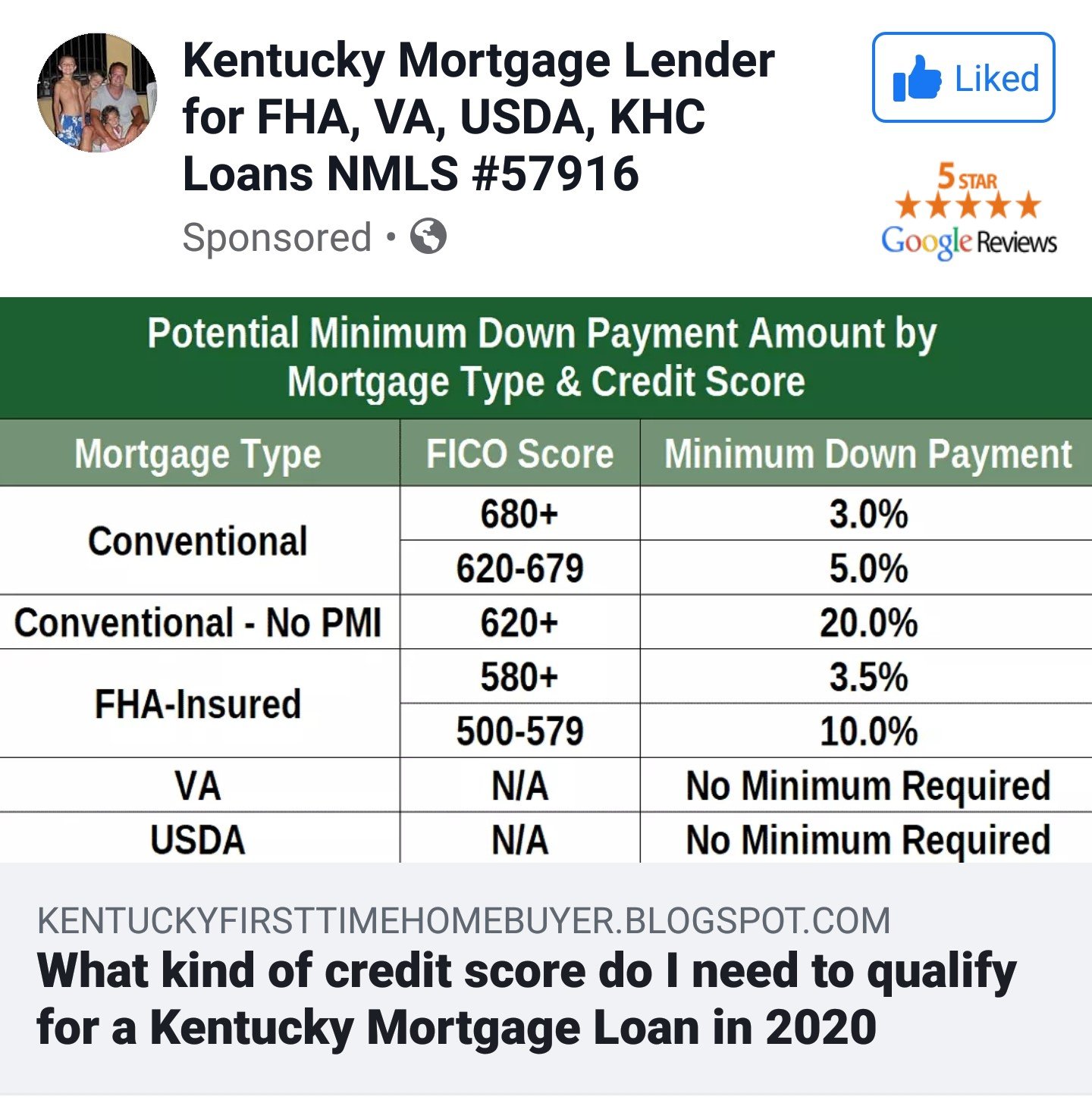

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could fetch lower interest rates, which can save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all. So, it makes sense to check and monitor your credit scores regularly, especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

How Your Credit Score Affects Your Interest Rates

Knowing your credit score is the first step in getting the best rates on your mortgage. While mortgage interest rates are currently at an all-time low, they drop even lower when your credit score is above 760.

According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 .

This 1.589% savings in APR may seem negligible. But it means saving about $260 per month on your mortgage, or $3,120 per year and roughly $93,600 over the lifetime of the loan.

If you currently have a mortgage and are interested in seeing if you can switch to a better rate, look into the pros and cons of refinancing your home.

Past Bankruptcies Foreclosures Or Court Filings

Bankruptcies may be reported for up to 10 years, while foreclosures, short sales, judgments, and lawsuits could remain for 3â7 years.

Borrowers initially take a big credit hit after a bankruptcy, severely damaging their payment history and credit score.

Some lenders view borrowers with foreclosures on their record as too risky. Although others may approve a mortgage three years after the action, those loan terms will likely be unsatisfactory with a high interest rate.

Some lenders will approve an applicant for a mortgage within a few years of a Chapter 7 bankruptcy discharge.

| Lender |

|---|

The impact on your creditworthiness varies depending on the specifics of the case.

Read Also: What Does Qm Stand For In Mortgage

How Your Credit Score Impacts Your Apr

Your credit score has a major effect on the APR of your loan. The APR of any installment loan, such as a mortgage, reflects the cost of interest expense and fees over the life of the loan. The higher the APR, the more the borrower will have to pay.

If you apply for a $250,000, 30-year mortgage, you can wind up paying wildly different amounts depending on your credit score, as shown below.

What Credit Score Model Do Lenders Use When You Apply For A Mortgage

When you apply for a mortgage, lenders typically pull your credit report from the three main credit bureaus: Experian, Equifax and TransUnion. Each credit bureau uses a different FICO model to determine your credit score. We outline the models used by the credit bureaus below:

Experian: FICO Score 2

Equifax: FICO Score 5

TransUnion: FICO Score 4

The credit score models take into account multiple factors including your current and past credit accounts, payment history, credit capacity and credit events such as a collection, charge off, bankruptcy, short sale, default or foreclosure.

There are variations between the different FICO models but the underlying inputs and scoring factors are relatively similar. Making your loan payments on time, maintaining low credit utilization and limiting the number of credit accounts you have open leads to higher credit scores for all FICO scoring models.

Although the FICO models utilize a consistent methodology, there may be differences in your credit scores across the three main credit bureaus. Score differences may be attributable to inconsistent account information or subtle differences in how accounts or credit events are weighted by the models.

Also Check: How Much Interest Did I Pay On My Mortgage

What Is A Vantagescore

A VantageScore® was jointly developed by three credit bureaus Equifax®, Experian, and TransUnion® as a more consumer-friendly credit scoring system. It essentially offers credit applicants more approachable and actionable reporting information that explains how an individual can improve their credit score based on data provided in their credit report. Your VantageScore® can be used in tandem with your FICO® Score by lenders to determine if your mortgage application will be approved, and at which interest rate.

Six factors play into the formula through which your VantageScore® is calculated. Although actual weighting is unspecified, credit bureaus have noted how impactful each factor can be with regards to overall level of influence. These categories include:

Recent versions of the VantageScore® formula tend to adopt a 300 850 scoring range, as with ones FICO® Score.

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

You May Like: Can You Add Someone To Your Mortgage Loan Without Refinancing

Don’t Miss: How To Apply For A 2nd Mortgage

The Most Popular Credit Score

According to a report in Fair Isaac, an overwhelming majority about 90 percent of the top lenders in the United States use the FICO score to determine consumer risk. But noting this, its important to keep certain things in mind when it comes to the FICO score there are more than 60 different types of it, so one FICO scoring formula may not necessarily come up with the same number as another scoring formula.The report goes on to state that the most popular FICO score used is FICO Score 8. Mortgage lenders typically use FICO Scores 5, 2 and 4 when determining whether or not to approve a loan. Additionally, one type of credit score to keep an eye on moving forward is the VantageScore, a score that was developed by the three main credit bureaus and currently serves as a competitor to FICO. Theres some speculation that VantageScore will continue to gain traction in the future. VANTAGE 3.0 is the latest score from this family of credit scores.

One Mortgage Application = Either Three Or Six Credit Reports And Fico Scores

If youre like most people, a home is likely the largest purchase you will ever make. Because youre asking to borrow such a large amount when taking out a mortgage loan, the lender will be very thorough when it reviews your creditworthiness.

A credit card issuer or an auto lender will generally only check one of your credit reports and scores when you apply for financing. A mortgage lender, on the other hand, will review your credit information from all three of the primary credit reporting agencies: Experian, TransUnion, and Equifax.

And, if you have a co-applicant, the lender is going to review all three of their credit reports as well.

That means one home loan application can equal as many as six credit reports and scores. In mortgage lending, because of the Federal Housing Finance Agency mandate, the only scores that can be used currently are three of FICOs older scoring models, although that may eventually change.

And, in a process that only exists in mortgage lending, the lender bases its decision not on your highest credit score, not on your lowest score, but rather on the middle numeric score. If your three FICO scores were 700, 709, and 730, the lender would use the 709 as the basis for its decision.

Reviewing this large collection of credit reports and credit scores gives the mortgage lender a more comprehensive picture of your credit risk. Your three credit reports likely arent identical, and its equally unlikely your scores will be the same.

Don’t Miss: Who Benefits From A Reverse Mortgage

What Else Do The Lenders Look At

When you apply for a home loan, lenders look at a lot of factors other than your credit history.

One of the most obvious things that lenders look at is your income. If you apply for a $1 million mortgage loan but only make $30,000 a year, the lender is going to know that you have no way to pay the loan back, even if you have perfect credit.

Conversely, someone with a high income may have a better chance of making payments on a $1 million loan, but if they have poor credit it will hurt their chances of qualifying for a loan.

Lenders also look at your debt-to-income ratio, which measures the amount of money you make compared to your monthly bill payments. The lower this ratio, the more money you have available to take on payments for new credit accounts.

If your debt-to-income ratio is too high, it means you dont have extra room in your budget to handle a new loan payment.

Can I Check My Credit Score For Free

Yes. Sites like UK Credit Ratings let you see your monthly credit report for free. All you need to do is make an account and you can track how your actions are helping or hindering your credit score. Bear in mind that this score isnt definitive again, its just one agencys interpretation of your borrowing and repaying behaviours.

Recommended Reading: What Is A Cash Out Refinance Mortgage

What Information Do Credit Reference Agencies Have

-

The Electoral Roll. This shows how long youâve been registered to vote at your given address

-

Public records. This shows any county court judgments, bankruptcies, IVAs, Debt Relief Orders and Administration Orders.

-

Account information. This shows the financial status of your existing accounts, how much youâve borrowed and whether or not youâve paid on time

-

Home repossessions. This shows if youâve information This is information from members of the Council of Mortgage Lenders about homes that have been repossessed

-

Associated financial partners. This shows all of the people who you are financially connected to. For example, you could have a joint bank account

-

Previous searches. This shows companies and organisations who you have looked at in the last 12 months. For example, if you made an application for credit in the last 12 months, it would show here.

Work With A Trusted Mortgage Loan Officer

Your mortgage lender is the ideal resource for asking questions about any part of the homebuying process before you are even ready to apply.

The professional loan officers at home.com by Homefinity can get you pre-approved so you can solidify your budget and take the proper next steps. or apply now to get started.

Image by StartupStockPhotos from Pixabay

Also Check: What Is The Average Interest Rate On Home Mortgages

If Youve Ever Checked Your Credit Scores Its Likely You Got Them Separately From The Three Major Consumer Credit

A mortgage lender trying to figure out if youre creditworthy wants a complete picture of how you use credit. But it can be challenging to put that picture together by looking at a single credit report from one of the three major consumer credit bureaus. Thats because lenders and other creditors may not report to each of the big three, resulting in each bureau having different information for you.

To help solve this, lenders can obtain special compiled credit reports that merge multiple reports into one, giving a more-complete picture of your credit history.

There are two types of compiled credit reports a mortgage lender might pull to evaluate your finances. Theres the so-called tri-merge report: a single, easy-to-read credit report compiled from the individual reports issued by the three major consumer credit bureaus. And then theres the residential mortgage credit report, which compiles at least two reports from the three bureaus and typically offers additional information to help lenders assess how risky a borrower you are.

When Are Credit Reports Used In The Mortgage Process

A lender will typically pull and review your credit reports once youve completed your mortgage application. Morse advises against having your reports pulled by the lender when youre just starting the home-buying process, because its considered a hard credit inquiry, which can hurt your credit scores.

Instead, he recommends using a lender whos willing to first talk about your budget and ensure youre financially ready to move forward. That way you can be certain a hard inquiry will be worth it.

Recommended Reading: How Much Is Mortgage On 1 Million

How Can I Get Something Wrong On My Credit Report Removed

If you think that information on your credit report is wrong, you have the right to dispute it with the company that has registered the error. This can sometimes be a tedious process but errors on credit reports can delay mortgage applications and can exclude you from access to the best rates.

If you decide to seek help from a mortgage broker, youll be happy to know that they can assist with helping you to get bad credit removed from your record as well as advising you on how to improve your score with the CRAs in the UK.

Read Also: Does Rocket Mortgage Sell Their Loans

Increase Your Available Credit

Another thing lenders look at when assessing a borrowers creditworthiness is their credit utilization ratio. This ratio compares the borrowers debt, particularly credit card debt, to their overall credit limits.

For example, if you have one credit card with a $2,000 balance and a $4,000 credit limit, your credit utilization would be 50%. Lenders look for borrowers with lower credit utilization because maxing out credit cards can be a sign of default risk.

A credit utilization of 30% is good, but less than 10% is better. So if you have a card with a $1,000 credit limit, to optimize your credit score youll want no more than $100 outstanding on the statement date for the card.

That means that one of the easiest ways to boost your credit score is to decrease your credit utilization ratio. You can do this by paying down debt or increasing your credit limits.

If youve had a credit card for a while and have built a good payment history, most card issuers will be willing to offer a credit limit increase. You can typically request an increase through your online account.

Theres no risk when requesting a credit limit increase. The worst a lender can do is say no, leaving you exactly where you started. In the best-case scenario, youll get a big credit limit increase, dropping your credit utilization ratio and giving your credit score an immediate boost.

Also Check: What Direction Are Mortgage Rates Going

Logic Of Using The Middle Score

Mortgage lenders understand that credit bureau information is not as consistent or identical as it should be. Like figure skating judges at the Olympics, they throw out the high and low scores, and use the middle score as the most representative reflection of your credit standing. The logic is sound the credit bureau data, often, is not. This reality reinforces the advice to examine your three credit reports at least once per year to ensure that harmful, erroneous data is not present.

Read Also: Does Rent A Center Report To The Credit Bureaus

Is Transunion Or Experian Better

TransUnion: The Bottom Line. While both TransUnion and Experian have some similarities, Experian offers a more robust suite of consumer services. It also reveals your FICO Score 8the score most lenders usewhich can give you a better idea of what lenders see than the VantageScore that TransUnion provides.

Read Also: What Is Considered When Applying For A Mortgage

How Do You Find Your Tri

You cant order a copy of your tri-merge credit report. This report is only offered to lenders. However, you can order copies of your individual reports maintained by ExperianTM, Equifax® and TransUnion®.

You can even do this for free at www.AnnualCreditReport.com. Under federal law, you are allowed one free copy of each of your reports every year. This means you can order your reports from TransUnion®, Equifax® and ExperianTM at no cost every year.

Doing this is a smart move. Studying your credit reports will give you a better idea of what types of mortgages you might qualify for. If your report lists low account balances and no negative information such as missed payments, foreclosures, or bankruptcies, youre more likely to qualify for mortgages with low interest rates.

You might also want to order your FICO® credit score before you apply for a mortgage. Unfortunately, you cant get this for free directly from FICO®. For the basic plan, you can order it for $19.95 from FICO®. However, your credit card provider or bank might also provide you with free credit scores.

Just be aware that these free scores are rarely the same ones that lenders use when making lending decisions. Free scores, though, can give you a general idea of how strong your credit is as they usually dont vary too much from your official FICO® Score.