipient. Document the transfer at every step so youll be prepared for any questions that arise. Some of the things to keep track of are:

- Bank statements

- Evidence of the wire transfer

- A copy of the check and your deposit slip

- A copy of the settlement statement showing how, when, and where you deposited the gift.

Don’t Miss: How Much Mortgage 200k Salary

Do You Need To Disclose Gift Funds In Your Mortgage Application

Your lender needs to know about any finances that are contributing to your mortgage as part of the application process. To document the transfer of gift funds from a donor to you, your lender would need to see:

A completed gift letter form with the donors information and signature .

Evidence of the gift funds transferred from the donors account to your bank account. This can usually be satisfied with a copy of the donors check and a copy of your bank statement showing the funds deposited into your account.

Another option is for the gift donor to transfer the funds directly to the lender. In this case, the lender would want to see a copy of the cashiers check that the donor sent.

If you are funding your down payment with money from other bank accounts or retirement accounts in addition to the gift, the lender would ask to see two months of statements for those accounts as well.

Usda Loans Down Payment Gift Rules

USDA loans don’t require a down payment if you meet certain income criteria. Note that you will owe mortgage insurance on USDA Loans, which will increase your monthly payment. As with a VA loan, you may still wish to receive a gift to cover closing costs or reduce your loan balance.

Here are the rules for down payment gifts on USDA mortgages:

- Who can make a gift: Family members or friends can make gifts, as can charitable organizations, employers, or labor unions. And money can come from homeownership assistance grants or programs.

- Maximum down payment gifts: There are no restrictions on the amount.

Recommended Reading: What Is A Single Purpose Reverse Mortgage

What Do I Need To Use A Gift For A Mortgage Deposit

To use a cash gift as a deposit, you need proof that the gifted deposit is not a loan or being offered in exchange for any rights to the property you plan to buy. A signed document from the person giving you the money stating that it is a gift and they will have no rights to the property or to ask for the money back should do the trick.

Some mortgage lenders have their own legal forms for this process. If thats not the case, your cash gift deposit letter should come from the family member gifting the money and should state:

-

That they are assisting you to buy a home

-

How much they are gifting you

-

That they understand a gift is an act of kindness and love, not one motivated by commercial interest

-

That they understand the gift is unconditional, non-repayable and does not give them any right over the property or the mortgage provided by

-

That their finances are in good order at the time of writing and they have no reason to believe they will go bankrupt in the future

It should then end with their signature, name, and the date and should also be signed by a witness.

If you have any doubts about the process, your solicitor or conveyancer should be able to help. He or she will also need proof of ID and proof of address from the person gifting the deposit money, in accordance with anti-money-laundering rules.

Dos And Donts For Mortgage Gift

Whether its your first primary residence or a second home purchase, there are several key DOs and DONTs when it comes to down payment gift rules.

- Be upfront with your mortgage lender if youre receiving a down payment gift.

- Keep a paper trail of the funds changing hands.

- Make sure the gift is coming from an allowed relationship depending on your loan.

- Know the monetary total of gift funds for any applicable tax reporting.

DONT

- Tell your lender youre receiving a gift if theres an expectation to pay back the funds.

- Fail to disclose a gift youve already received to your lender.

- Assume all mortgage programs allow down payment gifts.

- Forget about federal tax gift exclusion limits.

Read Also: When Do I Stop Paying Mortgage Insurance

Mortgage Gift Fund Basics

Mortgage Gift Fund Basics

Article Excerpt

Learn the basics of mortgage gift funds: who can receive, who can give, differences in rules across loan programs, gift letters, and tax considerations.

Many homebuyers, especially first-time buyers, may find the down payment as one of the most difficult parts of the process. Its typically the largest expense associated with buying a home. But theres good news! Homebuyers can use money received as a gift, known as a mortgage gift fund, to put towards the down payment on a home.

Each loan program has different rules regarding gift funds. Lets review the basics.

Who Can Give You A Down Payment Gift

Your lender has to make sure that the money is actually a gift, with no expectation of repayment. To do that, many have limitations on who can give you a down payment gift. These requirements vary based on the type of loan, which well break down below.

- Conventional loans

- Charitable organizations

Note: An interested person is anyone who is involved in the purchase of a home. That includes the seller, builder, developer, real estate agents, or anyone else who stands to benefit from the sale. USDA and VA loans allow anyone who isnt one of these interested parties to give you a down payment gift.

Also Check: Can I Sell My House With A Mortgage

What Does This Mean For You And Your Mortgage

Mortgage prices are likely to rise, but also borrowers will face a smaller pool of products to choose from.

Mortgage borrowers who are already on fixed deals are likely to be protected from much of the upheaval for now.

But when they do have to find a new deal they will face significantly higher borrowing costs after all UK Finance predicts that another 3.1 million households are due to renew their mortgages when their fixed-rate periods expire in 2022-2023.

For the 1.6 million people on variable rate deals, rates on the mortgages will see an immediate rise.

New buyers are likely to find that the maximum amount they can borrow is now lower due to affordability stress testing.

And this problem is not just confined to new buyers. Those looking to remortgage next year may find it more difficult to do so as they may be unable to pass lenders affordability stress tests.

Probably more people than ever will stay with their existing lender and take product transfer rates, said Aaron Strutt, of Trinity Financial mortgage brokers.

For some the increase in mortgage costs will mean that they need to take tough decisions and cut down spending on other things, but many people may have to cut down on essential spending and simply may not be able to weather the increases in mortgage costs.

Tax Implications For Gift Funds

In most cases, the person receiving gift money doesnt have to pay taxes on it. However, the person gifting the money might have to file additional tax paperwork. The annual exclusion per individual recipient is $16,000 for 2022, so if your gift exceeds that, the donor will have to file a gift tax return. This gift will go against their lifetime exclusion however, as this is currently set at $12.06 million, theyll likely be a long way from triggering a tax penalty.

Don’t Miss: What Percentage Of Your Salary Should Your Mortgage Payment Be

Proving You Received The Down Payment Gift Money

Home buyers receiving a down payment gift must show they received the gifted funds and where they came from. There are several ways to prove this including:

- A copy of a canceled check from the gifter and a deposit slip from the recipient’s bank account

- A copy of the gifter’s withdrawal slip and recipient’s deposit slip showing the money was taken from the gifter’s account and put into the recipient’s

- Proof of a wire transfer moving the money from the gifter’s account to the recipient’s

- A copy of a check the gifter wrote to the title agent

- A copy of the settlement statement showing the check had been deposited