The Amount You Have Left Over Each Month

Some lenders calculate a minimum amount that we should have left over each month after fixed payments and a living allowance are deducted.

This is called UMI and varies from bank to bank.

For a couple, the calculations are based on combined income. For someone with children, lenders will expect to see less surplus.

If youre borrowing a large amount of the purchase price, lenders will expect you to have more spare income. This is so you can deal better with any future uncertainties like a rise in interest rates or a reduction in income. For example, if someone is borrowing 95%, some banks will want to see a UMI of $750 to $1,000 a month.

Talk To Multiple Lenders

You may find the mortgage amount youre pre-approved for will vary greatly from lender to lender. Some will be more comfortable taking on risk or will see your finances in a different light.

Comparing a few offers from different lenders will also help you find a better interest rate, which will reduce how much you pay every month and over the life of your loan.

A Freddie Mac study found that comparing rates from at least five lenders can make a $3,000 difference in how much you save over time.

Borrowing From Home Equity With Reverse Mortgage Loans

Fortunately, there is a third option that does not require a monthly mortgage payment. Government insured reverse mortgages, also known as an equity home release or a Home Equity Conversion Mortgage , are quickly becoming the top choice for equity-rich senior homeowners interested in taking equity out of their home.

Reverse mortgages are loans that allow you to borrow against home equity without being required to pay a monthly mortgage payment. Borrowers remain responsible for paying property taxes, homeowners insurance, and for home maintenance. Instead, some of the equity in your home is first used to pay off any existing mortgages, and the remaining loan amount is converted to non-taxed cash that you may receive in a lump sum, a monthly disbursement, or a line of credit. Meanwhile, you may continue to live in the comfort of your home. The loan becomes due and payable if the borrower moves away, passes, or fails to comply with loan terms such as neglecting to pay taxes and insurance.

Read Also: How To Get Removed From A Mortgage

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums. In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

How Much Mortgage Can I Afford

How much mortgage you can borrow and how much mortgage you can afford are slightly different. While a lender may be prepared to let you borrow a lot, you may prefer a smaller mortgage so that you can still afford to do other things.Before you borrow the maximum amount, you should think about whether you could comfortably afford the monthly repayments on a large mortgage.

A general rule of thumb is that you don’t want to spend more than 30% of your take home salary on mortgage repayments.

Any more than that and you risk being “house poor” – where you own a house, but lack the money to do other important things

In London, where house prices are very high, it can be hard to keep your repayments under 30% of your income.

Before getting a mortgage, it is vital to work out what the total cost of home ownership would be for you. If your mortgage payments and household bills look like they will take up 40 or 50% of your income, you should consider getting a smaller mortgage.

Don’t Miss: What Can I Do To Lower My Mortgage Payments

When Does A Reverse Mortgage Make Sense

| Homeowners Story | Tom, 70, and Barbara, 68, enjoy a comfortable lifestyle and have substantial retirement savings. However, theyd like to travel more and spend more without worrying about outliving their funds. They own their home free and clear, and its currently worth $700,000. |

| Homeowners Reverse Mortgage Decision | They choose a HECM line of credit, which requires no annual mortgage insurance as long as it goes unused. The line can grow over time, ready to provide cash if they deplete their retirement savings. This loan provides peace of mind for the couple, allowing them to enjoy their retirement and worry less about overspending. |

| Home Value |

* Any property value greater than $625,500 is calculated at the HECM maximum value.

** If unused, HECM credit lines grow at the loans variable interest rate.

Now lets look at an example where the reverse mortgage choice is not so clear.

* Elimores property may be worth $300,000, but its subject to a $80,000 loan.

** If unused, HECM credit lines grow at the loans variable interest rate.

Now lets look at a situation where the homeowners are house-rich and cash-poor.

Read Also: How To Calculate Self Employed Income For Mortgage

Mortgage Stress And The 30 Per Cent Rule

There’s a few reasons why:

- Firstly, some people on high incomes might be comfortable paying 30 per cent or more on housing.

- Some people might choose to pay more than 30 per cent of their income on their home loan to reduce their debt.

- If someone has a 25-year mortgage, they may be able to lower their repayments by refinancing to a 30-year mortgage.

All of that said, if you’re not a high-income earner and your minimum home loan repayments are more than 30 per cent of your household pre-tax income, it’s a sign you could be stretching yourself thin.

Also Check: How Much Of Income To Mortgage

Can I Borrow Up To Five Times My Salary

It is possible to borrow five times your salary but only if you meet the lenders affordability tests and requirements for loan-to-value and minimum salary. To get a mortgage of this scale, youre likely to need a deposit of at least 10%, if not more to have access to a wider range of mortgage deal and may face a maximum lending cap. Some borrowers may look to lengthen their mortgage term to thirty years help make monthly payments more affordable.

Make Yourself A Competitive Buyer

Don’t spend all your time daydreaming about listings you find on Zillow. Do research to learn what kinds of mortgage loans are out there, including FHA, conventional, VA and USDA loan programs. Get pre-approved by a lender before you start shopping, so you know your price range, and you’ll be ready to make an offer on the spot if need be.

It’s also important to know your credit score. Having a score of 760 or higher will qualify you for the best mortgage rates, so take a few months and build your credit if you can. And then do everything you can to keep it in good standing.

If you’re not sure where your credit score currently stands, sign up for a free or paid to check your score.

is a free credit monitoring service that anyone regardless of whether they are Capital One cardholder can use. Receive an updated VantageScore credit score from TransUnion every week and credit report updates from TransUnion and Experian in real time. Use the credit score simulator to check the potential effect that certain actions, such as paying off debt or closing a credit card, may have on your credit score. In the months leading up to applying for your mortgage, you’ll want to be extra careful about closing accounts and racking up debt, as it can decrease your score and make your mortgage more expensive.

Read Also: How Much Will I Be Preapproved For A Mortgage

What To Expect From An Affordability Assessment

When you apply for a mortgage, the lender wants to ensure you can afford to borrow a large sum of money and keep up with the repayments on it.

This means getting a good understanding of your financial situation which, in turn, means counting what money is coming in and whats going out.

Income: Youll be asked to supply proof of earningsin the form of three months payslips, as well as proof of employment.

If youre self-employed, youll need the last three years worth of chartered accounts. If you dont have these, three years tax returns may suffice.

The lender might consider other income, such as annual bonuses, but probably not 100% of them. The amount considered will vary by lender and by applicant.

Outgoings: The lender will then look at your regular monthly outgoings. Since major rule-changes were implemented back in 2014 under the Mortgage Market Review, the assessment of monthly spending has become a lot more stringent and, in some cases, may even involve a telephone interview.

Expenses that will considered may include the following:

- Debt payments, such as personal loans, credit or store cards

- Regular bills, including council tax, and utilities

- Insurance payments

- Eating out and entertainment

Its an extensive list so, if you know you will be applying for a mortgage in the near future, its worth applying a little more care to your spending.

How Much Should You Borrow When Buying A Home

When youâre in the market for a new home, it can be tempting to stretch your budget in order to buy a place that has all the features you want. But doing so could cause money trouble for you and your family.

Emily Holbrook, director of personal markets at Northwestern Mutual, says homebuyers can get into trouble by borrowing too much. âSome people have unrealistic expectations about what they can afford,â she said. âThey have a vision in their heads of their dream home, and they donât understand all the hidden costs of homeownership that they need to factor into their budget.â

Holbrook believes itâs critical that buyers spend time figuring out what they can truly afford to make sure that they donât end up in over their heads. âWhen you become cash-strapped by borrowing too much,â she said, âit affects your ability to invest in your future and save for your other goals. It can also make people feel trapped since they often have to cut back on hobbies, travel or other things that matter to them.â

Here are some things to consider before making an offer on your dream house:

HOW TO DETERMINE THE TRUE COSTS OF HOMEOWNERSHIP

When Holbrook was shopping for her first home, she calculated the cost of her mortgage and assumed that the expense of owning a home would be close to the amount she was already paying in rent. But once she added in all the other expenses involved in homeownership, the monthly cost nearly doubled.

Take the next step

Don’t Miss: What Is A Good Tip Mortgage

Do I Have Enough Equity For A Reverse Mortgage

What youre eligible for will depend on your circumstances and reverse mortgage terms. For example, if youre younger and the sole titleholder, youll need more equity to qualify. In the first example above where the homeowner owns a $400,000 home outright a 62-year-old borrower would only receive a $176,360 lump sum.

The payment type you select will also affect your loan amount. In many cases, you may receive more with a monthly payment or credit line option than with a single disbursement.

A reverse mortgage calculator can estimate your payout however, a HECM counselor approved by the U.S. Department of Housing and Urban Development and reputable reverse mortgage lenders will provide more accurate figures based on your financial situation.

Also Check: Is Taking Out A Second Mortgage A Good Idea

How Much Of A Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Don’t Miss: How Much Should Your Mortgage Be In Relation To Income

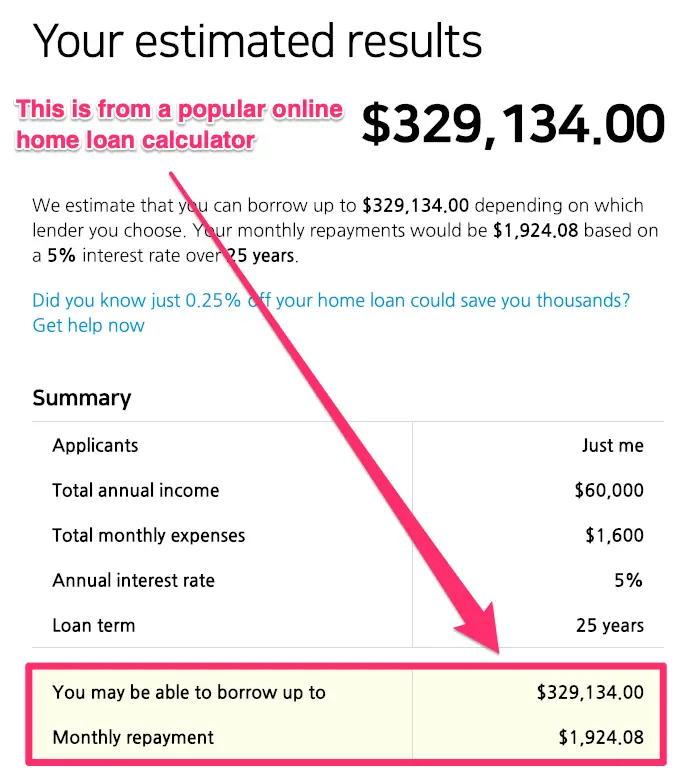

How To Use Our Borrowing Power Calculator

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity, or how much you would be eligible to take out on a home loan. If youre not sure, just put an estimate.

There are three parts to this calculator: Annual income, monthly expenses and loan details.

-

Annual income. The calculator will ask you to provide all your income streams including your net salary before tax, rental income, and any other regular sources of income.

-

Monthly expenses. Youll need to enter your overall day-to-day expenses, existing loan repayments and any other financial commitments such as insurance, additional superannuation contributions, and the combined limit of your credit cards and overdrafts.

-

Loan details. Lastly youll need to fill in the details of your loan including the interest rate and the loan term. Take note the calculator will estimate your borrowing power based on a fixed interest rate over a loan term.

Check Your Credit Score

Affordability is based on an in-depth study of your income, your outgoings and your total debt. They will also scrutinise your .

Lenders also want to be sure you could afford the repayments, even if the interest rates were to increase by 4% above the Bank of England base rate. This is known as stress testing.

Additionally, you may only be able to borrow the maximum amount if you already have a current account with the lender, or a very large deposit.

Also Check: Is 5.5 Percent Interest Rate Good For Mortgage

How Much Can I Afford To Borrow

Knowing how much you may be able to borrow is one thing, but knowing how much you can comfortably afford and being confident in your ability to keep up with your repayments is another. This is why youll need to carefully go through your outgoings, making sure to use a mortgage repayment calculator so you get an idea of what your repayments could be and whether you could absorb them in your current salary.

Bear in mind that if youre moving to a bigger property there could be additional expenses to pay, and if youre moving from rented accommodation into homeownership, your outgoings could change again, and thats before we even get to the additional costs of moving . This means its vital to go through everything in advance to make sure youre prepared for the impact on your finances.

Once youve tallied everything up, you can make a decision about the kind of mortgage you can comfortably afford. Though make sure to be realistic its generally recommended that no more than 28% of your household income should go on housing expenses, so if your final total is above this level, it may be worth reconsidering.

Loan To Value And The Size Of Your Deposit

All mortgages require some form of deposit, but they are not directly linked to how much you could borrow. The loan to value or LTV of your mortgage, means how much the mortgage is in relation to the value of the property. So, if you have a £50,000 deposit for a £200,000 property, the mortgage you need would be £150,000 75% of the property’s worth, or 75% loan-to-value.

Recommended Reading: How Long Should You Wait Before Refinancing A Mortgage

What Are The Costs Of A Reverse Mortgage

HUD adjusted insurance premiums for reverse mortgages in October 2017. Since lenders cant ask homeowners or their heirs to pay up if the loan balance grows larger than the homes value, the insurance premiums provide a pool of funds that lenders can draw on so that they dont lose money when this happens.

One change was an increase in the up-front premium, from 0.5% to 2.0%, for three out of four borrowers and a decrease in the up-front premium, from 2.5% to 2.0%, for the other one out of four borrowers. The up-front premium used to be tied to how much borrowers took out in the first year, with homeowners who took out the mostbecause they needed to pay off an existing mortgagepaying the higher rate. Now, all borrowers pay the same 2.0% rate. The up-front premium is calculated based on the homes value, so for every $100,000 in appraised value, you pay $2,000. Thats $6,000 on a $300,000 house, for example. In fact, the fee is capped at $6,000, even if your home is worth more.

All borrowers must also pay annual MIPs of 0.5% of the amount borrowed. This change saves borrowers $750 a year for every $100,000 borrowed and helps offset the higher up-front premium. It also means that the borrowers debt grows more slowly, preserving more of the homeowners equity over time, providing a source of funds later in life, and increasing the possibility of being able to pass down the home to heirs.