Have Your Home Value Assessed

Usually, your property taxes fluctuate yearly based on your home value assessment. If your property taxes go up, your mortgage payment will go up. If your property is assessed incorrectly, you will be forced to pay higher property taxes. However, as a homeowner, you have the option to appeal your property taxes through your local assessors office. If you review the assessors information and find discrepancies or inaccurate information, you may be able to make the case to appeal your property taxes.

How Does Mortgage Refinancing Work

Refinancing takes about 30 to 60 days, and the process itself is similar to the process you went through when you applied for your original mortgage, so aim to be prepared by gathering all of your important financial documents ahead of time so that the process can be as seamless as possible.

The lender will need to review your financial condition again to determine your ability to repay the new mortgage and will reevaluate your home to obtain an updated property value, says Thomas Parrish, managing director and head of retail lending product management at BMO Financial Group. You will need to provide various documentation to your lender. Based on evaluating all these aspects your lender will determine if you qualify for a new mortgage.

Pro tip: Get a preapproval from multiple mortgage lenders so you can compare interest rates and terms and choose the most favorable option.

Streamline Refinances Can Be A Lot Easier

Even if youre not eligible for these programs or able to negotiate a lower rate, it might be possible to execute a streamline refinance.

As the name implies, its a faster and easier way to refinance a home loan for the express purpose of securing a lower interest rate.

This option allows you to refinance without the typical requirements like a minimum credit score or maximum LTV, and with limited paperwork. You might be able to skip the appraisal too!

Even though its technically still a refinance, it should prove to be a lot easier to qualify, and it shouldnt be as painstaking of a process.

Read Also: How Much Is A 30000 Mortgage Per Month

Have Your Homes Tax Assessment Redone

If your home loan has an escrow, property taxes may take up a noticeable chunk of your mortgage payment each month.

Property taxes are based on each countys tax assessment of how much your home or land are worth. Some homes in urban areas are overvalued, causing the taxes to be high. The assessment is different from an appraisal since it is conducted by your county for tax purposes only.

As a homeowner, you can request to have the assessment done again by filing with your county and requesting a hearing with the State Board of Equalization. If the protest is approved, your homeowners taxes will decrease along with your monthly mortgage payment.

Prepaying Your Way To A Lower Rate

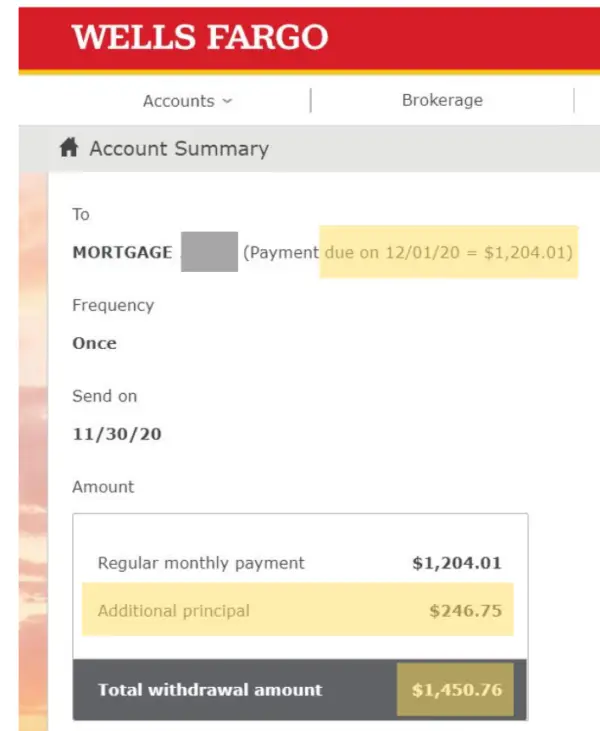

It’s a bit of a mathematical construct, but prepaying your mortgage can lower the effective interest rate on your mortgage. Although the math is complicated, the concept is pretty simple: Retiring your mortgage more quickly saves interest cost… and lower interest cost is usually what’s achieved with a refinance.

HSH’s PreFism Prepayment-is-equivalent-to-Refinance calculator can do the math for you. For example, you have a $200,000 loan at a 3% rate you took out in August 2017. You start making prepayments of $100 per month in October of 2021. Your prepayment will save you $13,118.81 over the remaining term of your loan, creating an equivalent 2.574% interest rate for your mortgage.

If you want to achieve these savings by refinancing you would need to start the “amortization clock all over again at a new 30 years and get a new interest rate of 2.217% — and you’ll likely need to pay closing costs again, too.

It’s technically possible to engineer any interest rate you want via prepaying all that matters is the amount. Pick a rate you would like to create for your mortgage and our LowerRatesmPrepayment Calculator will tell you the amount of prepayment you’ll need to create the same savings as a refinance at that interest rate. From the example above, if you want a 2% effective rate, you’ll need to prepay $165.56 per month.

Read Also: How To Prequalify For A Home Mortgage

Get Your Mortgage Paperwork In Order

You need a lot of documentation that proves your financial readiness to refinance.

The documents you should have handy include your latest pay stubs, the last two years of W-2s, information about your current home loan, as well as information on property taxes and home insurance.

If youre self-employed or have a non-traditional job, have two years of bank statements available. You may also need a profit and loss statement from your bank, the last two years of 1099 forms and client invoices as proof of income.

A lender may have additional documentation requirements depending on their initial assessment of your finances. Once you have decided on a lender, find out about any other requirements so you can get it together ahead of time. Doing so will make the application process a lot smoother.

Shop Around For Lower Homeowners Insurance Rates

If youre paying for your homeowners insurance as part of your monthly mortgage payment, then shopping for a better homeowners insurance rate could be an easy way to lower your overall monthly payment.

You can also review your coverages to make sure youre not overpaying for something you dont need. If you can afford it, raising your deductibles is a surefire way to make sure your premiums are lower. Just make sure you know what coverage your lender requires if youre reducing or eliminating anything. A good insurance agent should be able to help you find ways to save money while making sure all your bases are covered.

Read Also: How Do Banks Calculate Mortgage Payments

How To Use A Refinance Calculator

There are many free refinance calculators readily available online which can help you determine if refinancing will save you money. With a refinance calculator, you can enter your current mortgage terms, the new proposed mortgage terms and any fees for refinancing. You can try this refinance calculator at LendingTree to see how it works.

A refinance calculator will help you figure out how much money youll save on a monthly basis and over the life of your loan, and whether its worth the costs of acquiring a new mortgage.

When Its A Good Idea To Refinance Your Mortgage

Generally, if refinancing will save you money, help you build equity and pay off your mortgage faster, its a good decision.

Even borrowers who have fairly new mortgages might be able to benefit from refinancing. Say you were approved for your mortgage at the start of 2020. Although youre less than two years into your loan, the ability to now lower your interest rate by one-half to three-quarters of a percentage point can substantially lower your monthly payment and reduce the interest over the life of the loan.

So, when is it a bad idea to refinance? For the above example, it might not be smart to refinance if you plan to move in the next two years, which gives you little time to recoup the cost.

The question of when to refinance is not just about interest rates or your timeline, either its about your credit being good enough to qualify for the right refinance loan. The best rates and terms go to those with the best credit, so check your credit report to have a solid understanding of your risk profile. If youre carrying a high credit card balance or youve missed a payment recently, you might look like a riskier borrower.

Recommended Reading: What Kind Of Mortgage Loans Are There

Switch From An Fha To A Conventional Loan

FHA loans require a higher mortgage insurance premium payments as compared to conventional loans . Lets take a closer look at MIP. It has two components: an upfront premium and an annual premium. The current upfront premium rate is 1.75% of the loan amount. The current annual premium is 0.85% for the most common category of FHA loans. Though, annual premiums can be lower for lower LTV values or mortgage terms of fifteen years or less. Regardless, its not an uncommon financial strategy for borrowers to refinance from an FHA to a conventional loan once the 20% equity requirement is met just so they can avoid further mortgage insurance payments.

Make One Extra Payment For The Year

If you have been budgeting, chances are that one month out of the year you can afford to pay an extra payment on your mortgage. This method can lower your interest rate and you can imagine how much it will add up on a 30-year mortgage one extra payment per year may even shave off some years of payment.

Recommended Reading: What Does A Mortgage Attorney Do

Appeal Your Homes Assessed Value With The County

Property taxes are high the average is 1%. In some states, such as Texas, they are really high, over 2% of the propertys assessed value every year.

If you think youre paying too much property tax and your homes value should be lower than it is, you can appeal the tax assessment with the county.

Get your county tax assessment of your home and verify they have everything listed correctly. Do they have the number of bedrooms and bathrooms, right?

The square footage, how many acres you actually have, are all of these correct? If not, you can contact your local tax assessor and let them know they have incorrect facts listed in their report.

Read Also: How To Get Assistance With Mortgage Payments

Rethink Your Payment Patterns

If the reduction techniques above dont pan out and you can afford it, you can try to save money in the long run by shifting your payment habits. This wont decrease your rate or monthly payments, but will help you to save later by chipping away at the overall loan balance. According to The Mortgage Reports, by simply making one extra payment every year, rounding up your monthly payment to the nearest hundred or switching to a biweekly payment plan, you can reduce your mortgage payments by years.

Recommended Reading: What Comes After Pre Approval Mortgage

Refinance To A Longer Loan Term

Another way to lower your mortgage payment is to refinance to a longer loan term. For example, if you have 20 years left on your mortgage and you refinance to a new 30-year mortgage, your monthly payments might go down.

However it is important to understand that doing this could increase the total amount you pay in interest over the life of your loan. Thats because you are paying back the money you own over a longer period of time. In this case, lowering your mortgage payment does not mean you are “saving money.”

If you are a current Freedom Mortgage customer, we can often help you keep your loan term the same when you refinance your home. That means we might be able to offer you a lower interest rate without adding years to the term of your new mortgage.

Can I Lower My Mortgage Rate Without Refinancing

Your mortgage interest rate plays a major part in determining how affordable your loan is, and the easiest way to trade a higher rate for a lower one is through a mortgage refinance.

There is one way you can get a lower mortgage interest rate without refinancing, however. A mortgage modification allows you to change the original terms of your home loan due to a financial hardship.

Your lender may adjust your loan by:

- Extending your loan term

- Reducing your principal balance

- Lowering your mortgage rate

Not every borrower can get a loan modification, though. Typically, you must either be behind on your mortgage or anticipate that youll miss your upcoming monthly mortgage payments.

This option should only be pursued in dire situations, though, since there are significant risks that come with it. Youll likely have to prove financial stress, even to the point that you make late mortgage payments, which will drop your credit score.

Falling just 30 days behind on your mortgage payments can drop your credit score by as many as 110 points, according to FICO research.

Read Also: How To Get A Mortgage In Jamaica

Choose An Adjustable Rate Mortgage

When mortgage rates are super low, you might consider refinancing to an adjustable-rate mortgage to get a low initial rate and lower your mortgage payment. But before getting an ARM, consider if you can afford higher payments in the future. If mortgage rates rise before your rate resets, then the rate on your mortgage will increase, along with your mortgage payment.

Remember:Find out if refinancing is right for you

- Actual rates from multiple lenders In 3 minutes, get actual prequalified rates without impacting your credit score.

- Smart technology We streamline the questions you need to answer and automate the document upload process.

- End-to-end experience Complete the entire origination process from rate comparison up to closing, all on Credible.

Find The Best Refinance Rates

To find the best refinance rates, youll have to do some work, but it wont take much time. Look at banks, credit unions and online comparison sites. You also can work with a mortgage broker if you want someone to do the legwork for you and potentially get you access to lenders you wouldnt find on your ownlenders that might offer you better terms.

Submit three to five applications to secure formal loan estimates. The government requires the loan estimate to show your estimated interest rate, monthly payment and closing costs on a standard form that makes it easy to compare information across lenders.

On page 3 of the loan estimate, youll see the annual percentage rate, and on page 1, youll see the interest rate. When youre buying a car, it usually makes sense to pick the loan with the lowest APR, because APR includes a loans fees.

With mortgages, its different. The APR assumes that you will keep the loan for its full term. As weve already seen, that doesnt usually happen with home loans. You might be better off with a loan that has a higher APR and a higher monthly payment but no fees.

Instead of putting cash toward closing costs, you could keep that money in your emergency fund or use it to pay down debt with a higher interest rate than your mortgage.

Another problem is that if youre comparing the APRs on a 30-year and a 15-year loan, the 15-year loan might have the higher APR despite being much less expensive in the long run.

Read Also: What Does It Mean Points On A Mortgage

How Much Will It Cost To Complete The Refinancing

Depending on your lender and your loan terms, you may pay as little as a few hundred dollars or as much as 2% to 3% of the new loan value to complete a refinancing. If its going to cost you $3,000 to complete the refinance and it will take four years to recoup that money, it may not make sense for you.

Alternatively, if you can refinance and pay only $1,000, and have no plans to sell anytime soon, its very likely worth paying that $1,000 to save over time. In addition, some lenders allow you to roll your closing costs into the amount of the loan, so you dont have to come up with money out of pocket for closing costs.

Refinance To A Lower Rate

Refinancing a 30-year loan makes sense if the interest rate is lower than what you have now. If you took out a mortgage before the recession, you likely have a higher rate than what’s available now.

If you don’t want the higher payments of a 15- or 20-year loan, a 30-year loan will offer a lower interest rate and lower payments. However, it won’t help pay off the loan quicker unless you make higher payments, such as if you had a 15-year loan.

This can make sense if your income might drop or some family emergency happens. You can make higher principal payments until – if ever – you lose your job or the money is needed elsewhere.

Don’t Miss: How Much Should Your Mortgage Be Compared To Income

What Are Todays Mortgage Rates

There are ways to lower your house payment without refinancing. But if youre trying to exit an adjustable-rate mortgage or if you need to take cash out of your home youll still need a new home loan.

Todays average refinance rates are higher than the record lows of 2020 and 2021. But actual rates are borrower- and lender-specific.

Why Did My Mortgage Payment Go Up

Because many home loans require that taxes and insurance costs be lumped into your mortgage mortgage payment, your payment amount will go up if your property taxes or home insurance premiums increase. Even if you have a fixed-rate loan, property taxes and insurance premiums are not fixed amounts. Therefore, you can expect to pay a slightly different amount each year.

You May Like: How Much Should You Budget For Mortgage

Who Qualifies For A Refinance

Many borrowers who currently have a mortgage loan are eligible to refinance.

According to Khari Washington, mortgage broker and owner of 1st United Realty & Mortgage, the requirements for refinancing a loan are similar to those for purchasing a home. Washington says a lender will look at:

- Your debttoincome ratio

- The equity in your home

- The stability of your income

- Your current home value

You should also understand the costs and benefits of a refinance to decide if its right for your situation.

Keep in mind that you will pay refinance closing costs, which are typically 26% of your loan amount. The average refinancing closing costs across the country are $5,749, per recent data from ClosingCorp, a real estate data and technology firm.

To find out if a refinance is worth it for you, compare your estimated closing costs with your monthly savings. If youll save more in the long run than you spend upfront, a refinance is typically worth it.

You May Like: Rocket Mortgage Vs Bank