What’s The Difference Between Fannie Ginnie And Freddie

Fannie Mae, Freddie Mac, and Ginnie Mae are all government-sponsored mortgage companies, but each serve a different purpose and different homebuyers.Fannie Mae was created in 1938 as part of FDRs New Deal, in an effort to secure mortgages via what are called mortgage-backed securities . Mortgage-backed securities are packaged mortgage loans that are then sold to investors.

The creation of Fannie Mae and MBS helped increase the number of lenders, as lenders no longer need to rely on personal or private funding for home mortgage loans.

Homeready Loans Vs Fha Loans

Like HomeReady loans, FHA loans help people overcome the financial challenges to homeownership.

If you qualify for HomeReady, you might also qualify for FHA. But which mortgage program is better?

Renters with limited cash for a down payment have used FHA loans since 1934. FHAs minimum down payment amount is 3.5%, slightly higher than HomeReadys 3%.

The down payments are similar, but these two loan programs have some big differences.

What This Means For You

Since you cant take out a mortgage directly from Fannie Mae or Freddie Mac, why should you care about these big names in the mortgage market? The major takeaways are: they create more affordable financing options, including lower-down payment loan programs they make homeownership more accessible overall they foster competition in the market, leading to lower rates and they influence the requirements you might need to meet to obtain a mortgage.

Today, Fannie Mae and Freddie Mac also have a role in times of economic stress. For example, both were able to step in during the pandemic to help ease financial hardship for homeowners.

To find out if you have a Fannie Mae- or Freddie Mac-backed loan:

Also Check: How Much Of My Net Income Should Go To Mortgage

Fannie Mae Homeready Vs Freddie Mac Home Possible

Freddie Macs Home Possible program works a lot like Fannie Maes HomeReady.

Like the HomeReady program, Freddie Macs Home Possible loan:

- Allows 3% down payment

- Has an income limit of 80% of the area median income

- Is co-borrower friendly

One of the biggest differences between these two programs is the minimum credit score. Many lenders require a credit score of at least 660 to qualify for a Home Possible loan. HomeReady, on the other hand, is typically available with a FICO score of 620 or higher.

Who Can Be A Loan Servicer

Loan servicers are responsible for collecting payments, managing your loan, and communicating any important information about the loan. Your lender can also be your loan servicer, or it can be another company your lender uses. Loan servicers manage all different types of loans, but mortgages are the most common.

Read Also: When Should You Prequalify For A Mortgage

How Do Mortgage Service Providers Make Money

Mortgage lenders can make money in a variety of ways, including origination fees, yield spread premiums, discount points, closing costs, mortgage-backed securities , and loan servicing. Closing costs fees that lenders may make money from include application, processing, underwriting, loan lock, and other fees.

Fannie Mae Guidelines: Conforming And Conventional Mortgages

Loans that conform to Fannie Mae and Freddie Macs guidelines are called conforming mortgages.

Another term you might have heard is conventional financing. A conventional mortgage is simply a non-government mortgage. These loans are not backed by the FHA, VA or USDA.

In effect, its possible for a mortgage to both conforming, meaning it meets Freddie/Fannie guidelines, and conventional, meaning its not insured or guaranteed by a government program.

Fannie Mae and Freddie Macs guidelines are important in the mortgage world.

These requirements can include things like:

- The size of the home loan

- Minimum credit score requirement

- Down payment requirements

- Private mortgage insurance

- Debt-to-income ratios

However, as a borrower, you also need to know that guidelines are often not absolute.

If you have a lot of monthly bills, for example, your debt-to-income ratio could be high. In theory, this would make it hard to qualify for a conforming loan. However, compensating factors like a large down payment or beefy savings account could help offset that DTI and let you qualify.

In short, Fannie Mae and Freddie Macs loan guidelines are often less strict than borrowers might believe.

Read Also: How Much Income For A 250k Mortgage

Fannie Mae And Freddie Mac Similarities

Fannie Mae, Freddie Mac, and the Federal Home Loan Bank system made housing affordable for most Americans for decades. But they functioned as government-sponsored entities. This meant they had to be profitable for the shareholders while creating the secondary market that made the resale of mortgages feasible.

Together, Fannie and Freddie saved the U.S. housing market. By 2009, Fannie Mae, Freddie Mac, and FHLB provided 90% of the financing for new mortgages. That was more than double their share of the mortgage market prior to the 2008 crisis. Private mortgage financing had simply dried up.

After the recession, most banks would not give anyone a loan without Fannie Mae and Freddie Mac guarantees.

Both Fannie and Freddie are now under the conservatorship of the Federal Housing Finance Agency. The U.S. Treasury Department owns all their senior preferred stock. All of their profits go to the U.S. Treasury. Investors can still buy common stock and junior preferred stock. The conservatorship doesnât allow them to pay dividends.

Recommended Reading: 70000 Mortgage Over 30 Years

Tips For Finding A Mortgage

- It can be tough to attain a complete view of the current mortgage rates available on the market. If you know where you want to live, your target home price and the size of your prospective down payment, you can utilize SmartAssets mortgage rates page.

- A financial advisor can offer valuable insight and guidance as you consider various financing options. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

Read Also: How Much Mortgage Can I Afford For 2500 Per Month

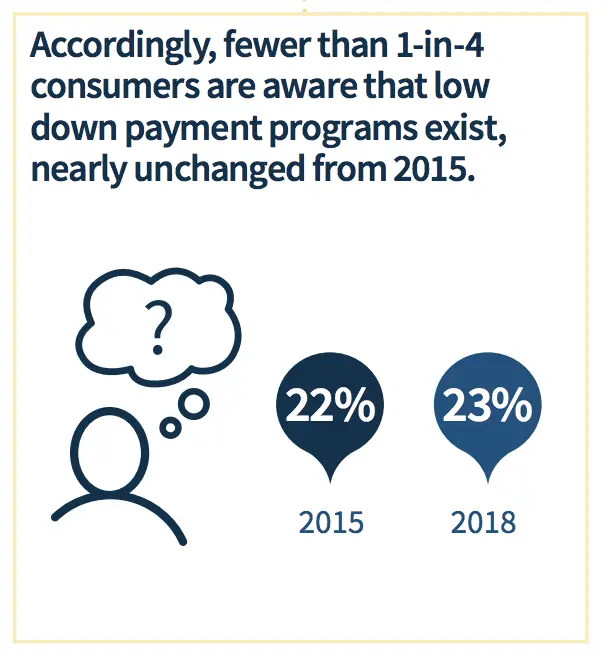

Low Down Payment Loan Options

If you dont have a lot of money saved, getting 20% together for a down payment can seem impossible. But since the goal of the Fannie Mae loans is to help more people get into houses, its possible to get a mortgage without a lot of cash upfront.

In fact, you may only need to put 3% down. This low down payment can save you a lot of money on the front end of your purchase, making it easier to buy your dream home.

History Of Fannie Mae

Fannie Mae was established in 1938 by the US Congress during the Great Depression as part of the New Deal instituted by President Franklin Roosevelt to manage the effects of the downturn on the economy. Its role was to grow the mortgage market by securitizing mortgages, thus allowing lenders to reinvest the assets into more lending and reduce reliance on local savings and loan associations. At that time, the body could only buy mortgages insured by the Federal Housing Administration.

In 1968, Fannie Mae transitioned from a government entity to a quasi-governmental corporation owned by shareholders, and this enabled the entity to buy any mortgage, including those listed on the New York Stock Exchange.

During the 2008 financial crisis, the subprime mortgage crisis affected Fannie Maes ability to purchase new mortgages from the market. Lenders engaged in unethical lending practices by lending to borrowers with poor credit history, which led to the housing bubble burst. The agency was delisted from the New York Stock Exchange after its stock dropped below the minimum capital required by the NYSE.

You May Like: How Does Interest Rate On Mortgage Work

The Role Of Fannie Mae And Freddie Mac In The 2008 Financial Crisis

Fannie Mae and Freddie Mac played a starring role in the financial crisis of 2008, thanks to their âimplicit guarantee.â Remember that both companies were chartered by Congress and filled federally mandated roles to maintain the stability and functioning of the mortgage market. But they were also public companies, whose bonds and shares were widely held by investors.

Given their importance, most investors in Fannie and Freddie assumed that they were too big to fail. If the companies ever ran into trouble, they assumed the government would bail Freddie and Fannie out. This wasnât something stated explicitly in any laws or regulations. Nevertheless, this made FNMA and FMCC seem to be less risky investments than many other similar companies.

This especially gave Freddie and Fannie favorable treatment in the bond market. The implicit guarantee made their bonds less risky bets than bonds from other financial companies, helping them borrow money more cheaply. Even the highest-rated debt of top financial companies couldnât compete. Fannie and Freddie borrowed trillions of dollars, meaning that their bonds were very widely heldâfurther ensuring they became too big to fail.

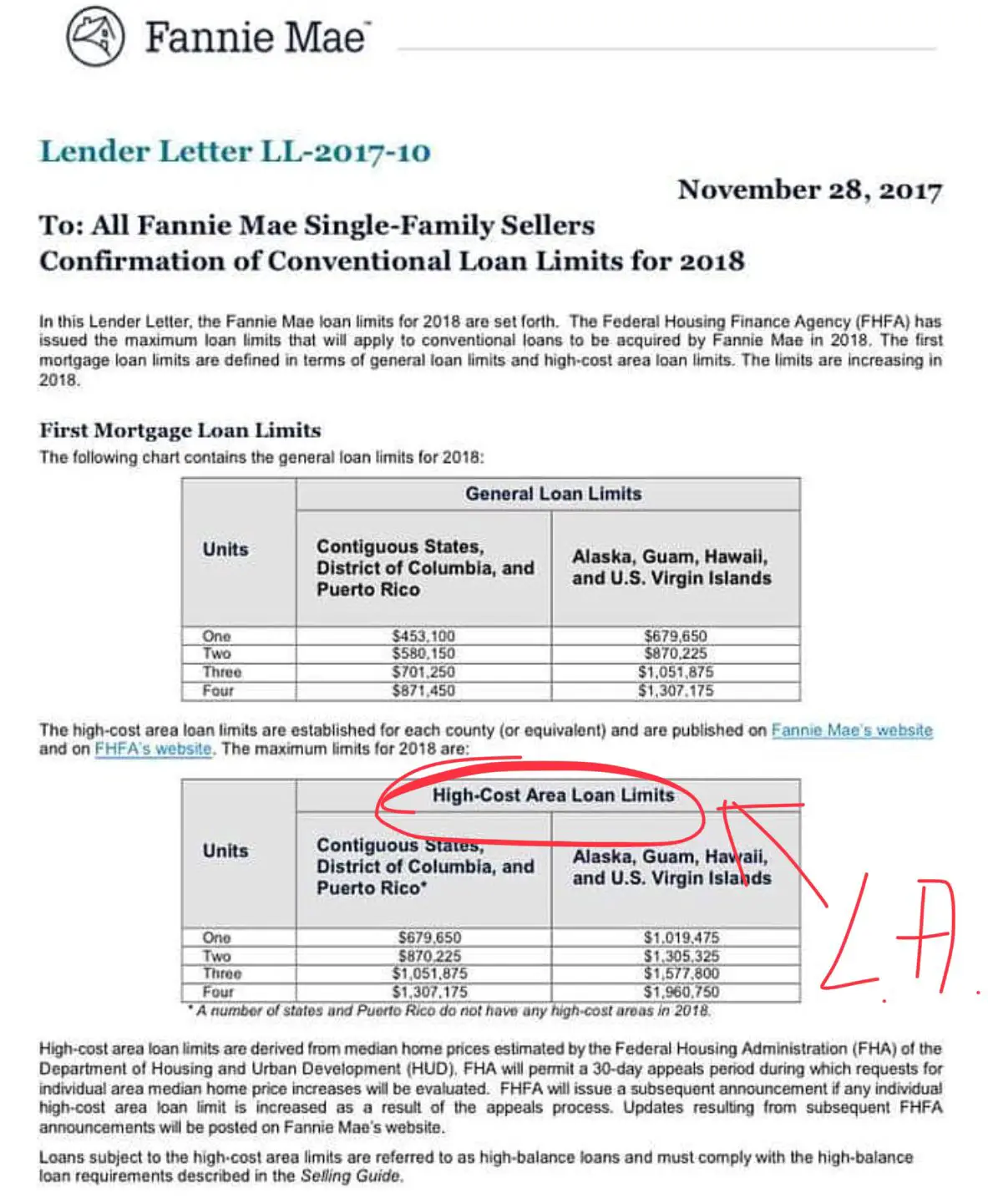

Fannie Mae And Freddie Mac Requirements

Fannie Mae and Freddie Mac have similar qualification requirements, which include:

- Debt-to-income ratio as high as 43% or 50% in some cases

- Down payment as low as 3%

- No recent major derogatory credit factors, such as foreclosure, short sale, bankruptcy or repossession

- Borrower income can be verified through three years of tax returns and W-2 forms, though exceptions may be permitted

- Loan limit for one-unit properties is $510,400 as of 2020, $765,600 in Alaska, Hawaii, Guam, and the U.S. Virgin Islands

While some of these requirements may seem like complex mortgage terminology, its simpler to understand with the right context. For example, to calculate the debt-to-income ratio, divide your total monthly debt payments by your total monthly income. Heres an example: If your total monthly debt payments add up to $3,000, and you have a monthly income of $9,000, your debt-to-income ratio would be 33%.

You May Like: Can I Get A Mortgage Based On Rental Income

What Would Happen If We Fully Privatized The Us Mortgage Market

Many conservative analysts and politiciansresorting to heated rhetoric and mistruths about the origins of the crisisargue that we need a fully private mortgage market run by Wall Street. It was the fully private segment of the market, however, that caused millions of foreclosures and brought down the entire financial system. If we draw the wrong lesson from the financial crisis and abruptly withdraw the government from mortgage finance, it will lead to a sharp reduction in the availability of home loans, cutting off access to mortgage finance for the middle class.

History is a helpful guide here. Prior to the introduction of the government guarantee on residential mortgages in the 1930s, mortgages typically had 50 percent down-payment requirements, short durations, and high interest ratesputting homeownership out of reach for many middle-class families. The housing finance system was subject to frequent panics during which depositors demanded cash from their banks, leaving lenders insolvent. That volatility is one reason why every other developed economy in the world has deep levels of government support for residential mortgage finance.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Where Are 30 Year Mortgage Rates Headed

Fannie Mae And Freddie Mac Help Inflate The Housing Bubble

Fannie Mae and Freddie Mac pumped more and more money into the U.S. home finance system in the years leading up to the financial crisis, buying an outsized number of mortgages on the secondary market. This helped support the bubble in home prices that emerged in 2005 through 2007.

Together with lax oversight and financial engineering at big investment banks, unsustainable mortgages took off, with many people getting mortgage loans who might not have qualified for home loan financing in more normal times. Both homebuyers and the financial system as a whole became overleveraged and unbalanced, driven by financing from Freddie Mac and Fannie Mae.

The unwinding of the housing bubble in 2007 and the financial crisis that followed in 2008 hit Fannie and Freddie hard. To avoid a complete collapse, the FHFA seized the companies and put them into conservatorship on September 6, 2008âjust days before Lehman Brothers filed for bankruptcy and sent the financial markets into a tailspin.

What Prospective Buyers Should Consider

Many consumers have turned to an adjustable-rate mortgage instead of fixed mortgages as borrowing costs have swelled.

Adjustable-rate loans accounted for more than 12% of mortgage applications in both June and July this year the largest share since 2007 and double the percentage from January this year, according to Zillow data.

These loans are riskier than fixed rate mortgages. Consumers generally pay a fixed rate for five or seven years, after which it resets consumers may then owe larger monthly payments depending on prevailing market conditions.

You could chase better numbers for years on end in some cases if things don’t go your way.Kevin Mahoneyfounder and CEO of Illumint

Kevin Mahoney, a certified financial planner based in Washington, D.C., favors fixed-rate loans due to the certainty they provide consumers. Homebuyers with a fixed mortgage can potentially refinance and lower their monthly payments when and if interest rates decline in the future.

More broadly, consumers should largely avoid using mortgage estimates like Fannie Mae’s as a guide for their buying decisions, he added. Personal circumstances and desires should be the primary driver for financial choices further, such predictions can prove to be wildly inaccurate, he said.

“You could chase better numbers for years on end in some cases if things don’t go your way,” said Mahoney, founder and CEO of millennial-focused financial planning firm Illumint.

Don’t Miss: What If I Pay Extra On My Mortgage

Qualification Guidelines Designed To Help More People Buy Homes

You must meet certain qualification guidelines to be approved for a Fannie Mae loan. But instead of limiting the number of people who can buy houses, these guidelines are designed to help more people buy homes.

For example, you can purchase a home with a Fannie Mae loan even if your credit score isn’t great. There’s a minimum requirement of 620, which is only in the fair range for FICO scores. This allows people who wouldnt normally qualify for a mortgage purchase a home.

How Are Fannie And Freddie Doing Today

Much better, but both companies still have a very long way to go. Thanks in part to rising home prices, Fannie Mae in August posted its largest quarterly profit since the crisis began, marking its second consecutive profitable quarter. Meanwhile, Freddie Mac reported a quarterly profit for the fifth time since the crisis began.

The improved finances at both companies led the U.S. Treasury Department in August to rework the terms of the government bailout. Under the previous agreement, Fannie and Freddie drew money from the Treasury Department as needed to bolster its capital reserves. In exchange, the companies issued preferred stock to the government on which they paid a mandatory 10 percent dividend. Under the new rules, Treasury will simply claim all of Fannie and Freddies profits at the end of each quarter and provide capital when necessary in the event of a quarterly loss.

While the worst of the crisis appears to be over, Fannie and Freddie are a long way from repaying their debt. According to Moodys Analytics, it could take the companies 15 years to pay back taxpayers in full. Meanwhile, as the government continues to play a central role in the day-to-day operations of Fannie and Freddie, the continued uncertainty has led many key staff to leave and has caused an underinvestment in necessary infrastructure and systems.

Recommended Reading: How Much Will I Be Loaned For A Mortgage

The Differences Between Fannie Vs Freddie Explained

Fannie Mae and Freddie Mac are government-sponsored enterprises whose missions are to help support homeownership and rental housing in the United States. Fannie and Freddie do this by ensuring there is “liquidity” in the housing market which means lenders have enough money to make home loans at reasonable rates to people who want mortgages and who qualify for them.

When Will Shares Of Fannie Mae And Freddie Mac Trade Again

Today, shares of Fannie Mae and Freddie Mac are traded over the counter , meaning you canât buy them on a major stock exchange. The shares of FNMA and FMCC are both valued at less than $1 a share as of September 2021.

Investors who still hold the shares are anxious for the companies to leave conservatorship, which would let them trade on a stock exchange again and rise in value.

In 2014, FHFA published a strategic plan for releasing Fannie and Freddie from conservatorship. The plan has three big goals:

The idea is to create a system that keeps mortgages affordable and accessible, but without the implicit guarantee that contributed to the financial crisis of 2008.

The FHFA has developed a scorecard that is released each year to measure progress towards these goals. However, Congress must also decide that Fannie and Freddie can be moved out of conservatorship.

Also Check: Can I Just Pay The Interest On My Mortgage