If You’re Thinking About Buying Start With This Home Affordability Calculator

Include pre-tax income from all applicants

Auto, credit card or student loans

Calculator results are estimates only based on the information you provide.

Home affordability estimate for a 30-year fixed rate loan

Need some more information? Now that you have your estimated home price, check out different loan options with our Mortgage Calculator.

Home affordability estimate and monthly payment are based on a 30-year fixed-rate mortgage on a single-family residence, with an interest rate of }% }% on }, for a borrower with excellent credit and user inputs. These home affordability calculator results are based on your debt-to-income ratio .

Do Fha Interest Rates Vary By Lender

Yes, FHA loan rates vary by lender, so it can pay to comparison shop. Once youve found a few lenders that seem right for you, compare each one.

If youre approved, each lender will provide you with a Loan Estimate form. This will let you compare not only FHA mortgage rates, but also origination fees, closing costs and everything else youll pay over the life of the loan. Comparing loan estimates from more than one lender will give you confidence that youre getting a good rate and that youre getting the right loan for your situation.

Investment Property Heloc Cons

On the downside, taking a HELOC on an investment property is generally more expensive than borrowing against your primary residence. Interest rates tend to be higher for investment and rental properties across the board. So while this might feel like a safer prospect, you could end up paying substantially more.

Its also tougher to qualify for this kind of HELOC. There are stricter requirements on HELOCs for an investment property than there are for a primary residence, and you may need to look harder to find a lender who offers HELOCs to investors, says Leonard Ang, owner of iPropertyManagement. A limited selection of lenders also makes it more difficult to compare options and find a lower interest rate.

Keep in mind that HELOC interest rates are variable, meaning your rate and payment can rise or fall with the market. When the Fed hikes interest rates, HELOC rates go up, too. By contrast, alternative options like a home equity loan or cash-out refinance come with fixed rates and predictable monthly payments.

Finally, depending on your HELOCs terms and how much you borrow from the credit line, you might have to make a large balloon payment after your draw phase ends.

Read Also: How Much Of Your Monthly Salary Should Go To Mortgage

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

Why Do I Have To Complete A Captcha And What Can I Do To Prevent This In The Future

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is notinfected with a virus or malware.

If you are at an office or shared network, you can ask the network administrator to run a scan across the networklooking for misconfigured or infected devices.

Your IP is: 168.196.237.110

The unique Ray ID for this page is: 74c7676379ee1993

comparethe.com is a trading name of Compare The Market Limited. Registered in England No. 10636682. Registered Office: Pegasus House, Bakewell Road, Orton Southgate, Peterborough, PE2 6YS. Compare The Market Limited is authorised and regulated by the Financial Conduct Authority for insurance distribution . Energy and Digital products are not regulated by the FCA.

Read Also: What Are Current Residential Mortgage Rates

Raise Your Credit Score

There are several ways to improve your credit score. First, its important to check your credit report from all three bureaus Experian, TransUnion and Equifax for inaccuracies. If there are mistakes in your credit history, you can file a dispute with the credit agencies. They are legally required to address any inaccuracies promptly.

If the information being reported is accurate, make sure to resolve any collections accounts, pay your outstanding debt on time every month and, if possible, reduce your overall credit card debt. The higher your credit score, the lower your interest rate.

Calculator: Start By Crunching The Numbers

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

Don’t Miss: How Much Is A Mortgage On A 265 000 Home

How Does Your Debt

Lenders will also look at your debt-to-income ratio, or DTI, to get a clear picture of how risky it is to loan you money. Simply put, the higher your debt-to-income ratio, the more the lender will doubt your ability to pay the loan back.

Lenders have maximum DTIs in place that could stand in the way of getting approved for a mortgage. On conventional loans, for example, lenders usually like to see debt-to-income ratios under 43 percent, although in some cases, 50 percent is the cutoff. If you want to shrink your debt-to-income ratio before applying for a mortgage which is a good idea pay off your credit cards and other recurring debts like student loans and car payments.

Here’s how to figure out your DTI:

Add up your total monthly debt and divide it by your gross monthly income, which is how much you brought home before taxes and deductions. Heres an example:

- Add up your monthly debt: $1,200 + $200 + $150 + $85 = $1,635 total

- Now, divide your debt by your gross monthly income : 1,635 ÷ 4,000 = .40875. By rounding up, your DTI is 41 percent.

- If you get rid of the $85 monthly credit card payment, for example, your DTI would drop to 39 percent.

Step : Calculate Your Monthly Income

To qualify for a mortgage, you and your spouse must prove that you have enough income to cover all of your housing costs, including homeowner association dues and property taxes.

You should also add up all sources of your monthly income, including your spouses if you are married, alimony if you are getting some and any other income that you receive.

If you have a fixed-term employment contract or receive a salary from your job, then the calculation is easy. Just add up all of your monthly income and divide it by 12 to get the average amount of money you make each month.

Gross monthly income is the total amount of money earned before any deductions have been made. For example, if you make $45,000 per year and work 40 hours per week, then your gross monthly income is $3,750 .

If your spouse earns $50,000 per year and works full-time. Her gross monthly income is $4,167 . Adding these two together gives you a gross monthly income of $7,917 .

If you receive variable or irregular income from self-employment, there are several things that you can do. For example, lets say that you are self-employed and your income varies from month to month or year to year due to market conditions or seasonal factors.

If you were getting alimony every month or had another source of income such as an investment property, then include that as well. Also include any investments in stocks and bonds or annuities as well as any government benefits.

Also Check: Does Applying For Mortgage Affect Credit Score

Tips For Buying A Home

In order to help ensure that you can afford your home and maintain it over time, there are some smart measures you can take. First, save up a cash reserve in excess of your down payment and keep it in reserve in case you lose your job or are unable to earn income. Having several months of mortgage payments in emergency savings lets you keep the house while looking for new work.

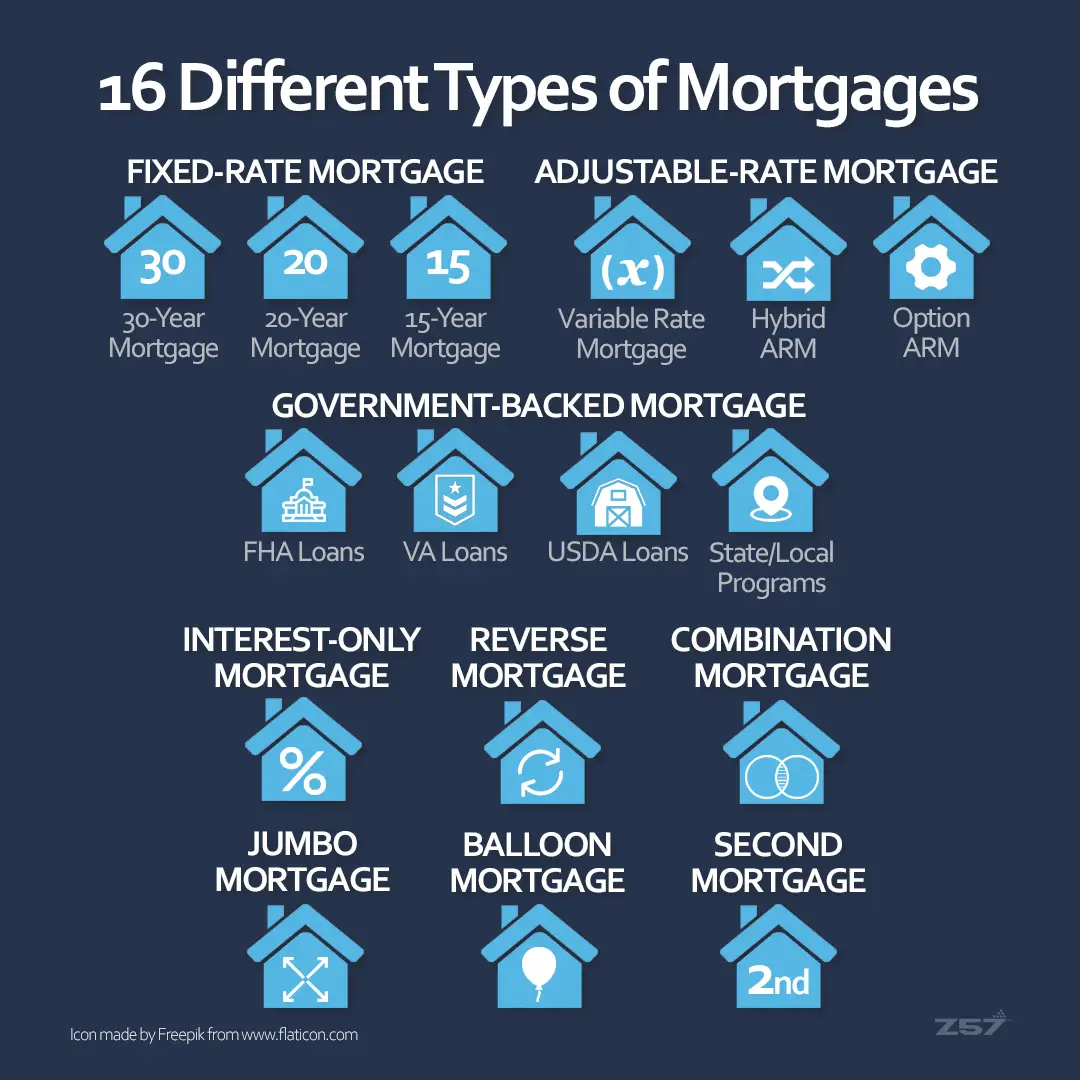

You should also look for ways to save on your mortgage payments. While a 15-year mortgage will cost you less over the loan’s life, a 30-year mortgage will feature lower monthly payments, which may make it easier to afford month-to-month. Certain loan programs also offer reduced or zero down payment options such as VA loans for veterans or USDA loans for rural properties.

Finally, don’t buy a bigger house than you can afford. Do you really need that extra room or finished basement? Does it need to be in this particular neighborhood? If you are willing to compromise a bit on things like this, you can often score lower home prices.

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Don’t Miss: Can You Sell House Before Paying Off Mortgage

How Is My Affordability Calculated

Heres a breakdown of each factor impacting your home affordability and the limit it places on your asking price. Your affordability is the minimum of all the values shown.

| Limiting Factor |

|---|

| 1,207,0001.21m |

- Your down payment directly imposes a limit on your maximum asking price.

- UnderCMHC regulations, your total debt service ratio cannot exceed44%. The TDS ratio is calculated by dividing your total annual housing-related and debt expenses by your gross annual income. These expenses include:

- Half of your condo fees

- All forms of debt payments

Can I Remortgage Straight Away

Some lenders will allow you to do so, but most lenders will require you to pay your existing mortgage for a minimum of 6 months before they will consider your application. It is also advised not to remortgage just because you can as there will be costs involved in the process. A fixed rate mortgage will last anywhere from 2 to 10 years and once this fixed rate term is complete you may be put onto the providers SVR which in some cases can produce a higher interest rate. You will need to ensure you have been accepted into your new mortgage before the term is up to avoid paying more than you need to. Get in touch with one of Pinnacles brokers in good time before your term is up to ensure we can find you the best product available to you.

Read Also: How Is Interest Rate Determined On A Mortgage

Keys To Successfully Qualifying For A Mortgage

Some income types have restrictions on when you can use them to qualify for a home. Two types that do not typically have restrictions are Salaried Employment and Full-time Employment. In most cases, both of these types of income are usable without averaging your income over the last two years.

Incomes other than Salary and Full-time will typically require a one or two year history to be reviewed and averaged to count that income towards home buying. So if you have less than two years of these types of income, you may not be able to count that income towards qualifying.

Some of those income types include: Self-employment, Part-time, Second Job, Seasonal, Shift Differential, Overtime, Commission, Bonus, Dividend, and more. If you have any of these types of income, its important to discuss your unique scenario with a loan originator to determine if your income can be used.

HAVE A FEW MORE QUESTIONS?

Our Loan Experts Can Help

-

A lender needs to review your income, assets, credit report to determine the best loan fit for you.

Income Documents typically include:

Can I Afford A $360k House

To afford a mortgage loan worth $360k, you would typically need to make an annual income of about $100k and be able to afford monthly payments worth $2,000 and upwards. For example, with a 30-year loan term, 5% interest rate and 5% down, you’d need an annual income exceeding $105,000 to afford the $2,478 monthly mortgage payment

Read Also: What Is A Good Dti For A Mortgage

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums. In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

Short Example Of First Time Buyer Mortgage

You spot a house for sale for 300,000 and wonder can you afford it.

As a first time buyer the highest level of mortgage facilities you can get is 90% of the purchase price i.e. 270,000.

This is calculated at purchase price 300,000 multiplied by 90% = 270,000

second hand

If the property is newly built and will be used as your home and you are a qualifying first time buyer , you may qualify for the help to buy scheme of up to 10% of the purchase price 30,000!

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

You May Like: How Many Personal Mortgages Can You Have

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2022, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $647,200. If this is the maximum conforming limit in your area, and your loan is worth $600,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $970,800 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.